What Is The Inflation Reduction Act For Solar Manufacturing?

The Inflation Reduction Act was signed into law in August 2022 and represents historic action by Congress to address climate change and advance clean energy in the United States. The legislation includes major investments aimed at reducing greenhouse gas emissions and accelerating the country’s transition to renewable energy sources like solar and wind power.

Some of the key goals of the Inflation Reduction Act around climate change and clean energy include:

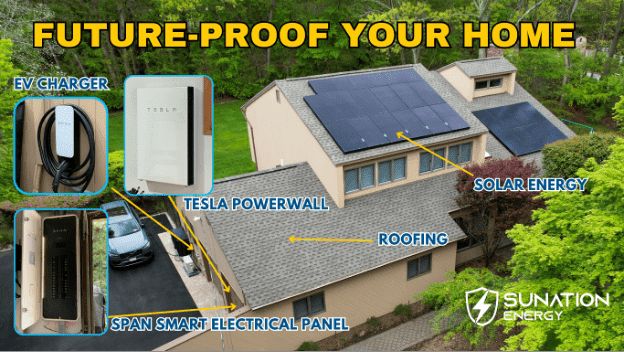

- Providing tax credits and rebates to make rooftop solar installations more affordable for homeowners

- Investing in domestic solar panel and battery manufacturing to strengthen American clean energy supply chains

- Funding initiatives to electrify the transportation sector and make electric vehicles more accessible to consumers

- Supporting the deployment of new large-scale clean energy projects like utility solar farms

- Upgrading energy efficiency in residential and commercial buildings to reduce energy consumption

- Investing in new technologies to cut emissions from industrial facilities

By enacting these measures, the Inflation Reduction Act aims to rapidly scale up clean energy, create jobs, lower consumer costs, improve grid reliability, reduce emissions, and position the U.S. as a leader in the global energy transition.

Solar Manufacturing Investments

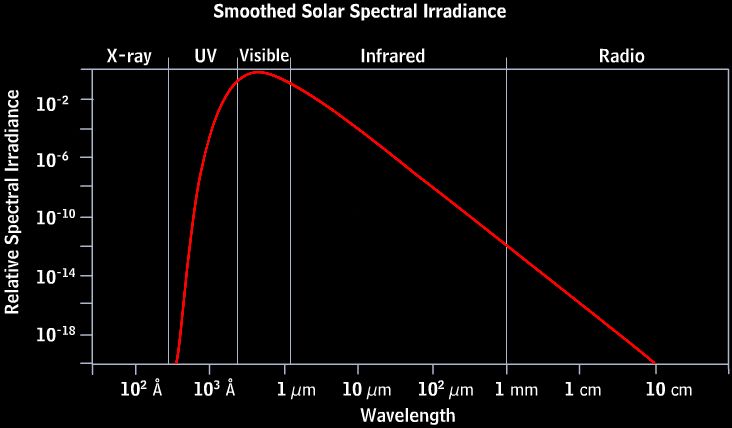

The Inflation Reduction Act includes major new investments and tax credits to spur domestic solar manufacturing in the United States. The legislation provides $10 billion in investment tax credits to build new solar panel and module manufacturing facilities as well as $20 billion in production tax credits for existing and new solar component manufacturing facilities [1].

The investment tax credit covers 30% of capital costs for facilities that manufacture solar panels, modules, wafers, cells, tracker and inverter components in the US. This aims to incentivize companies to build new manufacturing plants and expand production capacity domestically. The production tax credit provides up to 4 cents per watt-hour of solar components produced to offset operating expenses [2].

Together, these tax credits are intended to boost US solar manufacturing, reduce dependence on imports, create jobs, and support the transition to renewable energy. The incentives last 10 years, giving manufacturers long-term policy support to invest in new facilities and ramp up solar production.

Impact on Solar Panel Production

The Inflation Reduction Act includes over $370 billion in investments aimed at rapidly scaling up domestic solar panel manufacturing in the United States.1 This funding will turbocharge efforts to strengthen the solar supply chain and reduce reliance on imports. The Biden administration projects that the investments will quadruple domestic solar manufacturing capacity from 7.5 gigawatts currently to over 41 gigawatts by 2030.2

The legislation specifically allocates $10 billion in investment tax credits to build new manufacturing facilities or retool existing ones to produce solar panels, modules, and other key components domestically. It also provides a 10% production tax credit on new or retooled factories meeting domestic content requirements. These generous subsidies will spur private sector investment in expanding solar manufacturing across the country.

In addition, $500 million is allocated towards research and development to further enhance solar manufacturing technologies and processes. This will help improve efficiencies and lower costs. The investments should enable the United States to lead in solar innovation and competitiveness.

By bringing more solar manufacturing stateside, the country will benefit from economic development and job creation, while also securing supply chains against disruptions. The long-term goal is for the United States to produce over 50% of the solar panels and components it uses domestically by 2030.

Job Creation

The Inflation Reduction Act is expected to create a significant number of domestic solar jobs in the coming years. According to the BlueGreen Alliance, the climate provisions in the Act will create over 6 million jobs in clean energy industries like solar over the next decade.1 This includes jobs in solar panel manufacturing, installation, and maintenance.

Specifically for solar, the White House estimates that over 170,000 jobs have already been created in the year since the Act was passed.2 Analysis by Canary Media predicts the Act will lead to over 400,000 new solar jobs from the manufacturing investments and clean energy projects funded by the law.3 The domestic solar job growth is expected to continue as more provisions and funding from the Inflation Reduction Act are utilized in the coming years.

Energy Grid Improvements

The Inflation Reduction Act invests billions to improve and strengthen America’s energy grid as more solar power comes online. According to the U.S. Department of Energy, the act provides $27 billion in loan authority to build new high-capacity transmission lines that will deliver renewable energy across the country.

These investments will enable the integration of more solar and other renewables into the grid while maintaining reliability. As reported by UtilityDive, the shift towards clean energy requires rethinking traditional notions of grid reliability. While integrating variable renewables like solar poses challenges, experts are gaining confidence that reliability can be maintained through grid upgrades, advanced forecasting, energy storage, and smart grid technologies.

Upgrading transmission capacity will reduce congestion and bottlenecks that can limit renewable energy deployment, according to American Progress. Allowing solar and wind to access high-demand centers will improve resilience against disruptions and extreme weather events. The DOE also notes the act provides funding for grid modernization and hardening efforts to withstand storms, floods, cyber attacks and other threats.

In total, the Inflation Reduction Act will mobilize hundreds of billions in private capital for renewable energy and grid investments. This transformational funding will accelerate the transition to a cleaner, more robust grid powered by affordable solar energy and other carbon-free resources.

Emissions Reductions

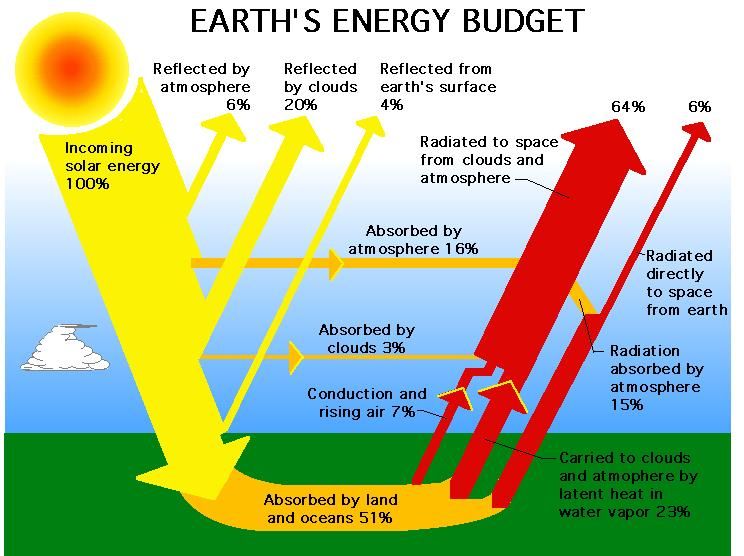

The Inflation Reduction Act aims to significantly reduce carbon emissions through investments in renewable energy like solar power. According to the EPA, the legislation could lead to emissions reductions of up to 42% below 2005 levels by 2030 across the entire US economy.

One key way it will accomplish this for the power sector is by incentivizing greater solar energy generation. The tax credits for solar manufacturing and development are predicted to boost solar capacity substantially. The White House estimates solar capacity could triple by 2030 due to the IRA (source).

As solar produces no direct carbon emissions, increased solar generation will directly displace fossil fuel power plants. The Department of Energy expects IRA policies to reduce power sector emissions by 830 million metric tons through 2032. This massive emissions reduction from the proliferation of solar power will be essential for meeting US climate goals.

Consumer Savings

The Inflation Reduction Act aims to substantially reduce costs for consumers through expanded solar power generation. The legislation provides tax credits and rebates to make rooftop solar installations more affordable for homeowners. According to the Treasury Department, tax credits can offset up to 30% of installation costs for households adding solar arrays [1]. These savings will enable more families to switch to solar energy and reduce their dependence on utility providers.

In addition, the Act allocates over $9 billion in home energy rebate programs, which will help households upgrade appliances, install heat pumps, and improve insulation. Analysis shows the average household could save up to $1,800 per year on utility bills after making these energy efficient upgrades [2]. With lower electricity costs, consumers will have more disposable income that can be spent at local businesses.

Experts project that the Inflation Reduction Act could save individual households thousands in energy costs over the next decade. By spurring wider adoption of rooftop solar and energy efficient upgrades, the legislation aims to provide substantial savings for consumers through reduced electricity and heating/cooling bills.

Criticisms

While the Inflation Reduction Act’s investments in domestic solar manufacturing have been largely praised, some concerns and criticisms have emerged. One critique is that the legislation does not go far enough in supporting American solar manufacturing and may still allow lower-cost imports to dominate the market. Specifically, some experts argue the tax credits for domestic solar production should be higher to fully compete against cheaper products from China and other countries.

Additionally, there are worries the legislation’s “prevailing wage” requirements could make solar projects more expensive, potentially slowing adoption. These provisions aim to ensure solar jobs created by the IRA pay decent wages, but may drive up costs. According to analysis from the Solar Energy Industries Association, the prevailing wage rules could increase project costs by 4-7% on average.

Finally, some conservative groups have argued the solar manufacturing investments amount to excessive government interference in energy markets. They claim the legislation could “pick winners and losers” rather than allowing free market competition to determine the ideal energy mix.

Future Outlook

The Inflation Reduction Act’s investments in expanding solar manufacturing in the United States have significant implications for the future of renewable energy. By incentivizing domestic production of solar panels and components, the legislation aims to construct a robust solar supply chain and reduce reliance on imports.

With more solar equipment made in America, experts predict solar deployment will accelerate rapidly in the coming decade.Impact of the Inflation Reduction Act | SEIA The Solar Energy Industries Association estimates the Inflation Reduction Act will lead to nearly $60 billion in new private sector investment in the solar industry and support up to 1.9 million new jobs by 2030.

This boost in solar panel manufacturing and installation is expected to substantially increase America’s renewable energy capacity. The Department of Energy projects solar energy generation could triple by 2035 under the bill.FACT SHEET: How the Inflation Reduction Act’s Tax … With more affordable and abundant clean electricity from solar power, the U.S. will be better positioned to meet climate goals and transition away from fossil fuels.

In summary, the Inflation Reduction Act lays the groundwork for solar energy to continue expanding and making up a larger share of America’s electricity generation. With the right investments and policies, the future is bright for domestic solar manufacturing and renewable energy.

Conclusion

In conclusion, the Inflation Reduction Act represents a historic investment by the U.S. government in domestic solar manufacturing. By providing tax credits, grants, and loans, the legislation aims to drastically increase America’s production capacity of solar panels and components. This should help drive down costs and increase adoption of solar energy across the country.

The bill has the potential to create hundreds of thousands of new jobs in the solar industry, while also reducing the country’s dependence on fossil fuels. This will lead to lower greenhouse gas emissions and air pollution. Consumers are expected to save money on utility bills as more low-cost solar energy connects to the grid.

While the IRA’s long-term impacts remain to be seen, it puts the U.S. on track to secure a competitive edge in clean energy innovation and manufacturing. With the right investments in technology, infrastructure and workforce development, America can lead the global transition to renewable power. The Inflation Reduction Act marks an important milestone in this journey.