Is Renewable Energy Recession Proof?

The term “recession proof” refers to assets, companies, industries or entities that are believed to be resistant to economic downturns and recessions. A recession proof industry or company continues to thrive and generate profits even as the overall economy declines (Investopedia, 2022).

The renewable energy sector has grown substantially over the past decade, driven by falling costs, technological improvements, policy support, and increased environmental awareness. Sources of renewable energy include wind, solar, hydropower, geothermal, and bioenergy. Many consider the renewable energy industry to be recession-proof due to its essential nature, cost competitiveness, policy mandates, and continued strong investment and job growth.

History of Renewable Energy During Recessions

The performance of renewable energy has been remarkably resilient during past recessions. According to a report from the EU think tank Bruegel Recessions, the Energy Mix and Environmental Policy, the share of renewables in total energy consumption has historically increased during recessions. This trend held true during the 1970s oil crisis, early 1980s recession, early 1990s recession, and 2008 global financial crisis. Government investment and incentives have played a key role in driving renewable energy growth during downturns. The 2008-2009 recession in the US was a boon for renewable energy due to government stimulus spending, tax credits, and loan guarantees for clean energy projects. The American Recovery and Reinvestment Act helped launch the US wind and solar industries despite harsh economic conditions.

Cost Competitiveness

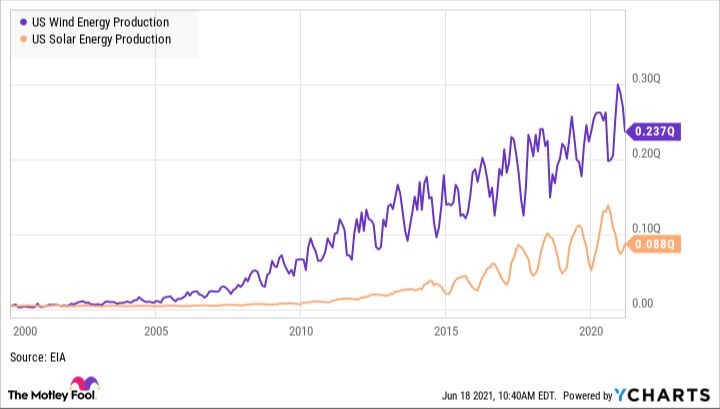

The costs of renewable energy technologies like solar and wind have declined dramatically in the last decade, becoming increasingly cost competitive with fossil fuels. According to Our World in Data, the global levelized cost of electricity for utility-scale solar photovoltaics declined 82% between 2010 and 2019. The cost of onshore wind declined 40% during the same period. In comparison, the cost of electricity from gas peaking plants declined 8%.

As a result, renewables have achieved grid parity in many parts of the world. As of 2020, analysis shows that the levelized cost of energy from renewable sources like solar, wind, and hydropower is cheaper than electricity from new coal and gas plants. The declining costs of renewables mean they are often the most cost-effective source of new electricity generation. This cost competitiveness provides a buffer for continued growth of renewables even during economic downturns.

Policy Support

Government policies like subsidies, incentives, and mandates have played a crucial role in supporting the growth of renewable energy, even during challenging economic times. Studies show that countries with consistent, long-term policies attract the most renewable energy investment.

The Inflation Reduction Act, passed in 2022, makes the largest investment in clean energy in U.S. history – $370 billion aimed at slashing greenhouse gas emissions 40% by 2030. The legislation extends tax credits for renewable power projects, provides rebates for homeowners to install rooftop solar, and offers tax breaks for electric vehicles.

By providing financial incentives and market certainty, government policies make renewable energy projects economically viable. During recessions, policy support helps counteract factors like reduced electricity demand and tightened financing. Stable policy environments also give confidence to investors and companies. Ultimately, government mandates and subsidies play an essential role in driving renewable energy growth and insulating the industry during economic downturns.

Investor Interest

Despite economic downturns, renewable energy continues to be an attractive investment for many investors seeking stable long-term returns. According to David Riester, “Solar wasn’t an asset class that attracted institutional investors at any scale in the early 2000’s – the last time interest rates were where they are now.” However, that has changed dramatically over the past decade.

As EY reports, climate risk is now a major factor driving continued investment into renewables from major institutional investors and asset managers. Renewable energy investments are seen as a way to hedge against climate risk and diversify portfolios. There is also significant interest from pension funds, insurance companies, endowments, and sovereign wealth funds looking to allocate capital into assets with stable, long-term returns. As a result, investment into renewable energy assets and companies continues to gain momentum.

Job Creation

The renewable energy industry has seen tremendous job growth in recent years. According to the U.S. Department of Energy, clean energy jobs grew 3.9% in 2022, adding 114,000 jobs and increasing to over 40% of total energy jobs in the U.S. DOE Report Finds Clean Energy Jobs Grew in Every State in 2022. In comparison, fossil fuel extraction and support jobs have seen declines. The DOE reports there are now over 924,000 renewable energy jobs in the U.S. across solar, wind, storage, biofuels and geothermal industries. Many of these are well-paying jobs that cannot be outsourced.

According to the International Renewable Energy Agency (IRENA), renewable energy jobs almost doubled in the past decade, reaching 13.7 million globally in 2022. Renewables Jobs Nearly Doubled in Past Decade, Soared to 13.7 Million in 2022. In contrast, fossil fuel industry employment has declined. The renewable energy transition represents a major opportunity for job creation and economic growth around the world.

Energy Security

Renewable energy sources can enhance domestic energy production and reduce reliance on imported fossil fuels, strengthening energy security (Energy Independence and Security, n.d.; Energy Security – Topics – IEA, n.d.). Most renewable energy is generated domestically, from resources like wind, solar, geothermal, hydro, and biomass. Unlike finite and geopolitically concentrated fossil fuels, renewable sources are available across the U.S. and cannot be easily interrupted by disputes or instability abroad. Shifting electricity generation to domestic renewables insulates the U.S. economy from fossil fuel supply disruptions and price volatility. According to the U.S. Department of Energy, “The United States can achieve energy independence and security by using renewable power” (Energy Independence and Security, n.d.).

Public Support

Despite economic turbulence, public support for renewable energy remains strong. A recent Pew Research poll found that 82% of Americans favor expanding solar panel farms, while 75% support more wind turbine farms. The public views renewable energy as reliable – 80% believe it is as dependable or more dependable than fossil fuels, per a national voter survey. Grassroots movements calling for a transition away from fossil fuels and towards clean energy continue to gain momentum.

There is strong public sentiment that renewable energy development should be a national priority. 69% of Americans believe the country’s top energy goal should be achieving carbon neutrality through renewable sources rather than expanding oil, gas, and coal production, according to Pew Research.

Challenges

While renewable energy has shown resilience during recessions, it still faces ongoing challenges. Two key challenges are ongoing subsidies for fossil fuels and construction/supply chain disruptions.

Fossil fuels continue to receive significant government subsidies, which can make it difficult for renewable energy to compete on cost alone. According to a 2021 report by the International Energy Agency, “Fossil fuels received around US$5.9 trillion in subsidies in 2020” (source). These subsidies for oil, gas and coal give them an advantage over renewable sources.

Supply chain disruptions caused by COVID-19 significantly impacted the renewable energy industry. Factory closures, labor shortages, and raw material constraints slowed production and construction. One analysis found that over 75% of solar and wind energy companies experienced delays in obtaining raw materials or components during 2020 (source). These ongoing disruptions make it harder to scale up renewable energy systems.

Conclusion

In summary, renewable energy has shown resilience during past economic downturns for several key reasons. The costs of renewables like solar and wind have declined dramatically, making them cost-competitive with fossil fuels. They enjoy strong policy support from federal and state governments, including tax credits, incentives, and renewable portfolio standards. Investor interest remains strong as renewable energy is seen as the future of the energy sector. Renewable projects can also create a significant number of construction and operation jobs, providing an economic boost. Renewable energy enhances energy security and reduces reliance on imported fuels. And finally, public support and enthusiasm for renewable power continues to be high.

Looking ahead, the outlook for continued growth in renewables remains positive. Prices are expected to continue falling as technologies improve. Ambitious government targets for renewable energy generation and carbon reduction will necessitate large-scale buildouts of wind, solar and other renewable sources. Investment funds are increasingly flowing into clean energy. Job growth will follow renewable energy investments. And public opinion strongly favors a transition to renewable energy to mitigate climate change. While challenges remain, renewable energy is poised to increase its share of electricity generation and energy consumption in the coming decades.