Will There Be Federal Solar Tax Credit In 2023?

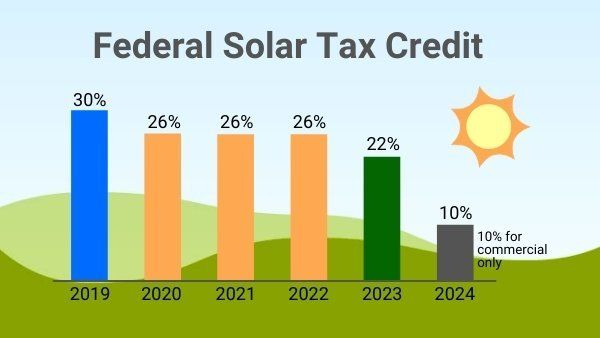

The federal solar tax credit, also known as the investment tax credit (ITC), allows homeowners to deduct 26% of the cost of installing a residential solar energy system from their federal taxes. This tax credit has helped drive the growth of residential solar, but it is currently set to phase out and expire completely after 2023 unless Congress acts to extend it. There is uncertainty around whether the tax credit will still be available in 2023 and beyond. The potential expiration raises questions about the future outlook for residential solar without this important incentive.

Current Federal Solar Tax Credit

The federal solar tax credit, known officially as the Solar Investment Tax Credit (ITC), currently offers a 26% tax credit for systems installed in 2022. This means taxpayers can claim a credit for 26% of the total cost of installing a residential solar system, including solar panels, inverters, wiring, and permitting fees (Source).

To claim the credit, homeowners must own and install the solar system on their primary or secondary residence located in the United States. There are no income limits to qualify. The credit is taken against federal tax liability, so taxpayers must have sufficient tax liability to use the full credit amount. If the credit exceeds tax liability, any excess can be carried forward to future tax years (Source).

The 26% applies to systems installed and put into service by December 31, 2022. After that, the percentage drops incrementally over the next two years before expiring completely in 2024 (Source).

Solar Investment Tax Credit History

The federal solar tax credit, officially known as the Solar Investment Tax Credit (ITC), has driven tremendous growth in solar energy adoption since it was first introduced in 2005. The credit was originally passed as part of the Energy Policy Act of 2005, which aimed to promote clean energy sources and energy independence.

The original legislation offered a 30% tax credit on residential and commercial solar energy systems that applied from January 1, 2006 through December 31, 2007. In 2006, the Tax Relief and Health Care Act extended the credit through December 31, 2008.

In 2008, the Emergency Economic Stabilization Act was passed, which included an eight-year extension of the residential and commercial ITC. The extended credit kept the 30% rate through 2016, then dropped incrementally each year: to 26% in 2020 and 22% in 2021. After 2021, the residential credit was set to drop to zero while the commercial credit would remain at 10% permanently.

Most recently, in December 2020, Congress passed legislation to further extend the residential ITC. The credit will now phase down more slowly, stepping down to 26% in 2022 and 22% in 2023 before expiring completely in 2024 for residential projects. The commercial credit remains at 10% indefinitely.

The periodic extensions and scheduled phase outs of the ITC have aimed to provide market stability and predictability for the solar industry while also reducing costs to taxpayers over time. The steady declines built into the credit have reflected expected cost reductions in solar technology.

Tax Credit Phase Out

The federal solar Investment Tax Credit (ITC) has been decreasing incrementally over the last few years. Originally, solar systems were eligible for a 30% tax credit. However, under the IRS guidelines, the ITC percentage began stepping down starting in 2020.

For solar panels installed in 2020-2021, the tax credit was 26%. It stepped down again to 22% for systems installed in 2022. Under the previous schedule, the ITC percentage would continue decreasing, with solar installations only qualifying for a 22% tax credit in 2023 and 0% in 2024 and beyond.

This phase out schedule was designed to slowly wean the solar industry off the ITC as costs decreased and adoption increased. However, the complete expiration of the tax credit after 2023 was projected to significantly slow solar growth. The phase out raised concerns in the solar industry around loss of jobs and momentum.

Importance of Solar Tax Credit

The federal solar tax credit has had an enormous impact on the adoption of residential solar since it was established in 2006. According to a report by the Solar Energy Industries Association, the tax credit has helped the solar industry grow by over 10,000% in the last decade [1]. The tax credit covers 26% of the cost of installing a solar energy system on a residential property in 2022, which can reduce installation costs by thousands of dollars [2].

Research shows that the existence of the ITC directly increases the likelihood that homeowners will adopt solar by installing photovoltaic systems. One study found a direct correlation between ITC percentage rates and the growth of solar capacity, with rates up to 30% spurring solar adoption most effectively [3]. The tax credit has played a major role in transforming solar from a niche product to a mainstream energy source.

According to the Solar Energy Industries Association, the ITC has brought over 300,000 solar jobs online since its implementation. As the costs of solar continue to decrease, the tax credit provides a crucial incentive for homeowners to choose solar over conventional energy sources [1]. With climate change driving the need for clean energy, the importance of continuing incentives like the ITC remains high.

Calls to Extend Tax Credit

The solar industry and policymakers have pushed hard to extend the federal solar tax credit past its scheduled phase-out in 2022. Major industry groups like the Solar Energy Industries Association (SEIA) have lobbied Congress to continue the credit, arguing it is vital to meet renewable energy goals and reduce carbon emissions.

In 2021, SEIA and other groups sent a letter to Congressional leaders calling for a 10-year extension of the tax credits for both residential and commercial solar installations. The letter argued the extension would create over 500,000 new jobs by 2031. https://www.energy.gov/eere/solar/articles/solar-investment-tax-credit-what-changed

There was also bipartisan support in Congress for extending the credit. In March 2021, Senators Michael Bennet (D-CO) and Dean Heller (R-NV) introduced the Renewable Energy Extension Act to extend the credit for 5 years. Similar bipartisan bills were introduced in the House.

These efforts paid off with the passage of the Inflation Reduction Act in August 2022, which included provisions to extend the solar tax credit at 30% for 10 years until 2032. This was hailed as a major victory by the solar industry and environmental groups who had lobbied extensively for the extension.

Chances of Extension in 2023

The chances of the solar tax credit getting extended in 2023 are very low. The current extension that was passed in 2022 increased the tax credit to 30% through 2032 [1]. This represents a significant extension from the previous phase out schedule that would have reduced the tax credit to 22% for 2023. Given this recent extension, it’s unlikely Congress will revisit the solar tax credit again next year. Barring an unforeseen change, the 30% credit for 2023 is set and extremely unlikely to be altered. While the solar industry continues to advocate for a longer extension or permanent tax credit, the political dynamics make it improbable that the credit gets expanded again so soon after the multi-year extension passed in 2022.

Impact if Tax Credit Expires

The potential expiration of the federal solar tax credit could have significant effects on the solar industry. The tax credit has been crucial in spurring adoption of residential solar systems since it was introduced in 2006. According to one analysis, the tax credit has helped the solar market grow by over 10,000% in 15 years.

If the 26% credit expires as currently scheduled after 2032, the number of new solar installations is projected to drop substantially. The Solar Energy Industries Association estimates solar adoption could fall by as much as 50% in the residential sector and 37% in the commercial sector. This would likely lead to major job losses in the solar industry, which currently employs over 250,000 Americans.

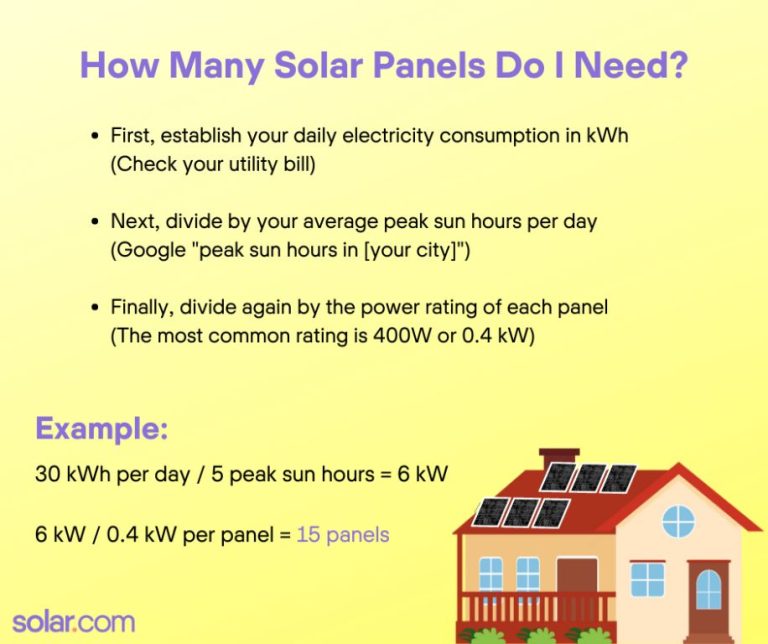

Without the tax credit incentive, the payback period for a home solar system increases to 9-12 years on average, compared to the current 6-8 years. This reduced ROI may deter many homeowners from adopting solar. System costs would also likely rise without the strong demand created by the tax credit.

However, the long-term outlook for solar remains positive even without the tax credit. Costs continue to fall, and solar is already cost competitive with conventional electricity in many markets. But losing the federal tax credit would nonetheless be a major setback for solar energy adoption in the U.S. in the near-term.

Outlook for Solar Without Tax Credit

The outlook for solar energy growth without the tax credit is still positive, but more subdued. According to research by SEIA, solar deployment is projected to be 30% lower from 2022 to 2024 without the ITC, versus if the full 30% credit were still in place. Their analysis shows that the U.S. solar market would see 67 GW of solar installations from 2022-2024 with the tax credit phased down, versus 97 GW of growth with the full ITC. However, even without the tax credit, the SEIA projects solar installations will continue to grow year-over-year as costs continue to fall.

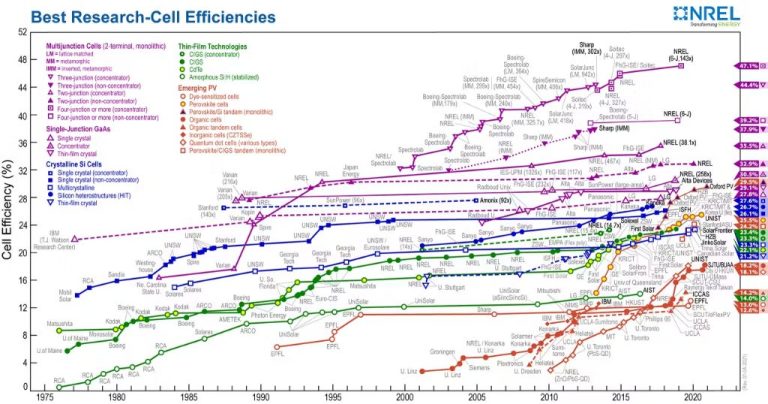

An analysis by Deloitte also predicts strong continued growth for renewable energy in general, though warns the phase down of tax credits could result in a small reduction in capacity additions in 2024. Their 2024 industry outlook sees renewables accounting for almost a quarter of US electricity generation by 2024, up from 21% in 2021. This demonstrates there are still strong underlying drivers for solar growth even without the tax credit, like state/corporate clean energy commitments and improving solar technology and efficiency.

Conclusion

In summary, the federal solar investment tax credit is currently 26% for systems installed in 2022 and is set to step down to 22% for systems installed in 2023. After 2023, the commercial tax credit will drop to 10% indefinitely while the residential credit is scheduled to expire. The tax credit has played a pivotal role in the rapid growth of solar energy in the U.S. over the last decade. While there have been calls in Congress to extend the credit, the chances of it being renewed in 2023 seem low given the current political climate. If the residential credit expires, it will likely lead to a slowdown in the home solar market. However, declining solar costs and state/utility incentives will continue to drive adoption even without the federal tax credit. The solar industry is expected to continue growing over the next decade, albeit at a slower pace without the tax credit.