What Is Replacing Nuclear Power?

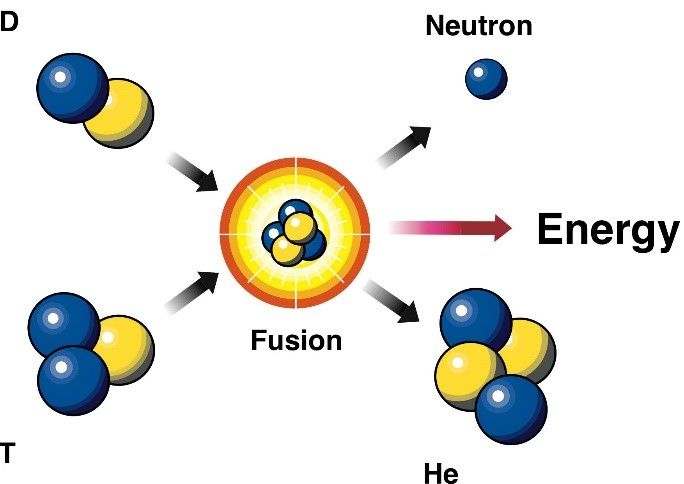

Nuclear power generates electricity through nuclear fission, the process of splitting uranium atoms to release energy. Nuclear power plants provided about 20% of U.S. electricity generation in recent decades.[1] However, nuclear’s contribution has declined in the past 10 years, with several reactors retiring and new construction limited. The main alternatives replacing nuclear power are renewable energy, natural gas, and increased energy efficiency.

Renewable Energy Growth

Renewable Energy Growth

Renewable energy sources like solar, wind, hydro and geothermal have seen tremendous growth worldwide in recent years. According to the International Energy Agency (IEA), renewables accounted for over 42% of global electricity generation in 2028, with the share of wind and solar PV doubling to 25% (IEA). The growth is expected to continue, with renewables making up 35% of U.S. electricity generation by 2030 according to the Center for Climate and Energy Solutions (C2ES).

Several factors are driving the expansion of renewables globally. Costs for solar and wind power have declined dramatically, making them cost competitive with fossil fuels in many markets. Government policies like renewable portfolio standards, feed-in tariffs, tax credits and other incentives have also boosted renewable energy adoption. Corporations and individual consumers are increasingly demanding clean energy options. And concerns about climate change and air pollution are prompting countries to transition away from coal and natural gas.

According to Our World in Data, solar generation has seen particularly robust growth compared to more established renewables like hydropower, with solar capacity expanding from under 10 gigawatts in 2008 to over 500 gigawatts in 2018 (Our World in Data). With costs continuing to fall and supportive policies in place, renewables are positioned to become the dominant source of new electricity capacity going forward.

Natural Gas

The natural gas boom from hydraulic fracturing, or fracking, has led to rapidly expanding natural gas production in the United States. According to the U.S. Energy Information Administration (EIA), natural gas production has increased by over 50% since 2005, with much of this growth coming from shale gas enabled by fracking (EIA). In 2022, natural gas accounted for 39% of electricity generation in the U.S., up from 37% in 2021, as it continues replacing coal generation (EIA).

Natural gas is often referred to as a “bridge fuel” that can enable the transition from higher emission electricity sources like coal to zero-emission renewable energy. Burning natural gas for electricity produces about half the carbon emissions of coal. This has enabled utilities to reduce emissions in the near-term by shifting from coal to gas. However, natural gas is still a fossil fuel that produces greenhouse gas emissions. Relying too heavily on natural gas would make it more difficult to reach zero-emission goals in the long run.

Energy Efficiency

Energy efficiency improvements have played a major role in reducing energy demand and avoiding the need for additional power plants. By using less energy to provide the same services, efficiency reduces the amount of energy that needs to be generated or transmitted 1. Examples of efficiency gains include switching to LED lighting, smart grids, and more efficient appliances and industrial processes. One study found that improving efficiency by just 15% could eliminate the need for 30 large power plants in the U.S. 3.

LED lighting alone has yielded massive efficiency improvements, using at least 75% less energy than incandescent lighting 2. Appliance efficiency has also improved steadily, with refrigerators using about 75% less energy than 40 years ago. Smart grids help match energy supply and demand in real time, reducing waste. Overall, energy efficiency investments have kept U.S. electricity demand flat for decades while the economy grew significantly.

Distributed Generation

Distributed generation refers to electricity generated at the point of consumption, rather than centrally. This includes rooftop solar panels, combined heat and power plants, microgrids, fuel cells, and other on-site generation technologies. Distributed generation has seen rapid growth in recent years, driven by falling costs, policy incentives, and growing demand for resilient and sustainable energy.

The rooftop solar market in particular has expanded significantly. The United States currently has over 100 gigawatts of rooftop solar capacity, and annual installations have grown over 20% in recent years [1]. State net metering policies, federal tax credits, and declining module prices have made rooftop solar increasingly affordable and attractive for homes and businesses. Rooftop solar provides resilience against grid outages, reduces electricity bills, and allows customers to have more control over their energy mix.

Microgrids and on-site power generation also enable customers to island from the central grid during outages and blackouts. Major hospitals, military bases, and corporate campuses have adopted microgrids to ensure electricity reliability. Diesel generators provide backup power, while solar, storage, and other distributed resources allow facilities to operate independently. The U.S. military has been an early adopter of microgrids to maintain critical operations during emergencies [2].

In addition to resilience benefits, falling costs for solar, batteries, fuel cells and efficiency measures make distributed generation competitive with conventional power. Key policies like net metering, feed-in tariffs and renewable portfolio standards have also encouraged distributed energy growth. According to NREL analysis, distributed generation could make up 40% of total U.S. generation capacity by 2050 [3]. As technologies improve and costs decline further, distributed energy resources are poised for even greater growth and adoption going forward.

Grid Modernization

Modernizing the electrical grid with smart grid technology is key for integrating renewable energy sources. Smart grids utilize digital communications, automation, and advanced analytics to detect issues and respond dynamically. This enables greater efficiency, reliability, and flexibility on the grid.

According to Markets and Markets, the global smart grid market size was estimated at $49.7 billion in 2022 and is projected to reach $93.8 billion by 2026.1 Smart grid upgrades involve adding advanced metering, sensors, automation, and analytics to better manage electricity demand, supply, and flow. This allows grids to smoothly integrate distributed renewable generation.

Some examples of grid modernization projects include:

- The European Union launched the Smart Grid Task Force in 2009 to accelerate smart grid deployment. This has funded over 300 projects to digitize grids and integrate renewables.2

- American Recovery and Reinvestment Act of 2009 provided $4.5 billion to modernize the U.S. grid with over 100 projects.

- The government of India aims to install 130 million smart meters by 2021 as part of grid modernization efforts.

With smarter, more responsive grids, utilities can better integrate solar, wind, and distributed renewable energy generation while maintaining reliability for consumers.

1. Markets and Markets Smart Grid Market Report

2. Statista Smart Grid Statistics

Energy Storage

Energy storage, particularly battery storage, has seen tremendous growth in recent years as it plays a critical role in enabling greater adoption of renewable energy sources like solar and wind. According to Statista, global investments in energy storage surpassed $337 billion in 2022 and the market is forecast to continue expanding rapidly.1 Energy research firm BloombergNEF predicts that 387GW/1,143GWh of new energy storage capacity will be added globally between 2022-2030, a 15-fold increase over today’s capacity.2

Batteries, especially lithium-ion batteries, have become the dominant form of energy storage due to rapid cost declines. Pumped hydro storage is also widely used for large-scale long duration storage. These technologies help smooth out the inherent variability of solar and wind generation by storing excess energy when supply exceeds demand and discharging when needed. Energy storage also provides valuable grid services and allows solar and wind to shift generation to more valuable peak demand times.

Notable examples of large-scale energy storage projects include the 400MW/1,600MWh Moss Landing storage system in California and the 316MW Lake Bonney battery system in Australia. By 2030, BloombergNEF predicts the world will have over 2,850GW of energy storage capacity, with batteries accounting for nearly 80% of that total.2 This massive growth in storage capacity will be critical to enabling high renewable energy penetration around the world.

Electric Vehicles

Electric vehicles (EVs) are projected to play a major role in electricity demand growth as adoption rates increase. According to EVAdoption.com, EV sales should grow to reach approximately 29.5% of all new car sales in 2030 from an expect roughly 3.4% in 2021. This would also see sales increase to 4.7 million in 2030 from 325,000 in 2021 (source). The U.S. Energy Information Administration also predicts rapid EV adoption, with EVs making up around 18% of new car sales by 2030. Lower battery costs and increased driving range capabilities are key factors driving this growth.

The rise in EVs will significantly impact electricity demand, with some estimates predicting EVs could add over 200 TWh to U.S. electricity demand by 2030. To manage this increased demand, investment in charging infrastructure is critical. Workplaces, public charging stations, and home charging capabilities will need expansion to provide convenient and adequate charging access. Smart charging technologies can also help optimize EV charging time to avoid straining grids during peak demand periods.

Policy and Regulation

Governments around the world are implementing policies to accelerate the transition away from nuclear power and towards renewable energy. This includes setting ambitious renewable energy targets, establishing carbon pricing mechanisms, and enacting clean energy standards.

Many countries have pledged to generate 100% of their electricity from renewable sources by 2050, with some setting interim targets of 50% by 2030. For example, the European Union aims to have 32% renewable energy by 2030 as part of its goal of being carbon neutral by 2050 (IEA). Carbon pricing programs like carbon taxes and cap-and-trade systems make fossil fuels more expensive, while subsidies make renewables more cost competitive.

Over 30 countries and many subnational jurisdictions have implemented carbon pricing, covering about 22% of global emissions (Deloitte). Clean energy standards that mandate minimum renewable energy percentages are another major policy driver. At the end of 2021, 146 countries had renewable energy targets while 131 had renewable electricity targets specifically (IEA).

These policies all make nuclear power less economically viable compared to renewables. With lower costs and more supportive policies, renewable energy is rapidly displacing nuclear generation in many markets.

Conclusion

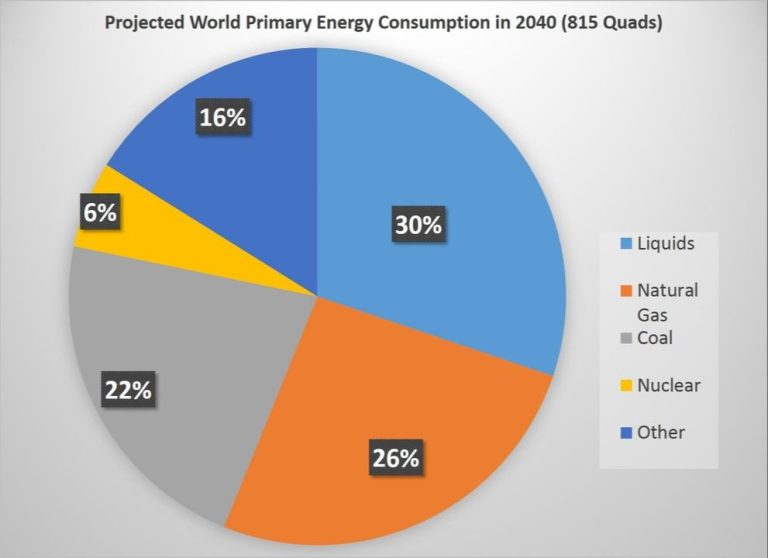

As we’ve seen, there are several emerging alternatives that are replacing nuclear power across the globe. Renewable energy sources like solar, wind, hydroelectric, and geothermal are being rapidly deployed and expanded. Natural gas has become more abundant and affordable due to fracking, making it a popular alternative for baseload power. Improving energy efficiency through better building codes, appliances, lighting, and industry practices is reducing energy demand overall.

Distributed renewable generation like rooftop solar, combined with grid modernization and energy storage solutions like batteries, are transforming electricity infrastructure as well. Electric vehicles continue to gain market share, further reducing demand for fossil fuels. Supportive policies, regulations, and public sentiment are driving many of these changes.

The pace of this energy transition is accelerating. As costs continue to fall for renewables, storage, and demand management solutions, nuclear power plants are having difficulty competing. While nuclear will remain part of the energy mix in some regions, its share of global electricity generation is projected to decline as cheaper and more flexible options scale up. The age of nuclear dominance is coming to an end, but its decline is being met by the rise of new energy alternatives.