How Do You Fund Green Energy?

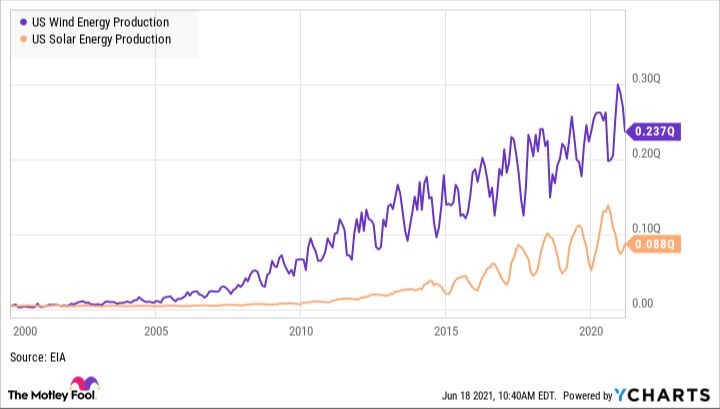

Green energy refers to renewable energy sources that are sustainable and environmentally friendly, such as solar, wind, hydroelectric, biomass, and geothermal power. Transitioning to green energy is crucial for reducing greenhouse gas emissions, mitigating climate change, improving public health, and ensuring energy security. However, scaling up green energy faces challenges due to high upfront capital costs and the intermittent nature of sources like solar and wind. The main ways to fund green energy projects include government subsidies, carbon pricing schemes, green bonds, crowdfunding, impact investing, corporate investments, and community financing models. With the right policies and financing mechanisms, green energy has the potential to transform our energy systems and build a cleaner future.

Government Subsidies

Governments around the world provide various subsidies to support renewable energy development. Some common types of subsidies include:

- Grants – Direct payments to cover costs of renewable energy projects.

- Tax credits – Tax reductions to incentivize renewable energy investment and production. Major tax credits in the U.S. include the Investment Tax Credit (ITC) and Production Tax Credit (PTC).

- Feed-in tariffs – Pricing incentives that guarantee renewable electricity generators fixed, premium rates per kWh over long periods.

- Renewable portfolio standards – Mandates requiring utilities to source specified percentages of power from renewables.

In the European Union, feed-in tariffs have been instrumental in enabling high growth in renewable energy capacity, but they are now being phased out in favor of auctions and tenders. The U.S. has provided substantial tax credits, grants, and loan guarantees for renewables through legislation like the American Recovery and Reinvestment Act.

While subsidies can accelerate renewable energy deployment, concerns include inefficient allocation of resources, market distortions, and costs to taxpayers or ratepayers. Policy designs that promote competitive pricing through auctions may provide greater market efficiency and cost-effectiveness.

Sources:

https://www.forbes.com/sites/uhenergy/2018/03/23/renewable-energy-subsidies-yes-or-no/

https://www.sciencedirect.com/science/article/pii/S030626192301512X

Carbon Pricing

Carbon pricing is a strategy to incentivize reductions in carbon emissions. Carbon prices are set and imposed on carbon emissions, forcing companies and individuals to pay for their carbon pollution. This pricing scheme can take the form of a carbon tax or a cap-and-trade system, as explained by the World Economic Forum.

Putting an adequate price on carbon pollution can help drive the transition to clean energy. As noted in a report by the IMF, “Carbon pricing shows serious promise as a tool in the fight against climate change. Deterring the use of fossil fuels, such as coal, fuel oil, and gasoline, can curb emissions.” According to the IEA, reflecting environmental costs in energy prices through carbon pricing “can be critical for a cost-effective and sustainable recovery.”

Countries like Canada, China, and Germany have implemented nationwide carbon pricing systems. The EU has the world’s largest carbon market. According to the World Bank, 64 national and subnational jurisdictions responsible for 22% of global greenhouse gas emissions are putting a price on carbon. The impact of carbon pricing varies, but it shows potential to help mobilize funding for green energy when designed properly.

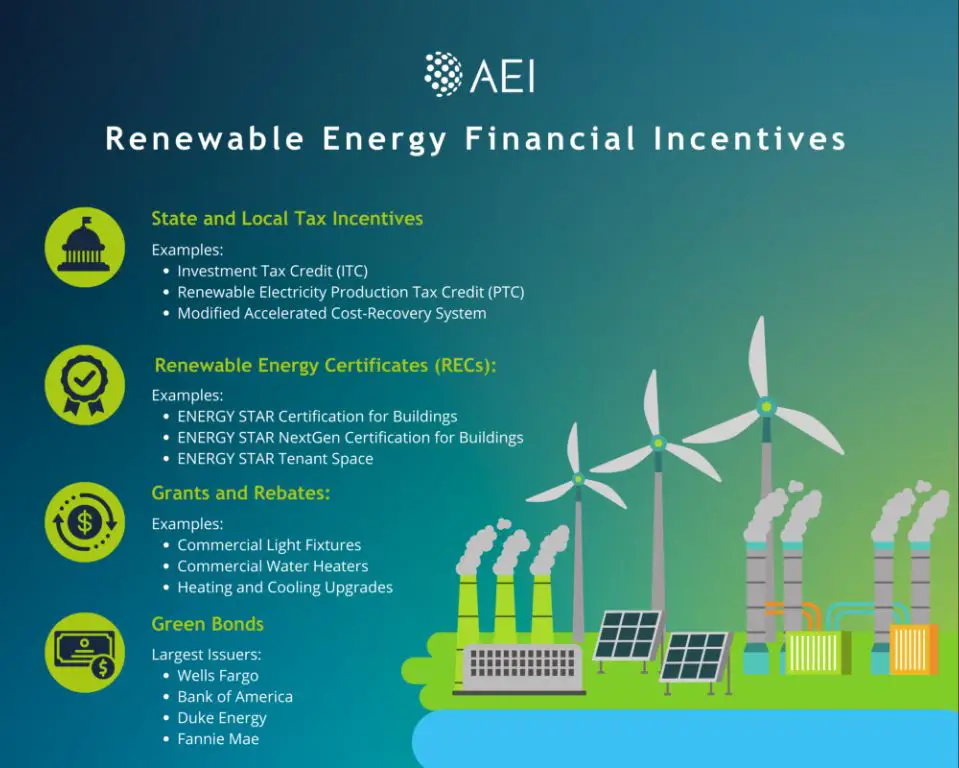

Green Bonds

Green bonds are fixed-income financial instruments specifically issued to fund climate change solutions and environmental projects like renewable energy. The first labeled green bond was issued in 2007 by the European Investment Bank. Since then the market has grown rapidly, reaching over $255 billion in issuance in 2019 (IRENA, 2020).

Major issuers of green bonds include development banks like the World Bank and the European Investment Bank, corporations such as Apple, Toyota, and Starbucks, and governments. The proceeds from green bonds are earmarked for renewable energy projects as well as energy efficiency, clean transportation, and other climate-friendly initiatives. According to the Climate Bonds Initiative, over 75% of green bond proceeds have been allocated to renewable energy projects in recent years.

Green bonds allow issuers to tap into growing investor demand and bring new investors to the table. They offer the same financial return as regular bonds, with the added benefit of funding environmental projects. While still a small fraction of the overall bond market, green bonds are growing rapidly as governments, companies, and investors align on climate goals (Alamgir, 2023).

Crowdfunding

Crowdfunding provides an innovative way to fund renewable energy projects through small investments from a large number of individuals. Popular crowdfunding models for green energy include donation-based, rewards-based, equity-based, and peer-to-peer lending.

Successful renewable energy crowdfunding platforms like Solar Mosaic allow investors to fund specific solar projects in exchange for interest payments based on the project’s energy production. Other sites like SunFunder enable individuals to finance solar projects in developing countries. The benefits of renewable energy crowdfunding include giving more people the ability to directly impact green energy growth.

However, crowdfunding for green energy does have limitations. Most crowdfunding investments are high-risk and illiquid with longer return timelines. There are also regulatory hurdles in some countries related to securities laws. Overall though, crowdfunding creates new opportunities for decentralized, grassroots funding of renewable projects.

Impact Investing

Impact investing refers to investments made with the intention of generating positive social or environmental impact alongside financial returns (Exploring the Benefits of Investing in Renewable Energy Projects, 2023). Major impact investors in renewable energy include groups like CollectiveSun, which allows individual investors to fund solar projects for nonprofits and public entities. Other platforms like Carbon Collective pool funds to invest directly in renewable energy projects.

Impact investments in renewable energy can provide solid returns of 6-8% while also reducing carbon emissions and expanding clean energy access (Renewable Investing | Definition, Types, Pros & Cons). The dual goals of profit and purpose make impact investing an attractive option for funding green energy projects with positive environmental and social impacts.

Corporate Investments

Corporations are directly investing in renewable energy projects to meet sustainability goals and save money on energy costs.

Amazon recently announced its first utility-scale renewable energy project in India, a 410 MW solar farm developed by ReNew Power. This investment will support Amazon’s commitment to reach 100% renewable energy use by 2025 (Amazon Announces Its First Utility-Scale Renewable Energy). In 2020, Amazon was the largest corporate buyer of renewable energy globally according to CEBA, demonstrating the tech giant’s significant investments in clean energy (CEBA Announces Top 10 U.S. Large Energy Buyers in 2020).

Other major companies like Google, Apple, and Facebook have also made sizable renewable energy investments to power data centers and operations. Buying clean power directly allows corporations to secure stable, low-cost energy while meeting ambitious carbon reduction goals.

Community Investing

Local communities are investing in renewable energy projects as a way to gain financial returns while also supporting energy autonomy and environmental benefits. Community solar projects allow utility customers to collectively invest in and receive credits from a shared solar array, even if they can’t install panels on their own property. According to the Institute for Local Self-Reliance, the Oregon Clean Power Cooperative makes it easy for everyday people to invest locally in community-owned clean energy projects. Through Oregon’s community solar law, this electric co-op gives members ownership shares and a voice in what types of projects get funded. Community investments in local renewable energy can give people more control over their energy use while providing stable returns.

As noted by the Institute for Local Self-Reliance, community renewable energy investing allows residents to come together and have an impact on their energy supply (https://ilsr.org/oregon-clean-power-coop-ler-episode-96/). Rather than being passive consumers, community members can democratically decide on energy projects that benefit the local area. Investing locally helps money stay within the community. It also connects people to the clean energy they are using and supports broader energy independence and sustainability goals.

Challenges

Expanding renewable energy faces several key difficulties and hurdles. One of the biggest challenges is competing against fossil fuels, which are heavily subsidized in most countries. Fossil fuel subsidies were estimated at over $5.9 trillion in 2020, giving them a significant price advantage (IEA).

Another major issue for renewable energy is intermittency and storage. Solar and wind power are variable and weather-dependent. Energy storage solutions like batteries can help overcome this, but are currently limited. Developing grid flexibility and more affordable storage options remains an obstacle (AJG).

Finally, renewable energy projects require very high upfront capital costs. Building large-scale wind farms or solar arrays can cost billions upfront. Financing these high initial investments is difficult, especially in developing countries. Creative financing solutions are needed (IEEFA).

Conclusion

There are several key ways to fund green energy initiatives that were covered in this article. Government subsidies provide direct financial incentives for renewable energy production and adoption. Carbon pricing helps account for environmental externalities and makes fossil fuels less cost competitive. Green bonds allow for large-scale fundraising specifically for climate-friendly projects. Crowdfunding platforms enable individuals to directly contribute to clean energy startups and projects. Impact investing allows funds to be directed to renewable companies and assets. Corporations are allocating more capital spending to green energy with sustainability targets. Community solar and wind projects allow collectives to develop local clean power.

A diversified approach across these funding sources is important to scale renewable energy as quickly as possible. Relying solely on one mechanism would likely be insufficient. Government policies that are supportive of renewables are also crucial to provide a favorable landscape.

More creative funding sources and models may emerge in the future. But it is clear much greater investments in green energy are needed today by governments, businesses, organizations and individuals to rapidly transition away from fossil fuels and mitigate climate change. The opportunities and returns from doing so will only continue to grow.