Where Are Wind Turbines Used In The Us Made?

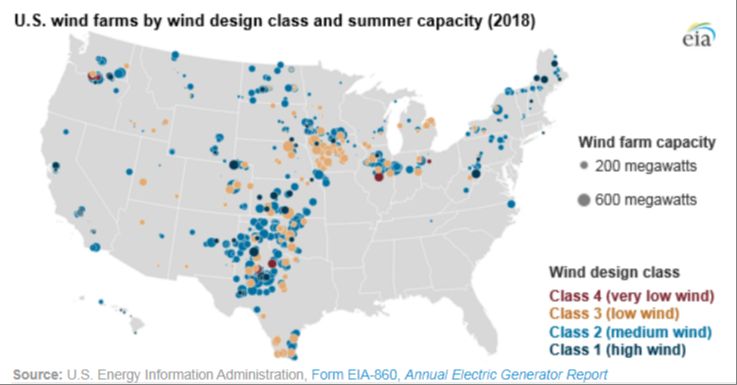

Wind energy has grown significantly in the United States over the past few decades. As of 2021, the U.S. had over 122 gigawatts of installed wind capacity, enough to power over 42 million homes. This growth in wind power has also led to an expansion of the wind turbine manufacturing industry in the country. However, while the number of wind turbines installed in the U.S. has risen, domestic production of wind turbines and their major components still lags behind imports from other countries.

Overall, the U.S. wind turbine manufacturing industry has gone through periods of growth and decline influenced by policy incentives and global competition. Incentives such as the Production Tax Credit have driven demand for wind energy and supported domestic manufacturing. However, offshore production and competitive pressures have limited the share of the market captured by U.S. manufacturers. As the wind industry continues expanding in the 2020s, efforts are being made to bolster domestic wind turbine production through investments, tax credits, and local content requirements.

History of Wind Turbines in the US

Wind turbines first came to the United States in the late 19th century. These early wind turbines were used to generate electricity and pump water on farms and ranches in the Midwest. The turbines had a steel tower with a three- or four-blade propeller that spun when the wind blew. The spinning blades turned a shaft connected to a generator to produce electricity. These windmills generated DC power that could be used for lighting or charging batteries. They also pumped water out of the ground for irrigation and livestock.

By the early 20th century, over 6 million small wind turbines were in use across the American heartland. They played an important role providing power to rural areas that did not yet have access to the electric grid. However, once power lines reached more and more communities in the 1920s-1930s, the adoption of small wind turbines declined. Cheap and reliable electricity from utilities caused most farmers to stop using their windmills.

Major Wind Turbine Manufacturers

Over the last few decades, a number of major companies have emerged as leaders in wind turbine manufacturing and wind energy in the United States. Here is a look at some of the top wind turbine manufacturers in the country:

General Electric (GE) – With roots going back to the 1970s, GE has long been one of the largest wind turbine suppliers in America. The company has installed over 40,000 wind turbines worldwide and has manufacturing facilities in multiple states including Colorado, Florida and Maine.[1]

Vestas – A Danish company, Vestas is one of the biggest wind turbine manufacturers globally. In the U.S., Vestas has installed over 25,000 turbines across 41 states and has factories in Colorado, Texas and elsewhere.[2]

Siemens Gamesa – Created from a merger between Siemens Wind Power and Gamesa, this manufacturer has over 107 GW of wind power installed worldwide. Their major U.S. factories are in Iowa, Kansas, and Florida.[3]

Nordex – Based in Germany, Nordex is another major global wind company with over 8 GW of wind power installed in the U.S. alone. Their turbine manufacturing facility in Jonesboro, Arkansas opened in 2018.[4]

Domestic Production Capacity

The United States has steadily expanded its domestic wind turbine manufacturing capacity over the past two decades. According to the U.S. Department of Energy, the U.S. had over 500 facilities involved in wind turbine production and supply chain manufacturing as of 2020 (1). Major companies producing wind turbines and components in the U.S. include GE Renewable Energy, Vestas, Siemens Gamesa, LM Wind Power, TPI Composites, and Nordex (2).

In 2021, the U.S. had a production capacity to manufacture approximately 10 gigawatts worth of wind turbine nacelles, blades, towers, and other components annually. This capacity has grown steadily, more than doubling over the past decade from 4 gigawatts in 2011 (3). Major manufacturing hubs are located in states like Colorado, Iowa, Texas, and Oklahoma.

Imported Wind Turbines:

The wind industry in the US relies heavily on imported wind turbines and components. According to the U.S. Department of Energy’s 2022 Land-Based Wind Market Report, imports of wind-powered generating sets, towers, generators, blades, hubs and other wind turbine components totaled $3.1 billion in 2021.

Statistics from the U.S. International Trade Commission show that in 2021, over $1.5 billion worth of wind-powered generating sets were imported to the US. Blades and hubs accounted for $1.1 billion in imports, while towers made up over $500 million. The majority of these imports came from countries like China, Mexico, Brazil and India where manufacturing costs tend to be lower.

According to analysis by Recharge News, China supplied 19% of imported wind blades and hubs to the US in 2021, followed by Mexico (18%), India (14%), Spain (13%) and Brazil (10%).

Reasons for Imported Turbines

The majority of wind turbines installed in the United States are imported due to insufficient domestic manufacturing capacity. According to the U.S. Energy Information Administration, the U.S. had over 60 gigawatts of installed wind capacity in 2020, but domestic factories only had the capacity to produce 7-9 gigawatts annually (1). This massive gap between demand and domestic production is the primary reason for imported turbines.

While major manufacturers like GE have factories in the U.S., they still rely heavily on imported components and sub-assemblies to meet demand. With the U.S. aiming to dramatically expand wind capacity to help achieve renewable energy goals, imports are expected to continue satisfying a large portion of new turbine demand until domestic facilities can scale up.

The wind industry and government have set goals to expand domestic manufacturing, but rapidly building sufficient capacity will take major investments and policy support. Until domestic capacity catches up, imports from Europe and Asia are likely to remain the dominant supplier of new wind turbines in the U.S.

Domestic Turbine Manufacturing Locations

The United States has a growing domestic wind turbine manufacturing industry. According to the National Renewable Energy Laboratory (NREL), there are over 500 facilities in the US involved in wind turbine component manufacturing and supply chain services [1]. Some of the major domestic production facilities include:

- GE Renewable Energy has a turbine manufacturing facility in Pensacola, Florida and a blade facility in New Orleans, Louisiana [1]

- Siemens Gamesa has blade factories in Fort Madison, Iowa and Hutchinson, Kansas as well as a nacelle assembly facility in Hutchinson, Kansas [2]

- Vestas has blade facilities in Windsor, Colorado; Brighton, Colorado; and Pueblo, Colorado as well as a tower factory in Pueblo, Colorado [2]

- LM Wind Power operates blade manufacturing plants in Little Rock, Arkansas and Grand Forks, North Dakota [2]

Other major wind energy states with domestic manufacturing include Iowa, Kansas, Texas, South Dakota, and Minnesota [2]. The Central and South regions of the United States have attracted the most wind turbine manufacturing investment.

Challenges Facing Domestic Production

There are several issues restricting the growth of domestic wind turbine manufacturing capacity in the United States. One major challenge is the inconsistent policy environment surrounding wind energy production and investment. Tax credits and other incentives that support wind farm development often expire or change unexpectedly, creating uncertainty for manufacturers looking to invest in new facilities and equipment. According to the Department of Energy, more stable, long-term policies could encourage greater domestic production by providing more certainty for manufacturers.

The high costs associated with building new factories and equipment also pose a hurdle to expanding domestic wind turbine manufacturing. Constructing a new production facility requires significant upfront capital expenditures. Due to economies of scale, some components like blades and towers can be manufactured most cost-effectively in very large, expensive facilities. The costs and risks of these major investments limit the growth of new domestic suppliers.

Additionally, the existing international supply chain makes importing turbines and components very affordable. With substantial manufacturing capacity already established in Europe and Asia, foreign suppliers can produce wind turbine parts at very competitive prices. Lower labor costs in some regions also enable overseas manufacturers to maintain lower operating costs. This makes it difficult for new U.S. manufacturers to compete on cost.

Efforts to Expand Domestic Manufacturing

In recent years, there have been various initiatives and investments aimed at expanding domestic wind turbine manufacturing in the United States.

The passage of the Inflation Reduction Act in 2022 was a major boost, as it extended tax credits for renewable energy projects that use domestically manufactured equipment. This has incentivized more production within the U.S. (Canary Media)

States like Colorado, Texas, and Iowa have also offered incentives to attract more wind turbine and component manufacturing facilities. For example, Iowa put $5 million towards a program to support in-state wind turbine blade production. Vestas used these funds to upgrade a factory in Fort Madison.

Major turbine makers like GE and Siemens Gamesa have announced new factories and expansions to existing facilities over the past couple years. This is increasing domestic capacity for nacelle, blade, and tower manufacturing. Most of this activity has centered around states with strong wind resources and established industry presence like Colorado, Iowa, and Texas.

The U.S. Department of Energy has also invested over $50 million since 2015 into innovations that can improve domestic manufacturing competitiveness. This encompasses advanced materials, automated production, and other technologies that can reduce costs.

Future Outlook

The future looks bright for domestic wind turbine manufacturing in the United States. Several factors point towards continued growth and expansion:

Firstly, wind energy is one of the fastest growing renewable energy sources in the US. Total wind power capacity is projected to double over the next decade as more states increase their renewable portfolio standards. This rising demand will necessitate increased domestic production of wind turbines and components.

Secondly, the US government has implemented policies and initiatives aimed at supporting domestic manufacturing of wind energy equipment. Recent legislation extended tax credits for renewable energy projects that use a certain percentage of US made components. There are also federal and state grants available to help manufacturers expand or establish new facilities.

Finally, major turbine manufacturers like GE and Siemens have announced plans to expand their domestic production facilities and supply chains in response to increased demand and favorable policies. Over the next 5-10 years, several new and expanded wind turbine manufacturing plants are expected to come online.

In summary, increasing wind energy adoption, supportive government policies, and manufacturing investments all point towards significantly greater domestic production capacity for wind turbines and components in the years ahead.