Is Renewable Energy Cheaper Without Subsidies?

For many years, fossil fuels like coal and natural gas have been cheaper sources of energy than renewable options like solar and wind. However, in recent years the costs of renewable energy have fallen dramatically due to technology improvements that increase efficiency and scale up manufacturing. As a result, renewable energy is now cost competitive with or even cheaper than fossil fuels in many locations around the world. While renewable energy subsidies have helped drive down costs through economies of scale, the unsubsidized costs of wind and solar power have declined as well. The key question is whether renewables can become less expensive than fossil fuels on an unsubsidized basis globally. This analysis will examine the factors impacting the current and future costs of renewable energy compared to fossil fuels. The main thesis is that while renewable energy is not yet cheaper than fossil fuels without subsidies in most cases currently, costs are declining rapidly and expected to fall below fossil fuels in the coming decade in many regions.

Fossil Fuel Subsidies

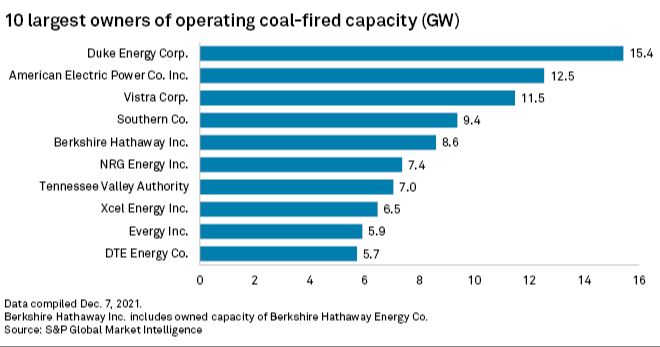

Governments around the world provide large subsidies for fossil fuel production and consumption. According to the IMF, global fossil fuel subsidies reached $5.9 trillion in 2020, which is equivalent to 6.8% of global GDP [1]. The IMF estimates that just eliminating fossil fuel subsidies would reduce global carbon emissions by over 20% [2]. Fossil fuel subsidies encourage wasteful consumption, disproportionately benefit higher income groups, and encourage emission-intensive energy generation [3].

The largest subsidy providers are China, the United States, Russia, and the European Union. In the US, federal fossil fuel subsidies totaled $72 billion in 2020. Subsidies include tax breaks, royalty relief, below-market lending, and insurance for oil and gas companies [1].

Renewable Energy Subsidies

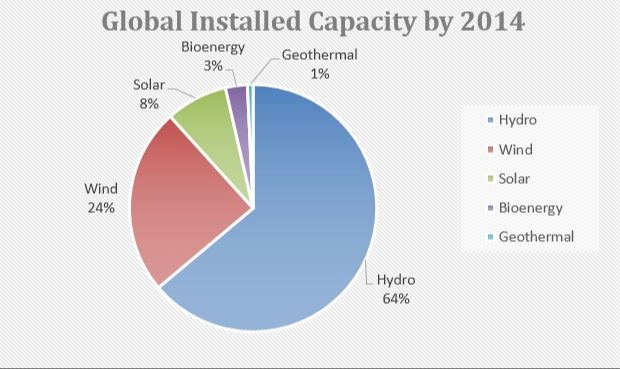

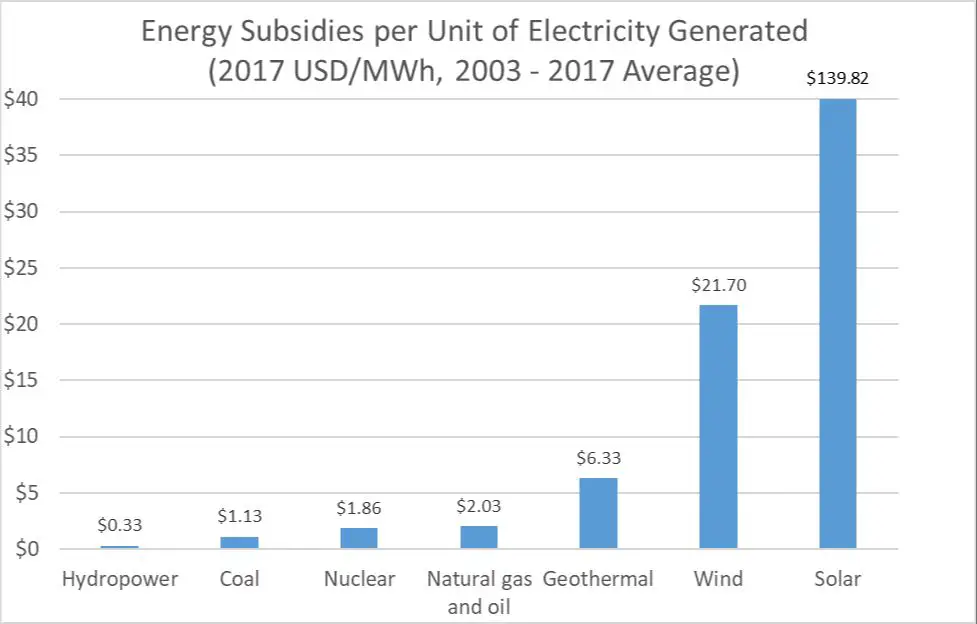

Governments around the world provide various subsidies to support renewable energy production and adoption. According to the Energy Information Administration, federal renewable energy subsidies in the United States more than doubled from $7.4 billion in fiscal year 2016 to $15.6 billion in fiscal year 2022 (EIA). These subsidies aim to accelerate renewable energy deployment, overcome cost barriers relative to fossil fuels, and reduce greenhouse gas emissions. The types of subsidies include tax credits, grants, rebates, loans, and incentive programs. The leading renewable energy technologies receiving subsidies are wind, solar, biofuels, hydropower, and geothermal. While fossil fuels receive even larger subsidies globally, renewable energy subsidies are rising rapidly as costs fall and adoption expands.

Renewable Cost Declines

The costs of renewable energy technologies like solar, wind, and batteries have declined rapidly over the past decade. According to the National Renewable Energy Lab (NREL), the median installed price of solar photovoltaic (PV) systems in the United States fell by 70% between 2010 and 2020, from around $7 per watt to $2 per watt (1). This dramatic cost reduction is attributed primarily to cheaper solar panels and improved installation efficiencies. The price decline trend is expected to continue, with some experts predicting an additional 50% drop in solar costs by 2025 (2).

Wind energy costs have also fallen substantially, with the levelized cost of electricity from new wind farms dropping by 41% between 2014 and 2020 according to Lazard estimates. This is due to taller wind turbines with longer blades and improved capacity factors. Offshore wind in particular is becoming competitive with other energy sources as costs fall.

Lithium-ion battery prices, critical for energy storage to support renewable growth, have declined by nearly 90% over the last decade (3). Further cost reductions are expected as manufacturing scales up. The declining costs of wind, solar, and storage technologies are making renewable energy increasingly cost-competitive with fossil fuel sources in many markets.

Grid Integration Challenges

Integrating large amounts of intermittent renewable energy like wind and solar power can pose challenges for grid management. Because the power output from these sources fluctuates based on weather conditions, it requires grid operators to continuously balance electricity supply and demand. This can incur additional costs related to upgrading transmission lines, forecasting generation, and operating reserve requirements.

According to a literature review by Synapse Energy, the integration costs for wind and solar are typically less than $5 per megawatt-hour (MWh) (Synapse, 2021). However, costs can vary considerably based on local grid characteristics and renewable energy penetration levels. A comprehensive review in Nature Energy found average integration costs ranging from $0.50 – $5.80 per MWh for wind and $0.27 – $8.78 per MWh for solar (Heptonstall et al., 2021).

The National Renewable Energy Laboratory (NREL) has modeled integration costs for specific U.S. distribution feeders, finding costs generally below $5/MWh even at penetrations over 50% renewable energy (NREL, 2022). However, higher costs have been estimated for solar penetrations exceeding 30% in some regions. Overall, while integrating renewables poses grid management challenges, costs appear manageable based on current research.

Carbon Pricing

Putting a price on carbon makes fossil fuels reflect true costs. Carbon pricing is an important policy tool for tackling climate change that involves setting a fee on carbon pollution to incentivize emission reductions and the transition to cleaner energy sources (What is Carbon Pricing?, n.d.). According to the World Bank, there are currently 64 carbon pricing initiatives implemented or scheduled, covering 22% of global greenhouse gas emissions (What is Carbon Pricing?, n.d.).

Carbon pricing changes the relative prices of carbon-intensive goods and services versus their lower carbon alternatives. This sends a powerful signal to consumers and firms, encouraging emission reductions across many parts of the economy (How will higher carbon prices affect growth and inflation?, 2023). Studies show that carbon pricing can reduce emissions cost-effectively while also generating revenue that can support fiscal stimulus and address impacts on low-income groups (What is Carbon Pricing?, n.d.).

However, carbon prices are often set too low to drive meaningful change. The IMF estimates carbon prices between $75-$100 per ton are needed by 2030 for major economies to reach net zero emissions (Five Things to Know about Carbon Pricing, 2021). Designing carbon pricing schemes that balance effectiveness and political viability remains an ongoing challenge.

Stranded Asset Risks

As the world transitions to a low-carbon economy, there is a risk that fossil fuel assets like coal, oil, and natural gas reserves will lose significant value or become “stranded assets.” This occurs when assets are no longer able to earn an economic return because of changes associated with the transition, such as carbon pricing, regulations, technology shifts, or changing consumer demand (Grantham Institute, 2022).

One study estimates that a third of oil reserves, half of gas reserves, and over 80% of coal reserves may become stranded by 2050 under a 2°C global warming target (Semieniuk et al., 2022). This represents trillions of dollars in potential losses. Companies and investors with significant fossil fuel holdings may see their assets devalued or written off entirely. Financial institutions may also be exposed through their lending portfolios. Overall, stranded assets present major transition risks for entities tied to fossil fuels that fail to adapt.

New Renewable Business Models

Innovative business models are emerging that are helping to drive down the costs of renewable energy. Some examples include:

Community solar or shared solar allows utility customers to subscribe to a portion of a larger solar array located elsewhere. This makes solar power accessible to renters or those whose rooftops are not suitable. The Green Rhino Energy business model manual highlights examples like CleanChoice Energy which aggregates customers in community solar projects.

Corporate renewable energy purchasing through power purchase agreements provides companies with long-term fixed pricing on renewable electricity. This provides a stable revenue stream for new renewable projects. The C40 Cities Climate Leadership Group highlights examples like Apple, Google, and Amazon making large corporate renewable energy commitments.

Peer-to-peer energy trading allows consumers like homeowners with solar panels to sell excess electricity to their neighbors rather than just feeding it back to the grid. This increases the value of rooftop solar. Startups like Power Ledger provide blockchain-enabled platforms to facilitate these transactions.

These innovative business models are making renewable energy more accessible and economically viable across the board.

Developing World

Renewable energy has become increasingly competitive even in developing nations without extensive energy infrastructure. According to the UN Conference on Trade and Development (UNCTAD), the annual investment needed for developing countries to transition to renewable energy is approximately $5.8 trillion from 2023 to 2030, equal to 19% of their combined GDP. However, this cost is offset by long-term savings from switching away from volatile fossil fuel imports. Renewables can accelerate access to electricity in remote and rural areas through decentralized systems like solar microgrids. The International Energy Agency is working with developing nations to cut the costs of deploying renewable energy by focusing on areas like power system flexibility, transmission lines, and energy efficiency.

Conclusion

In summary, while renewable energy has become cheaper in recent years thanks to technology improvements and economies of scale, subsidies still play an important role. Fossil fuels receive large direct and indirect subsidies in most countries, which can make them seem artificially cheap. Renewable energy subsidies help level the playing field and address externalities like pollution and climate change that are not factored into fossil fuel prices.

Going forward, renewables are likely to become even more cost competitive as they scale up further. However, integrating large amounts of variable renewables will require additional investments in grid flexibility and storage. Well-designed power markets, carbon pricing, and phase out of fossil fuel subsidies can accelerate the transition. But renewables may still depend partly on subsidies in some markets for awhile, especially in the developing world where upfront costs can be prohibitive. Overall the long-term trajectory is clearly towards cheaper renewables, but getting there may still require subsidies and supportive policies for the next decade or more.