What Is The Solar Incentive Program In Florida 2023?

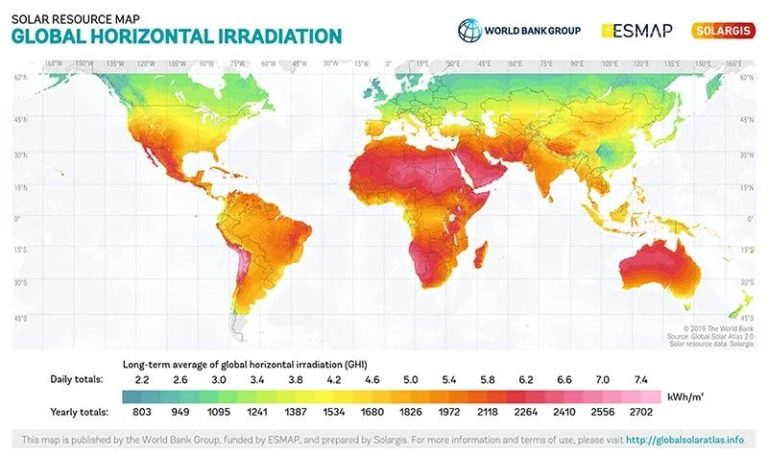

Solar incentives in Florida provide financial benefits to residents who install solar panels on their homes. These programs make solar more affordable and accessible to homeowners across the state. With Florida’s abundant sunshine, incentives can accelerate solar adoption and help the state transition to clean energy.

There are several key solar incentive programs available in 2023 for Florida residents. These include net metering, rebates, federal tax credits, property tax exemptions, solar co-ops, community solar, solar leasing, and performance-based incentives. Each program provides unique advantages that can significantly offset the cost of a solar system.

Understanding the options allows homeowners to maximize savings. The financial benefits, combined with solar energy’s environmental advantages, make these programs a win-win for Florida families and communities.

Net Metering

Net metering allows solar panel system owners to send excess electricity they generate back to the grid. This essentially runs their electric meter backwards, offsetting the electricity they use from the utility. Here’s how it works in more detail:

When your solar panels produce more electricity than your home or business is using, the extra power gets fed back into the grid. Your electric meter spins backwards to provide you with a credit for those kilowatt-hours. At night or on cloudy days when your system isn’t generating enough solar energy, you simply pull electricity from the grid. At the end of the billing cycle, you’re charged for your net energy use after subtracting the solar credits.

The main benefits of net metering include:

- Lower electricity bills – Your monthly charges are reduced since solar credits offset grid usage.

- Simplified billing – You only pay for your net usage rather than solar production and consumption separately.

- Grid backup – The utility grid essentially serves as a battery storage system.

Florida currently allows net metering for residential solar customers, subject to some restrictions. The main limit is that your system’s capacity cannot exceed 2 megawatts. There is also a cap on the total net metered capacity allowed across all customers for each utility.

Solar Rebate Programs

Florida offers several solar rebate programs to incentivize residents to install solar panels on their homes.

The main rebate program is the Solar Energy System Incentives Program, which provides rebates for installing new solar systems on homes, businesses, and community buildings. This program is administered by the Florida Department of Agriculture and Consumer Services.

To qualify for the rebate, you must install a new solar PV or solar thermal system. Rebates are based on system size and component costs, up to $20,000 for homes and $100,000 for businesses and communities. The program accepts applications during designated application periods throughout the year.

Another option is the Solar and Energy Loan Fund (SELF), administered by the Florida Solar Energy Center. This program offers low-interest loans to residents who install solar systems. Loan amounts range from $5,000 to $50,000 at interest rates around 3-6%.

To apply for solar rebates in Florida, you’ll need to submit an application with details on your solar installation, permits, costs and other required documents. Make sure to review the eligibility requirements and follow the application instructions closely.

Taking advantage of solar rebates allows Florida homeowners to recoup some of the upfront costs of going solar, making it a more affordable clean energy option.

Federal Tax Credits for Solar

The federal government offers tax credits to offset the cost of installing solar energy systems. This incentive allows taxpayers to deduct a portion of their solar panel system costs from their federal tax bill.

As of 2022, there is a 26% federal tax credit for solar installations. This credit applies to both residential and commercial solar systems. The credit covers 26% of the total cost of purchasing and installing a solar system, including panels, inverters, wiring, etc. There is no cap on the amount that can be claimed.

To qualify for the tax credit, the solar energy system must be placed into service during the tax year when the credit is claimed. Additionally, the taxpayer must own the solar system rather than leasing it or signing a power purchase agreement.

Homeowners can claim the credit when they file their personal income taxes. Businesses can claim it on their corporate income taxes. If the credit exceeds a filer’s tax liability for the year, they can carry forward the remainder of the credit for use in future tax years. The current 26% rate will continue until 2032, when it is scheduled to decrease.

Consulting with a tax professional can help determine eligibility and ensure the credit is properly claimed. Proper documentation, including invoices for the solar installation, must be retained as evidence to support the tax credit.

Property Tax Exemption

Florida offers a property tax exemption for renewable energy installations on residential properties. This allows homeowners to exempt the added value of their solar installation from their property value for tax purposes.

To qualify for the exemption, the solar installation must be located on the owner’s residence. Rentals or commercial properties do not qualify. The exemption applies to the added value of the solar installation, so if a home is valued at $300,000 and the solar system adds $30,000 in value, the exemption would apply to the $30,000.

The amount of savings from the exemption depends on the local property tax rate. With Florida property tax rates averaging around 1%, a homeowner with a $30,000 system value could save around $300 per year. The exemption remains in place for 20 years after the installation.

To receive the exemption, homeowners must submit a renewable energy source exemption form to their county property appraiser by March 1st of the tax year. This form can be obtained from the county property appraiser’s office. The homeowner must provide documentation showing the value of the solar installation.

Florida’s property tax exemption makes solar more affordable by reducing ongoing costs. It allows homeowners to fully capitalize on their investment in renewable energy.

Solar Co-ops

A solar co-op is when a group of homeowners join together to install solar panels on their homes at a discounted rate. The co-op negotiates a lower price by purchasing solar systems in bulk from an installer. This helps homeowners save significantly on the costs of going solar.

Some key benefits of joining a solar co-op include:

- Lower equipment and installation costs – Bulk purchasing provides volume discounts

- Simplified process – The co-op handles finding an installer and negotiating terms

- Support network – Work together with other co-op members throughout the process

In Florida, Solar United Neighbors is leading the effort in organizing solar co-ops across the state. They help educate homeowners and provide guidance in forming a co-op. Once the group selects an installer, members can individually choose to install solar with the negotiated discount pricing and terms.

Joining a solar co-op can make going solar more affordable and easier to navigate for Florida homeowners. It’s a great way to save money while also being part of a renewable energy community.

Community Solar

Community solar, also known as shared solar, is an option that allows multiple homeowners to share the benefits of a single solar array. Participants don’t need to install panels on their own property, but can subscribe to a portion of a larger, shared system located elsewhere in the community.

In Florida, some utilities like Florida Power & Light (FPL) offer community solar programs. FPL’s SolarTogether program allows both homeowners and businesses to subscribe to blocks of solar power produced at FPL solar energy centers. Participants receive credits on their monthly bills based on the amount of energy their subscription produced.

Community solar is open to all FPL customers – both homeowners and renters can participate. It provides a way for those who can’t install rooftop solar panels to still benefit from clean energy. The minimum subscription is just half a kilowatt, and credits appear as a line item on your electric bill.

The benefits of joining a community solar program include supporting renewable energy, locked-in monthly credits, and no panels to maintain. It provides a flexible, affordable way to go solar with no long-term commitment. As community solar grows in Florida, it opens up solar savings and ownership to more utility customers across the state.

Solar Leasing

Solar leasing has become a popular way for residents to go solar in Florida without having to pay the high upfront costs of purchasing a solar system. With solar leasing, a company installs a solar system on your home for little to no money down, and you pay a fixed monthly amount to lease the system.

The solar leasing company owns, maintains, and insures the system while you benefit from lower electricity bills. This allows homeowners to adopt solar energy with no upfront investment. The monthly lease payment is often estimated to be 10-30% less than your current utility bill.

Some of the major solar leasing companies operating in Florida include Sunrun, SunPower, Tesla (formerly SolarCity), Sunnova, and Vivint Solar. Key advantages of solar leasing include no upfront costs, fixed monthly payments, system maintenance/monitoring included, increased home value, and environmental benefits.

Potential drawbacks are that you don’t own the system so you can’t get tax credits or rebates, lease terms tend to be long (20+ years), and costs may escalate over time. You’ll also want to read the fine print to understand the terms and conditions.

Average solar lease rates in Florida tend to range from $30 to $150 per month, depending on system size, your energy usage, location and other factors. Overall, solar leasing provides a simple path to solar energy in Florida if you don’t want to buy and own a system yourself.

Performance-Based Incentives

Florida has limited performance-based incentives compared to some other states. However, some of the major utility companies like Florida Power & Light (FPL), Duke Energy and Tampa Electric Company (TECO) offer programs that provide payments based on the amount of solar energy produced.

For example, FPL offers a Commercial Solar Rebate Program that provides businesses $0.07 per kWh produced over the first year of operation for systems up to 100 kW. The utility also has a community solar program that pays subscribers based on the energy generation of the overall solar installation.

Duke Energy has a similar program called Shared Solar that provides bill credits to customers based on the energy output of community solar projects. TECO also offers commercial solar rebates based on system production and capacity.

While Florida’s performance-based incentives are still developing compared to leading solar states, the utilities are spearheading new programs to reward solar adoption and energy generation.

Conclusion

In summary, there are a variety of solar incentive programs available to Florida residents and businesses in 2023. The incentives make going solar more affordable and financially beneficial. Key programs include net metering, solar rebates, federal tax credits, property tax exemptions, solar co-ops, community solar, solar leasing, and performance-based incentives.

With the high electricity costs and abundant sunshine in the Sunshine State, solar power is an extremely attractive option. Taking advantage of the available incentives can lead to greater energy bill savings and a faster return on your solar investment. Going solar helps homeowners and businesses reduce their carbon footprint while harnessing free renewable energy.

For any Florida resident or business considering solar, it is worth exploring the current incentive programs. A tax credit, rebate, or other incentive could potentially cover a significant portion of your solar installation costs. Consult with a qualified solar installer to determine which incentives make the most financial sense for your particular situation. The time to go solar is now.