What Is The Energy Situation In The Uae?

The United Arab Emirates (UAE) has a highly developed economy that is dependent on oil and gas production. The UAE has the sixth largest proven oil reserves in the world, with about 98 billion barrels. It is the fourth largest producer and exporter of crude oil globally. Oil production accounts for roughly 30% of the UAE’s GDP. The country joined OPEC in 1967. In recent decades, the UAE has taken steps to diversify its economy beyond hydrocarbons. However, oil and gas revenues still play a major role in the economic growth of the country.

Oil Production

The UAE is a major oil producing country and a member of OPEC. As of 2020, the UAE produced around 3.1 million barrels per day of crude oil. The country holds the 7th largest proven oil reserves in the world at around 98 billion barrels. The largest oil fields are located in Abu Dhabi and include Zakum, Umm Shaif and Upper Zakum. Major oil companies operating in the UAE include the Abu Dhabi National Oil Company (ADNOC), ExxonMobil, BP and Shell.

Oil production and exports drive the UAE economy, accounting for around 30% of the country’s GDP. Petroleum exports alone account for around 85% of total export revenue. The UAE relies heavily on oil income to fuel economic growth and fund major development projects. Diversifying the economy away from hydrocarbons dependence remains a priority for the government.

Natural Gas

The UAE holds the seventh largest proven reserves of natural gas in the world at over 6 trillion cubic meters, according to the UAE Ministry of Energy and Infrastructure [1]. The country’s major natural gas fields are located offshore near Abu Dhabi and hold nearly 94% of the UAE’s natural gas reserves. These include the Umm Shaif gas field, which contains over 50% of reserves.

Natural gas accounts for about 75% of the UAE’s electricity generation capacity [2]. The UAE also exports liquefied natural gas (LNG) and in 2021 became the world’s 5th largest exporter of LNG. The country has plans to expand production at the Integrated Gas Development Expansion projects in Abu Dhabi to meet rising domestic demand and increase exports. Gas production is targeted to reach 7 billion cubic feet per day by 2025.

Renewable Energy

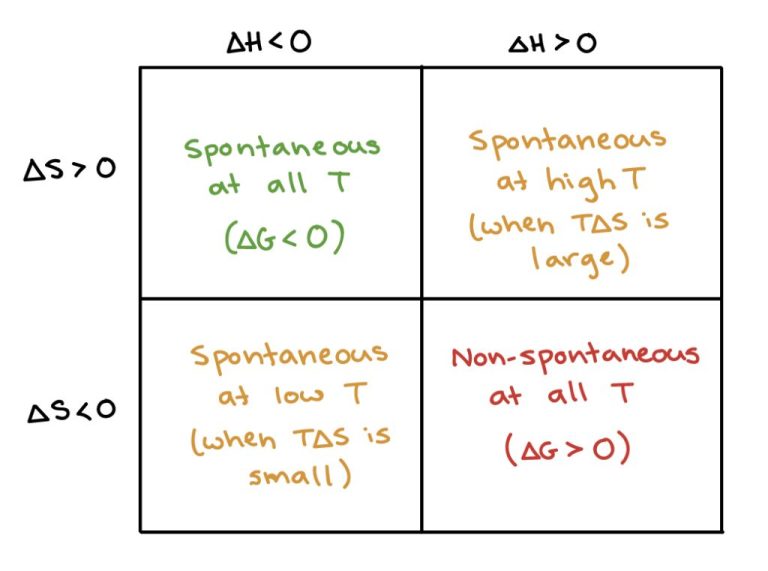

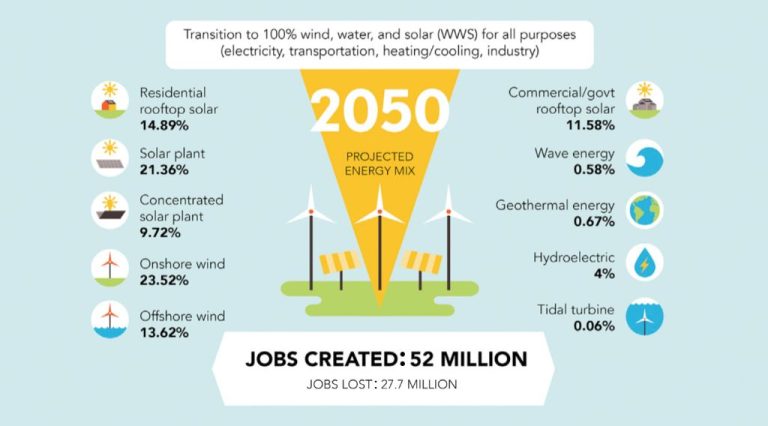

The UAE has set ambitious targets to increase its renewable energy capacity. As part of the UAE Energy Strategy 2050, the country aims to have 50% of its energy from renewable sources by 2050. Currently, renewable energy accounts for around 1% of the total energy mix.

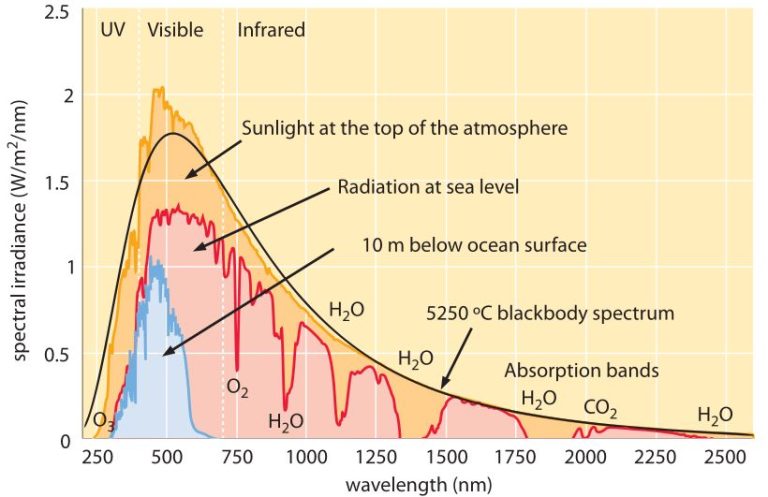

Solar energy is a major focus. The Mohammed Bin Rashid Al Maktoum Solar Park in Dubai is one of the largest single-site solar parks in the world, with a planned capacity of 5,000 MW by 2030. Major solar projects are also underway in Abu Dhabi, including the 1,177 MW Noor Abu Dhabi plant. For onshore wind, projects like the 50 MW Taweelah plant in Abu Dhabi and the 50 MW Dhadna plant in Dubai are helping grow capacity.

However, expanding renewable energy faces challenges like the high upfront costs, the variability of solar and wind resources, and the grid integration of large-scale renewable projects. The extreme heat and dusty conditions in the UAE climate can also impact efficiency. The UAE will need substantial investments and infrastructure upgrades to meet its ambitious renewable targets.

Sources:

https://u.ae/en/about-the-uae/strategies-initiatives-and-awards/strategies-plans-and-visions/environment-and-energy/uae-energy-strategy-2050

https://www.irena.org/-/media/Files/IRENA/Agency/Webinars/UAE-Presentation_LTES.pdf?la=en%26hash=7AB6DF56E17BE7CE5841CF5015DA9BE55F10C919

Nuclear Energy

The United Arab Emirates (UAE) has made major investments in nuclear energy in recent years as part of its strategy to diversify its energy mix and meet rising electricity demand. The country’s first nuclear power plant, Barakah Nuclear Power Plant, is currently under construction and will eventually consist of four nuclear reactors.

The first of the four nuclear reactors at Barakah has already been connected to the national grid and began commercial operations in April 2021. The second reactor began commercial operations in March 2022. The remaining two reactors are still under construction, with the third reactor likely to come online later this year and the fourth in 2024. When completed, the four reactors will have a total capacity of 5,600 MW and are expected to generate up to 25% of the UAE’s electricity needs.

In addition to the Barakah plant, the UAE government has announced plans to build more nuclear reactors in the future to further boost nuclear capacity. According to the World Nuclear Association, the UAE plans to increase its nuclear capacity up to 5.6 GWe by 2025 and up to 14.4 GWe by 2030 through further new-build projects. This demonstrates the country’s long-term commitment to nuclear power as a major part of its national energy strategy.

The development of nuclear power will help the UAE meet rising electricity demand, reduce dependence on natural gas, and diversify its energy mix with a clean, reliable baseload source of power. However, the large upfront investments required for nuclear projects present financial and construction risks that must be managed carefully.

Energy Consumption

The UAE has one of the highest rates of per capita energy consumption in the world. According to a study published on ResearchGate, the UAE’s per capita energy consumption is over 9 times the global average (Electricity production and consumption of Abu Dhbai, UAE). This high energy usage is driven by rapid urbanization, economic growth, and energy subsidies.

The industrial sector accounts for over 50% of total energy consumption in the UAE. Major industrial energy users include oil and gas extraction and processing, petrochemicals, aluminum and cement production. The buildings sector, including residential and commercial buildings, accounts for nearly 40% of energy use. Air conditioning is a major contributor during the hot summer months. Transportation makes up around 9% of energy consumption, while agriculture and other uses account for the remainder.

With continued population and economic growth expected, energy demand in the UAE is projected to keep rising. The government has implemented some policies to try to curb energy consumption and improve efficiency, but per capita usage remains exceptionally high.

Energy Subsidies

The UAE government has provided substantial subsidies for gasoline, electricity, and natural gas, which led to overconsumption and inefficient energy use. According to Brookings, these subsidies accounted for 22% of total government spending in 2013. However, recognizing their unsustainability, the UAE has undertaken reforms, gradually reducing and removing many energy subsidies since 2015.

Electricity and water subsidies alone were estimated to account for $7 billion per year, encouraging overconsumption. A 2017 RTI study found that removing electricity and water subsidies could reduce consumption by 43% for nationals and 32% for expats in Abu Dhabi. The phasing out of gasoline and diesel subsidies is also expected to reduce fuel demand growth from over 5% to under 1% per year.

While reforms aimed at reducing energy subsidies may lead to short-term price increases, they encourage more efficient energy use and make renewable energy more cost-competitive in the long run. The government is also considering targeted subsidies for low-income groups to ease the transition.

Energy Efficiency

The UAE has implemented several policies and programs to improve energy efficiency in key sectors like buildings, industry, and transportation. Some of the major initiatives include:

The UAE Energy Strategy 2050 aims to improve energy efficiency by 40% by 2050 through retrofitting existing buildings, implementing efficiency standards for new buildings, and adopting efficient lighting and appliances (Ras Al Khaimah mulls clean energy targets of around 25 to 30 per cent by 2040). The Estidama program rates buildings on sustainability, including energy usage. Dubai has mandated green building regulations for all new constructions.

For industry, Dubai has initiated an Industrial Energy Efficiency program offering audits and retrofits to cut consumption. Abu Dhabi’s Tadweer recycles industrial waste into energy. The Emirates Authority for Standardization and Metrology promotes efficiency standards for industrial equipment.

For transportation, the UAE Fuel Economy Policy sets minimum fuel economy standards for light duty vehicles. Dubai and Abu Dhabi have expanded mass transit systems and are adding hybrid and electric buses. Dubai has goals for electric and hybrid vehicles to account for 10% of total vehicles by 2030 (Ras Al Khaimah mulls clean energy targets of around 25 to 30 per cent by 2040).

The UAE is making steady progress towards its efficiency goals, though persistent low energy prices reduce motivation for consumers and industries to save energy. Stronger incentives and regulations can help overcome this challenge.

Environmental Impact

The UAE’s energy sector is a major contributor to greenhouse gas emissions. According to the International Energy Agency, the UAE’s CO2 emissions from fuel combustion increased by 33% between 2000-2021 (IEA). In 2016, greenhouse gas emissions from the energy sector were estimated at 78.653 million tons CO2 equivalent, having more than doubled since 1994 (Khondaker). The UAE has one of the highest per capita CO2 emission rates globally.

The government has set ambitious goals to reduce emissions intensity by 25% by 2030 compared to 2015 levels as part of the UAE Energy Strategy 2050. Plans include increasing renewable energy capacity, nuclear power, clean energy technologies, and energy efficiency across sectors (Hummieda). While renewable energy capacity has expanded significantly, natural gas and oil continue to dominate the energy mix. Reducing dependence on fossil fuels is critical for the UAE to lower its environmental footprint and meet its climate targets.

Future Outlook

The UAE faces both challenges and opportunities in diversifying its energy mix and reducing emissions while meeting projected demand growth. The country aims to increase the share of clean energy in its mix to 30% and reduce carbon emissions by 23% by 2030 (UAE Energy Diversification). However, natural gas and oil will likely remain dominant, supplying 70% of demand in 2030 (Renewable Energy Prospects: United Arab Emirates).

Major investments in solar and nuclear will be needed to meet the 2030 targets. Solar capacity is projected to reach 14 GW, requiring large-scale projects across the emirates (UAE raises targets for sustainable energy in 2030). The Barakah nuclear plant aims to supply 25% of demand in Abu Dhabi, but further reactors would be needed. Improving energy efficiency, especially in buildings, industry and transportation, provides another opportunity.

The UAE must also prepare for rising electricity and water demand driven by economic and population growth. Managing peak demand will be critical through demand-side management and storage solutions. Developing a skilled workforce and securing finance for projects present additional challenges. Overall, the UAE has shown commitment to a sustainable energy transition, but fossil fuels will remain dominant in the medium-term.