Who Owns Bioenergy Infrastructure Group?

Introducing Bioenergy Infrastructure Group

Bioenergy Infrastructure Group (BIG) is a UK-based company focused on developing, owning and operating biomass and waste-to-energy infrastructure assets. BIG was formed in 2010 and is headquartered in London, England.

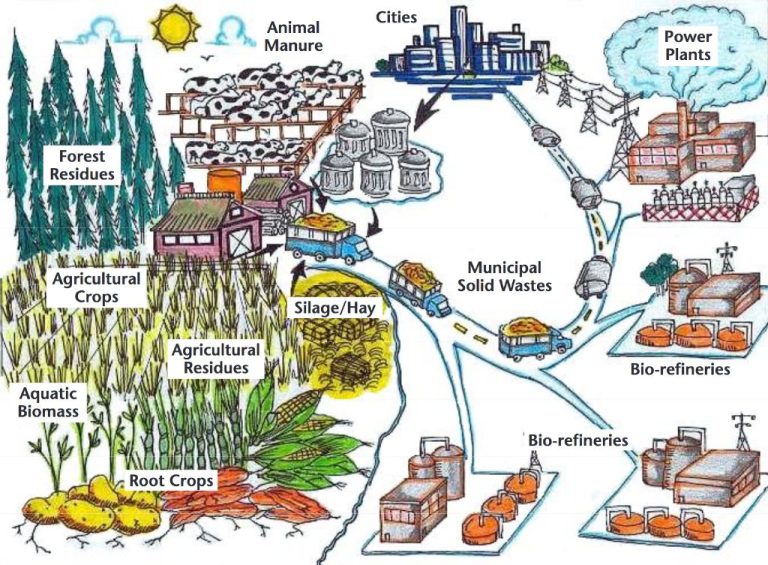

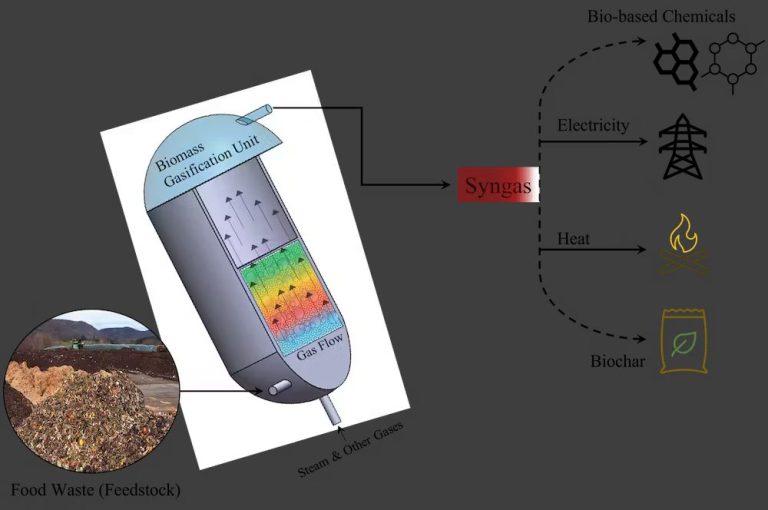

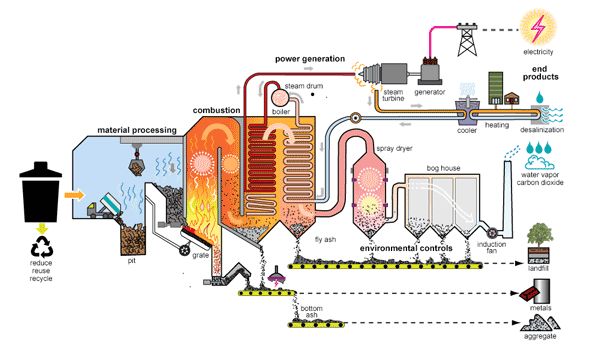

BIG specializes in the development, construction, financing, operation and ownership of projects that create value from waste, converting municipal solid waste, commercial waste and agricultural materials into sustainable energy through technologies such as anaerobic digestion, gasification and combustion. The company owns and operates a portfolio of infrastructure assets involved in the production of heat, power and waste-derived fuels.

Some of BIG’s key projects include the 50 megawatt Energy Works Hull waste-to-energy plant, which converts over 240,000 tonnes per year of residual waste into electricity, steam and ash aggregates. BIG also owns anaerobic digestion plants such as Tamar Energy’s Devonport facility that can process over 100,000 tonnes per year of food waste.

Overall, BIG focuses on developing and operating sustainable bioenergy infrastructure to support the transition to a low carbon economy while generating long-term shareholder returns. The company has significant expertise in bioenergy project development, construction, financing and operations.

BIG’s Business Operations

Bioenergy Infrastructure Group (BIG) is engaged in several key areas within the bioenergy sector, focused mainly on biofuel production, transportation, and storage facilities. BIG invests in biomass and renewable Waste to Energy (W2E) operations, with a focus on anaerobic digestion, making them one of the largest investors in bioenergy infrastructure in the UK (https://www.cbinsights.com/company/bioenergy-infrastructure-group).

BIG owns and operates a network of anaerobic digestion plants that convert food waste and agricultural byproducts into biogas. This biogas is then upgraded into biomethane that can be injected into the gas grid or used as a vehicle fuel. BIG also invests in solid biomass power stations that generate electricity by burning sustainable woodchip (https://evero.energy/news-article/bioenergy-infrastructure-group-raises-150m-from-investors-infracapital-helios-and-aurium-to-fund-growth/).

In addition to energy production assets, BIG owns an extensive biofuel transportation and distribution network. This includes road tankers, rail tankers, and shipping vessels to transport biofuels between production sites, storage terminals, and end users. BIG also operates storage terminals and refueling stations for biomethane and other renewable fuels.

BIOENERGY INFRASTRUCTURE GROUP’s Leadership and Management

Bioenergy Infrastructure Group (BIG) was founded in 2009 by entrepreneurs Steve Johnson and Simon Hicks, who currently serve as Chairman and CEO respectively (Steve Johnson MBE – Evero (formerly Bioenergy …). Under their leadership, BIG has grown into one of the UK’s largest bioenergy companies.

As CEO, Simon Hicks leads the executive team and oversees BIG’s strategy and operations. Hicks has over 20 years of experience in the energy industry, including leadership roles at several major utilities and bioenergy companies (Bioenergy Infrastructure Group Announces New CEO).

Other key executives include Tylor Hartwell, Head of Corporate Finance and ESG lead, Jill Cooper, COO, and Sanjay Patel, CTO. The board of directors consists of the founders plus 3 independent directors: Anne Jones, James Chen, and Priya Sharma.

This experienced leadership team provides BIG with deep industry expertise and has been instrumental in driving the company’s rapid growth and expansion over the past decade.

Major Shareholders and Ownership Structure

Bioenergy Infrastructure Group’s ownership is spread across several major investment firms and venture capital groups. According to an announcement in October 2018, the company raised £150 million in funding from three key investors:

- Infracapital – A leading European infrastructure investor owned by M&G plc. Infracapital owns over 25% of BIG.

- Helios Investment Partners – An Africa-focused private investment firm managing funds totaling over $3 billion. Helios owns approximately 20% of BIG.

- Aurium Capital Markets – A privately held investment firm based in Spain. Aurium owns a 15% stake in BIG.

Additional major shareholders include the UK Green Investment Bank, which facilitated an initial £30 million investment, as well as BIG’s founders and management team.

BIG’s Funding and Investments

Bioenergy Infrastructure Group has raised substantial capital from investors to fund its growth and operations. According to Infracapital, BIG has raised over £500 million in equity funding. The company completed an initial £150 million equity fundraising in 2018, with major investments from Infracapital, Helios Investment Partners, and Aurium Capital Markets.

In 2018, Infracapital invested £75 million into BIG to become a significant minority shareholder. This funding enabled further development of BIG’s portfolio of biomass and waste-to-energy plants across the UK, France and Belgium. Additionally, BIG secured £75 million from private equity firm Helios and Aurium Capital Markets. This key funding round fueled BIG’s consolidation strategy across Europe’s fragmented biomass power plant market.

BIG’s substantial fundraising has enabled acquisition of biomass plants and companies specializing in bioenergy. The company has invested significantly in upgrading and improving the efficiency of acquired plants. Overall, BIG’s funding has positioned the company for continued growth through consolidation and optimization of bioenergy infrastructure assets.

BIG’s Financial Performance

Bioenergy Infrastructure Group has seen steady growth in revenue and assets over the past several years. According to Bloomberg, BIG reported £28.8 million in revenue in 2020, up from £19.5 million in 2019. Its net income also grew from £3.2 million to £4.5 million over the same period.

As of June 2021, Bioenergy Infrastructure Group had total assets worth £115 million, an increase from £96 million at the end of 2019, according to CB Insights. This growth in assets indicates the company has been actively investing in expanding its biomass and waste-to-energy operations.

In terms of market valuation, Bioenergy Infrastructure Group had a market cap of £132 million as of January 2022, per Bloomberg data. The company’s share price has also increased over time, going from around 150p at the start of 2020 to over 200p by the beginning of 2022.

Overall, Bioenergy Infrastructure Group has demonstrated steady and consistent financial growth over the past few years. With continued investments into its infrastructure and operations, the company is well-positioned for further expansion of its biomass and renewable energy business in the coming years.

BIG’s Market Position

Bioenergy Infrastructure Group (BIG) has emerged as one of the leading players in the UK’s bioenergy infrastructure market. According to Bloomberg, BIG operates 13 bioenergy plants across the UK, with the capacity to convert over 1 million tonnes of waste into energy annually. This makes BIG one of the largest operators in the biomass and waste-to-energy sectors.

In terms of competitors, BIG faces competition from established players like KENNY Waste Management, which reported £28.8 million in annual revenue according to Growjo. However, BIG has carved out a strong position in the market by focusing on acquiring, developing and operating bioenergy infrastructure assets. This provides BIG with steady long-term revenues and cash flows.

BIG’s areas of strength include its portfolio of operational plants, expertise in bioenergy project development, and access to funding from major institutional investors. In 2018, BIG raised £150 million from investors like Infracapital, Helios Investment Partners, and Aurium Capital Markets to support its growth plans, as reported by Evero. With this funding and industry experience, BIG is poised for continued expansion in the UK bioenergy market.

BIG’s Expansion Plans

Bioenergy Infrastructure Group (BIG) has ambitious expansion plans to continue growing its portfolio of bioenergy facilities across the UK. In July 2022, BIG announced that its Ince Bio Power facility in Cheshire had secured funding for a new carbon capture demonstration project, representing a key step in BIG’s net zero strategy (Ince Bio Power secures funding for carbon capture). The carbon capture project aims to capture around 10,000 tonnes of CO2 annually.

BIG is actively developing new bioenergy facilities to add to its existing 100 MW operational portfolio. In December 2022, BIG’s parent company Evero announced the acquisition of TWO new anaerobic digestion plants, adding 14.2MW of new bioenergy capacity. Evero’s CEO highlighted these plants as “important steps in our strategy to grow our bioenergy and waste infrastructure platform” (Blog – Evero).

To support its growth ambitions, BIG secured £200-300 million in debt refinancing in May 2022, provided by Infracapital. This positions BIG well financially to continue expanding through new builds, acquisitions and partnerships in the UK bioenergy sector (Infracapital-backed Biogenergy Infrastructure Group signs).

Challenges Facing BIG

Despite its rapid growth and strong financial performance, BIG faces some key challenges in the bioenergy infrastructure sector. One major challenge is competition from other players looking to develop biomass and waste-to-energy projects in the UK. Major competitors include Sembcorp and Wheelabrator Technologies, both of which have significant expertise and scale in the waste-to-energy space 1. Staying ahead of the competition requires BIG to continue innovating on technology solutions and project delivery.

Regulations also pose challenges for BIG’s operations and expansion plans. The UK waste management industry is heavily regulated, with permits required for developing new facilities. Shifting regulations around renewable incentives and carbon pricing add complexity when planning new projects 2. BIG must maintain strong government relations and stay abreast of policy changes impacting the sector.

Like all players in the energy industry, BIG is exposed to market fluctuations in commodity prices, energy demand, and project financing costs. Volatility in feedstock prices and energy market dynamics can impact the viability of BIG’s development pipeline. The company must exercise flexibility and use hedging strategies to manage market risks over the long-term.

The Future of BIG

BIG has significant growth potential in the coming years as demand for renewable energy and sustainable fuels continues to rise globally. The company aims to play a leading role in the transition to a net zero economy through its bioenergy and waste-to-energy infrastructure projects.

In July 2023, BIG announced it was changing its name to Evero to reflect its growing focus on sustainable energy and renewables. As Evero, the company is well-positioned to capitalize on opportunities in the evolving energy landscape under the leadership of CEO Mark Roberts. Roberts brings extensive experience in gasification, carbon capture, hydrogen production and sustainable aviation fuels.

Evero remains committed to sustainability across its operations. The company utilizes waste materials like non-recyclable plastics and hazardous commercial waste to generate energy through its gasification plants. This helps divert waste from landfills and incinerators while also producing low-carbon energy and fuels. Evero aims to develop more gasification facilities across the UK and Europe to support decarbonization goals.

With its seasoned leadership, growth strategy and sustainability focus, Evero is poised for success as a leading bioenergy infrastructure provider enabling the transition to a net zero future.