Does Florida Offer Tax Credit For Solar Panels?

The solar energy landscape in Florida has seen substantial growth over the past decade, thanks in large part to favorable federal and state incentives. Solar power has the potential to provide clean, affordable electricity throughout the Sunshine State. But one key incentive Florida lacks compared to many other states is a state tax credit for solar panel installation.

Whether or not Florida will offer tax credits for solar energy is an important issue impacting homeowners, businesses, and the renewable energy industry in the state. Tax credits can provide significant savings that make solar power more accessible and affordable. With a state tax credit, more Florida residents may be motivated to go solar, creating jobs while reducing dependence on fossil fuels and utility bills. But enacting solar tax credits also has drawbacks like reduced tax revenue.

In this article, we will explore Florida’s current solar policies, incentives, andtax landscape. We will look at the debate around adding a state tax credit for solar panels and analyze the potential benefits and challenges.

Current State of Solar in Florida

Solar energy is growing rapidly in the Sunshine State. According to the Solar Energy Industries Association (SEIA), Florida currently ranks 3rd in the nation for total installed solar capacity. Over 4.4 gigawatts of solar energy have been installed across the state, enough to power nearly 700,000 homes. The state also ranks 11th for total solar generation as a percentage of electricity.

Solar power in Florida has seen tremendous growth over the past decade, with installed capacity increasing over 3,200% since 2010. In 2021 alone, Florida installed over 915 megawatts of solar electric capacity. Much of this growth has been driven by large utility-scale installations, but residential solar is also on the rise and accounted for over 25% of new installations in 2021.

Many of Florida’s largest metro areas are leading the way on solar adoption. Miami/South Florida, Tampa Bay, Orlando, and Jacksonville are hotbeds for residential solar, while large solar farms are being built across rural areas of the state. With Florida’s abundant sunshine and large energy demands, the market for solar power will likely continue expanding in the years ahead.

Federal Tax Credits

The federal government currently offers some valuable tax credits that can reduce the cost of going solar for Florida residents. The most significant one is the federal Investment Tax Credit (ITC).

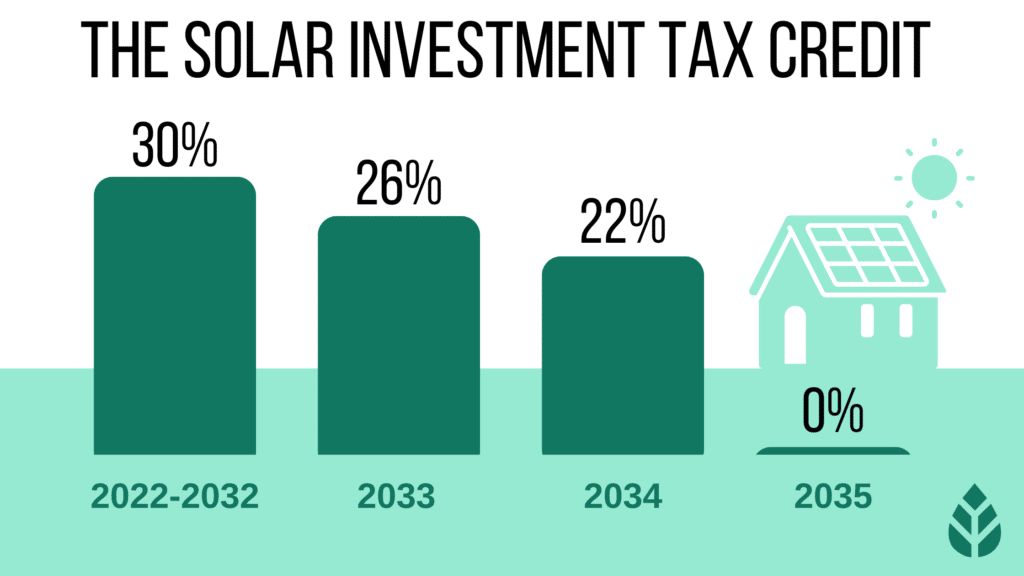

The ITC allows homeowners to deduct 26% of the cost of installing a residential solar energy system from their federal taxes. For a commercial solar energy system, the ITC offers a tax credit equal to 30% of the installation costs. There is no cap on the size of the credit. This can add up to thousands of dollars in savings for many homeowners and businesses.

To qualify for the full ITC, solar panels must be installed by December 31, 2022. After that, the residential credit drops to 22% for systems installed in 2023. Then in 2024, the residential credit goes away completely while the commercial credit drops to 10%. So the ITC is currently more generous than it will be in coming years.

Overall, the federal ITC significantly reduces the payback time and improves the return-on-investment for going solar. While Florida does not offer a state tax credit, the federal ITC still makes solar power highly affordable for both residential and commercial property owners.

State Tax Credits

Many states offer additional state tax credits to supplement the federal tax credit and further incentivize solar panel installation. These state-level credits can significantly reduce the cost of going solar for residents. For example, New York offers a tax credit covering 25% of the cost of installing a solar system, up to $5,000. Oregon offers a tax credit covering 50% of system costs up to $6,000 for residential installations. Other states with generous solar tax credits include Massachusetts (up to $1,000 credit), Louisiana (up to $2,000 credit), Utah (up to $1,600 credit), and others.

These types of state tax credits, when combined with the federal ITC, can cover a major portion of the upfront costs of installing solar panels. This makes embracing solar energy much more financially appealing and feasible for homeowners and businesses in those states. Unfortunately, not all states offer these extra incentives, which can hamper solar adoption.

Florida’s Solar Tax Policies

Florida currently does not offer any state tax credits or rebates for installing solar panels. This marks a change from past policies, as Florida previously had solar rebates and tax incentives but allowed them to expire over the past decade.

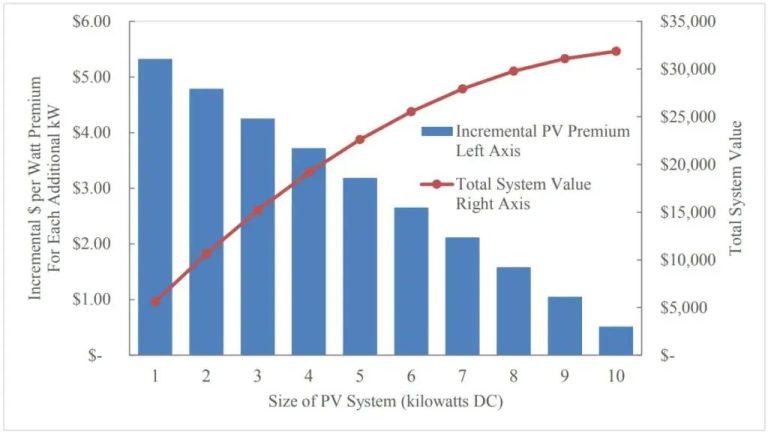

From 2006 to 2010, Florida offered rebates for solar PV and solar thermal systems under the Florida Solar Energy System Incentives Program. This program provided rebates of up to $4 per watt for grid-tied PV systems up to 10 kW and $15 per square foot for solar water heating systems. However, the program was discontinued in 2010 after the allocated funds were exhausted.

Florida also previously offered a corporate tax credit equal to 75% of all capital costs associated with installing a renewable energy system, including solar panels. This tax credit was available from 2006 to 2014 but was allowed to expire at the end of 2014. Since then, efforts to reinstate a solar tax credit in Florida have not succeeded.

The expiration of Florida’s past solar incentives, including tax credits, means the state currently lacks favorable tax policies for going solar. Without a state tax credit, the cost of installing solar must be recouped solely from federal tax incentives and electricity bill savings. This has made Florida a less economically attractive solar market compared to many other states.

Other Florida Solar Incentives

Florida offers some solar incentives besides tax credits. These other incentives help to reduce the costs of installing solar panels for homeowners and businesses. Some of the key incentives are:

- Solar Rebates – Some utilities like Duke Energy provide rebates to customers to make solar more affordable. Depending on the utility, rebates can cover 20-40% of the cost of solar panels and installation.

- Net Metering – Florida has statewide net metering rules which allow solar customers to sell excess electricity back to the grid. This helps offset the costs of solar power.

- Property Tax Exemption – Solar equipment installed on residential properties is exempt from being taxed as part of the home’s assessed property value. This reduces property taxes.

- Solar Renewable Energy Certificates – SRECs can be earned and sold on the open market for solar power that is produced and put into the grid. SRECs provide added solar incentives.

While not as lucrative as an income tax credit, these other incentives do help encourage solar adoption across Florida by reducing costs.

Benefits of Solar Tax Credits

Florida is currently one of the few states that does not offer any state tax credits or rebates for residential solar installations. If Florida were to implement a state solar tax credit program, it could incentivize more homeowners to adopt solar energy. This could provide several potential benefits for the state:

Increased Solar Adoption: A state tax credit would help offset the upfront costs of going solar, which remains one of the biggest barriers to wider adoption. More Floridians may find solar to be an affordable option with a state tax credit, leading to higher installation rates.

Job Creation: The solar industry is a major source of employment, with over 250,000 jobs in the US as of 2019. Much of the job growth is in installation and other services to support new solar adoption. Increased demand from a state tax credit program could boost solar job creation in Florida.

Grid Benefits: Wider solar adoption provides benefits to the overall electric grid. Solar energy generated at homes helps reduce demands on the grid during peak hours. It can improve grid resilience and reliability. Utility-scale solar also continues to expand in Florida, with tax credits further accelerating growth.

Environmental Benefits: Solar energy generates electricity without carbon emissions or other pollution. Increased solar adoption from a state tax credit program would help lower Florida’s overall greenhouse gas emissions from power generation. It would support cleaner air and public health.

In-State Economic Growth: Expanding solar would keep more energy spending in the state rather than exporting fossil fuel-derived energy dollars out of state. Solar installation, maintenance and financing activities would also growth the in-state economy.

If designed well, a Florida state tax credit could provide these types of benefits and establish the state as a leader in solar energy. However, the policy specifics would determine the ultimate impacts of any solar tax credit program.

Opposition Viewpoints

While solar energy continues to gain popularity across the country, some groups oppose states offering additional tax credits and incentives for residential solar installations. Those against expanding solar tax credits argue:

– Solar tax credits are expensive and lead to higher taxes overall or spending cuts in other areas. Some studies estimate solar tax credits can cost states hundreds of millions per year in lost revenue.

– Solar primarily benefits the upper middle class who can afford the upfront investment. Tax credits allow the wealthy to pay less taxes while transferring costs to low-income residents.

– The solar industry should be able to thrive and grow without subsidies. Tax credits distort the energy market, favoring solar over other energy sources.

– Money would be better spent further developing solar technology itself to reduce costs rather than subsidizing consumer installation. This would lead to wider solar adoption long-term.

– Solar tax credits can complicate the tax code and create opportunities for fraud and abuse.

– States and the country as a whole should focus more on increasing energy efficiency, which provides a better return on investment.

While opposition exists, many still see significant benefits from promoting renewable energy growth and energy choice through solar tax credits.

Efforts to Add Solar Tax Credit in Florida

In recent years, there has been a growing push by environmental and renewable energy advocates to establish a solar tax credit in Florida similar to incentives offered in many other states. Several bills have been introduced in the Florida legislature that would provide tax credits to residents who install solar panels on their homes, including HB 321 and SB 548 filed in 2021. While none of these proposals have yet passed, supporters remain committed to the effort.

The group Floridians for Solar Choice, a coalition of solar companies and clean energy organizations, has been one of the main groups calling for enacting a tax credit. They argue that incentives would help more Florida homeowners adopt solar power, spurring job growth while reducing carbon emissions. According to the group, over 75,000 Floridians work in the solar industry, and a tax credit could add an estimated 18,000 more solar jobs. They also cite polls showing bipartisan support among voters for solar energy.

Some lawmakers, mainly Democrats, have echoed these arguments and pledged their support for solar tax credit bills. They face resistance from conservative legislators who argue incentives would undermine free market competition and raise costs for non-solar customers. With GOP control of the state legislature, advocates have an uphill battle. But Floridians for Solar Choice and others vow to keep pressure on lawmakers to reward residents who invest in clean energy.

Conclusion

Despite efforts to add a state tax credit, Florida currently does not offer any tax incentives for residential solar panel installation. For now, Florida homeowners are limited to claiming the federal solar tax credit which allows taxpayers to deduct 30% of installation costs from their federal taxes. However, interest groups and legislators continue to propose bills to add a state solar tax credit in Florida.

While a Florida state tax credit would likely incentivize more solar adoption, arguments against it cite budgetary concerns and question if it’s the government’s role to subsidize solar panels. Regardless, the solar industry and environmental advocates remain committed to their efforts, believing Florida is missing out on solar job growth and clean energy opportunities.

Looking ahead, the odds of a Florida state solar tax credit passing in the near future remain uncertain. With the federal tax credit set to phase down, a state tax policy may become more appealing. Florida already offers generous rebates and net metering, but a tax credit could provide a more immediate financial return. As the economics of solar continue to improve, a state tax credit may reach viability. For the time being, interested homeowners can still benefit from the federal credit.