What Percentage Of Solar Panels Are Produced In China?

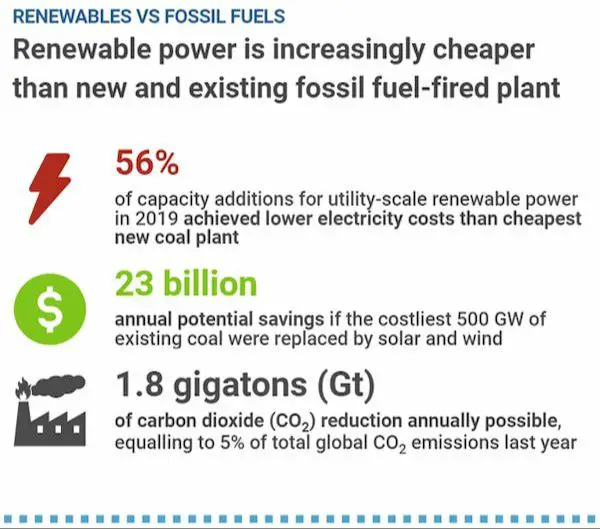

Solar panels have become an increasingly important source of renewable energy globally. Installed solar photovoltaic capacity reached over 1,115 gigawatts worldwide by the end of 2021, supplying over 4% of the world’s electricity demand. With the costs of solar panels dropping dramatically in the past decade, more homes and businesses are adopting solar to reduce their carbon footprint and electricity bills.

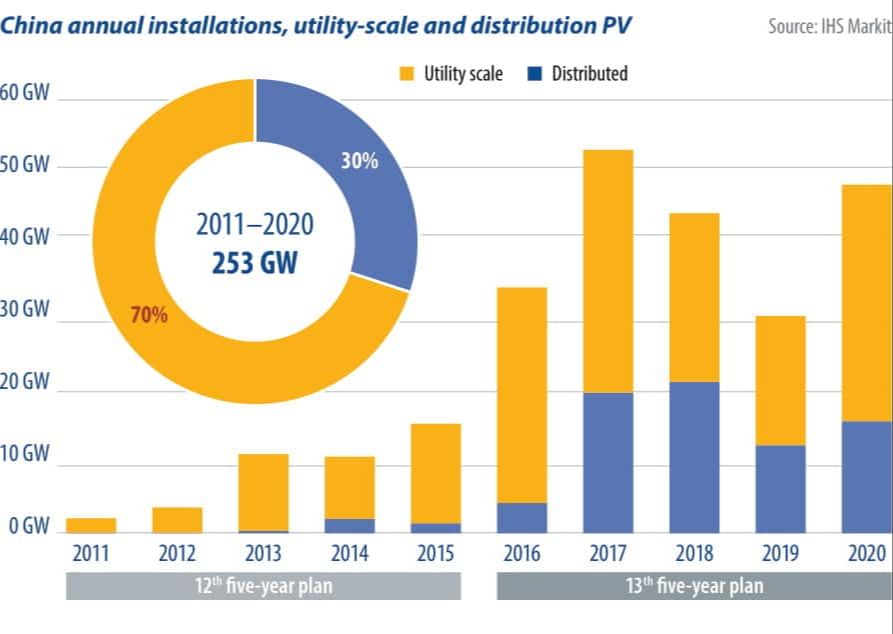

While solar panels are installed all around the world, their production and manufacturing is heavily concentrated in one major region – China. Over the past two decades, China has invested heavily in building up solar panel production capacity and integrated supply chains. Today, China accounts for over 80% of the world’s solar panel production.

China’s Dominance in Solar Panel Production

China has emerged as the dominant global producer of solar panels over the past decade. According to Forbes, China’s share of global solar panel production leapt from less than 10% in 2000 to about 50% of total output by 2011. Another report confirms that China accounted for around half of solar panel production globally by 2011 (Damien Block).

This rapid growth demonstrates how China has come to dominate worldwide solar panel manufacturing in a short period of time. Through heavy investment and supportive government policies, Chinese solar companies now supply around half of the world’s solar panels.

Major Chinese Solar Panel Producers

China is home to many of the world’s largest solar panel manufacturers. According to IHS Markit, of the top 10 solar module producers globally in 2019, 7 were based in China1. Some of the major Chinese companies producing solar panels include:

JinkoSolar – Founded in 2006, JinkoSolar is currently one of the largest solar panel suppliers in the world. The company has production facilities in China and offices globally. In 2019, JinkoSolar shipped around 14.3 GW of solar panels.

JA Solar – Established in 2005, JA Solar is a leading manufacturer of high-performance solar panels. The company has production bases in China, Malaysia and Vietnam. JA Solar shipped around 10 GW of solar panels in 2019.

Trina Solar – Founded in 1997, Trina Solar is one of the oldest and largest solar companies in China. It has module and cell production facilities in China and Vietnam. Trina Solar delivered around 10.6 GW of solar modules in 2019.

Canadian Solar – Though headquartered in Canada, the majority of Canadian Solar’s manufacturing capacity is located in China. The company shipped around 8.6 GW worth of solar modules in 2019.

Other major Chinese solar panel producers include Risen Energy, Chint Group and LONGi Solar.

Cost Advantages for Chinese Producers

Chinese solar panel manufacturers benefit from several cost advantages that allow them to produce panels at a lower cost than competitors in other countries. Some of the key factors contributing to the lower costs of Chinese producers include:

Labor costs in China are significantly lower than in developed countries. Solar panel production is a labor-intensive industry, so cheaper wages provide a major cost advantage. According to a study by the Lawrence Berkeley National Laboratory, labor accounts for only 10% of the total cost of a solar panel produced in China, versus 22% in the United States (Source).

China’s enormous production scale also leads to lower costs. The country produces over 70% of the world’s solar panels, allowing manufacturers to achieve economies of scale not possible in smaller markets. Large factories can spread fixed costs over a high volume of production (Source).

Chinese firms have developed sophisticated supply chains and industrial clusters supporting solar manufacturing. This grants proximity to low-cost inputs like glass, aluminum frames, and silicon. Established infrastructure for making solar components further reduces costs.

Government Support in China

The Chinese government has provided substantial support to grow the domestic solar industry through various subsidies, incentives, and initiatives. According to a report from the National Renewable Energy Laboratory (NREL), major financial incentives include subsidies, tax-related incentives, custom duties, and pricing incentives (source). For example, China’s central government created incentives for domestic solar demand as part of broader economic stimulus efforts (source). The U.S. Department of Energy notes that Chinese solar manufacturers have benefited from government loans, tax incentives, export subsidies, and cheap land from local governments.

Growth of Chinese Solar Panel Exports

China has grown into the dominant global exporter of solar panels over the last decade. According to Ember Climate, China’s exports of solar panels grew 34% in the first half of 2023 compared to the same period in 2022, reaching 114 GW worldwide.1 This represents over three-quarters of total global module exports. By contrast, exports from other major manufacturing hubs like Vietnam and Malaysia pale in comparison.

A key destination for Chinese solar panel exports is Europe. Despite efforts by the EU to reshore more solar manufacturing, China exported 27 GW worth of solar panels to Europe in the first half of 2023, up 15% from the prior year.2 The US is another major market for Chinese solar, importing 18 GW in H1 2023.3 The growth of exports reflects surging worldwide demand for solar even as some regions aim to reduce reliance on China.

Quality Concerns

Chinese solar panels have faced some scrutiny regarding quality and durability. In the early 2010s, there were a number of reports about some Chinese solar panels failing earlier than expected or not performing to their rated specifications1. This led to negative perceptions about Chinese panel quality.

However, major Chinese manufacturers have made efforts to improve quality control and testing. For example, companies like JA Solar, Trina Solar, and JinkoSolar have received ISO 9001 certifications for their quality management systems2. Many now produce panels that meet international standards and pass third-party reliability tests.

While low prices from some smaller producers may still raise concerns, major Chinese brands are now seen as offering good value and reasonable quality for most applications. Independent testing has shown significant improvements over early products. Still, durability can vary across manufacturers, so sourcing quality suppliers remains important.

Competitiveness of Other Regions

While China currently dominates global solar panel production, other regions like the US and Europe are making efforts to increase their competitiveness in this industry.

The US solar industry has benefitted from federal tax credits, loans and grants that have stimulated demand and supported domestic manufacturing. Major US solar companies like First Solar and SunPower have invested in expanding production capabilities. However, it has been challenging for US manufacturers to match the low costs of Chinese producers.

Europe was formerly a leader in solar panel production through companies like SolarWorld in Germany. But many European producers have struggled to compete with low-cost imports from China and some have gone bankrupt or shifted production overseas. The European Union has imposed some anti-dumping duties on Chinese solar panels to help protect European manufacturers.

Some emerging solar markets like India and Southeast Asia are also building up domestic production capacities to supply their growing demand and reduce reliance on imports from China.

Overall, while China will likely maintain dominance in solar panel production, other regions are making efforts to expand manufacturing and support more of the solar supply chain domestically.

Future Trends

Looking ahead, China is projected to maintain its dominant position in solar panel production and expand its global market share even further. According to the International Energy Agency (IEA), based on manufacturing capacity under construction, China’s share of global polysilicon, ingot and wafer production will soon reach almost 95% (IEA Solar Supply Chain Report). Wood Mackenzie, an energy research and consultancy group, predicts that China will have over 80% of the world’s solar manufacturing capacity through 2026 and will be capable of satisfying all global demand for solar panels (Reuters).

This continued growth is driven by China’s competitive advantages, including economies of scale, vertically integrated production, favorable policies, and access to raw materials and low-cost labor. Barring any major disruptions, China is poised to consolidate its commanding position in solar panel manufacturing this decade.

Conclusion

In summary, China has emerged as the dominant force in global solar panel production and exports. Chinese companies now account for over 70% of the world’s solar panel supply. This leading position is due to several key factors:

China’s massive investments in manufacturing capacity, economies of scale, and highly efficient production have led to lower costs compared to other regions. This cost advantage, combined with generous government subsidies, has enabled Chinese firms to rapidly gain market share.

The Chinese government has also provided strong policy support to grow its domestic solar industry, including targets for solar adoption and funding for R&D. This has spurred the rapid growth of Chinese solar companies.

While quality and performance issues plagued some early Chinese panels, major producers have improved standards and are now viewed as comparable to Western brands. As solar power expands globally, China is likely to maintain a commanding role in solar panel production and exports for the foreseeable future.