How Do You Finance Renewable Energy?

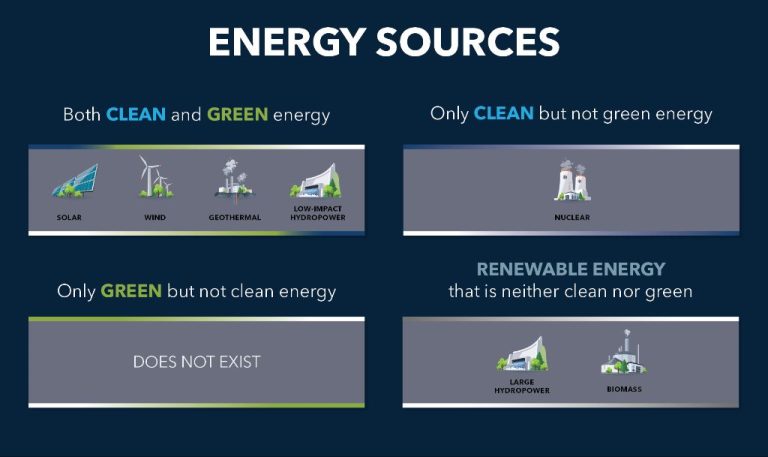

Renewable energy comes from natural sources that are constantly replenished, such as sunlight, wind, water, plants, and geothermal heat. Some of the most common types of renewable energy include solar, wind, hydroelectric, geothermal, and biomass. Developing renewable energy is crucial for addressing climate change, reducing pollution, creating jobs, and ensuring energy access and security (Source).

However, renewable energy projects often face financing challenges. They tend to have high upfront capital costs and long payback periods. Many renewable technologies are still maturing, so they can be seen as risky investments. There is a funding gap between available financing and what’s needed to truly transition to renewable energy worldwide. Creative financing solutions are required to attract sufficient investment in renewable energy and overcome traditional financing barriers. This article provides an overview of options to finance renewable energy projects, from government incentives to innovative mechanisms like green bonds and community financing.

Government Incentives

The federal government provides various incentives to support the growth of renewable energy. Some key incentives include tax credits, grants, and loan guarantees.

Tax credits help reduce the cost of installing renewable energy systems like solar panels or wind turbines. There are credits for both residential and commercial installations. The most widely used credit is the solar Investment Tax Credit (ITC), which provides a 26% tax credit for systems installed in 2022-2023. This credit will step down to 22% in 2024 and 0% in 2025 for residential projects, while remaining at 10% indefinitely for commercial projects (EIA).

Grants are funds provided by the government that do not need to be repaid. For example, the Rural Energy for America Program (REAP) offers grants to farmers, ranchers and small businesses in rural areas to purchase renewable energy systems. REAP provided $41 million in grants in 2021 (DOE).

Loan guarantees lower the risk for lenders, enabling projects to secure financing more easily. The Department of Energy’s Loan Programs Office has issued over $35 billion in guarantees for large-scale renewable projects using technologies like solar, wind, and geothermal (DOE LPO).

Carbon pricing

Carbon pricing is a way to put a cost on carbon emissions that contributes to climate change. There are two main forms of carbon pricing: carbon taxes and cap-and-trade systems. Both make emitting CO2 more expensive, which incentivizes companies and consumers to shift to low-carbon or carbon-free options.

A carbon tax is a fee imposed by a government directly on carbon pollution, usually based on the tons of CO2 emitted. Over 40 countries and 25+ subnational jurisdictions now have some form of carbon tax in place, with widely varying prices across jurisdictions (The Impact of Carbon Prices on Renewable Energy Support). The revenues generated can be used to support renewable energy and energy efficiency programs. A higher carbon tax increases the costs of fossil fuels relative to clean energy, helping drive adoption of renewables. However, effective carbon taxes require broad political and public support, which has been challenging to sustain long-term in many areas.

A cap-and-trade system sets an overall limit on emissions in a region or sector, issues tradable permits up to that cap, and allows companies to buy and sell permits amongst each other. The cap gets stricter over time. The European Union Emissions Trading System is the largest existing cap-and-trade market. By putting a cap on total emissions that must be met, it gives certainty about emission reductions. However, the carbon price in these systems can be volatile based on permit supply and demand (The Impact of Carbon Credits on Renewable Energy Development).

Green banks

Green banks are public financing institutions that leverage public funds to attract private capital investment in clean energy projects. They provide loans, credit enhancements, and other financial products to accelerate the deployment of renewable energy sources such as solar and wind power.

According to the Coalition for Green Capital, a green bank is “a focused institution, created to maximize clean energy adoption.” Green banks use tools like credit enhancements and securitization to lower the risk and improve the return profile of clean energy investments. This enables projects to attract more private capital investment. They also provide long-term, low-cost financing directly to projects that traditional banks won’t finance due to perceived risks.

By mobilizing private sector investment, green banks aim to drive the widespread adoption of renewable energy sources. This accelerates the transition away from fossil fuels to a clean energy economy. Some notable green banks in the U.S. include NY Green Bank, Connecticut Green Bank, and the Clean Energy Finance Corporation in Australia.

For more information, see:

https://www.nrel.gov/state-local-tribal/basics-green-banks.html

Bonds

Green bonds are bonds issued specifically to finance renewable energy projects. According to the EPA, “State and local governments may issue bonds to finance capital improvement projects, including clean energy projects. When a government issues a ‘green bond,’ it signifies that the proceeds will be used to finance environmentally beneficial projects.” https://www.epa.gov/statelocalenergy/municipal-bonds-and-green-bonds

Green bonds offer investors stable returns while also enabling green investments. They are similar to traditional government bonds but the proceeds go towards financing renewable energy projects such as wind or solar farms. Some key advantages of green bonds include tax incentives, stable cash flows, and social benefits. https://www.energy.gov/scep/slsc/articles/leveraging-bond-financing-support-energy-efficiency-and-renewable-energy-goals-1

Yieldcos are publicly traded companies that own renewable energy assets. They provide steady dividends to investors based on the cash flows from those assets. Major banks on Wall Street are arranging billions in financing for yieldcos as the demand for renewable energy grows. https://www.forbes.com/sites/christopherhelman/2022/12/07/big-wall-street-banks-will-reap-billions-from-renewable-energy-bonds/

Crowdfunding platforms allow individuals to invest directly in specific renewable energy projects, providing an alternative source of financing. This allows community members to support local clean energy projects.

Venture capital and private equity

Venture capital (VC) and private equity (PE) firms have become important sources of financing for renewable energy over the last decade. Between 2006 and 2011, PE/VC invested almost $50 billion in the clean energy sector according to The Banker. This early stage and growth funding has helped launch and scale many innovative renewable energy companies.

VC firms typically provide capital to early-stage startups, funding proof of concepts, prototypes, and bringing first products to market. For example, Breakthrough Energy Ventures, a $1 billion VC fund led by Bill Gates, invests in clean energy technology startups like Form Energy, an innovator in next-generation battery storage (Oliver Wyman).

Later stage PE firms provide larger amounts of growth capital as companies expand manufacturing and operations. VC and PE financing has been critical in advancing wind, solar, smart grids, energy efficiency, electric vehicles, battery storage, hydrogen, and carbon removal technologies.

While VC investment in cleantech startups slowed from $9 billion in 2019 to $6 billion in 2020 according to Carta, long-term trends point to ongoing innovation and opportunities in renewable energy finance.

Project Finance

Project finance is a common method of financing renewable energy projects, especially large-scale installations like solar farms or wind parks. It involves creating a legally independent project company that can take on non-recourse debt to finance up to 80-90% of the project costs. The project company’s main assets are the renewable energy installation itself and a long-term power purchase agreement (PPA) that provides stable and predictable cash flows from selling the electricity generated.

Under a PPA, an electricity buyer like a utility agrees to purchase the power generated by the project at a fixed price for 15-20 years. These future revenue streams give lenders the confidence to provide financing for construction costs and make project finance possible. As one of the key sources noted, “The revenue certainty provided by a long-term PPA with an investment grade utility counterparty is essential for project finance to work.” [1]

Leveraging the stable operating cash flows from a PPA is the foundation of project finance for renewable energy. The financing is tied directly to the project itself, rather than the project sponsors. This limits risks for lenders and allows developers to finance up to 80-90% of project costs through non-recourse debt. Equity investors put up the remaining 10-20% in exchange for owning the project assets and receiving the long-term cash flows. Project finance makes financing large renewable energy installations feasible by allowing developers to leverage future revenue streams.

Community financing

Community financing models allow members of a community to collectively invest in and benefit from local renewable energy projects. Two common community financing approaches are community solar and crowdfunding.

Community solar refers to solar facilities shared by multiple community subscribers who receive credits on their electricity bills based on the amount of energy produced by their portion of the solar installation. This allows community members to access solar power even if they cannot install solar panels on their own property. There are several community solar financing models including utility-sponsored, special purpose entity, and nonprofit models [1]. The shared investment and return through energy credits allow greater access to renewable energy.

Crowdfunding involves raising small amounts of capital from a large number of investors, often through online platforms. This has emerged as a way for individuals to collectively finance small-scale renewable energy projects. Individuals invest or donate directly to specific projects and may receive a financial return. Crowdfunding increases community engagement and allows people to directly support renewable energy projects in their region [2].

Corporate investments

Corporations are increasingly investing in renewable energy, both by purchasing renewable power and developing their own renewable energy projects.

One way corporations invest in renewables is through power purchase agreements (PPAs). A PPA is a contract between the developer of a renewable energy project and a corporate buyer, where the corporate agrees to purchase the power generated by the project at a fixed price. PPAs provide financial certainty for renewable projects and allow corporations to lock in low electricity prices (BNEF Corporate Energy Market Outlook 2021). Major corporations like Google, Amazon, Facebook, and Walmart have signed hundreds of PPAs for wind and solar projects in order to power their operations with renewable energy (WWF, Calvert Investments, & Ceres. Power Forward 3.0).

Companies are also directly investing in developing their own renewable energy projects, like onsite solar installations and offsite wind and solar farms. For example, Apple has invested over $4.7 billion in renewable energy projects like solar arrays and wind farms in Nevada, Oregon, and Denmark to power their offices, data centers, and retail stores (Apple. Environment Progress Report 2021, p. 35). Investing in their own renewable energy generation allows companies to have more control over meeting their sustainability goals.

Overall, corporations are playing a significant role in scaling up renewable energy by purchasing renewable power and directly investing billions in clean energy projects. Their demand and investments are enabling the continued growth of the renewable energy industry (Medium – The Power of Progress).

Conclusion

In summary, there are various financing options available for renewable energy projects, including government incentives, carbon pricing, green banks, bonds, venture capital and private equity, project finance, community financing, and corporate investments. Each option has its own benefits and drawbacks.

Government incentives like tax credits and rebates can offset the high upfront costs of renewable projects. Carbon pricing and green banks use market mechanisms to encourage clean energy investment. Bonds allow companies to raise large amounts of capital from investors. Venture capital and private equity provide early stage funding for innovative startups. Project finance deals spread risk across multiple stakeholders. Community financing allows local investors to fund small-scale renewable projects. Corporations are also allocating more capital towards renewables as part of their sustainability goals.

The future outlook for renewable energy financing is positive. Costs continue to fall rapidly for solar, wind and other technologies, making them increasingly competitive with fossil fuels even without subsidies in many markets. Global investment in clean energy has grown steadily over the past decade, reaching over $300 billion in 2018. With growing urgency to address climate change, governments, corporations and investors are expected to unleash trillions more in capital towards decarbonization in the coming decades. Innovation in financing models like crowdfunding, blockchain and tokenization could further accelerate the transition.