Why Doesn T Japan Use Geothermal Power?

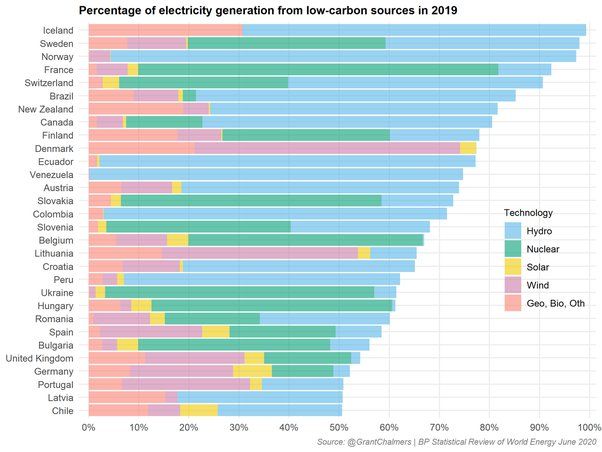

Despite being home to one of the world’s largest geothermal reserves, Japan generates very little of its energy from this renewable resource. With over 23,000 megawatts of geothermal potential, Japan could tap into a vast source of clean, reliable baseload power. However, as of 2019, geothermal accounted for less than 0.2% of Japan’s total electricity generation. This stands in stark contrast to leading geothermal producers like the United States, where geothermal supplies 0.4% of total power, and countries such as Kenya and Iceland that source over 20% of their electricity from geothermal. While Japan has successfully leveraged other renewables like solar and wind, the nation has only just begun to unlock the possibilities of its extensive geothermal reserves.

Geological Challenges

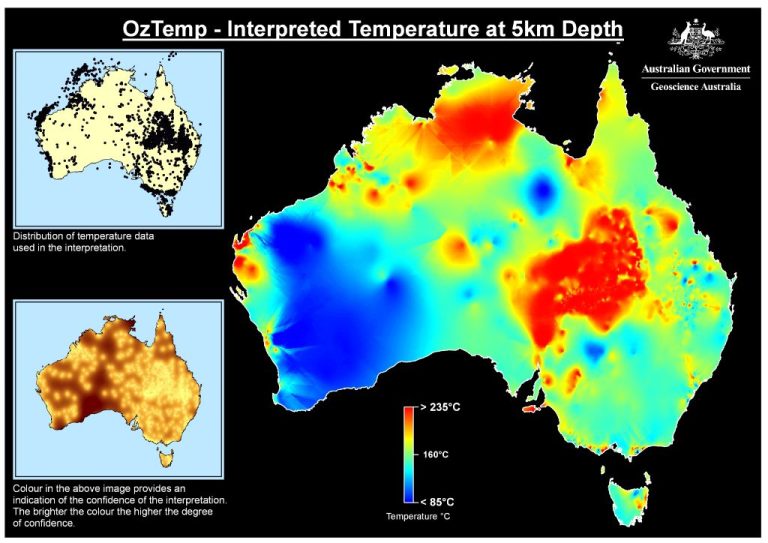

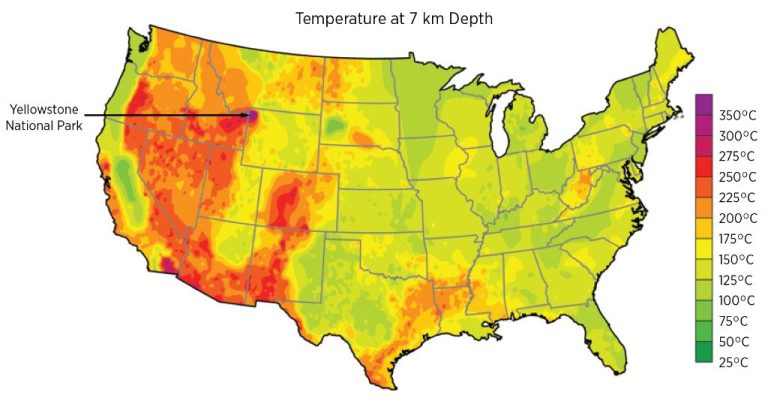

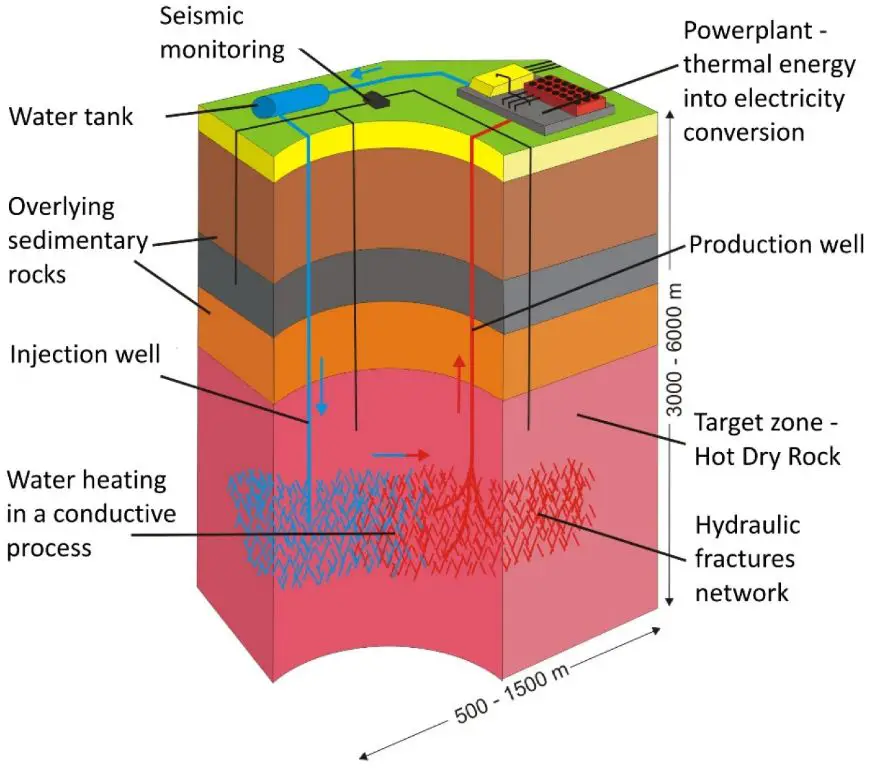

Japan faces significant geological challenges in developing geothermal power. High temperature geothermal resources are located deep underground, often at depths of 2-4 kilometers, making development difficult and expensive (Think GeoEnergy). Drilling deep wells and creating underground reservoirs is costly and technically challenging. Additionally, Japan’s complex underground geology, with many faults and fractured rock, makes it hard to locate viable geothermal reservoirs and effectively circulate fluid (NYTimes). The high upfront costs and risks of deep drilling have hindered geothermal development.

Existing Infrastructure

Currently, Japan is heavily invested in conventional forms of energy infrastructure beyond geothermal like nuclear power, coal, and natural gas. As of 2021, Japan’s energy mix consisted of approximately 36% natural gas, 32% coal, 18% renewable energy sources, and 7% nuclear power according to MIT Energy. The country has long relied on imported oil, coal, and natural gas and made major investments in conventional power plants and distribution systems for these sources.

In particular, Japan has invested heavily in LNG terminals and pipelines to support natural gas imports after the Fukushima nuclear accident in 2011 led to the shutdown of most of the country’s nuclear reactors. Significant infrastructure already exists for coal and oil as well. With major existing assets devoted to fossil fuels and nuclear power, there is less incentive currently to divert resources to building up new geothermal capacity.

Public Perception

In recent years, Japanese public opinion towards geothermal power has become more favorable. According to a 2021 survey, almost 40 percent of respondents stated support for geothermal energy in Japan (Statista, 2023). However, some concerns remain over the possible induced seismicity from geothermal power plants.

A 2012 survey of local governments in Japan found that the top concern regarding geothermal power was the fear of induced earthquakes and ground subsidence from geothermal development (Kubota, 2015). Visualizations and models that show how public opinion towards geothermal plants evolves over time in Japan highlight that addressing concerns over induced seismicity is key for social acceptance (Phys.org, 2022).

While the public has become more supportive of geothermal energy overall, allaying fears over the risk of induced earthquakes through education and transparent monitoring will be important for gaining wider social acceptance in Japan.

Regulatory Barriers

Japan has strict regulations for geothermal development that have limited growth in the sector. Geothermal resources exist primarily within protected national park areas, where development has historically been restricted (https://www.jogmec.go.jp/english/geothermal/geothermal_10_000005.html). However, regulations have been gradually easing. In 2015, laws were revised to open up national parks to more geothermal projects while still requiring environmental assessments. There has also been resistance from some local governments and communities to proposed geothermal plants over concerns about impacts to hot spring resorts that are culturally important and serve as tourist destinations (https://grsj.gr.jp/english/gej/). But the Japanese government has been pushing policies aimed at deregulation and doubling geothermal capacity by 2030. This includes regulatory reforms passed in 2020 to make the environmental assessment process more efficient.

Cost Competitiveness

One key challenge facing geothermal power in Japan is cost competitiveness compared to other energy sources like fossil fuels. Geothermal power requires substantial upfront capital costs for resource exploration, test drilling, and building power plants and transmission infrastructure. According to Statista, in 2020 the levelized cost of energy (LCOE) for geothermal in Japan was 13.3 yen per kWh. This is higher than the LCOE for some fossil fuel sources like coal (12.2 yen/kWh) and natural gas (10.4 yen/kWh). The high drilling costs and risks associated with finding viable geothermal resources in Japan makes projects financially challenging.

The upfront capital costs for geothermal remain a hurdle for wider adoption. Unless costs can come down through technological improvements or policy incentives, geothermal will likely continue facing challenges competing with cheaper established energy sources like coal and natural gas.

Technological Limitations

Japan lacks substantial expertise and experience developing geothermal power domestically. The geothermal industry is still nascent, with limited commercial development and knowledge transfer thus far. Though Japan has abundant geothermal resources, extracting and converting that energy into electricity requires specialized engineering capabilities and technical know-how that are underdeveloped compared to other renewable sources like solar PV and wind power.1

Domestic universities and research centers have only begun focused R&D into enhanced geothermal systems and technologies tailored for Japan’s unique geology and seismic conditions. The subsurface heat extraction process faces hurdles around unpredictable permeability, high temperatures, remote locations, and induced seismicity.2 Building up this expertise will take time.

Compared to importing fossil fuels, exploiting homegrown geothermal energy is a relatively new possibility for Japan. Both the public and private sectors lack the practical knowledge base required for rapid, widespread adoption. Targeted investments and collaborative efforts with international partners can help accelerate learning.

Policy Focus

The Japanese government has historically promoted nuclear power as a key part of the country’s energy policy priorities. After the oil crises in the 1970s, Japan invested heavily in nuclear power to improve energy security and reduce dependency on imported fossil fuels (Japan’s Energy Priorities and Policies in the MENA Region). Nuclear power was seen as an affordable and reliable baseload energy source. At its peak in the 1990s, nuclear accounted for about 30% of Japan’s electricity generation.

However, the 2011 Fukushima nuclear disaster led to a major shift in policy. With most nuclear plants shut down after Fukushima, Japan has had to rely more on imported coal, oil and natural gas. But the government has also promoted renewable energy as part of its strategic energy plan. Solar power in particular has seen massive growth thanks to generous feed-in tariffs. Renewables now account for about 18% of Japan’s power generation mix.

While nuclear power remains controversial politically, the government still sees it playing an important role in Japan’s future energy security. Only a handful of reactors have resumed operations under stricter safety regulations. But the strategic energy plan aims to have nuclear provide 20-22% of electricity by 2030. The focus remains on diversifying energy sources while reducing carbon emissions.

Cultural Factors

Unlike many countries, geothermal energy has not traditionally been part of Japan’s energy mix. While Japan was an early pioneer in geothermal technology, with the first geothermal power plant opening in 1924, wider adoption has been limited. This is partly because geothermal resources in Japan tend to be spread out in smaller fields, unlike large concentrated sources found in places like Iceland and New Zealand.

Additionally, there has been less advocacy for geothermal energy in Japan compared to solar, wind, and nuclear power. With fewer visible large-scale plants, geothermal energy has remained more unfamiliar to the general public. This lack of public pressure and demand has meant there is less urgency within government and industry circles to prioritize geothermal development.

Culturally, there is a greater focus in Japan on advanced technologies like nuclear, robotics, and electronics. Geothermal has often been viewed as an old fashioned or niche source of energy. With less hype and excitement surrounding it, geothermal has not been able to capture the public imagination to the same degree as other energy technologies.

Lastly, Japan’s geography and population concentration means most of its energy needs can be met by centralized sources located near urban demand centers. This reduces the incentive to develop smaller distributed geothermal resources in more rural areas.

Conclusion

In conclusion, there are several key factors that have constrained the growth of geothermal power in Japan despite the country’s extensive geothermal resources.

Geological challenges such as volcanic activity, earthquakes, and variable subsurface conditions have made site development risky and costly. The high population density and extensive infrastructure of Japan also limit site availability.

Cultural perceptions that associate geothermal with onsen hot springs and volcanoes have stifled public acceptance. Strict regulations and policy focus on nuclear and renewable energy alternatives have directed investments away from geothermal.

Cost competitiveness with imported fuels, high upfront capital costs, and technological limitations have further hindered geothermal adoption. But with its extensive resources and technical capabilities, Japan still has significant untapped potential to overcome these barriers and grow its geothermal energy production.