Who Are Novozymes Competitors?

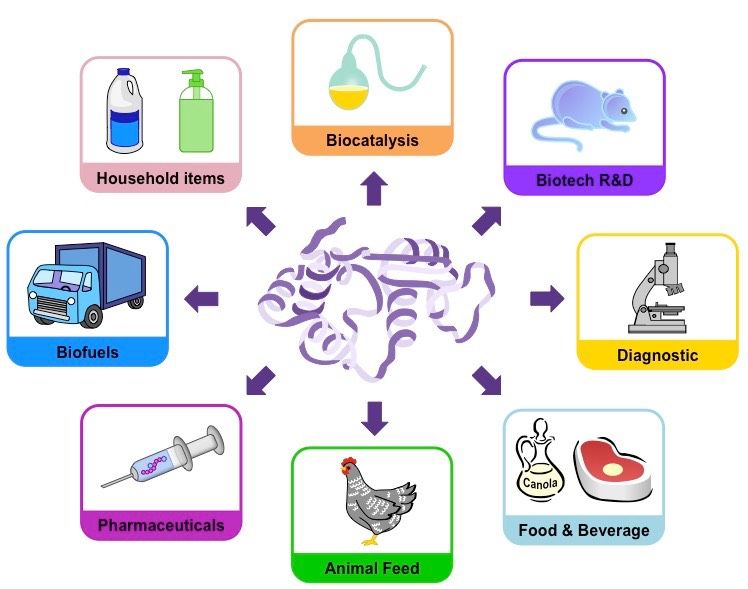

Novozymes is a Danish biotechnology company and the world’s largest producer of industrial enzymes. The company plays a significant role in the enzyme industry with an estimated 48% market share in industrial enzymes as of 2020. Novozymes market share of enzymes. Novozymes produces enzymes used in a variety of industries including food, feed, bioenergy, textiles, and more. Enzymes are proteins that act as catalysts and speed up chemical reactions. The growing demand for sustainable and environmentally-friendly solutions has increased the use of industrial enzymes as an alternative to harsh chemicals.

DSM

DSM is a Dutch multinational company based in the Netherlands that specializes in health, nutrition and bioscience. DSM is a major producer of enzymes and other ingredients for food, dietary supplements, personal care, biofuels, textiles and more. According to Industrial Enzymes Market Size, Share, Growth Opportunities, DSM held a market share of 9% in the industrial enzymes industry in 2021, making it one of the top players in this market.

DSM offers a wide range of enzymes including amylases, cellulases, lipases, and proteases. These enzymes are used in various applications like starch processing, textiles, bioethanol production, detergents, food processing and more. DSM focuses on innovation in enzyme technology and works to optimize enzymes for customers’ specific needs and applications.

In addition to enzymes, DSM produces vitamins, carotenoids, nutritional lipids and other specialty ingredients for food, dietary supplements and personal care products. The company has a strong focus on sustainability and works with partners throughout its value chains to improve environmental and social impacts.

BASF

BASF SE is a leading German chemical company headquartered in Ludwigshafen that produces and markets enzymes globally.

BASF has over 21 production sites for enzymes and probiotics. The company offers a broad portfolio of enzymes for human and animal nutrition, as well as industrial applications like biofuels, biochemicals, and natural plastics. In 2021, BASF generated €1.95 billion in sales from enzymes and probiotics.

Recently, BASF invested €30 million to expand production capacity of vitamins and enzymes for animal nutrition at its site in Ludwigshafen. The new enzyme plant has already started production and will supply larger quantities of feed enzymes for livestock farming as of 2022.

BASF continues to strengthen its global production footprint for enzymes. In 2021, the company announced plans to build a new production facility for enzymes in Ludwigshafen. With the new plant, BASF aims to meet rising global demand for sustainable solutions for detergents, food, feed as well as pharmaceutical applications.

DuPont

DuPont is a major American chemical company that has invested heavily in industrial biotechnology. The company generated over $12 billion in revenue in 2022, with a significant portion coming from its nutrition and biosciences division focused on industrial biotech [1]. DuPont has dedicated research facilities and production sites working on industrial enzymes, biopolymers, and other bio-based materials. The company sees industrial biotech as a strategic growth area and has made multiple acquisitions to expand its capabilities, including DuPont Industrial Biosciences which it acquired in 2015. Key industrial biotech products from DuPont include biopolymers like Sorona and enzymes used in ethanol production, food processing, and detergents.

Chr. Hansen

Chr. Hansen is a Danish bioscience company and a major global provider of cultures, enzymes, probiotics and natural colors for the food, nutritional, pharmaceutical and agricultural industries. According to their Fact Sheet, Chr. Hansen generated revenue of €1.33 billion in 2022/2023. The company focuses on producing ingredients for food and health industries based on microbial solutions.

As per their company overview, Chr. Hansen is the world’s largest food cultures and dairy enzymes producer and a leading manufacturer of natural colors, probiotics, enzymes and biosolutions for agriculture. The company aims to improve food and health for consumers globally through natural biosolutions. Chr. Hansen has operations in over 30 countries and employs around 3,600 people worldwide.

In a press release, Chr. Hansen reported 9% organic revenue growth in 2021/2022 to €1.22 billion, mainly driven by increased sales volumes. This highlights Chr. Hansen’s position as a major player in the food ingredient and bioscience markets.

Advanced Enzyme Technologies

Advanced Enzyme Technologies is an Indian manufacturer of enzymes focused on pharmaceutical, nutrition, and animal feed applications (Source). Based in Thane, Maharashtra, Advanced Enzyme Technologies was founded in 1989 and currently has manufacturing facilities in Nashik, Maharashtra as well as the United States. Since its inception, Advanced Enzyme Technologies has grown rapidly to become one of the leading providers of enzymes in India. It posted revenues of $83 million USD in fiscal year 2019.

Advanced Enzyme Technologies sells three main types of enzymes for the pharmaceutical industry including proteases, lipases, papain, and bromelain. These enzymes are used as active ingredients in anti-inflammatory drugs and to improve digestion. For the nutrition industry, Advanced Enzyme Technologies offers digestive enzymes like lactase and lipase to help digest fats, proteins, and carbs. They also provide enzymes for the animal feed industry such as phytase and non-starch polysaccharides to promote efficient nutrition absorption in livestock (Source).

Looking ahead, Advanced Enzyme Technologies aims to expand its global footprint, particularly in Europe and the United States. It also plans to grow through strategic acquisitions. In 2019, Advanced Enzyme Technologies acquired Germany-based enzyme manufacturer, SciTech Specialties, for $5.5 million USD (Source).

Amano Enzyme Inc.

Amano Enzyme Inc. is a Japanese biotechnology company that produces enzymes for food and pharmaceutical use. Founded in 1949 and headquartered in Nagoya, Amano Enzyme is a manufacturer of specialty enzymes used in the food, pharmaceutical, leather, and detergent industries (Growjo). The company has a global footprint, with subsidiaries and factories located in the United States, China, Singapore, France, and Germany.

Amano Enzyme generates an estimated annual revenue between $5 million to $10 million according to Cience (Cience). The company offers over 700 enzyme products and enzyme mixtures used in baking, meat processing, palm oil extraction, and other food applications. Amano also produces enzymes for pharmaceutical processes like peptide and amino acid synthesis. As a specialist enzyme company, Amano competes with other industrial enzyme manufacturers like BASF, DuPont, and Novozymes.

AB Enzymes

Like Novozymes, AB Enzymes is a German manufacturer and supplier of enzymes for industrial and consumer applications. AB Enzymes specializes in providing enzymes for bread baking as well as the animal feed industry.

According to their website, AB Enzymes offers over 500 different enzyme products and enzyme preparations for various industries. Some of their main application areas include baked goods, animal nutrition, starch processing, and technical enzymes.

In the baked goods segment, AB Enzymes provides enzymes such as amylases, xylanases, lipases and oxidases to help improve dough rheology, crumb structure, and other properties. For animal feed, they offer phytase, xylanase, β-glucanase and other enzymes to increase digestibility of nutrients.

Compared to Novozymes, AB Enzymes has a smaller product portfolio and less diversity in their application areas. However, they have built strength and expertise around enzymes for baking and animal feed – two major markets where Novozymes is also active. This makes them a direct competitor in those segments.

Sunson Industry Group

Sunson Industry Group Co., Ltd is a Chinese enzyme producer that serves a broad range of industries. Founded in 1996, Sunson was the first local company in China to produce cellulase enzymes using submerged fermentation technology (Sunson Industry Group Co., Ltd). Today, Sunson has over 9 different business divisions and an R&D center dedicated to strain research and development. The company produces enzymes like cellulase, protease, lipase, and more, which are used in detergent, textile, biofuel, food, feed, and other applications (Sunson Industry Group Co., Ltd. – Cellulase, Protease). As a full-scale enzyme producer in China, Sunson provides R&D, manufacturing, and sales/distribution services.

Conclusion

Novozymes faces competition from several major players in the industrial enzymes market, including DSM, BASF, DuPont, Chr. Hansen, Advanced Enzyme Technologies, Amano Enzyme Inc., AB Enzymes, and Sunson Industry Group.

Novozymes holds a leading position in the global market for industrial enzymes and has maintained strong sales and profits even amidst increasing competition. The company has a diverse product portfolio, a focus on research and innovation, and long-standing client relationships that help it maintain a competitive advantage. While new players are entering the market, Novozymes’ scale, expertise and continued investment in new technologies ensure it remains a dominant force in industrial biotechnology.