Who Owns Renewable Energy Systems?

Renewable energy has seen tremendous growth over the past decade. As costs have declined dramatically for solar and wind power, more homeowners, businesses, and utilities are adopting renewable energy systems. However, the ownership models for renewable energy are evolving. Whereas utilities traditionally owned large-scale renewable energy projects, new options like distributed solar ownership, community solar, and third-party financing have opened the door for more diverse ownership models. As a result, renewable energy system ownership is shifting as costs decline and new business models emerge.

Current State of Renewable Energy

Renewable energy sources like wind, solar, hydropower, geothermal, and biomass provided 21% of total U.S. electricity generation in 2021, according to the U.S. Energy Information Administration (EIA) [1]. This represents steady growth over the past decade, up from 13% in 2010.

The leading renewable electricity sources in the U.S. are hydropower and wind power. Hydropower accounted for over 7% of total generation in 2021. Wind power contributed more than 9% in 2021, making it the largest single renewable source. Solar energy, biomass, and geothermal sources together provided about 5% of total generation [2].

Total installed solar capacity has grown at an average annual rate of 24% over the past decade and reached 150 gigawatts (GW) in 2022 [3]. This makes solar power the fastest growing renewable electricity source in the country.

Utility-Scale Renewables

Utility companies own the majority of large-scale wind and solar projects in the United States. According to Leading utility-scale solar power plant owners, some of the biggest utility owners of solar plants include NextEra Energy, Southern Company, and Dominion Energy. These utilities build and operate large solar farms and wind farms to generate renewable electricity. The scale of these projects ranges from 50 megawatts to over 500 megawatts. By owning renewable energy generation assets, utilities are able to increase their clean energy portfolios and meet state renewable portfolio standards.

Distributed Renewables

Distributed renewables refer to small-scale renewable energy systems located close to where the energy is used, such as on rooftops or in communities. One major form of distributed renewables is rooftop solar panels installed on homes and businesses. According to a report by Mordor Intelligence, the global distributed solar power generation market size was estimated at USD 149.72 billion in 2024, and is expected to reach USD 209.69 billion by 2029, growing at a CAGR of 6% during 2024-2029 (https://www.mordorintelligence.com/industry-reports/global-distributed-solar-power-generation-market-industry).

Rooftop solar allows homeowners and businesses to generate their own electricity, reducing reliance on the grid. With net metering policies, any excess electricity produced can be fed back into the grid for credit. The adoption of rooftop solar has grown rapidly thanks to declining costs and supportive policies. Home and business owners may choose to install solar panels to save money on electricity bills, gain energy independence, or demonstrate a commitment to sustainability.

Community Renewables

Community renewable energy projects allow members of a community to collectively develop, own, and benefit from local clean energy systems. Some common types of community renewables include community solar gardens and renewable energy cooperatives.

Community solar gardens are centralized solar photovoltaic systems that provide power and/or financial benefits to multiple community members or households. Participants subscribe to a portion of the community solar project and receive bill credits proportional to their share of the system’s output (https://www.energy.gov/eere/clean-energy-communities-program). This model allows community members to access solar power even if they rent, have shaded roofs, or face other barriers to installing private onsite solar systems.

Renewable energy cooperatives are member-owned entities that develop and operate clean energy systems. Cooperatives allow members to collectively invest in and share benefits from renewable energy projects in their area. Profits are returned to co-op members or reinvested in the community. Many electric cooperatives have also begun offering community solar and renewable energy programs to their members (https://rapidtransition.org/stories/reclaiming-power-the-rapid-rise-of-community-renewable-energy-why-the-added-benefits-of-local-clear-power-can-help-accelerate-transition/).

Community renewables can provide an inclusive model for expanding access to clean power. They engage and empower communities in the energy transition while also providing local economic and social benefits.

Third-Party Ownership

One of the most popular models for renewable energy ownership is third-party ownership, where a solar developer installs a solar system on a customer’s property at little to no upfront cost and maintains ownership of the system. The customer then pays a monthly lease or power purchase agreement (PPA) payment to buy the power generated from the system. This allows homeowners and businesses to go solar with no upfront installation costs.

Solar leasing from developers has driven much of the growth in distributed solar over the past decade. According to Coherent Market Insights, the global solar lease service market was valued at $14.84 billion in 2023 and is expected to reach $49.26 billion by 2030. Major players in third-party solar financing include Sunrun, SunPower, Vivint Solar, and Tesla Energy. The third-party ownership model makes up over 70% of the residential solar market in leading states like California, according to Transparency Market Research.

The no-money-down leasing model has opened up solar energy access to a broader customer segment. It allows consumers to achieve electricity bill savings without large upfront investments. For developers and investors, owning and operating solar assets provides steady, long-term cash flow.

Corporate Renewables

In recent years, major corporations have become significant buyers and developers of renewable energy as part of their sustainability commitments. According to S&P Global (1) , corporations procured over 70 GW of renewable energy capacity in the US through 2022. Large tech companies like Google, Amazon, Facebook, and Microsoft have been leaders in purchasing renewable energy from projects through power purchase agreements (PPAs) and also developing their own utility-scale solar and wind farms. For example, in 2019 Facebook signed contracts for over 2.6 GW of new solar and wind energy (2). Major corporations see investing in renewable energy as improving sustainability, reducing operating costs, and helping meet aggressive emissions reductions goals.

Investor Ownership

Institutional investors are acquiring an increasing share of renewable energy projects according to an IEA report from 2023 (https://www.iea.org/news/clean-energy-investment-is-extending-its-lead-over-fossil-fuels-boosted-by-energy-security-strengths). Pension funds, insurance companies, and sovereign wealth funds are allocating more capital to renewables as they seek stable long-term returns. Falling technology costs have made renewable energy assets attractive to these investors looking for yield. As a result, the share of institutional investors in renewable energy deal value reached over 50% in 2022 for the first time according to BloombergNEF (https://about.bnef.com/blog/renewable-energy-investment-hits-record-breaking-358-billion-in-1h-2023/). This influx of institutional capital is expected to continue driving growth in renewable energy deployment worldwide.

Future Outlook

Projections for renewable energy ownership trends show that utility-scale renewable energy systems will continue to increase over the next decade. However, distributed and community renewables are also expected to grow rapidly. According to Deloitte’s 2024 renewable energy industry outlook, wind and solar jobs are projected to be among the fastest growing occupations over the next decade as renewable capacity expands across utility, commercial, and residential sectors. Yale Climate Connections reports that solar and wind power could provide between 35-55% of US electricity by 2030. With declining costs and supportive policies, ownership of renewable systems is forecasted to expand across utilities, companies, communities, and households.

Sources:

Deloitte 2024 renewable energy industry outlook

Yale Climate Connections renewable energy growth projections

Conclusions

In conclusion, we’ve seen major shifts in renewable energy ownership over the past decade. Utility-scale projects used to dominate, owned directly by electric utilities. But the cost of solar and wind has declined so much that we’re now seeing rapid growth in distributed, community, and third-party owned renewables. Corporations are also investing heavily in renewable energy to meet sustainability goals and lock in low energy prices. Meanwhile, direct investment by homeowners, businesses, and community groups is rising exponentially.

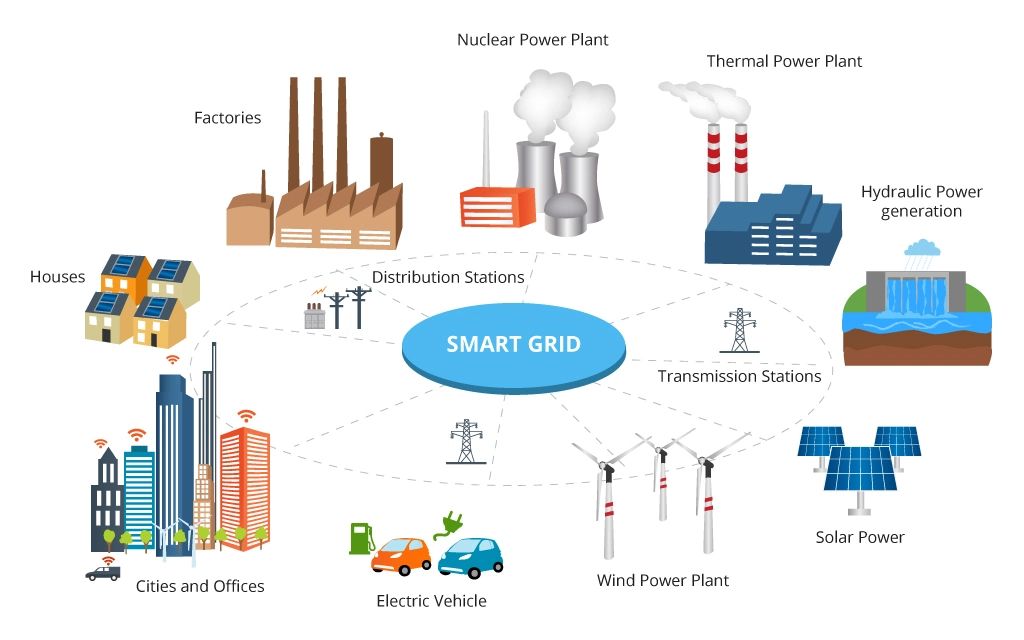

These trends point to a more democratized, decentralized future for renewable energy. Rather than reliance on monopolistic utilities, individuals and communities can generate their own clean power. This shift empowers consumers, creates local jobs and revenues, and builds support for an accelerated transition to renewables. It does raise challenges around grid management and utility business models that will need to be addressed. But the broad momentum behind local ownership models suggests that the future will be one of energy democracy and independence.