What Are The Top 3 Energy Companies In World?

The global energy industry is dominated by massive companies generating billions of dollars in revenue. Of these companies, three stand out as holding the top three spots for the largest energy companies in the world: Saudi Aramco, Gazprom, and the National Iranian Oil Company. These companies not only generate tremendous revenue and profits, but also hold vast proven oil and gas reserves, produce millions of barrels of oil equivalent per day, and employ hundreds of thousands of workers. This article will explore the financials, operations, and other details of these three energy giants as a way of understanding why they rank as the top energy companies globally.

#1 – Saudi Aramco

Saudi Aramco is the state-owned oil company of the Kingdom of Saudi Arabia and a fully integrated, global petroleum and chemicals enterprise. As the world’s largest exporter of crude oil and natural gas liquids, Saudi Aramco manages the kingdom’s proved reserves of 336.7 billion barrels of oil equivalent. The company’s headquarters are located in Dhahran, Saudi Arabia.

According to Investopedia, Saudi Aramco began attracting increased international attention in the 2010s when it started publishing more details about its financials and operations [1]. In April 2019, just before its debut international bond sale which raised $12 billion, Saudi Aramco revealed that its net income in 2018 was $111.1 billion, making it the most profitable company in the world [1].

On December 11, 2019, Saudi Aramco debuted on the Tadawul stock exchange in Riyadh at a share price of 35.2 Saudi riyals, giving the company a market valuation of $1.7 trillion [2]. The IPO was the largest ever, raising $25.6 billion by selling 1.5% of the company. Saudi Arabia’s Crown Prince Mohammed bin Salman first announced plans for a stock market listing in 2016 as part of efforts to diversify the kingdom’s economy beyond oil [2].

#2 – Gazprom

Gazprom is Russia’s largest company and one of the largest natural gas companies in the world, headquartered in Moscow. As of 2014, it produced close to 70% of the natural gas in Russia. According to GlobalCapital, Gazprom is a major supplier of natural gas to Europe, providing about 25% of European gas demand. The company operates gas pipelines, gas storage facilities, gas processing plants and other gas-related infrastructure. Gazprom also has interests in electricity generation, oil production and financial services.

#3 – National Iranian Oil Company

The National Iranian Oil Company (NIOC) is the third largest energy company in the world. Headquartered in Tehran, Iran, NIOC is responsible for the exploration, drilling, production, distribution and export of oil and gas resources in Iran.

As a state owned company, NIOC was established in 1951 and reports directly to the Ministry of Petroleum. It is tasked with making policies and directing all aspects of the oil and gas industry in Iran. According to NIOC’s website, the company’s oil output increased 60% under the 13th administration and its CEO announced operations for 50 new projects worth $47.5 billion.

The company has a global presence, with subsidiaries and joint ventures in various countries. However, its operations can be limited by international sanctions. NIOC also provides various services related to the oil and gas industry within Iran.

Financial Metrics

When comparing the top 3 energy companies in the world by revenue and profitability, Saudi Aramco leads the pack. According to Yahoo Finance, Saudi Aramco generated over $329 billion in revenue in 2021, significantly higher than Gazprom at $117 billion and NIOC at $65 billion. Saudi Aramco also reported net income of $110 billion, dwarfing Gazprom at $24 billion and NIOC at $12 billion.

In terms of assets, Saudi Aramco tops the list with over $357 billion in total assets as of 2021, followed by NIOC at $248 billion. Meanwhile, Gazprom reported total assets of $367 billion in 2021 according to Macrotrends. Overall, Saudi Aramco leads the top 3 energy giants in revenue, net income and assets, underlining its position as the largest energy company in the world.

Global Presence

Saudi Aramco operates globally across the hydrocarbon value chain. With its headquarters in Dhahran, Saudi Arabia, Saudi Aramco has offices in places like Amsterdam, Beijing, Delhi, Detroit, Dhaka, Houston, Istanbul, London, New York, Shanghai, Singapore and Tokyo (https://www.aramco.com/en/about-us/our-offices-and-facilities). Saudi Aramco subsidiaries are also key players in the Indian, Chinese, Japanese and South Korean energy markets, serving as a major crude oil supplier.

Gazprom operates globally in exploration, production, transportation, storage, processing and sales of gas and other hydrocarbons. Headquartered in Moscow, Russia, Gazprom has subsidiaries in over 20 countries across Europe, Asia and Latin America (https://guides.loc.gov/oil-and-gas-industry/companies).

The National Iranian Oil Company (NIOC) operates oil and gas fields, refineries, petrochemical plants and gas pipelines primarily in Iran. NIOC exports its products globally, with major customers in Asia. It has developed partnerships and joint ventures with international oil companies to explore oil and gas opportunities outside of Iran.

Products and Services

Saudi Aramco is the world’s largest oil producer and exporter with oil and gas at the heart of its business. The company produces approximately one in every eight barrels of the world’s oil supply. Some of Saudi Aramco’s key products and services include:

– Oil exploration, production, refining, distribution, and marketing. Some of the products Saudi Aramco produces and sells include crude oil, condensate, natural gas liquids, refined petroleum products like gasoline, diesel and kerosene. According to the company’s website, its refining network around Saudi Arabia produces products for use in homes, businesses and industries.

– Petrochemicals such as ethylene, propylene, butadiene, benzene, polyethylene and polypropylene. Saudi Aramco develops high-value added petrochemicals and derivatives to support economic diversification and industrial development.

– Natural gas processing and production. Saudi Aramco participates across the gas value chain including exploration, production, processing and distribution. The company produces around 10 billion standard cubic feet per day of natural gas.

Gazprom is the world’s largest natural gas company focused on geological exploration, production, transportation, storage, processing and sales of gas and other hydrocarbons. Some of Gazprom’s key products and services include:

– Natural gas exploration, production, processing, storage and transportation via pipeline networks. Gazprom accounts for 12% of the world’s and 72% of Russia’s gas production.

– Crude oil and gas condensate production. Gazprom also produces oil from fields in Russia.

– Refined products from oil such as diesel, heating oil, jet fuel, lubricants, bitumen and more. Gazprom refines some oil in-house and also sells crude oil for refining.

– Electricity and heat energy generation and distribution utilizing gas and other fuels. Gazprom subsidiaries produce and sell electricity and heat.

The National Iranian Oil Company (NIOC) is responsible for oil and natural gas production, exploration, extraction, transportation and exportation in Iran. Key products and services include:

– Crude oil and natural gas exploration, production and exports. NIOC accounts for around 10% of OPEC crude oil production.

– Refined oil products like liquefied petroleum gas, gasoline, kerosene, jet fuel, diesel and fuel oil. NIOC operates numerous refineries with total capacity over 1.5 million barrels per day.

– Petrochemical products including fertilizers, plastics, resins, synthetic fibers and more. NIOC is involved in multiple petrochemical projects and joint ventures.

Recent Developments

Saudi Aramco recently announced plans to acquire a 30% stake in South Korean refiner Hyundai Oilbank for $1.24 billion. This acquisition will allow Saudi Aramco to expand its downstream operations and strengthen its presence in Asia’s fastest growing markets. Additionally, Saudi Aramco signed agreements to develop a $10 billion refining complex in China’s Northeast province of Liaoning. The complex will process 300,000 barrels of crude oil per day, further boosting Saudi Aramco’s downstream capacity in Asia (1).

Gazprom is moving forward with plans for the Power of Siberia 2 pipeline that will deliver natural gas from Western Siberia to China. The project is estimated to cost around $11 billion and will add up to 50 billion cubic meters per year of natural gas exports to China. Gazprom also signed a contract with Indian company H-Energy for the supply of 2.5 million tons of liquefied natural gas (LNG) annually over 20 years. This deal marks Gazprom’s expansion into India’s rapidly growing LNG market (2).

The National Iranian Oil Company signed a $740 million agreement with Persia Oil & Gas Industry Development Company to develop the Yaran oil field near the Iran-Iraq border. This strategic project aims to boost the country’s oil output capacity. Additionally, the National Iranian Oil Company entered a $300 million contract with Petropars Group to develop the Belal gas field in the Persian Gulf, which is expected to produce 500 million cubic feet of gas per day (3).

Industry Outlook

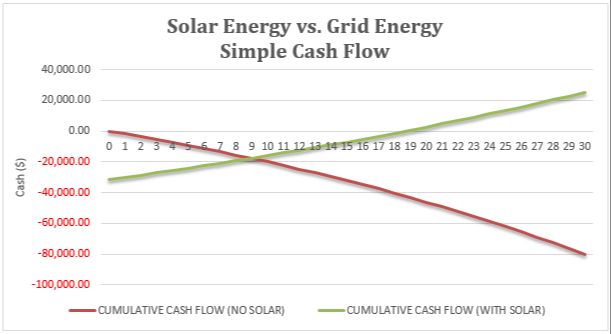

The energy industry is experiencing major shifts as the world transitions towards renewable energy sources. According to Alicia Knapp from the 2021 Kern County Energy Summit, key trends shaping the industry outlook include rapid growth in solar and wind power, decarbonization efforts by major corporations, and policy shifts towards emissions reductions.

Knapp notes that solar power capacity is projected to grow over 20% annually through 2025, while onshore wind power could see double digit growth globally in the coming years (2021 Kern County Energy Summit- Alicia Knapp – YouTube). Major corporations like Amazon, Apple, and Walmart have pledged to fully decarbonize operations through renewable power purchases. And over 120 countries have committed to net zero emissions by 2050.

These trends point to a future where renewables like solar and wind dominate new power generation. Though fossil fuels will remain a major part of the global energy mix, their growth is expected to slow. The International Energy Agency projects renewables reaching over 60% of global electricity generation by 2040, displacing coal and capping natural gas demand (BHE Renewables: Home).

Overall, the energy industry outlook is one of disruption and change. Though the transition brings challenges, it also presents opportunities for companies to innovate and adopt new clean energy technologies. The coming decades will likely see renewables transform electricity markets across the globe.

Conclusion

In summary, Saudi Aramco, Gazprom and the National Iranian Oil Company are currently the top 3 largest energy companies in the world by various metrics such as revenue, production and reserves. While the oil and gas industry faces challenges like the transition to renewable energy and geopolitical tensions, these companies will likely continue being energy powerhouses globally for years to come. Their scale, reach and dominance make them critical players in meeting worldwide energy demand. Looking forward, they will need to diversify, innovate and transform their businesses to remain competitive and sustainable. Though renewable energy presents challenges, these companies can leverage their vast resources to lead the industry into the future.

The top energy companies play a complex role on the global stage. This article provided an overview of their size and operations. However, many other factors beyond the scope of this piece contribute to their far-reaching impacts. Readers are encouraged to further explore the multifaceted challenges and opportunities facing these influential giants of the energy sector. Their decisions and performance have major ramifications for energy security, economic development and environmental sustainability worldwide.