Will Illinois Help Pay For Solar Panels?

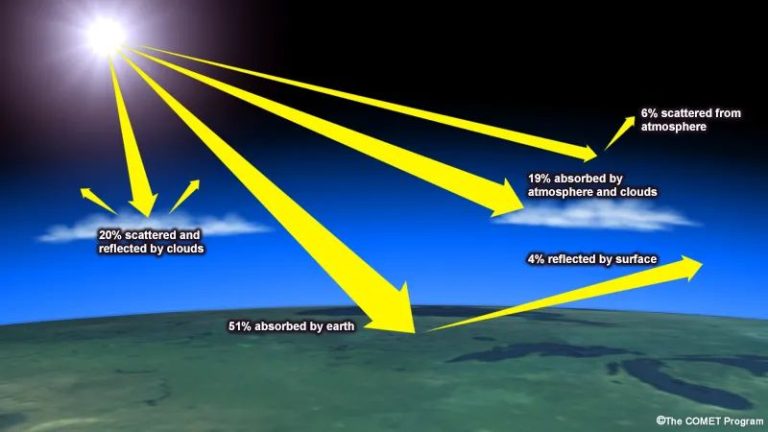

Solar power is growing in popularity across Illinois. According to the Solar Energy Industries Association (SEIA), Illinois currently ranks 15th in the U.S. for installed solar capacity, with enough to power over 375,000 homes. Solar accounts for 1.56% of the state’s electricity generation, up from just 0.3% in 2016 (SEIA). With abundant sunshine and decreasing costs, more Illinois residents and businesses are choosing to go solar every year.

Interest in rooftop solar panels and community solar has surged in recent years. As solar installation costs have dropped 70% over the last decade, payback periods have become faster and solar power in Illinois more cost-effective. Supportive policies at the state level, like the Future Energy Jobs Act, have also helped drive growth in solar. With solar already booming, many Illinois homeowners wonder – will the state help pay for part of the cost of going solar?

Current Illinois Solar Incentives

The State of Illinois currently offers a few incentive programs to help offset the costs of installing solar panels.

The Illinois Shines program, overseen by the Illinois Power Agency, provides financial incentives for onsite rooftop or ground-mounted solar arrays for large utility customers. Participants receive payments ranging from $35-$50 per megawatt hour produced (Illinois Power Agency).

Additionally, Illinois offers a state tax credit equal to 30% of the costs of installing a solar energy system for residential properties. There is a maximum credit amount of $5,000 per project (EnergySage).

Some local utility companies like Ameren Illinois and ComEd also offer rebates to offset solar installation costs for residential customers in certain areas of the state.

Federal Tax Credits

The federal government offers tax credits to homeowners who install solar panels, which can help reduce the upfront costs. The most common federal solar incentive is the federal solar investment tax credit (ITC). The ITC allows homeowners to deduct 26% of the cost of installing a residential solar system from their federal taxes. For 2022, the ITC will be 26%, but it is scheduled to drop to 22% in 2023. After 2023, the residential credit will be eliminated for homeowners.

To claim the ITC, homeowners must own the solar system, not lease it. The credit can be used to offset regular income taxes, so there is no limit based on how much tax you owe. If the credit exceeds your tax liability for the year, the excess amount can be carried forward to future tax years. The ITC applies to both the solar panels as well as other hardware like inverters and racking equipment. It can also be combined with other incentives like state rebates.

Using the ITC and state/local incentives together allows homeowners to maximize the value from all available solar incentives. With careful planning, these credits and rebates can cover a significant portion of the overall costs.

Net Metering in Illinois

Net metering allows solar panel system owners to receive bill credits for excess electricity they generate and send back to the grid. When a solar system generates more electricity than the home is using, the excess electricity is fed back into the grid. This excess generation results in credits on the customer’s electricity bill, offsetting electricity drawn from the grid when solar panels aren’t generating enough to meet their needs. Customers are only billed for their net energy use each month

Illinois has mandatory net metering laws, requiring major utilities like ComEd and Ameren to offer net metering to customers with renewable energy systems up to 2,000 kilowatts in size. The key benefits of net metering for Illinois solar customers include:

– Getting full retail value for excess solar generation, instead of lower wholesale rates

– Accumulating credits to offset electricity used at night or during cloudy weather

– Avoiding the need for expensive battery storage to capture excess daytime solar production

– Receiving payments from the utility for any net excess generation at the end of the year

Net metering enables solar panel owners to maximize the value of their investment and reduce their utility bills through on-site renewable generation. Illinois’ net metering laws provide important incentives for residential and commercial solar adoption in the state.

Property Assessed Clean Energy (PACE)

PACE financing allows property owners to fund energy efficiency, renewable energy, and other eligible improvements through a voluntary assessment on their property tax bill. With PACE, 100% of the project cost can be financed and paid back over time through the assessment.

Illinois has active PACE programs through the Illinois Energy Conservation Authority and the Illinois Finance Authority. These programs make PACE financing available statewide to commercial, industrial, multi-family, and non-profit property owners. In October 2022, the Pritzker administration expanded the Illinois Finance Authority’s PACE program to cover all Illinois counties and municipalities.

According to the Illinois Finance Authority, key benefits of PACE financing for solar projects include:

- Funding up to 100% of project costs

- Fixed interest rates

- Long repayment terms up to 25 years

- Financing that stays with the property upon sale

- No personal guarantees required

Community Solar

Community solar allows Illinois residents to access solar energy without installing panels on their property. Instead, they subscribe to a portion of a shared solar array located elsewhere in their community (Citizens Utility Board). This makes solar power accessible to renters, condo owners, and others who can’t install panels on site.

There are several benefits of participating in a community solar project for Illinois consumers. It allows them to support local clean energy generation. Subscribers receive credits on their electricity bills based on the energy production of their portion of the solar array. This can lead to savings on electricity costs over time without high upfront costs. Community solar also helps make solar power more equitable, since income-qualified residents can subscribe at a greater discount through the state’s Illinois Solar for All program (Illinois SFA).

Overall, community solar opens up the benefits of solar energy to more Illinois utilities customers. It provides a more affordable and accessible way to utilize clean energy without installing rooftop panels (Illinois Shines). With multiple projects underway, it continues to grow in popularity across the state.

Costs and Savings

According to Energysage.com, the average cost of a solar panel installation in Illinois ranges from $13,600 to $18,400. On a cost per watt ($/W) basis, a 5 kW system costs around $15,874 for the average home. However, costs can vary widely based on system size, equipment, and installation complexity [1].

While solar panel system costs may seem high upfront, there are significant long-term savings on energy bills. The Solar Energy Industries Association estimates that the average solar system in Illinois will produce annual savings of $1,050 on electricity bills. Over a 25 year lifespan, an average 5 kW solar system can save Illinois homeowners over $26,000 [2]. With incentives like federal tax credits and net metering, the payback period for solar in Illinois is around 6-8 years.

When weighing costs versus energy savings, most experts recommend Illinois homeowners calculate the levelized cost of energy (LCOE) for their solar system. This metric averages total lifetime costs and divides them by total lifetime electricity production. The resulting cents/kWh figure can be compared against current utility rates to determine if solar power is cost-effective.

Looking Ahead

The future looks bright for solar energy in Illinois. The state has set ambitious renewable energy goals, aiming for 40% renewable energy by 2030 and 100% clean energy by 2050. To help reach these targets, Illinois recently passed the Climate and Equitable Jobs Act which commits the state to 100% carbon-free electricity by 2045.

This legislation demonstrates Illinois’ commitment to growing its solar energy capacity. The state also aims to expand programs like Illinois Shines which provides incentives to make solar more affordable for residents. Illinois Shines administrator Anthony Star predicts the program’s incentives “will approximately double the amount of distributed photovoltaics in the state.”

Industry experts forecast Illinois solar capacity will grow over 1,700% in the next five years according to the Solar Energy Industries Association. With strong policy support and financial incentives, Illinois is poised to become a major solar energy producer. The state is turning up the power for solar and the future looks bright.

Making the Decision

When deciding whether or not to install solar panels, there are several key factors to consider:

Location and roof orientation – The roof needs to face south, southeast or southwest to maximize solar production. Panels facing west may overheat in the afternoon. There should be little to no shading from trees or other buildings.1

Energy usage and requirements – Assess how much electricity you use now and estimate your future needs. This determines what size solar system you’ll require. Having an energy audit done can help analyze your energy consumption.

Installation costs and incentives – Get multiple quotes and look into federal, state and local incentives, tax credits, rebates, net metering policies, etc. to offset the upfront costs. Solar loans are also available.

Long term savings – While there are upfront costs, electricity bills will drop significantly. Calculate the long-term savings and ROI to see if it’s worth the investment for your home.

Maintenance – Solar panels require little maintenance but consider accessibility for cleaning and repairs. Most solar systems have 25+ year warranties.

Aesthetics – Panels come in different colors and can be mounted flush to blend in. Make sure they conform to neighborhood codes and HOA rules.

Conclusion

In summary, Illinois currently offers several incentives for residents interested in installing solar panels. These include federal tax credits, net metering, PACE financing, and community solar programs. While not as robust as some other states, the incentives in Illinois help offset the upfront costs of solar installations and allow homeowners to recoup their investment over time through utility bill savings.

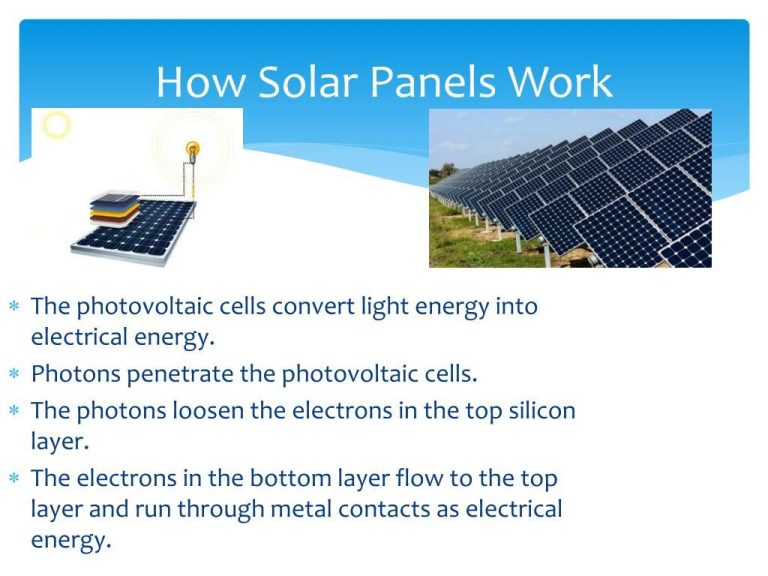

With the increasing affordability and efficiency of solar technology, there is significant room for growth in Illinois’ solar industry. For consumers considering going solar, it is important to look at the long-term costs and savings, assess different financing options, and understand how incentives can reduce payback periods. With smart planning and analysis, installing solar in Illinois can provide decades of free electricity from the sun.