What Appliances Qualify For Energy Tax Credit Irs?

Energy tax credits are incentives offered by the federal government and some states to encourage homeowners to make energy efficiency improvements to their homes. These tax credits help reduce the costs of installing qualifying energy-efficient products like insulation, windows, doors, roofs, water heaters, furnaces, air conditioners, and appliances. The goals of this article are to provide an overview of federal and state energy tax credits available for homeowners in 2023, detail which appliances and products qualify, explain the amounts available, and outline the requirements to claim the tax credits.

Overview of Energy Tax Credits

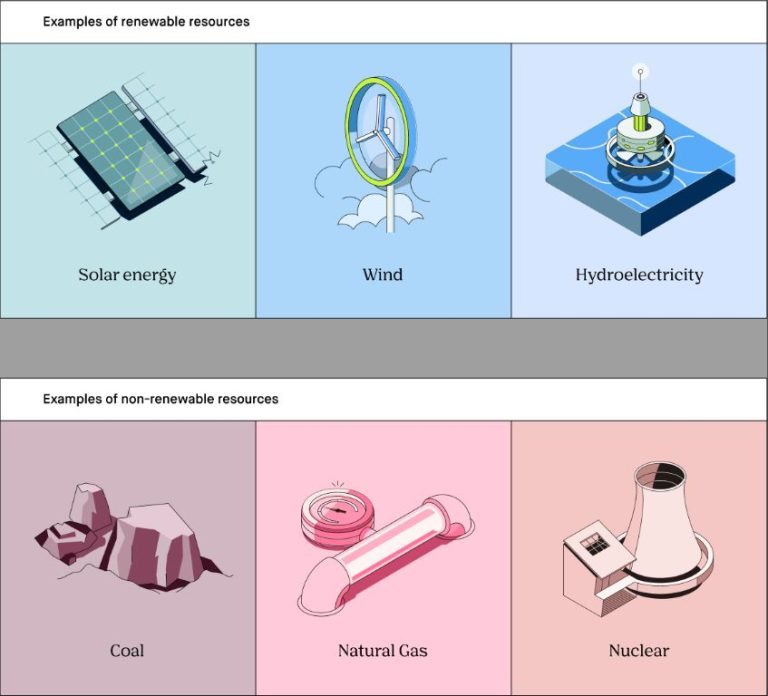

Energy tax credits are incentives offered by the federal government and some state governments to encourage homeowners to make energy efficiency improvements to their homes. The goal of these tax credits is to reduce energy consumption and promote the use of renewable energy sources like solar power (1).

The two main providers of energy tax credits are the federal government through the IRS, and state governments through their respective revenue/taxation agencies. At the federal level, credits are available for installing qualifying energy efficient products like insulation, windows, doors, roofing, and HVAC systems. There are also specific tax credits for solar panels, solar water heaters, small wind turbines, geothermal heat pumps, and fuel cells (2).

Most energy tax credits allow homeowners to claim a credit worth a percentage of the cost of purchasing and installing the energy efficient product. Credits directly reduce the amount of tax owed, so they provide significant savings for homeowners undertaking renovations to improve their home’s energy efficiency.

The federal government offers energy tax credits through legislation like the Inflation Reduction Act. States may have their own additional energy tax credit programs beyond the federal credits (3).

Federal Energy Tax Credits

The federal government offers tax credits to homeowners who make energy efficiency improvements to their primary residence. These credits encourage homeowners to upgrade to more energy efficient products and appliances by allowing them to recover some of the costs through a tax reduction. The credits are available through the Internal Revenue Service (IRS) and were recently extended through 2032 by the Inflation Reduction Act signed in August 2022.

The tax credits cover a portion of the cost of qualified energy efficiency improvements, including upgrading insulation, windows, doors, roofs, water heaters, furnaces, and air conditioners. For improvements made in 2023, homeowners can receive a tax credit for 30% of the cost up to $1,200 for most improvements. More significant upgrades like heat pumps, gas, propane, or oil water heaters and stoves qualify for a higher $2,000 credit limit.

The credits apply to a homeowner’s primary residence located in the United States. Rental properties and new construction do not qualify. The improvements must be expected to remain in use for at least 5 years after installation. Only specific Energy Star certified products qualify.

Homeowners claim the tax credits when they file their taxes by submitting IRS Form 5695. Receipts for the eligible improvements must be retained. It is important for homeowners to be aware of the requirements, eligible products, and certification standards to receive the maximum tax credit.

Qualifying Appliances

The federal government offers tax credits for purchasing energy efficient appliances that meet certain efficiency criteria. The following appliances can qualify for federal tax credits if they meet the efficiency requirements:

- Central air conditioners – Must have a SEER rating of at least 16

- Air source heat pumps – Must have a SEER rating of at least 15 and an HSPF of at least 8.5

- Gas, propane, or oil water heaters – Must have an EF of at least 0.82 or a thermal efficiency of at least 90%

- Electric heat pump water heaters – Must have an EF of at least 2.0

- Gas, propane or oil furnaces – Must have an AFUE of at least 95

- Boilers – Must have an AFUE of at least 95

- Advanced main air circulating fans – Must use no more than 2% of the furnace’s total energy

- Biomass stoves – Must have a thermal efficiency rating of at least 75%

All appliances must be new purchases and meet current Energy Star efficiency criteria to qualify for the tax credits. Only specific models will qualify, so it’s important to verify the efficiency ratings before making a purchase.

Tax Credit Amounts

The amount of tax credit an appliance qualifies for depends on the type of appliance and its efficiency rating. According to the IRS, the following tax credit amounts are available for certain ENERGY STAR certified appliances in 2023:

- Refrigerators, clothes washers, and dishwashers – $50 to $100 tax credit for select ENERGY STAR certified models that meet efficiency requirements.

- Electric heat pump water heaters – $300 tax credit for the most efficient models with an energy factor of at least 2.2.

- Central air conditioners – $50 to $300 tax credit depending on efficiency ratings. Systems rated at the highest SEER levels qualify for the maximum $300 credit.

- Natural gas, oil, and propane furnaces – $150 tax credit for the purchase of ENERGY STAR certified furnaces rated 94% AFUE or higher. This applies to all ENERGY STAR certified gas furnaces, excluding those only certified for the U.S. South.

- Biomass stoves – $300 tax credit for stoves that use renewable biomass fuel and have an efficiency rating of at least 75%.

According to Energystar.gov, the tax credit amounts for appliances are generally calculated as a percentage of the total cost paid, capped at certain maximum amounts per appliance. Always check the IRS guidelines and requirements to confirm tax credit eligibility before making a purchase.

Efficiency Requirements

To qualify for the tax credit, appliances must meet certain energy efficiency criteria set by the Environmental Protection Agency’s (EPA) Energy Star program. The Energy Star label indicates that an appliance meets federal guidelines for energy efficiency.

For appliances like refrigerators, dishwashers, clothes washers, room air conditioners, and water heaters, they must be Energy Star certified to qualify for the tax credit. Energy Star sets efficiency standards that these appliances must comply with through independent testing and certification.

According to Energy Star, qualifying gas furnaces must have an annual fuel utilization efficiency (AFUE) of 95% or greater. Oil furnaces need an AFUE of 90% or more. For central air conditioners, a Seasonal Energy Efficiency Ratio (SEER) of 16 or greater is required.

Energy Star also provides a full list of efficiency criteria on their website that appliances must meet to qualify for the tax credit. Consumers can search for qualifying models in their Certified Products Database.

Having the Energy Star label ensures an appliance meets or exceeds federal energy efficiency standards. Homeowners looking to claim the tax credit should verify the appliance has the Energy Star certification before purchasing and installation.

Claiming the Tax Credit

To claim the tax credit, homeowners must file IRS Form 5695 along with their annual income tax return. The credit can be claimed for qualified energy efficiency improvements placed into service during the tax year. According to the IRS, you must keep records showing the costs of any improvements made during the tax year to prove that you are entitled to the credit. This includes copies of receipts, manufacturer certifications, and other relevant documents.

The IRS requires the make, model number, and any other appropriate identifiers of eligible property. For insulation, you should record the square footage of added insulation per material type. For exterior windows and skylights, keep a separate statement for each item with the make, model number, address where the item was installed, and the date the original item was installed.

The credit is nonrefundable, meaning it can reduce your tax liability to zero but you will not receive any remaining amount as a refund. If the credit exceeds your tax liability for the year, the excess amount can be carried forward to the following tax year.

State Tax Credits

In addition to the federal tax credits for energy efficient appliances, some states also offer additional incentives. For example, California offers rebates and tax credits through various utility providers for purchasing qualifying ENERGY STAR appliances such as refrigerators, clothes washers, air conditioners, and more. Amounts vary but can be up to $75 back for installing a new energy efficient refrigerator. Other states like Oregon offer credits up to $300 when you purchase an energy efficient heat pump water heater. New York also has the Green Homes Tax Credit that provides a 25% credit up to $500 for the purchase of ENERGY STAR labeled appliances and insulation. It’s a good idea to check with your state and local energy departments to see what kinds of additional incentives may be available when buying energy efficient appliances.

Tax Credit Limits

There are a few important limitations to be aware of when claiming energy efficiency tax credits according to the IRS [1]:

- There are per-unit limits on the tax credit amount for different types of qualifying appliances and equipment. For example, the maximum credit for an electric heat pump water heater is $300.

- There are annual dollar caps that limit the total amount of credit that can be claimed each year. For 2023, the limit is $500 for qualifying appliances and $600 for home improvements/upgrades.

- The tax credit can only be claimed once per appliance or improvement. You cannot claim multiple credits over several years for the same item.

- There is a lifetime limit on total credits that can be claimed. The lifetime limit is $500 for all qualifying appliances/equipment and $1,200 for home improvements.

- If the credit exceeds your tax liability for the year, you cannot carry over or roll over the excess amount to future tax years.

It’s important to be strategic in timing larger upgrades to maximize the available credits each year while staying under the annual caps according to Intuit TurboTax [2]. Consulting a tax professional can help ensure you claim correctly.

Conclusion

The benefits of energy efficient appliances are clear. By purchasing appliances that meet strict energy efficiency guidelines, homeowners can qualify for valuable tax credits that reduce their tax burden. The federal government offers credits for energy efficient refrigerators, clothes washers, dishwashers, air conditioners, furnaces, water heaters, and more. These credits can add up to hundreds of dollars in savings. Going beyond the financial incentives, energy efficient appliances also help the environment by reducing energy consumption and greenhouse gas emissions. They can lower utility bills as well. With rising energy costs expected in the years ahead, the long-term savings will be even greater. By taking advantage of energy efficiency tax credits now, homeowners invest in the future – both financially and environmentally.