How Expensive Is Non Renewable Energy?

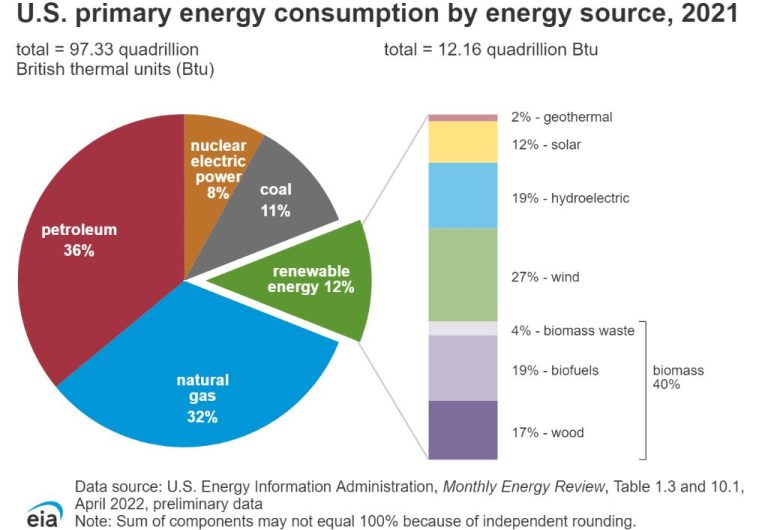

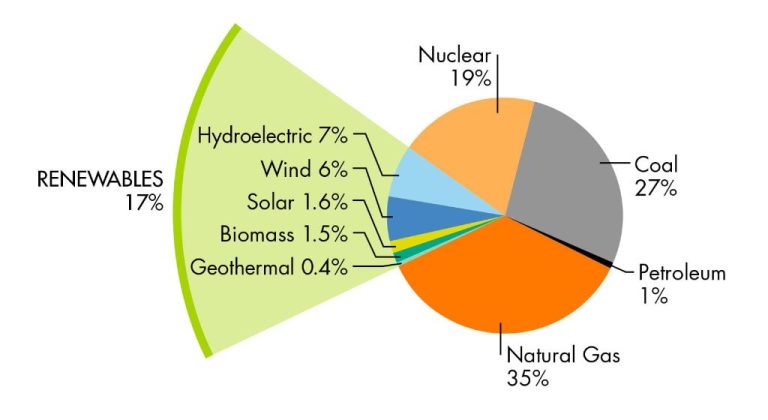

Non-renewable energy sources like coal, oil, and natural gas have provided much of the world’s power for the past century. However, these fossil fuels are finite resources that will eventually dwindle or become too expensive to retrieve. Their prices are also susceptible to market volatility and geopolitical events. In contrast, renewable energy from sources like wind, solar, and hydropower relies on practically limitless natural processes.

Calculating the true costs of non-renewable energy is complex. On one hand, they benefit from established infrastructure and technologies that provide inexpensive electricity in many regions. On the other hand, their environmental, health, and social impacts are not reflected in market prices. Comparing the economics of renewable and non-renewable energy requires analyzing direct costs alongside subsidies, externalities, and other factors.

Fossil Fuels

The fossil fuel industry in the United States is extremely capital intensive and includes costs for extraction, transportation and refining of petroleum products. Drilling and extraction of crude oil, which make up the raw material for products like gasoline and petrochemicals, has high upfront operational costs – especially for offshore drilling (The Hidden Costs of Fossil Fuels). Transporting crude oil via pipelines or tankers adds even more to the tally. Refining crude oil into usable products requires multi-billion dollar investments in infrastructure and has associated operating costs.

Coal mining and natural gas fracking also require heavy investment and operating costs. Transporting coal via rail and natural gas via pipelines is necessary before they can be used for electricity generation and other applications. The infrastructure in the United States required to get fossil fuels from the ground to the end user entails hundreds of billions of dollars in annual costs that are ultimately passed onto the consumer (The High Cost of Fossil Fuels).

Geopolitical factors also affect the costs of fossil fuels, especially oil and natural gas. Major fossil fuel producing nations can manipulate prices higher through supply restrictions or price collusion through groups like OPEC. Political instability in key producing regions can also cause significant volatility in fossil fuel markets.

Nuclear

Nuclear power plants have significant construction costs, largely from the stringent safety requirements and complex infrastructure needed to contain radioactive materials. According to the Union of Concerned Scientists, construction costs for new nuclear plants rose from an estimated $2-4 billion per unit in 2002 to over $9 billion per unit by 2008.

A major part of nuclear costs come from uranium mining and enrichment. Uranium fuel must go through complex chemical processes to enrich the uranium-235 isotope needed for nuclear fission. According to the World Nuclear Association, uranium fuel costs account for around 13% of the total generating costs for nuclear power.

Safety and regulatory compliance also add substantial expenses for nuclear plants. Containing radiation and preventing accidents requires thick containment structures, redundant backup systems, and many highly trained personnel. Nuclear plants must follow strict procedures to avoid catastrophic incidents. Decommissioning nuclear sites at end-of-life also costs hundreds of millions of dollars.

Overall, analysis by organizations like the International Energy Agency estimate nuclear as one of the more expensive electricity sources per kWh generated. However, nuclear proponents argue that factoring in externalities like emissions makes it competitive with fossil fuels.

Government Subsidies

Fossil fuel companies receive large direct subsidies from governments for production. According to the International Energy Agency (IEA), global fossil fuel consumption subsidies totaled $318 billion in 2017 (IEA). These subsidies encourage more fossil fuel production and make it difficult for renewable energy to compete.

There are also major indirect subsidies in the form of tax breaks. The IMF estimates that when environmental and health externalities are factored in, global fossil fuel subsidies rise to $5.2 trillion per year (IMF). Compared to an estimated $150 billion in subsidies for renewable energy (IEA), this tilted playing field makes fossil fuels look much cheaper than their true cost.

Environmental Externalities

Fossil fuels like coal, oil and natural gas have significant environmental externalities that are not reflected in their market price. Burning these fuels releases pollutants like sulfur dioxide, nitrogen oxides and particulate matter that contribute to smog, acid rain and respiratory illnesses. This imposes climate, health and environmental damage costs that society has to bear.

One way economists calculate these external costs is by estimating the “social cost of carbon” emissions. This attempts to quantify the economic damages associated with emitting carbon dioxide into the atmosphere. Estimates for the social cost of carbon range from $10 to $200 per metric ton of CO2. With U.S. power plants emitting over 2 billion tons of CO2 annually, these environmental costs can add up quickly.

Additional costs stem from mitigating the air and water pollution impacts of fossil fuel extraction and use. This includes installing scrubbers and filtration systems, remediating contaminated sites, and finding alternative water sources when supplies become contaminated. One study estimated U.S. air pollution costs from fossil fuels at over $170 billion per year, with associated health impacts of over 43,000 premature deaths annually.

Security Costs

Fossil fuels like oil and natural gas often require military intervention to protect supply lines and access to reserves. This imposes huge security costs on governments and taxpayers. According to the Union of Concerned Scientists, the U.S. spent over $81 billion annually protecting oil supplies overseas from 2010-2014. Securing fossil fuel interests has also been a major factor in geopolitical conflicts and instability in regions like the Middle East. Military campaigns to protect oil access in Iraq alone are estimated to have cost the U.S. over $1.9 trillion from 2003-2013. These massive security costs associated with fossil fuels are often overlooked or externalized but impose a huge burden on societies dependent on oil and gas.

Other Factors

Non-renewable energy sources like coal, oil, and natural gas often have additional costs beyond just fuel and construction expenses. These include:

Grid integration and transmission costs: Non-renewable power plants are often located away from population centers, requiring long transmission lines to connect to the grid. Transmitting electricity over long distances incurs line losses and requires expensive infrastructure investments (Cost of electricity by source).

Research and development costs: Fossil fuel and nuclear technologies require continual R&D expenditures to improve efficiency, reduce emissions, enhance safety, and address waste issues (Comparing Renewable and Non-Renewable Energy Costs). These costs may not be fully captured in levelized cost estimates.

Energy storage needs: Non-renewable plants provide baseload power, but lack the storage capabilities required to balance a grid with high shares of variable renewables. Additional expenditures for storage may be necessary as renewables expand (Cost Of Renewable Vs Non-Renewable Energy).

Levelized Cost Estimates

The levelized cost of energy (LCOE) is a metric used to compare the costs of different energy sources over the lifetime of the asset. It represents the per-megawatt hour cost of building and operating an energy plant across its useful life. LCOE takes into account capital costs, fuel costs, fixed and variable operations and maintenance costs, financing costs, and the utilization rate of the plant.

According to analysis from Lazard, the unsubsidized LCOE in 2021 for different energy sources were as follows:

- Gas combined cycle: $44-68/MWh

- Coal: $60-143/MWh

- Nuclear: $129-198/MWh

- Wind: $26-50/MWh

- Utility-scale solar PV: $32-42/MWh

This shows that renewable sources like wind and solar have become cost-competitive with traditional non-renewable sources. In particular, the LCOE for utility-scale solar has dropped 88% over the last decade, while wind has fallen 71% in that time. This dramatic decrease has been driven by economies of scale, technology improvements, and public and private investment.

Most projections indicate that renewables will continue to get cheaper over time and undercut fossil fuels further. The International Renewable Energy Agency predicts the global weighted average LCOE for solar PV could decline an additional 60% by 2030. Onshore wind could see costs drop another 25-30% in that timeframe.

The Price of Inaction

Delaying a transition to renewable energy sources comes with significant economic risks and costs. As a 2021 report notes, unchecked emissions lead to rising climate change impacts that incur escalating adaptation and mitigation costs. Each year of delay exponentially increases the price tag for addressing climate change. There are also substantial stranded asset risks associated with existing fossil fuel infrastructure that could become obsolete in a rapid energy transition. The International Renewable Energy Agency estimates $18 trillion in fossil fuel assets could become stranded by 2050 under a delayed transition scenario.

The economic shocks and societal costs caused by delaying an urgent transition to renewables also include market volatility, supply chain disruptions, lower productivity and reduced growth. Reports consistently highlight the urgent need to accelerate the transition before 2030 to avoid locking in unsustainable infrastructure and minimize economic risks. The benefits of an early and managed transition rather than a delayed and abrupt one include lowering medium-to-long term costs, minimizing stranded assets, driving new growth and employment opportunities, and reducing the likelihood of severe climate change impacts.

Conclusion

In summary, the true costs of non-renewable energy sources like coal, natural gas, and nuclear are much higher than their direct market prices reflect. Factors like government subsidies, environmental externalities, and energy security risks often are not included in the retail price of electricity from fossil fuels and nuclear. When accounting for these hidden costs, the total price of non-renewable electricity generation can be 2 to over 3 times higher than the current retail rates.

Accurately pricing non-renewable energy to reflect its full costs to society would help make alternatives like solar, wind, geothermal, and hydropower more cost competitive. With continued technology improvements and deployment, renewable energy is on track to be the most affordable and economical choice for electricity in the years ahead.

The outlook for clean energy is promising, with costs decreasing rapidly. With supportive policies and a levelized playing field, renewable energy can deliver reliable, low cost electricity for society while avoiding the hidden costs and risks of continued fossil fuel dependence.