What Is The Solar Incentive In Houston?

Solar incentives like rebates, tax credits, and net metering programs have become increasingly popular for Houston residents looking to go solar. With nearly 300 days of sun per year, Houston has great solar potential but still lags behind other major Texas cities in solar adoption. Solar incentives can help offset the upfront costs of installing solar panels, allowing more Houston households to realize the environmental and economic benefits of generating their own renewable power. This article will provide an overview of the main solar incentives available to Houston residents and businesses in 2023 and outline the potential savings.

Current Solar Incentives

There are several solar incentives currently available to Houston residents looking to go solar. The main incentives include the federal solar tax credit, local utility rebates, and net metering programs.

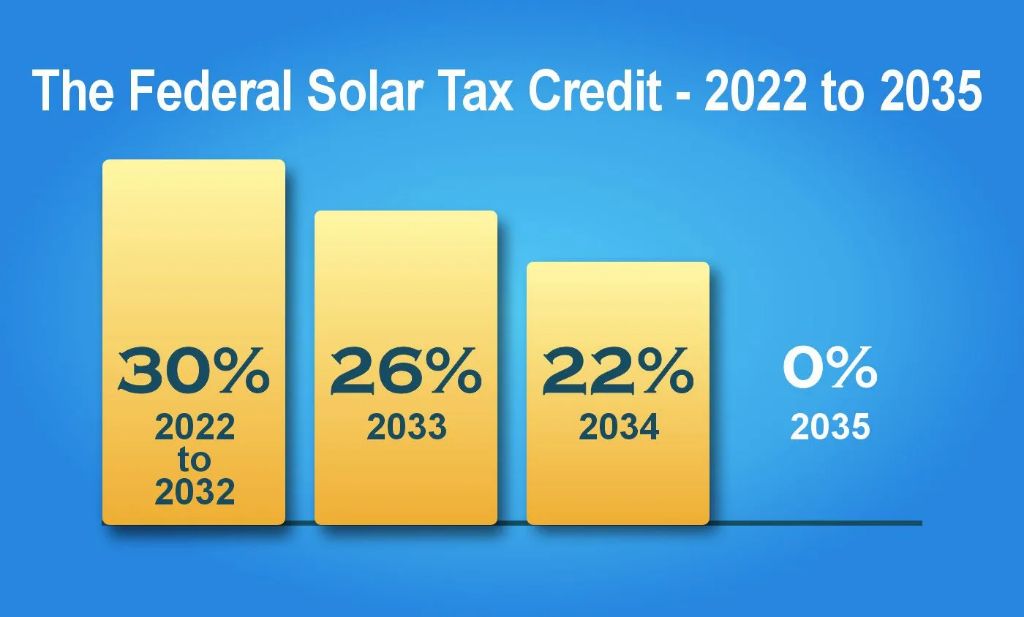

The federal solar tax credit allows homeowners to deduct 26% of the cost of installing a solar energy system from their federal taxes through 2032 (cite: https://www.ecowatch.com/solar/incentives/tx/houston). This tax credit applies to both residential and commercial solar installations.

Local utility rebates are also offered by some providers like Green Mountain Energy, which gives bill credits to homeowners who connect their solar panels to the grid (cite: https://www.cnet.com/home/energy-and-utilities/houston-solar-panels/). These rebates help offset the upfront cost of a solar system.

Net metering programs allow solar panel owners to get credit for excess electricity they generate and send back to the grid. This helps solar owners offset the cost of power drawn from the grid when their panels are not producing enough energy.

Federal Tax Credit

The federal solar tax credit, also known as the investment tax credit (ITC), allows homeowners to deduct 26% of the cost of installing a solar energy system from their federal taxes through 2032. After 2032, the ITC will drop to 22% for systems installed in 2033, and then down to 10% in 2034 for commercial projects and 0% for residential. There is no cap on the amount that can be claimed.

To qualify for the full 26% ITC, the solar energy system must be installed and placed into service before December 31, 2032. Additionally, the system must be intended for personal use, providing energy just for the home it is installed on. Rental properties or second homes do not qualify for the residential credit, only the primary residence.

The ITC covers both the cost of the solar panels or modules, as well as the cost of installation. Additional solar equipment required as part of the system, like inverters and mounting systems, is also eligible. Ongoing maintenance and operating costs do not qualify for the credit.

Homeowners must claim the ITC when filing their taxes in the year the solar system was installed. If the tax credit exceeds the amount of taxes owed, the excess can be carried forward to the following tax year. https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics

Local Rebates

The city of Houston offers some attractive rebates to homeowners who install solar panels. According to an article on Ecowatch, the Houston city government provides rebates of $0.85 per watt of solar capacity installed, up to $15,000. To qualify, you must install a system of at least 2 kW. The rebate comes in the form of a check 4-6 weeks after your final inspection.

Harris County, where Houston is located, also offers a rebate of $0.50 per watt for systems up to 20 kW, according to the same Ecowatch article. That means you could potentially get over $10,000 combined in rebates from the city and county for installing solar panels on your Houston home.

These local solar rebates can make installing a solar system much more affordable for Houston homeowners. They essentially discount the total cost by a significant amount. Just be sure to research all the eligibility requirements and application process details before moving forward.

Net Metering

Net metering is one of the key incentives for going solar in Houston and across the country. Net metering allows solar panel system owners to get credit for any excess electricity they generate and send back to the grid. Here’s how it works:

Your solar panels will produce electricity during the day that first supplies any power needed in your home. If you generate more electricity than you use, the excess gets fed back into the electric grid. With net metering, your utility company will give you credit for those kilowatt-hours (kWh) that you add to the grid. This will offset the cost of power that you need to pull from the grid when your solar system isn’t producing, such as at night.

At the end of each billing cycle, you will just pay for your net electricity use. If you produced more than you used in a month, you may even get paid by the utility for the excess if you generated a credit. The specific net metering policies and rates vary by state and utility company, but the overall concept is the same nationwide.

According to the Solar Energy Industries Association (SEIA), net metering is available in 40 states and allows residential solar owners to cut their electric bills by up to 50% [1]. Net metering provides a simple but powerful incentive for installing rooftop solar panels in Houston and earning credit for your clean energy contributions.

Estimated Savings

According to Energysage, solar panels can save the average Houston home between $855 to $1,175 per year on their electric bill, with an estimated payback period of 6 to 11 years.1 This factors in the average cost of solar in Houston at $2.51 per watt, as well as available incentives like the federal tax credit and net metering.

For a 5kW solar system, which is typical for the average home, you can expect total savings of $17,100 to $23,500 over the 25 year lifespan of the system. With the 26% federal solar tax credit, your out-of-pocket costs would be around $8,745 after claiming the credit on your taxes. Factoring in estimated electric bill savings of $1,010 per year, your payback period would be about 8-9 years.

Net metering also helps offset costs, as you can get credit for any excess power your panels produce during the day that goes back into the grid. This further reduces your effective cost per kWh from the utility.

Overall, solar panels in Houston can generate over 50% savings on your electricity costs thanks to sun exposure, incentives, and net metering credits. Payback periods are short, and lifetime savings are significant.

Future Outlook

The future of solar incentives in Houston looks bright. Here are some of the plans and proposals in the works that may impact solar incentives in the years to come:

The federal solar tax credit is scheduled to step down again in 2023 before expiring completely for residential projects in 2024. Some industry groups are lobbying Congress to extend the credit beyond 2024 to provide continued support for rooftop solar. The outcome of these efforts remains uncertain.

At the state level, Texas lawmakers have introduced bills to create a state tax credit for residential solar installations. The bills have not yet gained traction but signal growing political interest in solar incentives. Advocates will continue pushing for the policy in future legislative sessions.

Within the city of Houston, there are discussions around implementing a renewable energy incentive program similar to those offered in Austin and San Antonio. The program would provide rebates for local residents and businesses installing solar panels. Houston’s mayor has expressed interest in promoting renewable energy adoption. Concrete plans have not yet materialized but local solar advocates are optimistic about future policy support.

There are also grassroots efforts building to expand community solar and collective purchasing models that make solar more accessible to lower-income households. Non-profits are collaborating with the city’s housing authority on pilot projects that could pave the way for broader initiatives in the future.

While uncertainty remains around specific policies, the overall momentum seems to be moving towards more solar incentives at various levels of government. Houston’s abundance of sunshine, large buildings suited for solar, and energy-intensive economy make it a prime candidate for continued solar growth with the right policy support.

Challenges

While solar incentives in Houston provide significant savings for homeowners, there are some challenges and limitations to be aware of. One major challenge is that the federal solar tax credit is set to decrease from 26% in 2023 to 22% in 2024 before expiring completely in 2034 [1]. The declining tax credit means less savings in the future for homeowners who wait to adopt solar.

Interconnection issues also pose a problem in some areas, with utilities slow or unable to approve solar connections in a timely manner [2]. This can lead to long wait times and headaches for homeowners eager to start benefiting from their solar investment. Additionally, fluctuating interest rates impact the attractiveness of solar loans and leases [2].

While solar power offers significant environmental and financial benefits, the upfront cost of purchasing and installing a system remains high for many Houston households. This poses a challenge, especially for low-income residents who could benefit greatly from solar savings.

Call to Action

If you’re interested in going solar in Houston, here are some helpful resources to take the next steps:

Get quotes from top-rated local installers like NRG Clean Power, SunPower by SolarGuru, and others. Having multiple quotes allows you to compare costs and find the best deal.

Use the DOE’s Solar Decision Tool to estimate the costs and benefits of going solar for your particular home and location.

Check your eligibility for federal, state, and local solar incentives, rebates, and tax credits through sites like EnergySage.

Learn more about the basics of solar and whether it makes sense for you through educational resources like the Solar Energy Industries Association.

Consider financing options like solar loans and PPAs to reduce upfront costs and leverage savings.

By researching installers, incentives, financing, and more, you’ll be well prepared to decide if now is the right time to go solar in Houston!

Conclusion

In conclusion, solar incentives provide significant value and savings for Houston homeowners looking to go solar. The federal tax credit covers 26% of system costs in 2023. Local rebates like those from CenterPoint Energy can save up to $2,500. Net metering allows excess solar energy to be sold back to the grid for credit. Together, these incentives can reduce the upfront cost of a solar array by up to 50%. This makes the return on investment for solar much faster, often within 5-7 years. With solar costs continuing to fall and incentive programs being expanded, now is the time for Houston residents to explore solar. By going solar and taking advantage of these generous incentives, Houston homeowners can save money on electricity bills while also benefiting the environment.