How Much Does Lcoe Cost For Wind Energy?

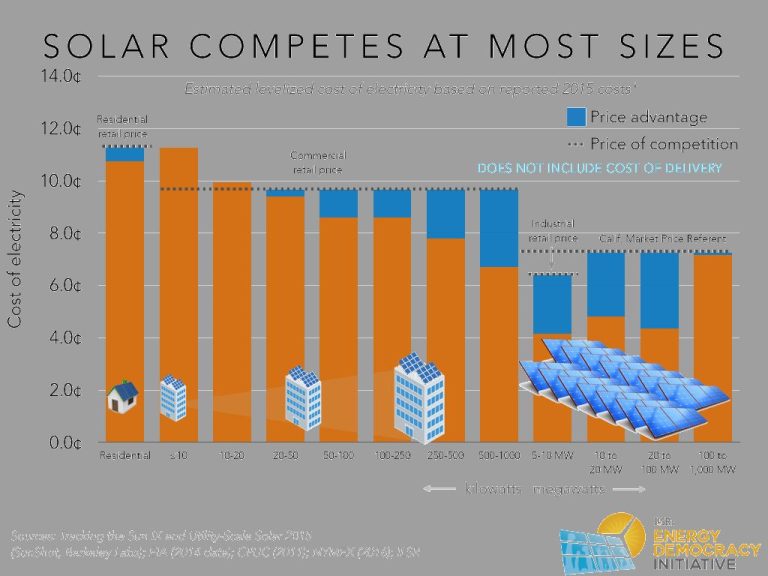

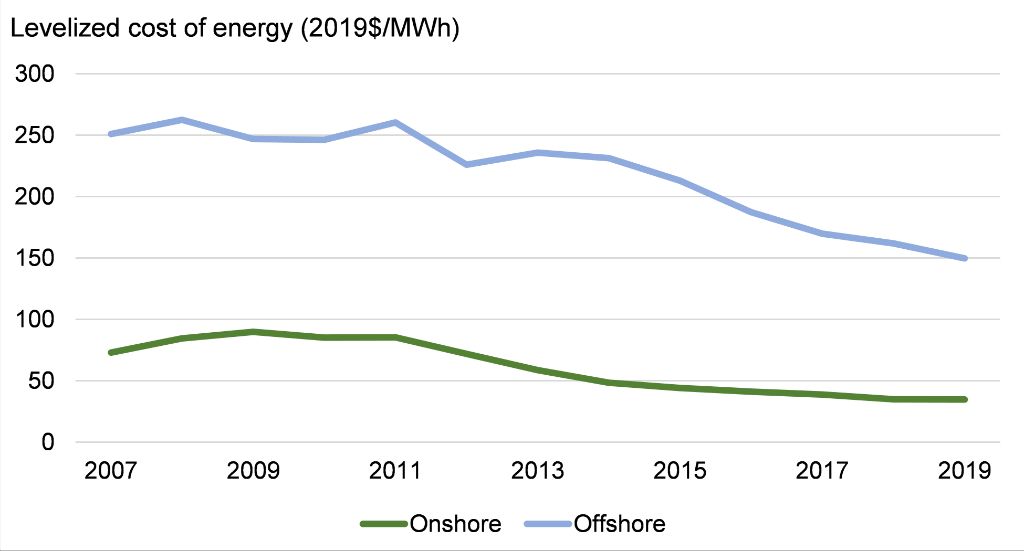

The levelized cost of energy (LCOE) for wind measures the total cost of building and operating a new wind power plant over its estimated lifetime. It allows a comparison of different technologies and project types on a consistent basis.

LCOE represents the per-megawatt-hour cost of building and operating a generating plant over an assumed financial life and duty cycle. It is one of the economic metrics used by investors to compare alternative energy investments. It also provides a benchmark for evaluating wind power relative to other electricity generation technologies such as solar, natural gas, coal, and nuclear.

Key factors that impact the LCOE of wind energy include capital costs, capacity factor, operations and maintenance (O&M) costs, cost of debt, tax credits, transmission investments, land leases, and geographic factors.

Capital Costs

The upfront capital costs make up the largest share of the levelized cost of wind energy. These costs include expenses for purchasing wind turbines, transporting equipment, civil works and construction, electrical infrastructure, and more. According to the 2021 Cost of Wind Energy Review by NREL, capital costs accounted for 65-84% of the levelized cost of wind in the United States in 2020 (https://www.nrel.gov/docs/fy23osti/84774.pdf).

The average capital cost for land-based wind farms built in 2020 was $1,470/kW. This includes all expenses for procuring wind turbines, foundations, electrical equipment, roads, permitting, engineering, interest during construction, and more. The wind turbine itself represents a significant portion of capital costs, averaging around $850/kW in 2020. Transportation and construction costs averaged around $460/kW. Capital costs can vary depending on wind resource quality, topography, labor rates, regulatory costs, and other local factors (https://www.energy.gov/eere/wind/articles/land-based-wind-market-report-2022-edition).

In Europe, an average onshore wind turbine installation incurs €1.23 million per megawatt (MW) in capital costs according to Wind Energy: The Facts. The turbine itself accounts for around 76% of this cost on average (https://www.wind-energy-the-facts.org/index-43.html). Transportation, construction, electrical infrastructure, and other balance-of-system costs make up the remainder.

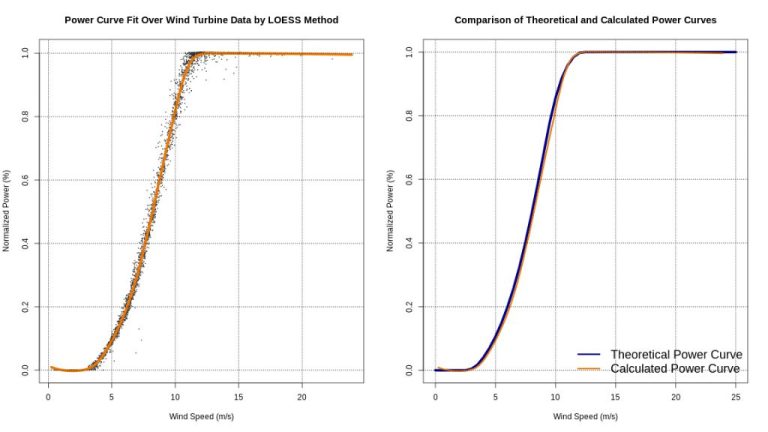

Capacity Factor

The capacity factor refers to the average power generated by a wind turbine divided by its maximum possible generation. It is a measure of how efficiently wind power is converted into electricity over time.

The capacity factor varies greatly by country. According to Windeurope.org, the average capacity factor for onshore wind farms in Europe is around 25-30%. The capacity factors are higher for offshore wind farms, averaging around 35-45% in Europe.

Some factors that influence wind capacity factor include wind speeds, turbine design, reliability, and site placement. Countries with the highest average wind speeds and offshore wind development tend to have higher capacity factors. For example, the UK and Denmark have capacity factors over 30% due to their significant offshore wind capacity.

Operation & Maintenance

Ongoing operation and maintenance (O&M) costs are a significant factor in the LCOE for wind energy. These costs include regular maintenance and repairs, spare parts, insurance, and operations staff. Major repairs and component replacements are also factored into O&M costs.

According to the U.S. Department of Energy, O&M costs for onshore wind plants in the United States average around $48 per kilowatt-year. For offshore wind, O&M costs are higher, averaging around $95/kW-yr.

O&M costs tend to be higher earlier in a wind project’s lifetime. As turbines age, more repairs and replacements are required. Unplanned maintenance also becomes more likely as components wear out.

Technological improvements that increase reliability can lower O&M costs over time. Larger turbines and offshore sites also have higher O&M expenses. Overall, experts estimate O&M represents 20-25% of the lifetime LCOE costs for a wind energy project.

(Source: U.S. Department of Energy)

Cost of Debt

The cost of debt refers to the interest rates paid on loans taken out to finance wind energy projects. This is a major factor in determining the levelized cost of wind energy (LCOE).

According to an NREL report, the median cost of debt for wind projects in 2021 was 2.7% for non-federal tax equity deals and 3.3% for federal tax equity deals (NREL). These rates were slightly higher than 2020, when median rates were 2.4% and 3.0% respectively.

The cost of debt can vary significantly depending on the risk profile of the project. Offshore wind projects, which tend to be larger and involve more upfront capital, often have higher interest rates compared to onshore projects. The creditworthiness of the developer and overall market conditions also impact interest rates.

According to industry experts, lenders view wind projects as relatively low risk investments due to the steady, long-term nature of power purchase agreements and production tax credits (Stoel). This helps secure lower interest rates for wind projects compared to other energy technologies.

Tax Credits

Tax credits and other financial incentives from the government can significantly reduce the LCOE for wind projects. The federal Production Tax Credit (PTC) allows wind farm owners to reduce their income tax by a set amount for every kilowatt-hour of electricity generated during the first 10 years of operation [1]. This tax credit has helped drive substantial growth in the wind industry since it was introduced in 1992. The inflation Reduction Act passed in 2022 extends and expands the PTC, which is projected to reduce LCOE for new wind projects by up to 9% [2]. Other tax credits like accelerated depreciation and the Investment Tax Credit (ITC) also lower costs for wind farm developers and operators.

Transmission

One factor that can impact the LCOE of wind power is the cost to transmit the electricity from the wind farm to the grid. According to a study by the the National Renewable Energy Laboratory, the average levelized transmission capital cost for connecting renewables like wind power to the grid ranges from $1 to $10/MWh (https://emp.lbl.gov/news/new-national-lab-study-quantifies-cost). Another study found that transmission capital costs can increase the LCOE of wind by 3-33%, depending on the baseline LCOE ($29-$56/MWh) (https://emp.lbl.gov/publications/improving-estimates-transmission). Factors like distance to grid infrastructure and terrain can impact transmission costs. Overall, connecting wind farms to the grid typically costs around 15% of total wind farm capital costs.

Land Leases

Wind energy companies need to lease large areas of land to build wind farms. Landowners can receive attractive lease payments for allowing wind turbines on their property. According to Landmark Dividend, on average, lease payments for a single wind turbine can pay landowners up to $8,000 per year. Thus, wind farming can provide significant recurring income for landowners with suitable properties.

Typical lease terms are $4,000 – $8,000 per turbine or 2-4% of gross revenues, as noted by Windustry. The royalty payments tend to start lower and increase over the 20+ year term of the lease. For example, starting at 4% in year 1 and increasing to 10% by year 20, according to Landgate. This provides landowners with an appreciating income stream.

The number of turbines possible depends on factors like property size, wind resources, permitting, and transmission access. Generally 40+ acres is needed per turbine. With proper siting, wind farms can co-exist with agriculture and ranching, providing farmers and ranchers drought-resistant income.

Geographic Factors

Location significantly impacts the levelized cost of electricity (LCOE) for wind projects. The main geographic factors that affect cost include wind resource quality, terrain complexity, climate and weather patterns, population density, and proximity to transmission infrastructure.

Regions with the highest quality wind resources, such as the Great Plains in the U.S., generally have lower LCOE. Higher average wind speeds allow turbines to generate more electricity, spreading fixed costs over more production. Complex terrain and forests can increase construction expenses and turbulence. Harsher climates raise operation and maintenance costs. Icing, strong storms, and temperature extremes can strain equipment.

Population density around wind projects influences labor, material, and land costs. More components often must be transported longer distances to remote wind farms. Additionally, acquiring suitable large-scale sites near load centers is challenging. Connecting to the transmission grid can be expensive far from infrastructure. According to the EIA, long transmission interties to load centers can add 20-30% to costs.

Conclusion

The levelized cost of energy (LCOE) for wind power has declined significantly over the past decade due to improvements in technology and economies of scale. According to the U.S. Department of Energy, the average LCOE for land-based wind fell by 32% from 2015 to 2021 [1]. Key factors driving this reduction include taller towers, larger rotors, improved turbine design, and more efficient operations and maintenance. Going forward, experts predict continued cost declines as new offshore wind resources are tapped and component costs decrease further. The International Renewable Energy Agency found the global average LCOE for onshore wind dropped 5% from 2021-2022 as technology matured [2]. With projected capacity growth and technology improvements, the LCOE for wind energy is expected to become increasingly cost-competitive with conventional power generation.