Which Bank Is Offering Solar Financing In Pakistan?

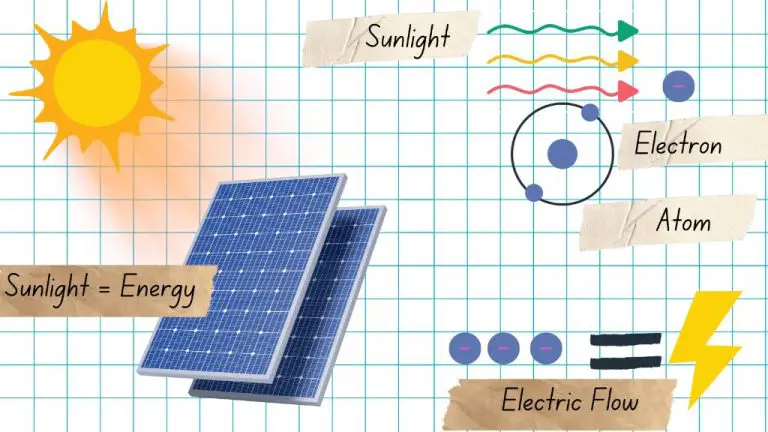

Solar energy has emerged as an important renewable energy source in Pakistan over the last decade. The abundant sunshine in the country provides tremendous potential for solar power generation. Estimates indicate that Pakistan has a solar energy potential of over 2.9 million megawatts, with parts of the country receiving over 300 days of sunshine per year.

However, despite the vast potential, solar energy currently accounts for less than 1% of the total power generation in Pakistan. In recent years, the government has introduced policies and initiatives to promote solar energy adoption, especially in the off-grid rural areas. Some of the key drivers boosting solar energy growth in Pakistan include rising electricity demand, chronic power shortages, reduced costs of solar panels, and increased environmental awareness.

Why Solar Financing Matters

Solar power offers numerous benefits as an alternative energy source in Pakistan. It provides a clean, renewable way to generate electricity that reduces the country’s dependence on fossil fuels. This helps improve energy security, lower pollution, and make progress towards climate change goals.

However, the high upfront costs of purchasing and installing solar panels have prevented wider adoption, especially for low-income households and businesses. Buying an average-sized 5kW solar system can cost $5,000 or more. That requires major savings or financing that many people do not have access to.

Therefore, increasing access to solar financing is crucial for Pakistan to unlock the full potential of solar energy. By making financing more available, affordable, and accessible, solar power can reach more homes and businesses across the country.

Government Initiatives

The government of Pakistan has implemented some policies and incentives to promote solar energy adoption in the country. One key initiative is net metering laws, which allow solar system owners to export excess electricity back to the grid and receive credits on their energy bills. The National Electric Power Regulatory Authority (NEPRA) has issued net metering regulations to facilitate grid interconnection of small renewable energy systems up to 1 MW.

There are also some tax incentives offered by the government. Import duties on solar panels and related equipment have been reduced or exempted over the years. According to the Alternative Energy Development Board (AEDB), there is a 100% depreciation allowance on investments in renewable energy projects and exemption from income tax for up to 10 years. Such fiscal incentives make the adoption of solar PV systems more affordable.

Commercial Banks

Several major commercial banks in Pakistan offer solar financing, aiming to support the adoption of renewable energy in the country. Some key banks providing solar loans include:

Meezan Bank – Offers Islamic financing called Meezan JARI for solar installations, with financing up to PKR 2.5 million and loan terms up to 5 years. The bank uses a diminishing partnership model.

Habib Bank Limited (HBL) – Provides solar financing up to PKR 3 million for residential customers and PKR 30 million for commercial customers, with loan terms up to 7 years.

Askari Bank – Offers Askari Solar loans up to PKR 5 million for residential customers and PKR 100 million for SMEs/commercial customers, with loan terms from 1 to 7 years.

Most banks require a down payment of 15-25% and offer competitive interest rates around 2-3% above KIBOR. The loan amount and terms vary based on factors like customer profile, system specs, and credit history.

Microfinance Institutions

Microfinance institutions such as U Microfinance Bank and HBL Microfinance Bank are emerging as key providers of solar financing in Pakistan, especially to rural and agricultural communities. These institutions offer solar loans and financing options that help families and small businesses access renewable energy solutions. The loans are designed to be affordable even for low income households.

A major benefit of solar loans from microfinance institutions is that they extend financing to remote areas that lack access to the traditional banking system. The microfinance branch networks and field officers are able to reach villages and provide solar financing at the grassroots level. This helps drive financial inclusion for rural populations while also enabling adoption of solar home systems, solar pumps, and other solar products. Microfinance solar loans can range from a few thousand rupees for solar home products up to hundreds of thousands for commercial solar systems.

By tapping into microfinance for solar financing, rural communities that were previously energy poor can leapfrog to sustainable and renewable solar power. This supports social development and increases resilience. The State Bank of Pakistan has recognized leading microfinance banks for their role in expanding access to solar financing across the country.

Non-Bank Financiers

Non-bank financiers are emerging as a popular option for solar financing in Pakistan. Unlike traditional bank loans, non-banks offer solar leasing models that allow customers to avoid large upfront costs and pay for solar energy systems through predictable monthly payments. According to PakSolar Services, the key advantages of solar leasing include:

- No large down payment required

- Fixed monthly payments that are typically 10-30% lower than current electricity bills

- Leasing terms that can extend up to 20 years

- System maintenance and repairs handled by the leasing company

- Potential tax benefits compared to purchasing a system outright

By removing prohibitive upfront costs, solar leasing allows homeowners, businesses, and institutions to adopt solar power with minimal financial barriers. Non-bank financiers like Alpha Solar are bringing innovative financing models to accelerate Pakistan’s transition to renewable energy.

International Organizations

International organizations like the Asian Development Bank (ADB) and World Bank have been supporting solar financing initiatives in Pakistan through various projects and partnerships. For example, the ADB approved a $100 million loan in 2017 for a solar rooftop program in Pakistan to finance new rooftop solar photovoltaic systems through commercial banks (ADB Solar Rooftop Program).

The World Bank’s Scaling Up Renewable Energy Program (SREP) invested $100 million in 2015 to support private sector renewable energy projects in Pakistan, including solar. This aimed to develop large-scale commercial and industrial solar PV projects through a “risk sharing facility” and credit enhancement (World Bank SREP Pakistan).

The Green Climate Fund (GCF) also approved $100 million in 2018 for distributed solar energy in Pakistan through credit lines, working capital financing, and tailored financing solutions to bridge the gap for solar investments (GCF Solar Financing).

Future Outlook

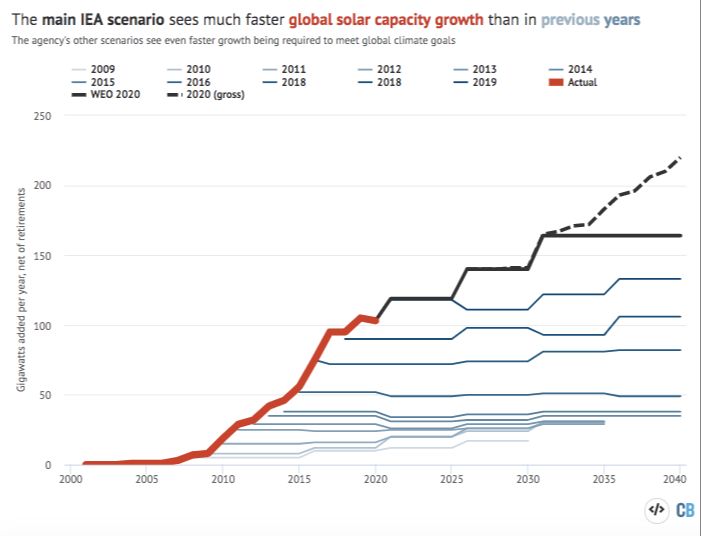

Solar energy in Pakistan is projected to see significant growth in the coming years. According to Mordor Intelligence, Pakistan’s solar capacity is forecast to reach over 3 GW by 2025. Several factors are driving this growth, including falling costs of solar panels, government incentives, and increased financing options.

Fintech is expected to play a major role in enabling the expansion of solar energy in Pakistan. New financial technology companies and products like digital lending platforms, pay-as-you-go models, and peer-to-peer lending networks can provide innovative financing options for solar installations. Companies like SolarBank are using digital financial services to offer solar panel loans to low income households. The increased access to financing can help overcome the high upfront costs that have traditionally limited solar adoption.

Overall, projections point to robust growth for Pakistan’s solar energy market. With supportive government policies and the rise of solar-focused fintech, Pakistan is poised to continue increasing its solar capacity and transitioning to renewable energy.

Challenges

One of the challenges to developing solar financing and initiatives in Pakistan has been low electricity prices. For years there was heavy subsidization of electricity rates in Pakistan, which kept prices low. According to a recent analysis, this led to market distortion and a lack of interest in transitioning to renewable energy. However, as the government works to phase out subsidies and electricity rates rise, renewable energy sources like solar become more economically viable.

Pakistan also has a weak electricity distribution infrastructure, which makes integrating large-scale solar energy difficult. The grid lacks the capacity and flexibility for handling intermittent power from solar, especially in more remote regions. Upgrading the grid to make it “solar ready” involves sizable investments that neither the government nor private companies have fully committed to yet. Specific technical weaknesses include unreliable metering and billing systems as well as frequent blackouts and load shedding issues.

Conclusion

In conclusion, solar financing has become increasingly important in Pakistan as the country aims to expand renewable energy production and increase energy access. We reviewed initiatives by the Pakistani government, commercial banks, microfinance institutions, non-bank financiers, and international organizations that are providing financing options for residential and commercial solar projects across the country. While some challenges remain, the overall outlook is positive as solar financing continues to expand.

Access to financing is crucial for unlocking Pakistan’s abundant solar energy potential. By making financing more readily available, Pakistan can reduce reliance on expensive imported fossil fuels, provide clean electricity to more households and businesses, and meet its climate and development goals. Though progress has been made, more can be done to develop solar financing products that meet the needs of Pakistanis and expand energy access. Overall, increased solar financing access will be vital for Pakistan’s energy future.