Who Owns The Biggest Energy Companies?

Energy companies play a crucial role in the global economy and geopolitics. The energy sector is responsible for locating, extracting, refining, transporting, and marketing fossil fuels such as oil, natural gas, and coal. These energy sources power homes, businesses, transportation, manufacturing, and more. With the world’s growing population and increasing standards of living, particularly in developing nations, demand for affordable and reliable energy continues to rise.

Fossil fuels currently supply over 80% of the world’s energy needs, with oil being the most consumed energy source. Major energy companies involved in oil and gas have extensive operations spanning multiple countries and continents. Their performance and strategic decisions can significantly impact energy prices and availability. As a result, the biggest energy companies wield immense economic power and influence over global markets and geopolitics.

Market Dominance

A small number of massive multinational corporations dominate the global energy market. According to S&P Global’s Top 250 energy company rankings, the top 5 companies alone account for over 15% of the total market capitalization.

The largest energy company in the world by market capitalization is Saudi Aramco, the state-owned oil company of Saudi Arabia. As of 2022, Saudi Aramco had a market cap of $2.1 trillion, giving it a 6% share of the global energy market by itself. Not far behind is ExxonMobil, the largest private oil company, with a market cap of $368 billion and over 1% market share.

Other oil and gas giants with substantial market share include Chevron, Shell, BP, TotalEnergies, PetroChina, and Petrobras. Many of these companies have interests across the entire energy supply chain from exploration and production to refining, marketing, and distribution. Their scale and reach gives them tremendous economic power and influence over energy markets.

Though the renewable energy sector is growing fast, it is still dwarfed in size by conventional hydrocarbon energy. However, some major renewable energy firms like Denmark’s Orsted and Spain’s Iberdrola are becoming competitive on the global stage.

State-Owned Enterprises

Many of the largest energy companies in the world are state-owned enterprises, with their shares owned by national governments. According to Nikkei Asia, three of China’s largest state-owned energy companies appointed new leaders in 2020. Countries establish state-owned enterprises to exert control over strategic resources and industries. The energy sector is often a key priority, given its importance to national economies and security.

Some of the biggest state-owned energy giants include Saudi Aramco, China National Petroleum Corp, Gazprom in Russia, PetroChina, and Petroleos Mexicanos. According to Nasdaq, companies like Gazprom and Rosneft have provided substantial dividends to the Russian government as majority shareholder. State ownership allows centralized control over energy assets and policy. However, it can also lead to inefficiency and bureaucracy without adequate transparency and governance standards.

Saudi Aramco

Saudi Aramco is Saudi Arabia’s state-owned oil company and is the world’s largest oil producer and exporter. It was founded in 1933 as the California-Arabian Standard Oil Company and later became fully owned by the Saudi government in 1980. Some key facts about Saudi Aramco:

Saudi Aramco has reserves of over 260 billion barrels of oil, far surpassing any other company in the world. Its daily production capacity is approximately 12 million barrels per day. The company owns the Ghawar field, the world’s largest conventional oil field, and the Shaybah field, the third largest (Source: https://www.quora.com/What-are-some-interesting-facts-about-Saudi-Aramco-worlds-biggest-and-most-profitable-company).

In 2018, Saudi Aramco generated $111 billion in net income, making it the world’s most profitable company by far. For comparison, Apple made $59.5 billion that same year. Aramco’s revenue was over $355 billion in 2018 (Source: https://www.theceomagazine.com/business/finance/the-worlds-most-profitable-firm-isnt-apple-google-or-amazon/).

Saudi Aramco employs over 70,000 workers worldwide, with expansive operations in exploration, production, refining, distribution, shipping, and research. Its refineries and integrated plants allow it to process approximately 5 million barrels per day. The company supplies around 10% of the world’s petroleum demand.

China Petroleum

China Petroleum, also known as Sinopec Group, is Asia’s largest oil refining, gas and petrochemical conglomerate. Headquartered in Beijing, it is the world’s third largest company by revenue and the second largest publicly traded oil company.

Founded in 1998, China Petroleum is a state-owned enterprise administered by China’s State-owned Assets Supervision and Administration Commission (SASAC). It has operations in over 30 countries across the globe.

China Petroleum’s core businesses are oil and gas exploration, refining, and marketing. It operates around 30,000 gas stations under various brand names in China. The company has major subsidiaries in areas like engineering, construction, chemicals, and finance. Its refining capacity exceeds one million barrels per day.

In recent years, China Petroleum has invested significantly in expanding natural gas and alternative energy operations as part of China’s overall strategy to increase use of cleaner energy sources. It is China’s largest producer of purified terephthalic acid, a raw material used to make polyester fibers and plastic bottles.

Gazprom

Gazprom is Russia’s massive natural gas company and the largest extractor of natural gas globally. The company produces over 10% of the world’s gas, and accounts for 17% of global natural gas reserves with over 72,000 billion cubic meters of natural gas reserves. Gazprom’s main business centers around exploration, production, transportation, storage, processing and sale of gas (source).

In addition to natural gas production and transportation, Gazprom is involved in oil production and generates electricity. The company owns the Unified Gas Supply System of Russia, the world’s largest gas transmission system covering over 172,000 km. Gazprom exports gas to over 30 countries across Europe, the CIS, Asia and North America. The Russian state owns a majority stake in Gazprom, with over 50% shares under its control (source).

With annual revenues of around $100 billion, Gazprom is a global energy giant. However, the company faces challenges in recent years due to increased competition, sanctions, and shifts in energy markets. Gazprom aims to transition towards lower carbon energy while maintaining its position as a leading global gas supplier (source).

ExxonMobil

ExxonMobil is the largest privately owned oil company in the world. It is headquartered in Irving, Texas and was formed in 1999 after the merger of Exxon and Mobil. Some key facts about ExxonMobil:

- It has annual revenues of around $300 billion and net income of $36 billion (2021 figures).

- It produces around 3.7 million barrels of oil equivalent per day.

- It has proved oil and gas reserves of around 15.2 billion barrels of oil equivalent.

- It operates 37 oil refineries and over 21,000 service stations worldwide.

- It is vertically integrated and involved in exploration, production, refining, transportation and marketing of petroleum products.

- It has major exploration and production operations in the U.S., Canada, Europe, Asia Pacific, Russia and the Caspian Sea region.

- It is ranked 9th on the Fortune Global 500 list of largest companies by revenue.

- It employs around 63,000 people worldwide (2022 figures).

Sources:

https://craft.co/exxon-mobil

Other Major Players

Other large energy companies include multinationals like Shell, BP and Chevron. Shell is one of the world’s largest oil and gas producers, generating billions in revenue annually (source). Though headquartered in the Netherlands, Shell has major operations around the globe. BP, headquartered in the UK, is another massive player, generating over $180 billion in revenue in 2021 (source). The company engages in exploration, refining, production and distribution of oil and gas globally. Chevron is an American multinational corporation and one of the world’s largest oil companies, with 2021 revenue of over $155 billion (source). Though smaller than some state-owned giants, Chevron has significant assets and produces substantial quantities of oil and natural gas.

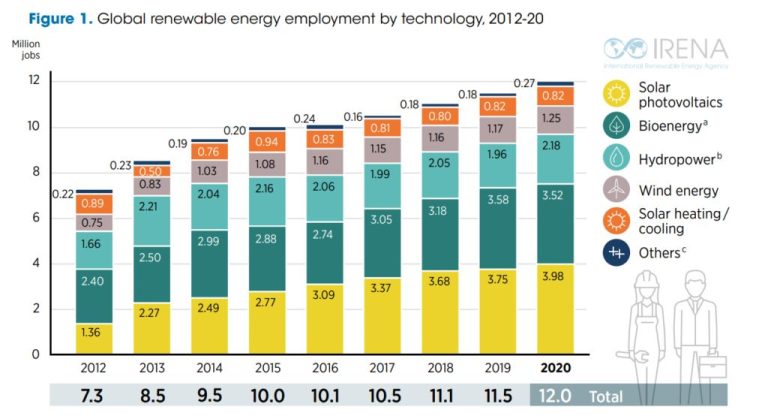

Renewable Energy Leaders

In recent years, renewable energy companies have risen to prominence as the world shifts towards cleaner energy sources. Some of the largest renewable energy firms include Vestas, Iberdrola, Orsted, and NextEra Energy.

Vestas, based in Denmark, is the world’s largest producer of wind turbines and leads the industry in wind technology innovations. The company has installed over 117 GW of wind capacity across 82 countries. Vestas saw its revenue grow to over $17 billion in 2021 as demand for wind power increased globally.

Spanish utility giant Iberdrola has become one of the world’s top renewable energy providers. The company owns wind farms, hydroelectric plants, solar power facilities, and biomass plants across Europe, the Americas, and Australia. Iberdrola continues to expand with billions invested annually into renewable energy projects.

Other leading clean energy firms like Orsted and NextEra Energy have also seen tremendous growth in recent years. These companies are positioning themselves to dominate the renewable power markets of the future through major investments in wind, solar, and other zero-emission technologies.

Conclusion

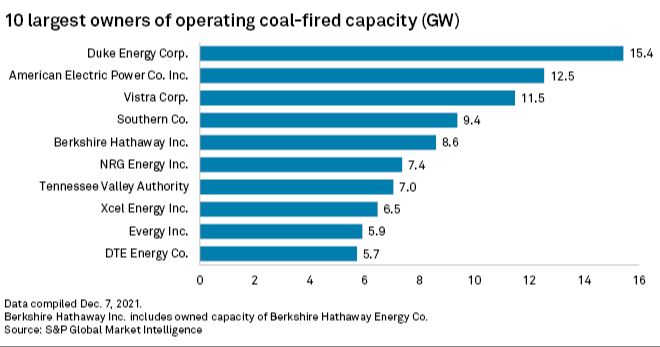

In review, the fossil fuel industry continues to be dominated by state-owned oil and gas conglomerates, with Saudi Aramco, China National Petroleum, and Gazprom topping the list as the world’s biggest energy companies by revenue. However, as concerns over climate change grow, major publicly traded oil giants like ExxonMobil face increasing pressure to shift toward renewable energy sources.

Looking ahead, the future energy landscape will likely see more diversity, with renewable energy companies joining the ranks of the industry’s power players. Though state-backed oil giants currently reign supreme, their dominance may gradually erode as solar, wind and other green technologies expand their reach and disrupt traditional energy markets. However, a total overhaul of the status quo will realistically take decades. For now, the titans of oil and gas remain firmly entrenched, but the growth of renewables foreshadows changes on the horizon.