Where Is The Most Renewable Energy Equipment Manufactured?

The manufacturing of renewable energy equipment has rapidly expanded over the past decade, driven by the growth in renewable electricity generation worldwide. Renewable energy sources, such as solar, wind, hydro, bioenergy, and geothermal, accounted for 28% of global electricity generation in 2020, up from 24% in 2015 (Mordor Intelligence, 2023). Government policies, declining technology costs, and corporate sustainability goals have spurred investments into renewable energy manufacturing capacity and supply chains globally.

China

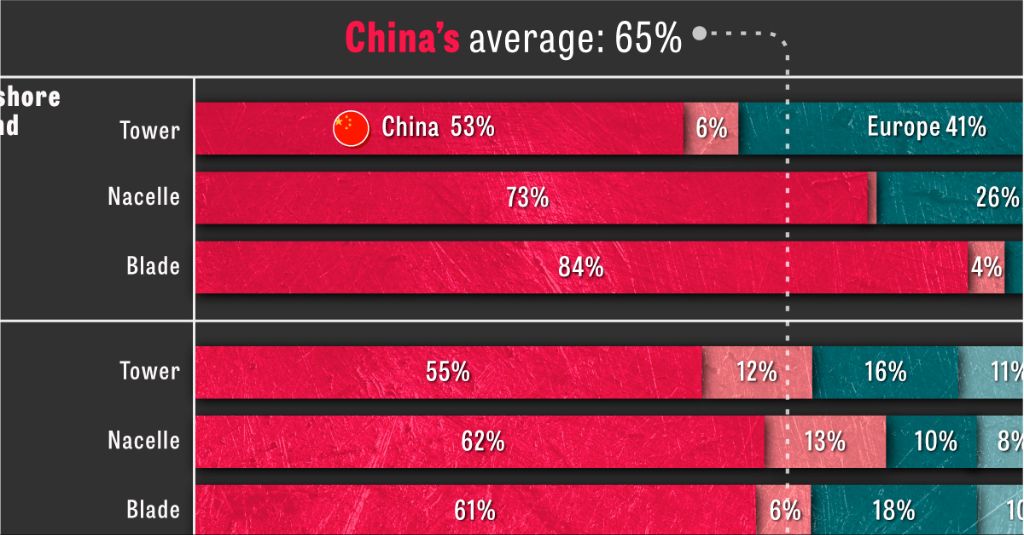

China leads the world in the manufacturing of equipment for renewable energy, including wind turbines, solar panels, and batteries. According to Reuters, China produces about two-thirds of the world’s solar panels, wind turbines and lithium-ion batteries for electric vehicles [1].

The scale of China’s production capacity across the renewable energy supply chain is immense. China accounts for over 80% of global solar panel production and over 60% of lithium-ion battery cell manufacturing [2]. For wind turbines, China produces well over 50% of the world’s towers, blades and other components.

This massive production capacity has been built up rapidly, with China investing billions in renewable energy manufacturing facilities over the past decade. Going forward, China is expected to maintain its dominance in renewables equipment production as its domestic market continues to grow and exports keep rising.

United States

The United States has rapidly expanded its renewable energy equipment manufacturing capacity over the past decade. According to a report by Wood Mackenzie, investments spurred by the Inflation Reduction Act will add over $114 billion to U.S. renewable energy manufacturing by 2031.

The U.S. is currently one of the world’s largest producers of wind turbines, with factories across states like Iowa and Colorado. Major wind turbine manufacturers with production facilities in the U.S. include GE Renewable Energy, Vestas, and Siemens Gamesa.

For solar panels, the U.S. has historically lagged behind Asia in manufacturing capacity. But new investments are expected to drastically increase U.S. solar manufacturing this decade. Major new solar factories have recently opened or are planned in states like Alabama, Ohio, and Texas.

The Inflation Reduction Act includes key incentives to boost U.S. clean energy manufacturing, like an investment tax credit for facilities producing solar panels, wind turbines, batteries, and critical minerals processing.

“The IRA will completely reshape the renewables supply chain in the U.S., incentivizing companies to build new clean energy equipment factories across the country,” said Voith Hydro, a hydropower equipment manufacturer investing in U.S. facilities.

Germany

Germany is a major producer of renewable energy equipment, particularly solar panels and wind turbines. According to the U.S. Commercial Service, Germany produced equipment for over 45 gigawatts of solar power and 15 gigawatts of wind power in 2019 (Source). The country is home to major manufacturers of solar panels like SolarWorld and wind turbine companies like Enercon.

Germany’s strength in renewable energy equipment production is driven by its Energiewende policy, which promotes the transition to renewable energy. The policy has spurred rapid growth in installed solar and wind capacity. Germany had over 49 GW of installed solar PV capacity and over 59 GW of installed wind capacity as of 2019, making it a leader in both technologies globally (Source). This domestic market has allowed German manufacturers to scale production and gain expertise in renewable energy technologies.

India

India has emerged as a major solar panel manufacturing hub in recent years. The country has an installed solar capacity of over 40 gigawatts (GW) and is targeting 100GW of solar capacity by 2022.http://mnscompany.com/vhttwq8f/sofar-company.html India’s domestic solar manufacturing industry is still relatively young, but it has grown rapidly thanks to supportive government policies and programs. Major Indian solar manufacturers include Vikram Solar, Waaree Energies, Indosolar, and Tata Power Solar. These companies produce solar photovoltaic (PV) cells, modules, and related components for both domestic use and export.

The state of Gujarat has become a major solar manufacturing cluster, with large factories established by major companies like Adani. Other states with significant solar production include Tamil Nadu, Andhra Pradesh, and Telangana. The Indian government has introduced several policy initiatives to boost domestic solar manufacturing and reduce reliance on imports from China. These include subsidies, low-interest loans, tax breaks, and mandates for government agencies to source solar products locally.

Analysts estimate India’s current solar module and cell manufacturing capacity at around 10 GW per year. With rising demand fueled by India’s renewable energy goals, the country is expected to continue expanding its solar manufacturing base and become an increasingly important player globally.

Japan

Japan has become a major player in renewable energy equipment production, especially in solar panels and batteries. The country is home to some of the world’s largest solar panel manufacturers such as Sharp, Kyocera, and Panasonic. These companies have invested heavily in solar panel production plants and R&D facilities across Japan.

In addition, Japan is a leading producer of lithium-ion batteries, which are used to store energy from solar panels and wind turbines. Major battery makers like Panasonic, Sony, and Hitachi have manufacturing facilities in Japan dedicated to producing high-quality lithium-ion batteries. The batteries are not only used domestically but also exported around the world for use in electric vehicles and energy storage systems.

The Japanese government has actively promoted the renewable energy industry through policy incentives like feed-in tariffs. As a result, Japan has cultivated a robust domestic market for solar panels and batteries. The established manufacturing base and strong home market have enabled Japanese companies to become globally competitive producers and exporters of renewable energy equipment.

South Korea

South Korea is one of the largest manufacturers of renewable energy equipment, especially in the areas of batteries and wind turbines. According to research from Statista, 53% of all new and renewable energy companies in South Korea in 2021 were power generation equipment manufacturers. Much of this equipment is exported around the world.

South Korea is particularly focused on manufacturing lithium-ion batteries for electric vehicles and energy storage. Major South Korean battery manufacturers include LG Chem and Samsung SDI. The country aims to capture over 30% of the global EV battery market by 2030, according to the Korea Trade Investment Promotion Agency (KOTRA).

In wind power, South Korea is home to one of the top wind turbine manufacturers globally – Doosan Heavy Industries. Doosan is among the world’s top 5 suppliers of wind turbines and has installed over 5,800 wind turbines worldwide as of 2020. South Korea also has ambitions to expand offshore wind capacity both domestically and via exports. The government has set targets for 12 GW of offshore wind installations by 2030.

Rest of Europe

Other countries in Europe besides Germany are also major producers of renewable energy equipment. Spain has become a leader in wind energy, ranking in the top 5 globally for wind power capacity according to the Global Wind Energy Council. Major Spanish wind turbine manufacturers include Siemens Gamesa and Vestas, which have factories across Spain.

Denmark is another major producer of wind turbines, with Vestas and Siemens Gamesa operating major facilities there. Vestas alone has produced and installed over 60,000 wind turbines from Denmark. Other Nordic countries like Finland and Sweden also have a strong renewable energy manufacturing presence.

Outside of wind, countries like France and Italy have major solar panel production and manufacturing facilities. According to the European Commission, Europe accounts for about 4% of global solar panel production, with most manufacturing concentrated in Germany, Spain, France and Italy.

Overall, the renewable energy industry employs over 1.5 million people across the EU, with solar PV representing the largest share at around 35%. Other equipment like smart grids, storage and heat pumps are also increasingly being produced in Europe.

https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Renewable_energy_statistics

Emerging Markets

Emerging markets are experiencing rapid growth in renewable energy manufacturing and installation. Countries like Brazil, Mexico, India, South Africa, and others are investing heavily in solar, wind, and other renewable technologies to meet rising energy demand and reduce reliance on fossil fuels.

According to the World Economic Forum, emerging economies could obtain up to 80% of their electricity from renewable sources by 2030, with solar and wind likely accounting for the majority (source). Key drivers include declining costs, supportive government policies, and the need for energy access and security.

Brazil, for example, increased its installed renewable energy capacity by 48% between 2014-2019, with most growth in wind power. Major manufacturers like WEG and Tecsis have opened factories to produce wind turbines domestically. Mexico is seeing booms in both solar and wind energy, aided by clean energy auctions, with companies like Acciona and Vestas building manufacturing plants.

With their large populations and growing energy appetite, emerging economies are poised to reshape renewable energy supply chains globally. Their markets will be instrumental in driving scale, innovation, and cost reductions across the industry.

Conclusion

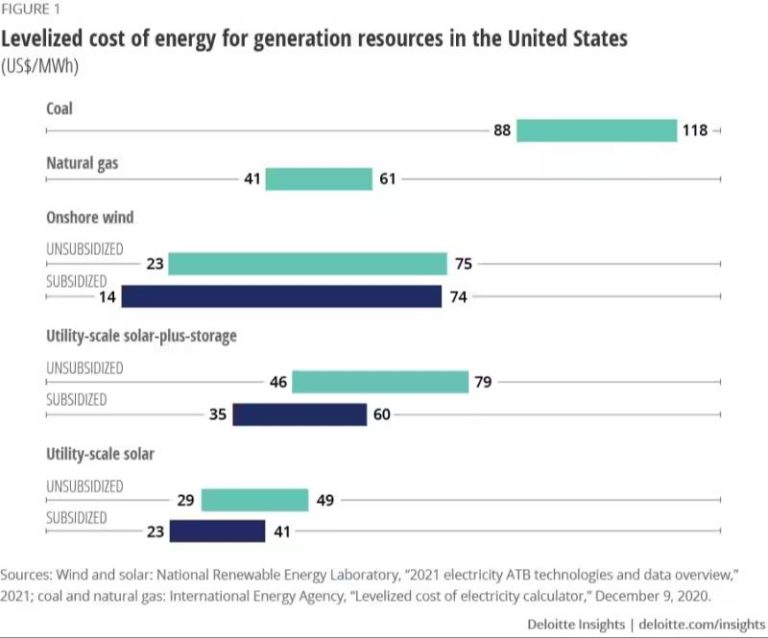

In summary, the major renewable energy equipment manufacturing countries are China, the United States, Germany, India, Japan, and South Korea. China leads globally, producing over 70% of solar panels and 45-50% of wind turbines. The United States and Germany follow, with strong domestic renewable energy markets driving demand. India is emerging as another major solar equipment manufacturer. Meanwhile, Japan and South Korea have strengths in high-tech renewable energy components. Across the board, technological improvements and falling costs are enabling renewables to compete with fossil fuels in more markets.

Going forward, China will likely maintain dominance, though its market share may decrease as other regions expand manufacturing capacity. Developing countries are expected to ramp up renewable energy installation and localization of equipment production. Overall, the transition to renewable energy is spurring major manufacturing industry growth and geographical shifts.