Is Renewable Energy A Good Investment

Renewable energy comes from natural sources that are constantly replenished, such as sunlight, wind, rain, tides, waves, and geothermal heat. There has been growing interest in renewable energy in recent years as an investment due to concerns about climate change and energy independence. Investments in renewable energy have been increasing as costs have fallen and government incentives have expanded. Many investors see potential in renewable energy to provide stable long-term returns while also bringing environmental benefits. This article will examine if renewable energy is a good investment by looking at the costs, incentives, returns, risks, major players, and future outlook.

Types of Renewable Energy

There are several major types of renewable energy sources that are used to generate electricity and help power our homes and businesses.

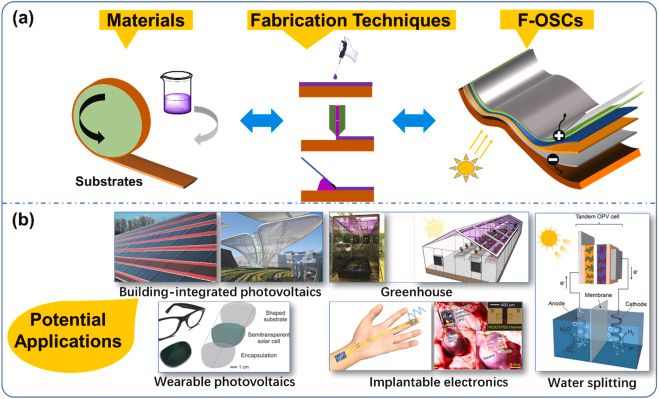

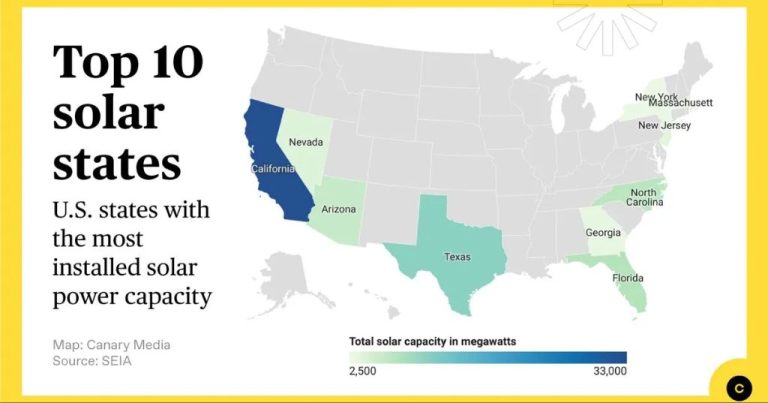

Solar energy harnesses the sun’s rays to generate electricity through photovoltaic panels. Arrays of solar panels can be installed on rooftops or ground-mounted systems to convert sunlight into usable electricity.

Wind energy captures the wind’s kinetic energy through turbines, usually grouped together in wind farms. As wind blows through the blades, a generator converts the rotation into electricity.

Hydroelectric power generates electricity from the flow of rivers using dams and turbines. The motion of the water rotates large turbines that feed into electric generators.

Geothermal energy taps into the natural heat under the earth’s surface to produce steam or hot water that can drive electric generators. Wells and pumps bring hot water or steam to the surface.

Biomass energy utilizes organic matter like plants, wood waste, and garbage to generate electricity. It can be burned directly or converted to liquid biofuels.

These major renewable sources provide alternatives to fossil fuels and reduce the amount of greenhouse gases emitted from generating electricity for homes and businesses.

Costs of Renewable Energy

The upfront capital costs of renewable energy can be higher than traditional fossil fuel sources. This is because the infrastructure for fossil fuels is already in place, while renewable energy requires building new facilities and distribution systems.

However, once built, the operating costs of renewable energy tend to be lower than fossil fuels. Wind, solar, hydro and geothermal energy do not require fuel to be purchased and transported. The “fuel” sources like wind and sunlight are free. This gives renewable energy a price advantage over the long term.

According to Inspire Clean Energy, the levelized cost of energy (LCOE) from renewable sources has fallen dramatically in the past decade, making it highly competitive with fossil fuels. The LCOE factors in both capital and operating costs over the lifetime of an energy facility.

Solar and wind power are now less expensive than coal and gas in many markets. The LCOE for utility-scale solar dropped 89% from 2009 to 2020, while onshore wind dropped 70% over the same period. This makes renewable energy much more cost-competitive as an investment.

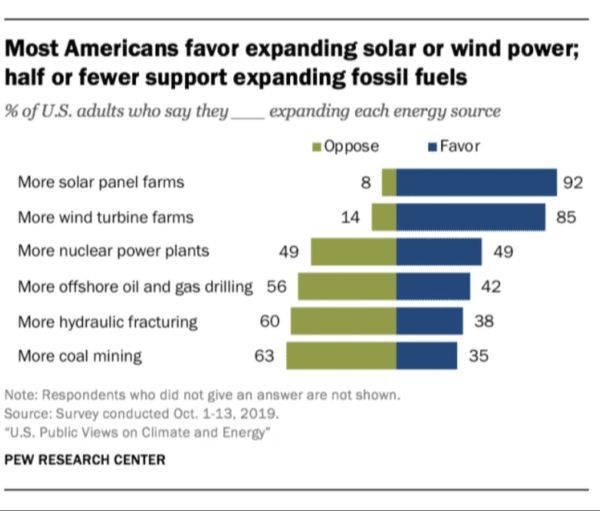

Government Incentives

There are various government incentives aimed at encouraging the adoption of renewable energy. These can significantly improve the return on investment for renewable energy projects.

The federal government offers an Investment Tax Credit (ITC) that allows you to deduct 26% of the cost of installing a residential renewable energy system from your federal taxes. Many states also offer additional tax credits and rebates. For example, California offers rebates through the California Solar Initiative along with property and sales tax exemptions for renewable energy systems.

Utilities in many states also offer rebates and incentives for renewable energy installation. These are usually structured as “performance-based incentives,” meaning you receive cash back based on the estimated annual energy production of your system. For example, SMUD in California offers an upfront incentive of $0.20 per watt for residential solar installations.

Overall, federal, state, and utility incentives can cover 30-50% of the upfront cost of a residential renewable energy system. When combined with long-term energy savings, this can make the return on investment for renewable energy very favorable in many parts of the United States.

Return on Investment

The return on investment (ROI) for renewable energy projects can be attractive but depends heavily on factors like government incentives, energy costs in your area, system size, equipment costs, and financing terms.

According to Forbes Business Council, one key consideration is determining the expected ROI of the investment. Calculating ROI involves estimating the upfront installation and equipment costs, ongoing maintenance expenses, total lifetime energy production, and the value of the energy generated.

The payback period refers to the number of years required to recover the initial investment through energy savings. Many solar projects can achieve payback in 5-7 years. The profitability and ROI will depend on the incentives received, energy prices, and system performance over its 25+ year lifetime.

Research from Forbes shows that global renewable energy investments have historically produced returns around 7 times higher than fossil fuel investments. However, ROI can vary substantially based on the specific technology, location, and incentives involved.

Thorough financial modeling and understanding all the costs, incentives, energy production variables, and financing options is key to evaluating the ROI for a potential renewable energy project.

Environmental Benefits

One of the strongest arguments in favor of renewable energy is the substantial environmental benefits it provides. Investing in renewable energy can significantly reduce carbon emissions that contribute to climate change. While fossil fuels like oil and coal emit harmful greenhouse gases like carbon dioxide into the atmosphere when burned for energy, renewable resources like solar and wind do not. According to the United Nations, renewable energy technologies could reduce global CO2 emissions by up to 70% by 2050 [1].

Transitioning to renewable energy is essential for building a sustainable future. Unlike finite fossil fuel reserves which are rapidly being depleted, sources like sunlight, wind, and geothermal heat will never run out. Renewable energy projects provide clean power while minimizing harm to the environment and natural ecosystems. Expanding the use of renewable energy allows us to dramatically cut emissions and energy waste, combat climate change, and preserve natural resources for future generations [2].

Risks and Drawbacks

While renewable energy offers many benefits, there are some risks and drawbacks to be aware of when investing in it:

Intermittency is one major challenge with some renewable sources like solar and wind. Energy production depends on weather conditions, so it is not as reliable as fossil fuels which can provide constant power. This requires integration with energy storage systems or a backup power grid, adding to costs (Source).

Related to intermittency, energy storage is another obstacle. Effective storage solutions like batteries can be expensive to install and maintain. Lack of storage capacity can limit renewable energy use and affect returns on investment (Source).

There are also larger upfront capital costs associated with building renewable energy systems compared to conventional power plants. The initial investment required can be risky and deter some investors, even though long-term savings are possible (Source).

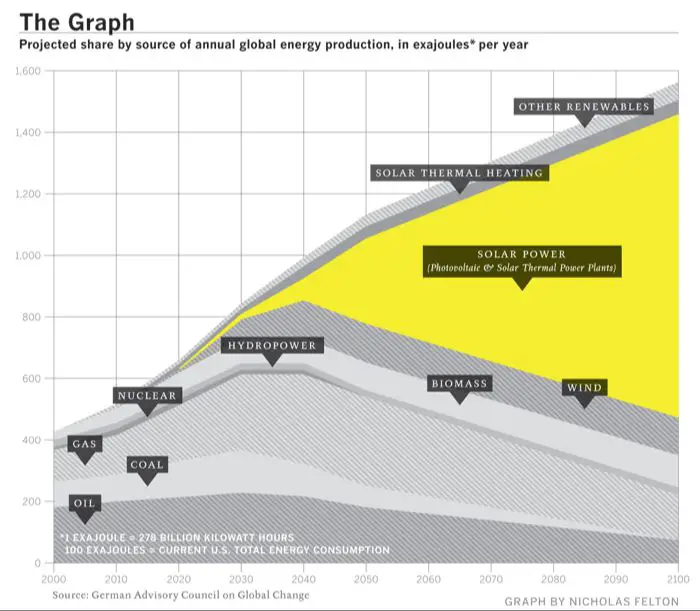

Future Outlook

The future outlook for renewable energy investment is quite promising due to projections of strong growth, continued policy support, and improvements in renewable energy technology.

According to the American Renewable Investment Campaign, the amount of investment in renewable energy is projected to increase significantly in the coming years. This growth will be driven by the declining costs of renewable energy technology as well as supportive government policies.

At the federal level, tax credits like the Solar Investment Tax Credit (ITC) and Production Tax Credit (PTC) will continue to make renewable energy projects financially attractive. Many state governments also have renewable portfolio standards that require utilities to source a percentage of their electricity from renewables. These policies provide a stable environment for investment.

Advances in technology like improved solar panels, wind turbine designs, and energy storage will further reduce the costs of renewable energy over time. As the costs decrease, investments in renewable energy will become even more financially viable.

With these positive trends in growth, policy support, and technology improvements, the future outlook for renewable energy investment remains bright. Investing in renewable energy today can provide strong returns as this sector continues its expansion.

Major Players

The renewable energy sector has attracted major companies looking to invest and develop large-scale projects. Some of the top players in renewable energy include:

NextEra Energy (NYSE: NEE) – The largest electric utility holding company in the US. NextEra is a leader in wind and solar energy projects and operates renewable energy plants capable of producing over 21,000 megawatts. As of 2022, NextEra had invested over $100 billion in renewable projects. [1]

First Solar (NASDAQ: FSLR) – A major solar panel manufacturer and project developer. First Solar has developed over 25 gigawatts of solar projects worldwide. The company specializes in utility-scale solar installations and has solar projects throughout the United States. [2]

Vestas (CPH: VWS) – The world’s largest wind turbine manufacturer, based in Denmark. Vestas has installed over 108 GW of wind capacity across 80 countries. The company manufactures onshore and offshore wind turbines and continues to expand its presence in growing wind energy markets.

In addition to companies that develop and operate renewable energy projects, major institutional investors, infrastructure funds, and oil supermajors like BP and Shell have allocated billions towards renewable energy investments to meet sustainability goals and diversify their portfolios.

Conclusion

In summary, investing in renewable energy has both advantages and disadvantages. The main benefits are reducing your carbon footprint, taking advantage of tax credits and other incentives, insulating yourself from fossil fuel price fluctuations, and contributing to the growth of the renewable energy industry. However, the upfront costs can be high and payback periods are long. Technologies are still improving and it may be better to wait a few years as panels, turbines, etc. become more efficient and affordable.

The outlook for renewable energy investment is quite positive. Costs are coming down, technologies are advancing, and government support is expanding. With climate change concerns growing, renewable energy is seeing strong tailwinds for growth. However, fossil fuels still dominate and there can be uncertainty around government policy. While returns are still uncertain, renewable energy investment lets you align your finances with your environmental values.

In conclusion, renewable energy investment offers both financial and social benefits, but requires long-term thinking and comfort with some risk. For investors concerned about climate change and interested in green tech, it can be a worthwhile part of a diversified portfolio. Assessing your specific situation is key, but the broader trends point toward renewables playing a bigger role in the future energy landscape.