Which Company Makes Biofuels In India?

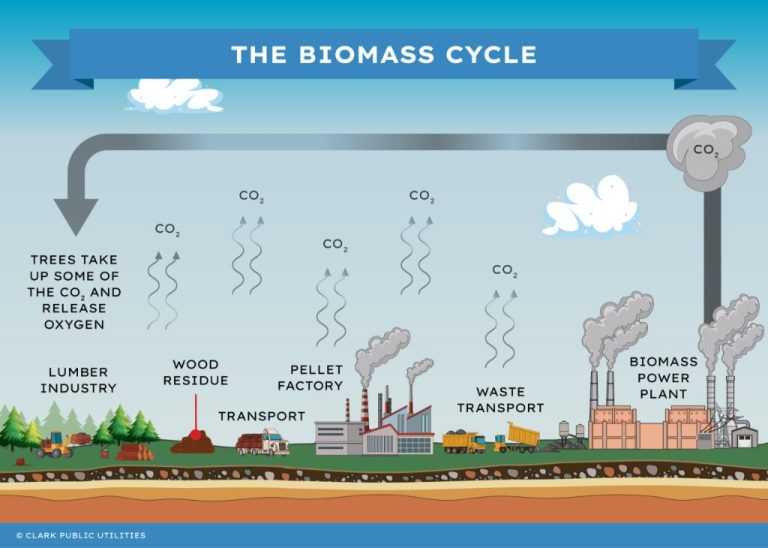

Biofuels are fuels produced directly or indirectly from organic material, including plant materials and animal waste. The two major types of biofuels used today are ethanol and biodiesel. Biofuels provide a renewable alternative to fossil fuels and help reduce greenhouse gas emissions.

India has ambitious targets for biofuel production and use. The National Biofuel Policy targets 20% blending of biofuels by 2030. However, currently biofuels meet only about 2% of India’s fuel needs. Ethanol and biodiesel production has been growing but is still limited. Most ethanol comes from molasses as a byproduct of sugar production. Biodiesel production uses non-edible oils like jatropha, pongamia and waste cooking oil.

Biofuels are important for India’s energy security and self-sufficiency. They can reduce reliance on imported fossil fuels. Biofuels also support agricultural growth as they utilize agricultural residues and non-edible oils. Increased biofuel adoption can reduce air pollution from vehicles. However, care must be taken to avoid conflict with food production or environmental damage. Overall, biofuels have significant potential benefits but require responsible policies and practices.

Major Biofuel Producers

India has several major companies involved in biofuel production. Some of the top producers include:

- Praj Industries – One of the largest biofuel technology companies in India. They have production facilities across the country and provide technology and engineering for bioethanol, biodiesel and bio-based chemicals. They use feedstocks like sugarcane juice, molasses, corn stover and bagasse. [1]

- Indian Oil Corporation – Operates biofuel production plants and has blending infrastructure for ethanol and biodiesel. They use feedstocks like sugarcane juice, damaged food grains and biomass. [2]

- Godavari Biorefineries – A leading biofuel producer using sugarcane as feedstock. They have production facilities in Maharashtra. [2]

- Renuka Sugars – A major sugar company that also operates biofuel facilities producing ethanol from sugarcane molasses. [2]

Ethanol Production

India has set ambitious targets for ethanol blending in gasoline. The current blending target is 10% but the government plans to increase this to 20% by 2025 Roadmap for Ethanol Blending in India 2020-25. The two major sources of ethanol production in India are sugarcane and cereal grains like corn and broken rice. While sugarcane based ethanol dominates current production, grain based ethanol is expected to grow to meet blending targets.

The top producers of ethanol in India are sugar companies located in the sugarcane producing states of Uttar Pradesh and Maharashtra. Some of the major companies include Balrampur Chini Mills, Bajaj Hindusthan Sugar Ltd, Dalmia Bharat Sugar and Industries Ltd, Dhampur Sugar Mills, EID Parry India Ltd, Shree Renuka Sugars Ltd and Triveni Engineering & Industries Ltd India Is Likely to Miss its Ethanol Blending Target This Year. These companies produce ethanol from sugarcane molasses, a byproduct of sugar production.

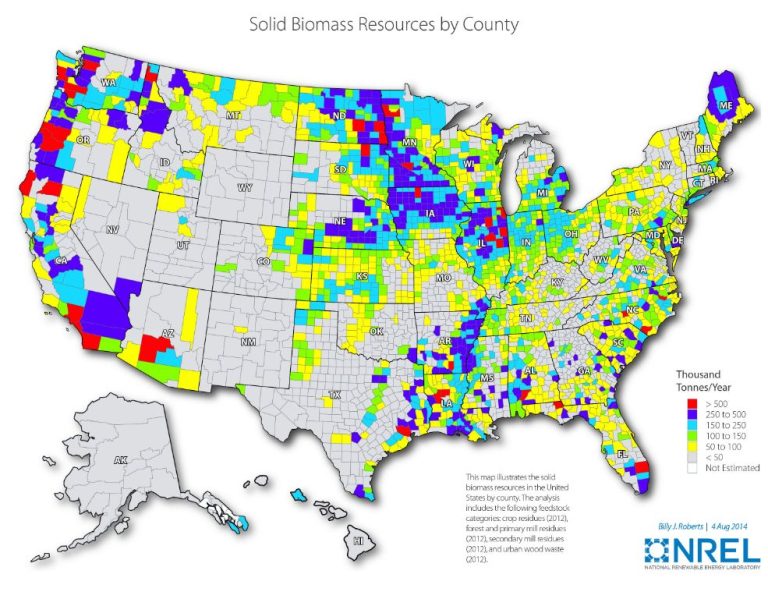

While sugarcane ethanol currently dominates, the government is pushing for increased production from damaged and surplus grains to reduce dependence on sugarcane. Producing ethanol from grains like corn, broken rice, and wheat is expected to help meet blending targets in a sustainable and cost effective manner. Several grain based ethanol plants are coming up, especially in grain surplus states like Punjab, Haryana and Madhya Pradesh.

Biodiesel Production

Major biodiesel producers in India include companies like Aemetis, Emami Agrotech, Southern Online Biotechnologies, etc. Aemetis recently completed an expansion of its India biodiesel plant, increasing annual production capacity to 60 million gallons (1). This supports the Indian government’s goal of reaching a 5% biodiesel blend, equal to approximately 1.25 billion gallons per year (2).

India’s biodiesel production primarily utilizes feedstocks like waste cooking oil, animal fats, and non-edible oils like jatropha, mahua, and palm oil. The country aims to promote jatropha cultivation for biodiesel production through various government schemes (3). However, palm oil imports also contribute significantly to India’s biodiesel output.

(2) https://biodieselmagazine.com/articles/aemetis-completes-expansion-of-india-biodiesel-plant-2518881

Advanced Biofuels

Some of the major companies working on advanced biofuels technologies in India include:

Praj Industries is one of the leading companies in second generation ethanol technology or cellulosic ethanol. They have partnered with oil marketing companies like IOCL to set up demonstration plants using their technology. Praj has also collaborated with Novozymes to develop enzymes needed for cellulosic ethanol production [1].

Indian Oil Corporation has set up an R&D facility focused on developing advanced biofuels from algal biomass. They are working on technologies for producing algal bio-oil and bio-hydrogen [2].

Reliance Industries is investing in research on cellulosic ethanol and other advanced biofuels through its subsidiary Reliance Life Sciences. They have also partnered with research organizations like IIT Bombay for developing advanced biofuel technologies [3].

Other companies like BPCL, HPCL, Bharat Petroleum are also carrying out pilot projects and research in second generation biofuel technologies.

Government Policy

The Indian government has implemented several policies and initiatives to promote biofuel production and use in the country. Some key government policies include:

In 2018, India released the National Policy on Biofuels, which set ambitious targets for ethanol and biodiesel blending in gasoline and diesel by 2030. The policy aims to cut fuel imports by 10% and boost farmer incomes through new demand for agricultural feedstocks like sugarcane, corn and used cooking oil (1).

India currently has ethanol blending mandates that require 5% blending nationally, moving to 10% by 2022 and 20% by 2030. For biodiesel, the mandate requires a national blend of 5%, moving to 10% by 2030 (2).

The government has invested over $1.6 billion since 2014 in supporting biofuel infrastructure like ethanol production units, biodiesel pumps and pipelines. Further investments of $7.5 billion are planned through 2025 (1).

Tax incentives like central excise and VAT reductions have been introduced to make biofuels more affordable. Government loan programs provide low-interest financing for new biofuel projects (3).

Sources:

(1) USDA Foreign Agricultural Service

(2) International Energy Agency

(3) ScienceDirect

Sustainability

Sourcing sustainable feedstocks is crucial for the long-term viability of India’s biofuels industry. Biofuels production should avoid conflicts with food production by utilizing non-food crops, agricultural residues, and waste materials as feedstocks. For example, companies are exploring the use of crop residues like wheat straw and rice straw, invasive weeds like prosopis juliflora, and municipal solid waste as biofuel sources [1]. Utilizing waste streams helps provide additional income to farmers while avoiding competition for land and resources used for food production.

Advanced biofuels from non-edible oils, agricultural residues, and municipal solid waste offer opportunities to increase production volumes without negatively impacting food security or land use. India’s 2030 ethanol blending roadmap highlights sustainability as a key priority. The government aims to develop sustainability certification frameworks and supporting policies to enable a sustainable scale-up of biofuels. Overall, a sustainable biofuels industry requires continued technology innovation, responsible feedstock sourcing, and supportive regulations that balance energy, economic, and environmental needs.

Future Outlook

India has set ambitious targets for biofuel production and use by 2030. This will require major expansions in production capacity across the country. According to the IEA, India could potentially produce enough ethanol to meet half of its projected 2030 gasoline demand. Ethanol production capacity is expected to reach over 10 billion liters by 2025, more than triple current levels. (IEA)

Major investments are planned in new biofuel production plants and expansion of existing facilities. Several Indian states have announced support for new ethanol production projects, including Maharashtra, Uttar Pradesh, and Punjab. Leading Indian oil marketing companies like IOC, HPCL and BPCL are also investing heavily in additional ethanol production capacity.

On the biodiesel side, companies like Emami Agrotech and Vikram Renewable Energy are building large new biodiesel plants across India. Total biodiesel production capacity could reach up to 5 billion liters by 2025 to meet the government’s blending target.

Beyond India’s domestic blending requirements, the country also has significant potential to become a major exporter of biofuels. With its ample feedstock sources and low production costs, India could produce far more than its current ethanol and biodiesel demand. Indian sugarcane ethanol is already price competitive globally. As production expands, exports to Europe, Japan, Korea and other markets could create major new revenue sources.

Challenges

India faces several constraints and challenges in scaling up its biofuels sector. One is high feedstock costs, with some estimates that first-generation biofuels made from food crops like sugarcane are not economically viable [1]. There is also the issue of water scarcity and impacts on food security from using arable land and water resources for biofuel crops instead of food crops [2]. Poor infrastructure and lack of coordination across the value chain pose additional obstacles.

Biofuels also face growing competition from other renewable energy sources in India like solar and wind power. These can often provide lower cost and more scalable clean energy solutions. There are concerns that subsidies and incentives for biofuels may divert investments away from more cost-effective renewables [3]. Overcoming these challenges will require continued technology improvements and policy support tailored to biofuels’ unique role in India’s energy mix.

Conclusions

In summary, biofuels play an important role in India’s energy landscape. India has ambitious targets for ethanol blending in gasoline and biodiesel blending in diesel in order to reduce dependence on imported crude oil. Major biofuel producers in India include oil marketing companies like IOC, HPCL and BPCL which have set up ethanol plants, as well as private companies like Praj Industries which are active in second generation biofuels. While ethanol production from molasses and biodiesel production from non-edible oils are well established, advanced biofuels using agricultural waste are still in early stages of development. Government policy provides incentives and mandates for biofuel adoption, but long-term sustainability through use of marginal lands and innovative feedstock supply chains needs further impetus. Though challenges around economics and infrastructure remain, biofuels present a promising pathway for improving India’s energy security and self-reliance.