How To Invest In Renewable Energy?

Renewable energy is energy that is generated from natural resources that are replenished at a faster rate than they are consumed. Some of the main types of renewable energy sources are solar, wind, hydropower, bioenergy and geothermal. Investing in renewable energy sources is important to combat climate change and reduce greenhouse gas emissions. As the world transitions to a low carbon economy, there will be significant growth in the renewable energy industry making it an attractive investment opportunity.

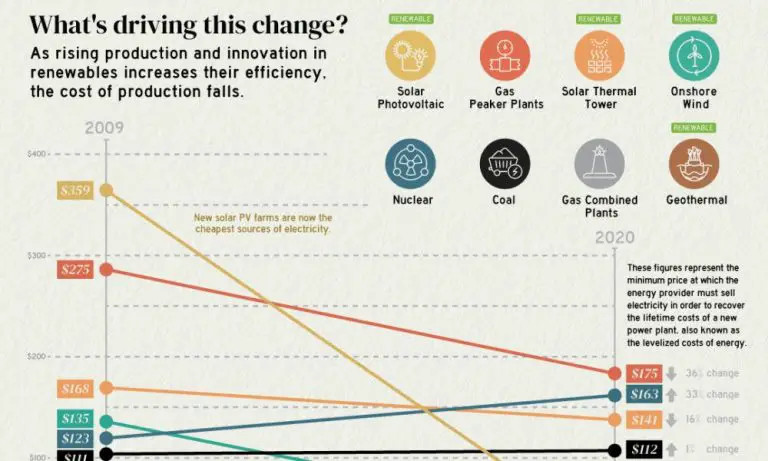

Shifting investments towards renewable energy can also have economic benefits in terms of new jobs, revenue opportunities and energy security. As renewable energy becomes more cost competitive with conventional sources, investing in this sector can offer good financial returns. Overall, investing in renewable energy delivers environmental, social and economic value.

Solar Energy

Solar energy involves harnessing sunlight to generate electricity or heat using solar panels. There are two main types of technologies in solar energy – solar photovoltaics (PV) and solar thermal. Solar PV converts sunlight into electricity using solar cells, while solar thermal systems use sunlight to generate heat for water or space heating (UNVELING THE SECRETS OF SOLAR ENERGY). Investing in solar energy can be profitable across residential, commercial and utility-scale projects.

For residential solar, homeowners can install solar PV systems to offset their electricity usage and potentially sell excess electricity back to the grid. This allows homeowners to reduce their electricity bills and earn income through net metering programs. The upfront costs of residential systems can deter some homeowners, but there are solar loans and financial incentives available (Solar Energy Project Funding and Investment Platform). Commercial solar projects operate under similar principles but on larger scales to power business facilities and offset electric bills.

Utility-scale solar farms generate massive amounts of solar power to be fed into the electric grid. These large-scale projects require substantial investments but can provide stable long-term cash flows. Solar investment platforms like Sunglo and Pineapple Energy acquire and operate distributed solar assets across residential, commercial and utility portfolios (Solar Energy Investment Opportunities). With solar energy capacity expanding rapidly, these diversified portfolios can offer investors steady returns.

Wind Energy

Wind energy harnesses the wind to generate electricity using wind turbines. There are two main types of wind farms: onshore and offshore.

Onshore wind farms are located on land and are one of the most cost-effective renewable energy sources. Major onshore wind companies include Vestas, Siemens Gamesa, and GE Renewable Energy. Onshore wind investment opportunities include stocks like NextEra Energy (NEE), Vestas Wind Systems (VWS.CO), and Siemens Energy (SIEGY).

Offshore wind farms are built in bodies of water and can generate more energy than onshore due to stronger winds. However, they are more expensive to build. Major offshore wind companies include Ørsted, Siemens Gamesa, and GE Renewable Energy. Stocks like Ørsted (DNNGY) provide exposure to offshore wind.

Wind energy ETFs like the First Trust Global Wind Energy ETF (FAN) and the Global X Wind Energy ETF (WNDY) offer diversified exposure to public wind energy companies. The US does not currently have a dedicated wind energy ETF.

The US Wind Capacity outlook for 2021-2030 estimates over 170 GW of wind capacity will come online, representing over $270 billion in investment [1]. Wind energy represents a major investment opportunity as renewable energy expands.

Hydropower

Hydropower is the use of flowing water to generate electricity. Hydropower projects often require the construction of dams, powerhouses and other infrastructure to harness the energy from rivers or waterfalls. There are various ways to invest in hydropower generation.

One approach is to invest directly in hydropower projects. This involves providing financing for the development and construction of new hydropower plants. Major hydropower generation companies like Duke Energy, Statkraft and Eletrobras undertake large-scale hydropower projects and seek investors to help fund the high upfront capital costs.

Another option is to invest in companies that own and operate hydropower assets. Many utilities and independent power producers have hydropower plants in their generation portfolios. Investing in their stocks or bonds provides exposure to existing hydropower facilities and their cash flows. Examples include American Electric Power, Brookfield Renewable Partners and Algonquin Power & Utilities.

There are also exchange-traded funds (ETFs) focused on the hydropower industry, such as the Global X Hydrogen ETF and the Invesco WilderHill Clean Energy ETF. These funds hold a basket of stocks related to hydropower and other renewable energy sources.

Overall, hydropower investments allow investors to support clean electricity generation while potentially earning attractive returns from stable, long-life assets.

Bioenergy

Bioenergy refers to renewable energy derived from biological sources, such as plants and organic waste materials. There are two main ways to produce energy from biomass: biofuel production and biopower.

Biofuels like ethanol and biodiesel are made by processing biomass feedstocks like corn, sugarcane, and vegetable oils. These liquid biofuels can replace gasoline and diesel for transportation. Major biofuel producers include companies like POET and Valero Renewables. Investing in biofuel companies provides exposure to the growing renewable transportation fuel market.

Biopower is generated by burning biomass directly to produce steam and electricity. Sources of biomass for power production include forest residues, agricultural crops and waste, and municipal solid waste. Biopower accounts for almost half of renewable energy produced in the United States. Key players in biopower include companies like Drax and Enviva that develop utility-scale biomass power plants.

The bioenergy industry is expected to see strong growth as governments continue to enact policies that encourage renewable power generation and low carbon transportation fuels. With rising demand, bioenergy companies and stocks can offer attractive investment opportunities.

Geothermal Energy

Geothermal energy utilizes heat from beneath the earth’s surface to generate electricity and provide heating and cooling. There are three main types of geothermal energy projects: geothermal power plants, direct use, and geothermal heat pumps (GHPs).

At geothermal power plants, wells are drilled into underground reservoirs to tap into hot water or steam that spins a turbine to generate electricity. The United States leads the world in geothermal electricity generation capacity, with over 3.7 gigawatts as of 2019, according to the U.S. Energy Information Administration. Major geothermal resources are located in western states like California, Nevada, Utah, Idaho, and Oregon.

Direct use applications take advantage of geothermal reservoirs closer to the earth’s surface that provide water for bathing, agriculture, aquaculture, and district heating. Direct use of geothermal energy dates back thousands of years, with examples found around the world from Turkey’s hot springs to Polynesian spas.

Geothermal heat pumps use shallow ground or water temperatures for space heating and cooling. These systems transfer heat between the earth and buildings, and are one of the most efficient heating and cooling technologies available.

Publicly traded geothermal companies involved in geothermal project development and technology include Ormat Technologies, Geothermal Engineering Ltd., and GreenFire Energy Inc. Investment in geothermal supports sustainable baseload power generation, reduces greenhouse gas emissions, and provides energy security.

Ocean Power

Ocean power refers to technologies that harness the energy of the oceans to generate electricity. There are several types of ocean power technologies that show promise for large-scale energy production:

Tidal Power

Tidal power utilizes the rise and fall of ocean tides to generate electricity through tidal barrage systems or in-stream tidal turbines. Tidal barrages construct dams across inlets that fill with water during high tides and empty during low tides. The movement of water turns turbines to produce electricity. In-stream tidal turbines function similar to wind turbines, where flowing tidal currents turn underwater rotors to generate power. The world’s first major tidal power plant opened in La Rance, France in 1966 and has an installed capacity of 240 MW. Modern tidal projects are being tested and implemented around the world, including in the Bay of Fundy, UK, South Korea, and Australia.

Wave Power

Wave power devices harness the kinetic energy of ocean surface waves to generate electricity. These devices utilize different design concepts, such as oscillating water columns, hinged contour devices, or buoys, to capture wave motion that powers turbines. While no wave power plants are currently operating at commercial scales, prototypes and pilot projects have demonstrated success off the coasts of Portugal, Australia, and Oregon.

Ocean Thermal Energy

Ocean thermal energy conversion (OTEC) utilizes the temperature difference between warm surface seawater and cold deep seawater to generate power. The temperature gradient drives a heat engine, which produces electricity. An OTEC plant was built in Hawaii in 2015, but technical challenges have limited widespread adoption of this technology.

Salinity Gradient

Salinity gradient energy utilizes the difference in salt concentration between fresh and salty water. As the two water types mix, energy is released that can be captured to generate electricity. While still an emerging and experimental technology, salinity gradient has potential for power generation in places where freshwater rivers meet the sea.

Investment opportunities in ocean power include startups focused on innovative technologies, tidal and wave power project developers, and companies that manufacture ocean power infrastructure like turbines. Governments are also investing heavily in ocean power R&D. According to a report, annual investment in ocean energy increased fivefold from $216 million in 2011 to $1.1 billion in 2015. With abundant resources that can provide renewable baseload power, ocean energy can become a major contributor to future clean energy portfolios with continued technology advancement and investment.

Renewable Energy Funds

There are several types of funds focused specifically on renewable energy investments, providing ways for individuals and institutions to support the growth of the renewable energy industry.

Yieldcos are publicly traded companies that own renewable energy assets like solar and wind farms. They provide dividends to investors based on the cash flows from these assets. Major yieldcos in the renewable energy sector include NextEra Energy Partners, TerraForm Power, and Pattern Energy.

There are also exchange-traded funds (ETFs) focused specifically on renewable energy stocks and projects. Examples include Invesco Solar ETF (TAN), First Trust Global Wind Energy ETF (FAN), and iShares Global Clean Energy ETF (ICLN). These provide a diversified way to invest in clean energy.

Green bonds are fixed-income securities issued by governments, multilateral banks or corporations to finance renewable energy and other environmental projects. They allow access to large scale sustainable infrastructure investments.

Overall, these specialized investment vehicles allow broader participation in financing the transition to renewable energy across the economy.

Financial Incentives

There are a variety of financial incentives available to support investments in renewable energy, including tax credits, rebates, grants, and other programs. These incentives help offset the upfront costs of installing renewable energy systems and make them more financially viable.

At the federal level, investment tax credits (ITCs) provide a credit against income taxes owed based on a percentage of the cost of installing certain renewable energy systems. For example, there is a 30% Solar ITC for solar electric and solar water heating systems through 2032, which helps reduce the payback period for installations. Many states also offer additional tax credits or rebates for renewable energy systems.

Utility and state rebate programs provide upfront discounts on the purchase and installation of qualifying systems. Popular options include solar panel rebates, rebates for Energy Star appliances, and rebates on electric vehicles and charging stations. These programs aim to incentivize customers to choose energy efficient and renewable solutions.

Some states and utilities offer performance-based incentives, which provide ongoing payments based on the amount of renewable energy generated. These help provide a steady revenue stream from renewable energy investments.

Low-cost financing programs from governments or utilities can assist with covering upfront costs, through options like low-interest loans, grants, and energy efficiency mortgages. These reduce borrowing costs and enable more consumers to invest in renewable energy.

It’s important to research available federal, state, utility, and local incentives where you live to maximize savings on renewable energy investments. Resources like the Database of State Incentives for Renewables & Efficiency provide details on current incentive programs (Source).

Conclusion

In summary, the best opportunities for investing in renewable energy lie in solar and wind power. Solar energy is seeing massive growth due to rapidly declining costs and supportive government policies. Residential and commercial solar installations are booming, creating opportunities for investors in solar panel manufacturers, solar installers, and solar leasing companies like SolarCity. Wind power is also poised for robust growth as costs have fallen dramatically and wind turbine technology has improved. Investing in wind energy companies with large project pipelines or wind turbine manufacturers like Vestas can provide solid returns.

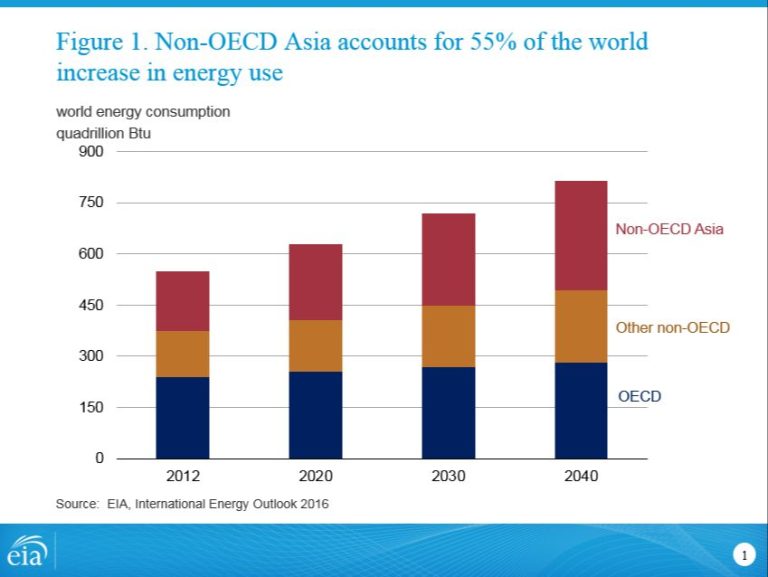

The outlook for renewable energy investment growth overall is very positive. Renewables are expected to comprise over 50% of new electricity capacity additions globally over the next decade, with solar and wind accounting for the majority. Government tax credits, clean energy targets, carbon pricing schemes and infrastructure investments will continue to incentivize the shift to renewables. As costs fall and technologies improve, renewables will become increasingly cost-competitive with fossil fuels, further accelerating investment flows. Individual and institutional investors alike have a tremendous opportunity to profit from the renewable energy revolution while enabling the transition to a clean energy future.