Who Is The Largest Renewable Developer In The Us?

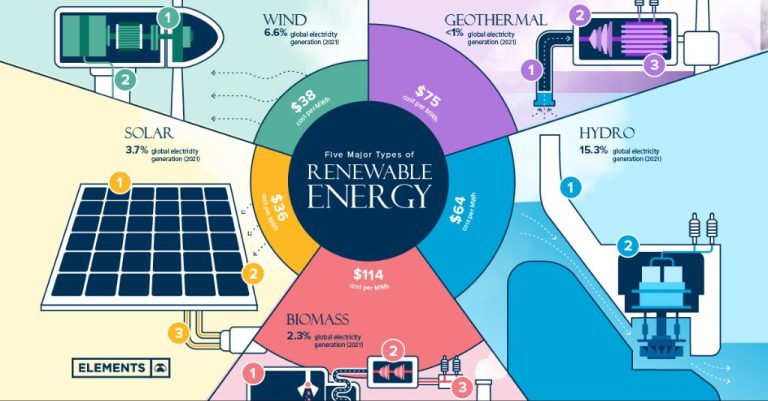

Renewable energy comes from natural sources that are constantly replenished, such as sunlight, wind, rain, tides, waves, and geothermal heat. Renewable energy provides around 11% of total U.S. energy consumption and 17% of electricity generation. The growth of renewable energy is accelerating as costs decline and new technologies emerge. Identifying the largest renewable energy developer in the U.S. provides insight into key industry players shaping the future of clean electricity production.

What is a Renewable Energy Developer?

A renewable energy developer is a company that specializes in developing and building renewable energy projects like solar farms, wind farms, hydropower facilities, and geothermal plants (Law Insider, 2022). They are involved in many aspects of bringing a renewable energy project to fruition, from initial site selection and feasibility studies, obtaining permits and financing, negotiating power purchase agreements, overseeing engineering and construction, and more.

Renewable energy developers have expertise in renewable energy technologies like photovoltaic solar panels, wind turbines, hydropower turbines, and geothermal wells. They understand both the technical and commercial aspects of developing successful renewable energy projects. Their goal is to successfully develop projects that generate clean electricity from renewable resources. This helps expand the supply of renewable energy on the grid and reduce dependence on fossil fuels (Law Insider, 2022).

Some of the major types of renewable energy projects that developers work on include utility-scale solar farms, onshore and offshore wind farms, hydropower dams and hydroelectric generators, geothermal power plants, and biomass power plants. In addition to these larger projects, some developers also specialize in smaller distributed renewable systems like rooftop solar on homes or businesses. Their role is to handle all aspects of realizing a renewable energy project and bringing it online to generate clean electricity.

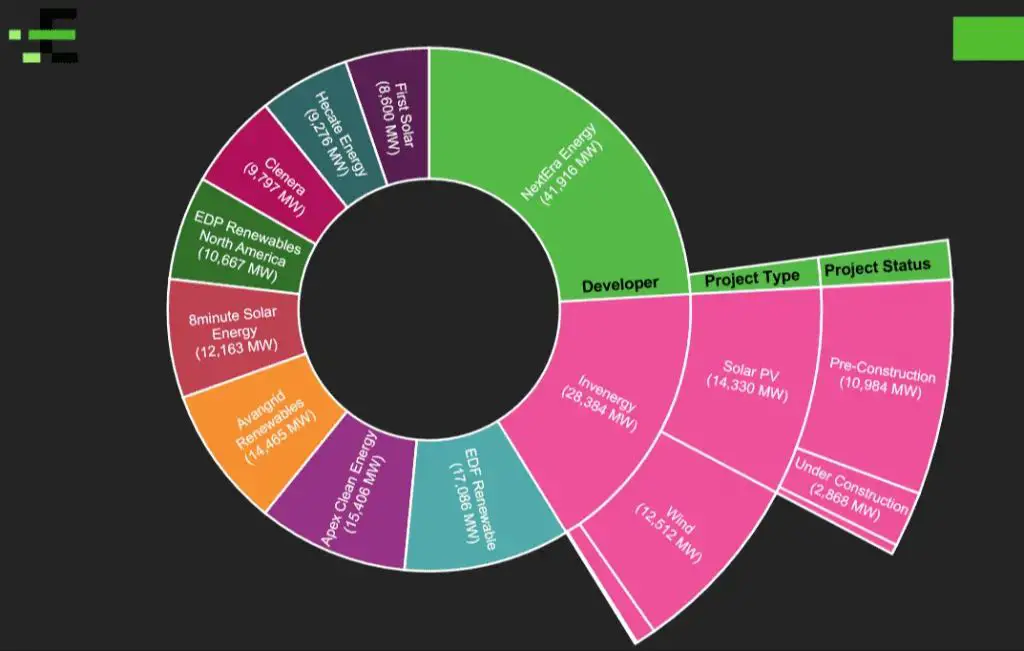

Top Renewable Developers by Total Capacity

NextEra Energy tops the list as the largest U.S. renewable energy developer with over 42,000 MW of installed renewable capacity across wind, solar, and energy storage projects, according to Enverus. Invenergy and AES Corporation round out the top three with 16,000 MW and 12,700 MW of renewable capacity respectively.

Other top developers by total renewable capacity include:

- Duke Energy – 10,400 MW

- sPower – 7,000 MW

- EDF Renewables – 6,800 MW

- Avangrid Renewables – 6,600 MW

- ENGIE – 6,100 MW

- EDP Renewables – 5,700 MW

Many of the largest renewable developers are subsidiaries or divisions of even bigger parent companies with diverse energy portfolios. However, Invenergy and AES Corporation are independent companies focused solely on renewable energy and energy storage.

Top Renewable Developers by New Capacity Added

When looking at new renewable energy capacity added in the past 1-2 years, the top developers in the U.S. are:

- NextEra Energy – Added over 4,500 MW of new renewable capacity in 2021, including wind, solar, and battery storage projects across the country (Source).

- Invenergy – Brought online over 3,000 MW of new wind, solar, and storage in 2021. Notable projects include the Samson Solar Energy Center in Texas and the Sugar Creek Wind Farm in Illinois (Source).

- EDF Renewables – Added over 2,500 MW of new wind, solar, and storage capacity in 2021. Major projects include the Space City Solar Project in Texas and the Palmer Solar Project in Massachusetts (Source 1, Source 2).

- Clearway Energy Group – Commissioned over 2,000 MW of new renewable assets in 2021, comprised mainly of wind and solar. Noteworthy projects include the Langford Wind project in Texas and the Daggett Solar project in California (Source).

Other leading developers of new renewable capacity include Apex Clean Energy, Recurrent Energy, and AES Corporation.

Developers with Large Pipeline

When looking at developers with a large pipeline of renewable energy projects in development, a few key players stand out according to the sources.

Apex Clean Energy has an extensive wind energy pipeline, with over 8,400 MW under development. Nearly 500 MW of their projects are already under construction as of 2022. Apex specializes in developing, constructing, and operating utility-scale wind farms across the United States.

NextEra Energy Resources, a subsidiary of NextEra Energy, has over 23,000 MW of wind, solar, and battery storage projects in its backlog pipeline across the country. They are one of the largest wholesale generators of electric power from the wind and sun in the world.

Invenergy is another major developer with over 16,000 MW of wind, solar, natural gas, and energy storage projects currently under development or construction in the United States, Canada, Japan, and Poland. They have extensive expertise across technologies.

EDP Renewables North America also has an extensive development pipeline of over 10,000 MW of wind and solar projects in the U.S. and Canada. They are actively developing new renewable energy projects for future construction.

With robust pipelines and actively developing new projects across technologies, these leading developers are well-positioned for continued growth in the renewable energy arena. Their development activities signal ongoing momentum in the sector.

Geographic Footprints

According to the data presented in the Enverus report, there seems to be some regional dominance among the top renewable energy developers in the United States.

For example, NextEra Energy has a particularly strong presence in the Southeast, Texas, and Southwest regions. They are currently developing renewable projects across 30 US states, but the bulk of their operational capacity is located in Florida, Texas, California and the Midwest.

Invenergy has a lot of activity in the Midwest and Northeast regions, especially in its home state of Illinois as well as Pennsylvania, Michigan and New York. The company also has projects underway in California and Texas.

Cypress Creek Renewables and Orsted are two more developers with footprints concentrated mostly in the Southeast and Northeast regions. Recurrent Energy and 8minute Solar have more of a West Coast focus in states like California, while Longroad Energy has projects across over a dozen states.

Overall, while some developers like NextEra operate renewable projects nationwide, certain companies tend to concentrate their efforts regionally based on their headquarters location and established business partnerships.

Project Diversity

Many large renewable energy developers work across multiple technologies like solar, wind, and energy storage. For example, Solar Sister X Lively Hoods Kenya develops solar, battery storage, and mini grid projects across Africa. Others focus on a specific technology like wind or solar. For instance, Scatec Solar has specialized in developing utility-scale solar projects around the world and has over 5 GW of solar capacity in operation or under construction.[1]

Developers that diversify their portfolios across technologies can take advantage of the best resources in a given area and hedge against changing market dynamics in any one sector. However, companies focused on a single technology often have very deep expertise that comes from years of specialization. Ultimately, both approaches can be successful business models.

Regardless of whether they focus on a single technology or have a diverse project portfolio, leading renewable developers are helping drive the transition to a clean energy future through their investments across the sector.

Ownership Structures

When it comes to the ownership models of major renewable energy developers in the U.S., there are some key differences between independent power producers (IPPs) and traditional utility companies.[1]

IPPs like NextEra Energy, Invenergy, and AES Corporation are structured as private companies not affiliated with any utility. They develop and operate renewable energy projects by securing land, permits, financing, and power purchase agreements with utilities or corporate customers.[2]

In contrast, many traditional electric utilities like Duke Energy, Dominion Energy, and Southern Company have built up renewable energy portfolios. As vertically integrated utilities, they can leverage existing resources and customers in pursuing renewable projects.[3]

There are trade-offs between the IPP model’s independence and agility and the utility model’s stability and built-in customer base. Both models continue to scale up renewables in the U.S. through a diversity of ownership structures and market approaches.

Conclusion

After reviewing the major renewable energy developers in the United States, two clear leaders emerge based on total capacity and new capacity added. NextEra Energy and AES Corporation stand out as the top utility-scale renewable developers when looking holistically at their portfolios.

NextEra Energy has developed over 22,000 MW of wind, solar, and energy storage projects across the country. They are the undisputed leader in wind energy and have aggressively expanded into solar and batteries over the last decade. With over 10,000 MW of renewable projects in their pipeline, NextEra is poised to continue their dominance.

AES Corporation has quietly assembled the second largest renewable portfolio at over 8,000 MW. Their strength is in solar and energy storage, where they have focused most of their development efforts. With a strong presence in western states and a 5,000 MW pipeline, AES is well-positioned to compete in the booming solar sector.

While other players like Cypress Creek Renewables, D.E. Shaw, and Capital Dynamics have noteworthy portfolios, NextEra and AES are in a class of their own when looking at the totality of their national renewable energy footprints today and their development outlook for the future. They represent the elite of US utility-scale renewable developers.

Further Reading

If you want to learn more about renewable energy developers in the United States, here are some additional resources to check out:

- Top U.S. Renewable Energy Companies in 2020 – Overview from NREL on the top developers based on renewable energy production.

- Leaders of the Pack: Annual Ranking of Utility Renewable Energy Deployment – Report ranking major utilities on renewable energy deployment from ACEEE.

- The top 10 trends transforming the electric power sector – Article from Utility Dive on major industry trends including growth of renewable developers.

Focusing on reports from reputable government and industry organizations can provide great overviews of the major players and trends in the renewable energy development industry.