What Qualifies For Bonus Depreciation In 2023?

Bonus depreciation is a tax incentive that allows businesses to immediately deduct a percentage of the cost of qualifying property in the year the property is placed in service. The intention behind bonus depreciation is to encourage business investment and economic growth by enabling businesses to expense more upfront, thereby reducing taxable income in the first year.

The bonus depreciation percentage varies by year based on tax legislation, but for 2023 it allows for full expensing or 100% bonus depreciation for qualified property acquired and placed in service that year. This means the entire cost can be deducted in the first year, providing an valuable tax benefit.

Qualified Property Types

The Tax Cuts and Jobs Act significantly expanded bonus depreciation by making both new and used property eligible. Qualified property types for bonus depreciation in 2023 include:

-

New tangible property with a recovery period of 20 years or less, which includes most machinery, equipment, vehicles, appliances, furniture, computers, and software.

-

Used tangible property if the taxpayer did not previously use the property and it meets the original use requirement.

-

Off-the-shelf computer software.

-

Qualified film, television and live theatrical productions.

-

Qualified improvement property, which is improvements made to the interior of a commercial building.

-

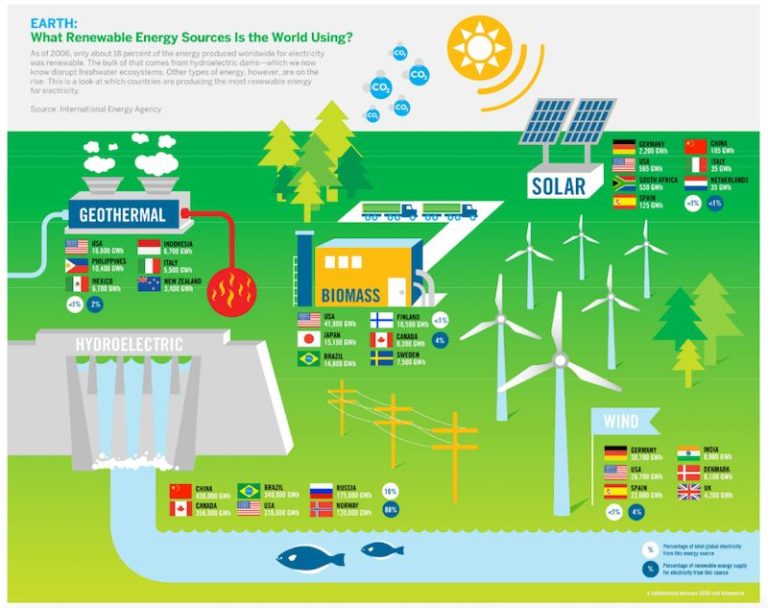

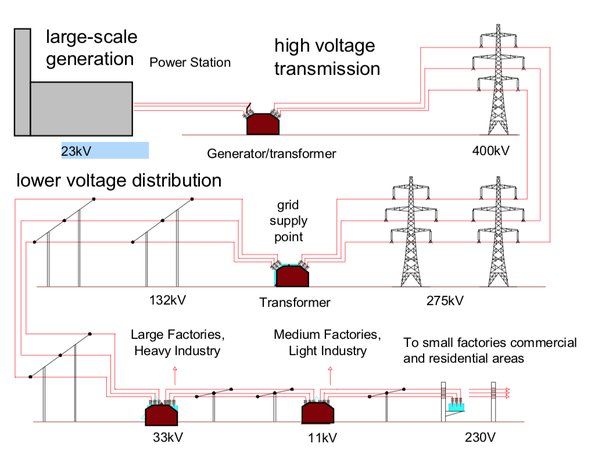

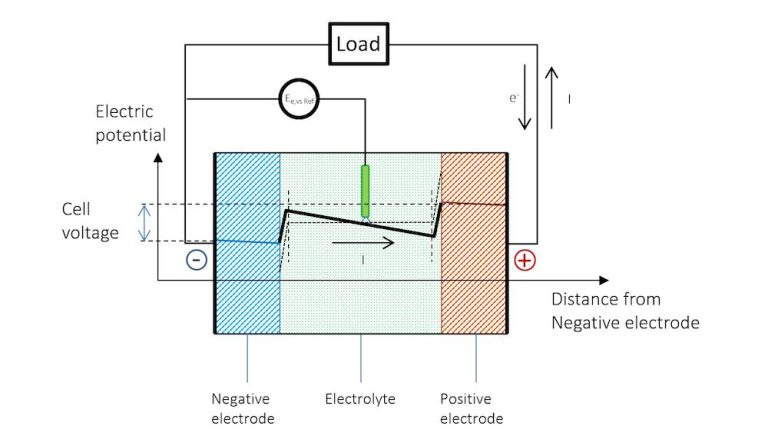

Qualified energy property such as solar panels, wind turbines, fuel cells, and more.

Land, buildings, and intangible property like goodwill do not qualify for bonus depreciation.

Original Use Requirement

The original use requirement states that in order to qualify for bonus depreciation, the property must be new and not have been used by anyone else previously. This means:

- The property must never have been used by the taxpayer or any other person before.

- The taxpayer must be the first user of the property.

So for example, if a business buys a new machine directly from the manufacturer to use in their operations, it satisfies the original use requirement. However, if they bought a used machine from another company that had already been in service, it would not qualify.

There are a few exceptions to this rule. The original use requirement does not apply to:

- Property acquired by the taxpayer for lease or rental to others.

- Certain inherited property.

But in general, brand new property put into use for the first time by the taxpayer meets the original use test for bonus depreciation eligibility.

Acquisition Date

The acquisition date determines whether the property qualifies for bonus depreciation. To qualify, the property must be acquired after September 27, 2017 and before January 1, 2027. There are specific acquisition date ranges to be aware of:

– For property acquired after September 27, 2017 and before January 1, 2023, bonus depreciation is 100%

– For property acquired in calendar year 2023, bonus depreciation is 80%

– For property acquired in calendar year 2024, bonus depreciation is 60%

– For property acquired in calendar year 2025, bonus depreciation is 40%

– For property acquired in calendar year 2026, bonus depreciation is 20%

So in summary, the acquisition date determines both eligibility for bonus depreciation and the percentage that can be claimed. Pay close attention to when the property was acquired when determining the available bonus depreciation.

Placed in Service Deadline

To qualify for bonus depreciation, property must be placed in service before a specified deadline. For 2023, the placed in service deadline is December 31, 2023. This means the property must be ready and available for use by the end of that tax year.

The placed in service date is not the same as the purchase date. Even if a business buys a piece of equipment in 2023, it must actually be operational and able to be used for its intended purpose by December 31, 2023 to qualify for bonus depreciation on the 2023 return. Any property that is not up and running by the end of the tax year will not qualify.

The placed in service deadline also applies to used property. Used property qualifies for bonus depreciation, but it must also be placed in service by the deadline like new property. There are no exceptions if there are delays in getting used equipment ready for use by the deadline.

Planning purchases and projects to ensure assets will be functioning in time to meet the placed in service deadline is an important element in successfully claiming bonus depreciation.

Depreciation Calculations

The bonus depreciation deduction is calculated before regular MACRS depreciation. For qualified property placed in service in 2023, bonus depreciation equals 100% of the adjusted basis of the property. This allows businesses to immediately deduct the full cost of the asset.

For example, if a business purchases new equipment for $100,000 and places it in service in 2023, they can take a bonus depreciation deduction of $100,000 for that tax year. This reduces the asset’s remaining tax basis to $0.

Without bonus depreciation, the equipment would have been depreciated over 5 years under MACRS. In the first year, the depreciation deduction would have been only $20,000 (20% of $100,000).

With 100% bonus depreciation, the entire $100,000 asset is expensed in Year 1, providing larger tax savings and improved cash flow for the business.

Impact on Taxable Income

Claiming bonus depreciation can greatly increase deductible expenses and lower taxable income in the year the asset is placed in service. By immediately deducting a portion of the cost as a bonus depreciation, taxable income is reduced compared to depreciating the asset slowly over its tax life.

For example, say a business spends $100,000 on equipment eligible for 100% bonus depreciation. If they claim the full bonus depreciation, they can deduct the entire $100,000 cost immediately, reducing taxable income by $100,000 in year one. Without bonus depreciation, they may only be able to deduct around $20,000 in year one based on a 5-year depreciation schedule.

The ability to frontload and accelerate depreciation deductions provides sizable tax savings and improves cash flow. Claiming bonus depreciation frees up capital in the early years of an asset’s life compared to standard depreciation. However, businesses do lose out on depreciation deductions in later years, so the long-term tax benefit is generally the same.

It’s important to weigh bonus depreciation against other tax incentives like Section 179 expensing limits. The optimal approach depends on the business’ tax situation each year. Overall, bonus depreciation is a valuable tax incentive for businesses to immediately realize deductions for major equipment purchases and technology upgrades.

Interplay With Section 179 Expensing

Bonus depreciation and Section 179 expensing are two tax deductions that allow businesses to deduct the costs of qualifying assets in the year they are placed in service, rather than depreciating the costs over time. They can be used together, but with some limitations.

Under Section 179, businesses can deduct up to $1,080,000 in 2023 of the purchase price of qualifying equipment and software in the first year it is placed in service. Any remaining cost is then depreciated under the normal tax depreciation rules.

Bonus depreciation and Section 179 expensing apply to costs left after the Section 179 deduction. For example, if a business buys a $2 million piece of equipment and claims the maximum $1,080,000 Section 179 deduction, the remaining $920,000 can qualify for 100% bonus depreciation in 2023.

However, the combined deduction amounts for Section 179 and bonus depreciation cannot exceed the cost of the asset. If the business from the example above bought a $500,000 piece of equipment, claiming the $500,000 maximum Section 179 deduction would leave $0 eligible for bonus depreciation.

So in summary, Section 179 expensing and bonus depreciation can work together to maximize first-year deductions, but businesses need to coordinate carefully to optimize the tax benefits while staying within the limitations.

Claiming Bonus Depreciation

To claim bonus depreciation for qualifying property, you must take the following steps:

Calculate the depreciation deduction: Determine the cost basis of the property, the applicable depreciation method, the placed-in-service date, the estimated useful life, and the applicable depreciation rate for bonus depreciation (100% for 2023). Use this information to calculate the depreciation deduction amount you can claim under bonus depreciation rules.

Claim it on IRS Form 4562: The bonus depreciation deduction gets reported on Part III of IRS Form 4562. The deductible amount flows through to your tax return (Form 1040 for individuals or Form 1120 for businesses).

Maintain documentation: Keep records of your cost basis calculations, depreciation worksheets, purchase invoices, and other documents that support the bonus depreciation deduction claimed. You’ll need to provide this if audited.

Claim over multiple years: For property placed in service during 2023, 100% of the basis is eligible for bonus depreciation. For subsequent years, the deduction phases down incrementally. You can continue claiming bonus depreciation on the remaining basis until the phase-down expires.

Consult your tax advisor or accountant to ensure you properly calculate and claim the maximum bonus depreciation allowed each year.

Conclusions

In summary, the key points about bonus depreciation in 2023 are:

- Bonus depreciation allows businesses to immediately deduct a percentage of the cost of qualified new or used property in the year it is placed in service.

- For 2023, the bonus depreciation percentage is 100% for qualified property.

- The main qualified property types are equipment, machinery, vehicles, and certain building components.

- To qualify, the original use of the property must begin with the taxpayer claiming the deduction.

- The property must be acquired and placed in service between September 28, 2017 and December 31, 2023.

- Taking bonus depreciation reduces taxable income in the first year which provides valuable cash flow benefits.

- Bonus depreciation interacts with Section 179 expensing – Section 179 is applied first, then bonus depreciation.

The key advice for maximizing use of bonus depreciation includes:

- Consider acquiring qualifying assets before the 2023 deadline to get 100% immediate deduction.

- Purchase used equipment instead of new if possible, to qualify for bonus depreciation.

- Consult with your tax advisor to properly calculate depreciation and confirm qualification.

- Take bonus depreciation even if it creates an NOL, since you can carry the loss back 5 years or forward indefinitely.

Bonus depreciation can provide a valuable tax deduction for businesses investing in equipment and facilities. Consult with a tax professional to utilize this tax benefit before it expires.