What State Is Most Solar Friendly?

Solar energy has been growing rapidly in the United States over the past decade. As solar technology improves and costs continue to fall, more homeowners, businesses and utilities are adopting solar. State policies can accelerate or inhibit solar energy growth through factors like renewable portfolio standards, net metering rules, permitting requirements, and financial incentives. This article examines state policies and metrics to determine which states are most supportive of solar energy.

Solar Potential by State

The potential for solar energy generation varies greatly across the United States due to differences in sunlight hours and land availability. According to a 2010 analysis by the Nebraska Energy Office, the Sunbelt states in the southwest such as California, Nevada, Arizona, New Mexico and Texas have the highest solar energy potential based on total sun hours per day [1]. Other states with high solar potential include Florida, Hawaii, Utah, Colorado and Oregon.

California leads the nation in total installed solar capacity, followed by Texas, Florida and Arizona [2]. The sunny climate and vast amounts of open land in the southwest provide abundant opportunity for solar farms and rooftop solar installations. States like California also have strong policy incentives that have enabled rapid growth in solar adoption. However, even some less sunny states like New Jersey and Massachusetts have seen increasing solar expansion due to state renewable energy goals and financial incentives.

Overall, the southwest region of the U.S. has the highest technical potential for solar power generation, but solar adoption continues to expand into new markets across the country. Advancements in solar panel efficiency and state-level incentives are making solar energy more accessible even in states that receive fewer sunny days per year.

Net Metering Policies

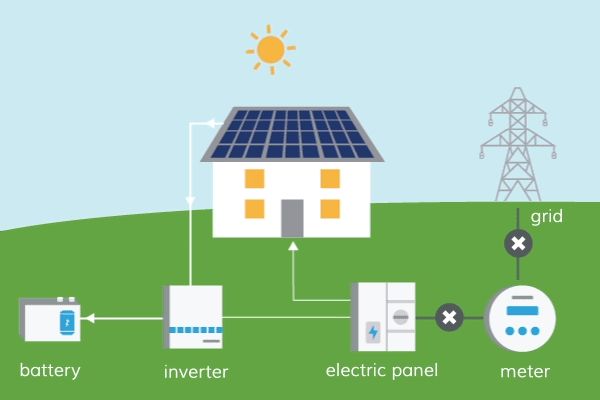

Net metering is a policy that allows solar energy system owners to receive credit for excess electricity they generate and send back to the grid. It essentially runs the electric meter backwards when solar panels generate more electricity than the home is using, allowing customers to offset their electricity usage over an entire billing period.

As of 2022, at least 41 states and Washington, D.C. have statewide net metering rules in place. However, there is variation in specific net metering policies across states. Some key aspects that differ include:

- Size limits – Maximum capacity of solar systems eligible for net metering

- Aggregate caps – Limits on total solar capacity in a utility’s service territory eligible for net metering

- Treatment of excess generation – Compensation rate and terms for net excess generation (NEG) sent back to the grid

- Applicable customer classes – Eligibility by customer type (residential, commercial, industrial, etc)

Many states are moving towards implementing alternatives to traditional net metering, such as buy-all/sell-all arrangements and net billing. There is ongoing policy debate around ensuring fair compensation for solar customers while also ensuring costs are not disproportionately shifted to non-solar customers.

Overall, well-designed net metering policies are considered crucial for supporting rooftop solar adoption and fair credit for solar generation. Striking the right policy balance continues to be an evolving landscape across states.

Renewable Portfolio Standards

Renewable portfolio standards (RPS) are state policies that require electricity providers to obtain a minimum amount of their power from renewable energy sources by a certain date. According to the Energy Information Administration, 30 states and Washington, D.C. have binding RPS policies as of 2021.

RPS policies help drive the growth of renewable energy by creating guaranteed demand. They also encourage innovation and cost reductions in renewable technologies. RPS targets vary significantly by state, ranging from 10% to 100% renewable electricity by dates spanning from 2020 to 2050. Some states also differentiate RPS targets by technology, carving out mandates for solar, wind or other sources.

For example, California’s RPS requires 60% renewable energy by 2030 and 100% carbon-free electricity by 2045. Minnesota’s RPS sets a target of 25% renewables by 2025 for investor-owned utilities. Texas, a leading wind energy state, has a target of 25% by 2025 which will be achieved primarily through wind. These and other state RPS policies are driving rapid growth in solar, wind and other renewables nationwide.

Solar Incentives and Rebates

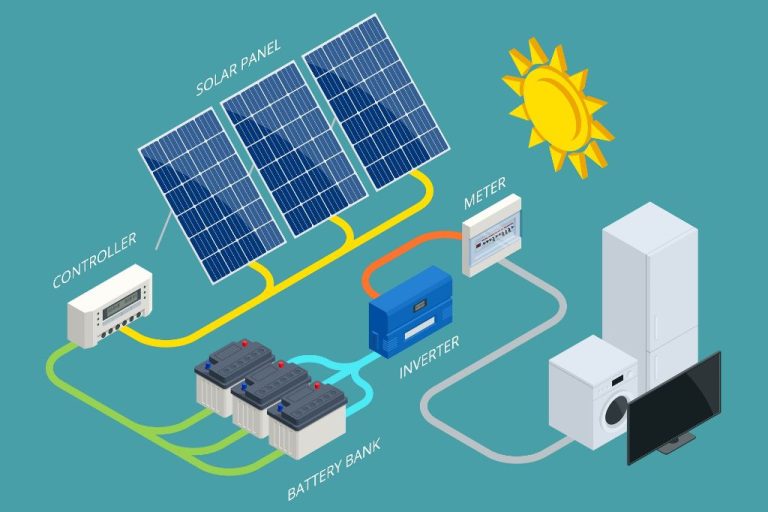

State and local governments offer various incentives and rebates to make solar more affordable for homeowners and businesses. These incentives help offset the upfront cost of installing a solar energy system. The main types of solar incentives include:

Tax credits – Many states offer tax credits for installing solar panels that can reduce your tax bill. For example, the federal solar tax credit is 26% for systems installed in 2023 and 22% for 2024. Some states like Arizona offer additional tax credits on top of the federal amount.

Rebates – States like California and New Jersey have rebate programs that provide upfront cash back for solar installation costs. The rebate amount depends on factors like system size and location.

Net metering – This policy allows solar customers to get credit from their utility for excess energy they export. It makes solar more economical by offsetting electric bills.

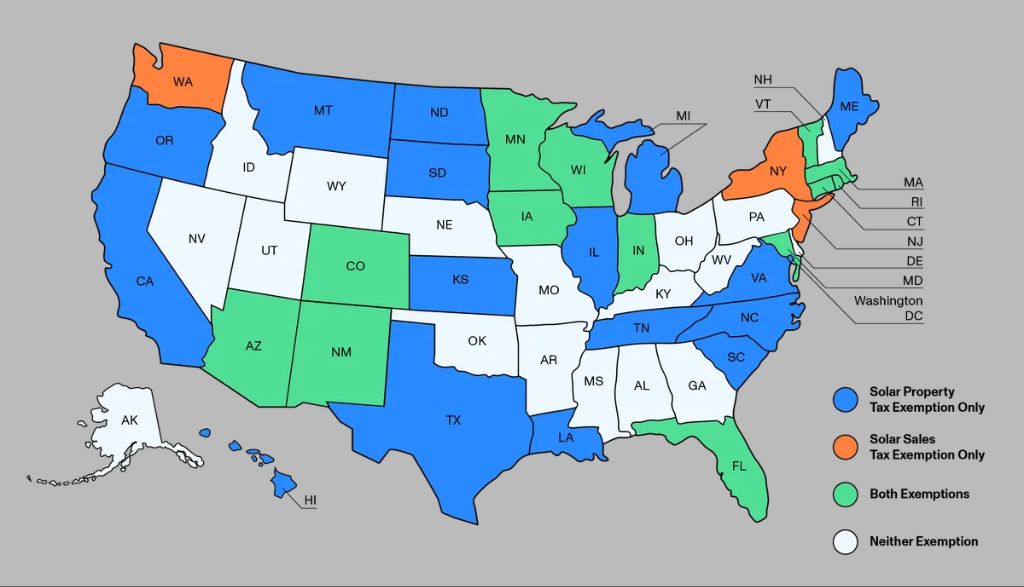

Property tax exemptions – Some states like North Carolina exempt the added value of solar from being taxed as part of the home’s property tax assessment. This reduces ongoing costs.

Renewable portfolio standards – These policies require utilities to obtain a portion of their electricity from renewable sources, creating compliance markets and incentives for solar.

Solar Tax Credits

Many states offer additional tax credits and incentives to supplement the federal solar tax credit and further reduce the cost of going solar. According to Bankrate1, over 20 states provide state tax credits, rebates, or other incentives for residential solar installations as of 2023.

For example, California offers a tax credit worth 15% of the cost of installing a solar system, up to $2,000 for single-family homes and up to $1,000 for multifamily homes2. Massachusetts offers a credit worth 15% of the first $1,000 and 10% of the next $4,000 spent on solar for a maximum credit of $5003. Overall, state tax credits and other incentives can make going solar even more affordable for homeowners.

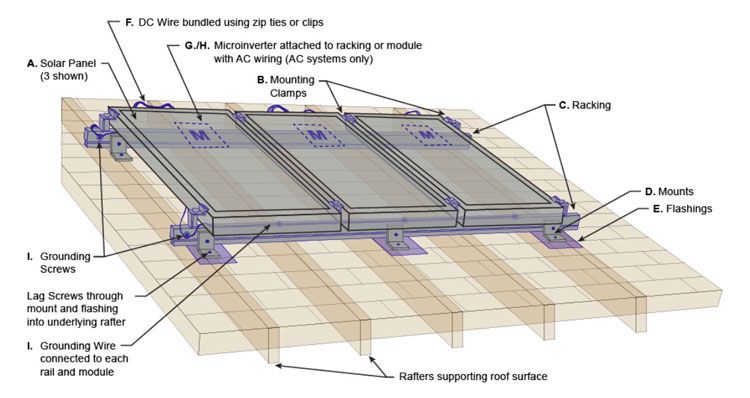

Permitting and Installation Rules

Permitting and installation regulations for solar systems vary greatly by state. According to the Solar Energy Industries Association (SEIA), streamlined solar permitting processes can reduce costs for consumers and create jobs within the solar industry (Source). Some states like California have implemented statewide standards to simplify and expedite solar permitting, while other states leave permitting up to local jurisdictions resulting in a patchwork system (Source).

The National Renewable Energy Laboratory provides data on permitting, inspection, and interconnection timelines by state. Their research shows median total permit times ranging from 1 day in Connecticut to 89 days in Hawaii (Source). Factors like online permitting systems, permit caps, and statewide standards contribute to faster permitting processes.

Overall, solar-friendly states tend to have more uniform statewide permitting standards, shorter permit timelines, lower permit fees, and simpler procedures. States can enable faster and more affordable solar adoption by implementing best practices for streamlined permitting.

Community Solar Policies

Community solar refers to solar energy systems that are shared by multiple households in a community rather than being installed on a single rooftop. Community solar allows renters, residents whose rooftops can’t support solar panels, and other consumers access to renewable energy options. Participants in a community solar project receive credits on their electricity bills for their share of the power produced by the community solar array.

According to the National Renewable Energy Laboratory (NREL), community solar projects exist in 39 states, Washington D.C., and Puerto Rico as of 2020, but the market is concentrated in just a few states. As of July 2020, 22 states plus Washington D.C. had enacted policies to support community solar development, such as virtual net metering rules, shared renewables programs, utility-administered community solar programs, and community solar gardens legislation [1]. Some leading states in community solar include Minnesota, Massachusetts, New York, Maryland, and Colorado.

Solar Rights Laws

Solar rights laws aim to protect an individual’s right to install solar panels and access sunlight on their property. These laws vary significantly by state. Some key aspects covered in solar rights laws include preventing homeowners associations from restricting solar installations, preventing local zoning laws from excessively restricting solar, and preventing neighbors from blocking sunlight access.

In Alabama, solar easements that define a right to unobstructed sunlight can be voluntarily negotiated between neighbors. California has a comprehensive Solar Rights Act that prevents homeowners associations and local governments from restricting solar installations. It also defines solar easements and prevents shading from vegetation and buildings on neighboring properties.

Colorado allows county governments to regulate solar access permits and easements. Florida prohibits restrictions on solar by local governments and homeowners associations. New York has a Solar Access Law that lets local governments develop solar access permits.

Top Solar States

Based on an analysis of the factors discussed, including net metering policies, renewable portfolio standards, available incentives and tax credits, permitting requirements, community solar programs, and solar rights laws, the most solar-friendly states in the US are:

California is widely regarded as the top solar state, due to its abundant sunshine, robust net metering policy, strong RPS goal of 60% renewable energy by 2030, and generous solar incentives like the California Solar Initiative rebate program. California also has streamlined permitting and interconnection processes, strong community solar policies, and solid solar access protections.

Massachusetts has emerged as another leading solar state. Key factors include its comprehensive net metering and community solar policies, Solar Renewable Energy Credits (SRECs), robust solar tax credits, and an RPS of 35% renewable energy by 2030. Permitting is also favorable. Massachusetts was 9th nationally in installed solar capacity as of 2020.

[2]

New Jersey has abundant solar resources and a strong RPS of 50% renewable energy by 2030. The state also offers beneficial net metering, community solar policies, strong tax credits, and rebates for residential installations. New Jersey ranked 7th for installed solar capacity in 2020.

[2]

Arizona, Florida, Nevada, New York, North Carolina, and Texas are other leading solar states with ample sunshine, robust incentives and renewable energy goals, streamlined solar rules and regulations, and growing solar markets.