What Happens If Your Solar Company Goes Out Of Business?

The U.S. residential solar industry has grown rapidly over the past decade, with more than 3 million homes now powered by rooftop solar panels. However, the industry is facing a reckoning as high inflation, rising interest rates, and the phasing out of subsidies have led to financial troubles for many solar companies.

In 2023 alone, over 100 residential solar installers filed for bankruptcy, according to SolarInsure. Major players like Day Break Solar Power and Hitech Solar have abruptly shut down operations, leaving homeowners wondering what will happen if their solar company goes under.

Why Solar Companies Fail

Many solar companies fail due to high overhead costs. Installing solar panels requires significant upfront investments in inventory, employees, trucks, warehouses, and sales teams. Solar companies must spend substantial amounts before they start generating revenue from completed installations. If the sales volume does not materialize as projected, solar companies can quickly burn through their working capital and go bankrupt. High overhead costs are often cited as a top reason new solar companies fail according to Solar Surge Podcast (source).

Additionally, customer acquisition costs in the solar industry are very high, with some estimates as high as $4,000 per customer. These high customer acquisition costs put further strain on solar companies’ finances. Without enough sales volume and revenue to cover their steep overhead expenses, solar companies often collapse under the weight of their own cost structure.

The Warranty

Most solar panels come with two warranties – a product warranty and a performance warranty. The product warranty typically guarantees the solar panels will be free of defects for 10-12 years (Solar Panel Warranties: What To Know). This means if there are any issues with the solar panels themselves like cracks, leaks, faulty wiring etc., the manufacturer will repair or replace them. The performance warranty guarantees a certain level of performance output for 25-30 years (A Guide to Understanding Solar Panel Warranties (2024)). This means the solar panels are guaranteed to maintain a minimum of 80-90% of their rated power output during the warranty period.

These warranties provide assurance that your solar panels will continue generating electricity for decades after installation. However, warranties are only as good as the company backing them up. If your solar company goes out of business, you may have trouble making warranty claims. It’s important to choose an established manufacturer with a solid reputation. Reading online reviews of solar panels can help determine which have the best track record for honoring warranties.

Maintenance

Even though solar panels require very little maintenance, some periodic upkeep is still necessary to keep your system running efficiently. If your solar company goes out of business, you’ll need to take over these maintenance responsibilities yourself or hire another company to do it.

Some of the key maintenance tasks include:

- Cleaning the panels – Solar panels should be cleaned at least twice per year to remove any dirt, dust, bird droppings, etc. that can block sunlight. You can clean them yourself with a soft brush and mild detergent. Just be careful not to damage the panels when cleaning. (1)

- Inspecting connections – Check that all wiring connections are tight and corrosion-free. Loose connections can cause drops in energy production.

- Clearing debris – Remove any overhanging tree branches or other objects that could cast shadows on your solar panels, reducing their efficiency.

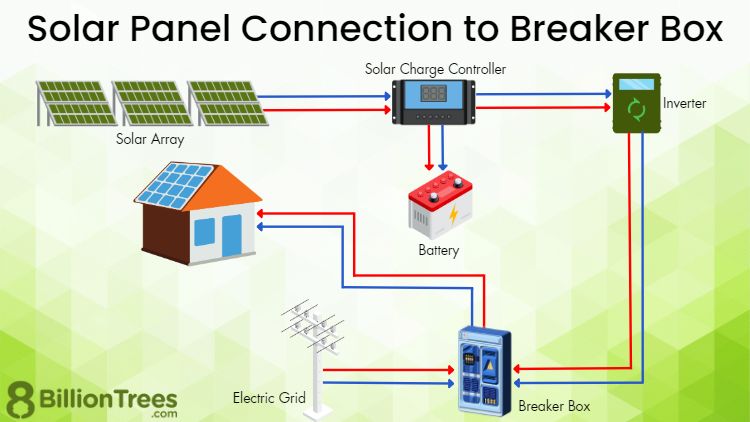

- Checking inverter – Make sure your inverter is operating properly. Many inverters have built-in self-monitoring capabilities to alert you to any issues.

If you don’t want to handle maintenance yourself, you can hire another solar company to do it for you. Some solar installers offer maintenance contracts or service plans to regularly service systems they did not originally install. Get quotes from several companies and compare pricing. (2)

Financing

One of the biggest concerns when a solar company goes out of business is what happens to any existing loans or leases for the solar panels. Many homeowners finance solar panels through loans or lease agreements rather than buying them outright. According to SolarReviews.com, if the solar company folds, another company will likely take over the lease or loan agreement as part of acquiring the company’s assets [1]. The new company is then responsible for maintaining the terms of the original financing agreement.

However, if no company steps in to take over the loans or leases, homeowners could be left making payments on solar panels they no longer own or have maintained. In some cases, they may be able to successfully petition to end the lease or loan, but this is not guaranteed. It’s advised to thoroughly vet solar financing companies for financial stability before entering into any long-term agreements. Reputable national companies are less risky than small startups or regional providers.

Selling the Home

Selling a home with an existing solar panel system requires some extra considerations. If you own the solar panels outright, meaning you purchased them with cash and hold the title, then selling your home will be straightforward like any other sale. The solar panels are viewed no differently than any other home improvement or fixture Here’s What Happens to Solar Panels When You Sell Your House.

However, if you financed the solar panels and still owe money on them, it can complicate the sale. The new home buyer will need to qualify to take over the payments on the solar loan and agree to the terms. This may deter some buyers or require negotiations on the home price to account for the solar loan assumption. You may also have the option to pay off the remainder of the loan yourself before closing so that the home is sold free and clear of any solar financing Selling A House With Solar Panels: A Guide.

It’s important to fully disclose the details of any solar financing early in the home selling process. Be prepared to provide loan terms, monthly payments owed, warranties or guarantees that will transfer, and any responsibilities for maintenance and repairs. With good communication, selling a home with leased or financed solar panels can go smoothly.

Removing the System

If the solar panels are no longer functioning and need to be fully removed, the costs can vary greatly depending on system size and roof type. According to Modernize, the average cost to remove solar panels from a roof in 2024 is between $300 to $1,000 per panel. When estimating solar panel removal costs, factors like the panel’s wattage, quantity, roof type and pitch are all important considerations.

The process of removing solar panels from a roof can be complicated and risky if not done properly. As Palmetto notes, it’s best to have a qualified solar installer handle both removal and reinstallation. They have the proper training, safety equipment and procedures to remove panels without damaging the underlying roof. Permits are also required in most cases, which solar installers can obtain on the homeowner’s behalf.

Replacing Components

If a solar panel or component like the inverter stops working properly, you may need to replace it. Sourcing replacement parts can be challenging since solar equipment has a typical lifespan of around 25 years. If the original solar company that installed the system is no longer in business, you’ll have to find the replacement parts yourself.

The solar panels should have a brand name and model number printed on the back that you can use to search for a matching replacement. However, solar panels are constantly being updated and improved, so you may not be able to find the exact same model. As long as the replacement solar panel has similar specifications like wattage and voltage, it can be compatible with your existing array. Check the manufacturer’s guidelines before installing a different model of solar panel (source).

For the inverter, you’ll need to find a replacement with the same voltage and power rating or higher to be compatible. The wiring connections also need to match. Some solar equipment suppliers can help source replacement inverters that will work with your system if you provide the specifications of your existing inverter. Companies like CPS America and Sensata Technologies sell replacement solar inverters for many older models (source).

Alternatives

If your solar panels fail or your solar company goes out of business, there are other renewable energy options to consider for your home. According to https://theecofriendlyfamily.com/5-home-renewable-energy-options-youve-never-heard-of/, some alternatives include:

Residential wind power – Small wind turbines can be installed on properties to generate electricity. They work best in windy, open areas.

Geothermal systems – These systems use the stable temperatures underground to heat and cool homes. They can be expensive to install but provide energy savings over time.

Micro hydropower – Mini hydroelectric systems can harness the flow of small streams or creeks near your home to generate electricity.

According to https://www.sustainableprinceton.org/your-home/renewable-energy-options/, other options include solar thermal systems, which use the sun’s energy for water heating, and biomass systems that can burn plant or animal matter for energy production.

So if your solar panels fail, there are other renewable ways to power your home, from wind and geothermal to micro hydropower and biomass. With some research, you can find an alternative green energy system that works for your property.

Conclusion

In summary, if your solar company goes out of business, it can certainly be an inconvenient and stressful situation. However, there are steps you can take to protect yourself and your investment.

First, understand the warranties in place and who is backing them so you know what coverage you’ll have. Also be sure to keep up with maintenance, as you’ll now be responsible for repairs and troubleshooting. Keep copies of your paperwork and contracts in case you need to reference anything.

If your financing is through the solar company, you may need to refinance or take over payments yourself. Check on any clauses in your contract regarding bankruptcy. If you plan to sell your home, inform potential buyers of the details and have paperwork ready.

As a last resort, you can remove the system entirely or replace components that fail. There are also reputable solar companies that may be able to take over servicing the existing equipment. While frustrating, with some planning and diligence, you can maintain your solar investment for years to come.