What Is The Inflation Reduction Act For Energy Efficiency?

The Inflation Reduction Act of 2022 is a landmark piece of legislation signed into law by President Biden in August 2022. The Act includes major investments and tax incentives aimed at accelerating the transition to clean energy and promoting energy efficiency across the United States. The wide-ranging climate and energy provisions in the Inflation Reduction Act represent the largest climate investment in U.S. history.

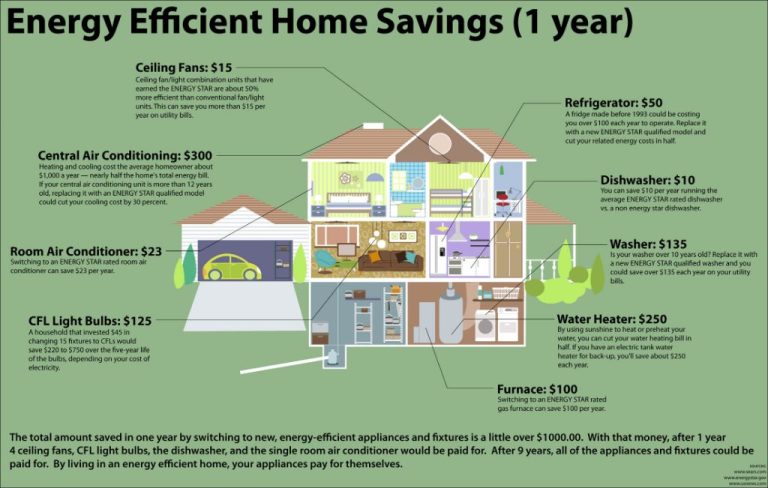

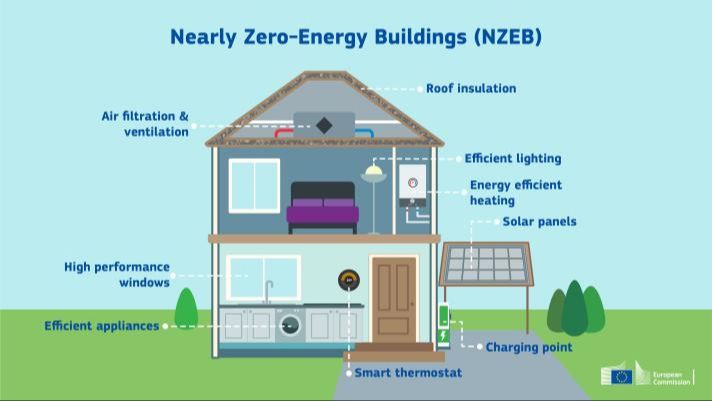

A key focus of the Inflation Reduction Act is driving energy efficiency improvements in the residential, commercial, and industrial sectors. The legislation provides extensive consumer rebates, tax credits, grants, and other financial incentives to help households and businesses install energy efficient upgrades like insulation, high-efficiency appliances, heat pumps, and more. These measures are intended to help consumers and businesses reduce energy waste, lower utility bills, decrease reliance on fossil fuels, and curb carbon emissions that drive climate change.

Residential Energy Efficiency Rebates

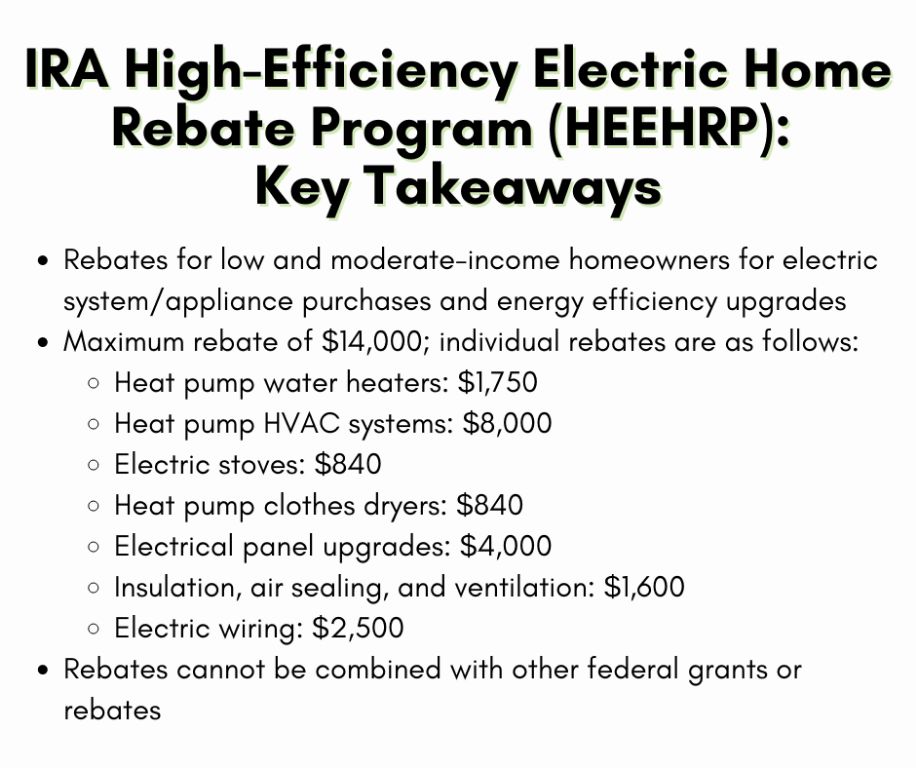

The Inflation Reduction Act includes billions of dollars for residential energy efficiency rebates and tax credits to help homeowners improve home energy efficiency. The law provides $4.5 billion over 10 years for the Home Energy Efficiency Rebate Program which will issue rebates for home electrification and energy efficiency upgrades like installing heat pumps, upgrading insulation and sealing air leaks in windows and doors.1

The rebates will cover up to 50% of the costs of eligible home improvements like insulation, air sealing, upgrading to Energy Star appliances, installing high efficiency heat pumps and heat pump water heaters, upgrading lighting, windows, and doors to more efficient options. States will administer the program and issue rebates directly to homeowners who complete qualifying energy efficiency projects. Low and moderate income households will be eligible for increased rebates covering up to 100% of improvement costs up to $14,000.

The rebates will make it more affordable for homeowners to upgrade insulation, reduce air leaks, install efficient electric appliances like heat pumps, and make other improvements to cut energy costs and emissions. Experts estimate the program could save households hundreds of dollars per year on utility bills while also creating jobs and reducing carbon emissions from home energy use.

Commercial Energy Efficiency Incentives

The Inflation Reduction Act expands and enhances tax incentives for commercial buildings to improve energy efficiency. Some of the key provisions include:

The IRA extends and expands the Section 179D tax deduction for energy efficient commercial buildings. This allows a deduction of up to $1.80 per square foot for lighting, HVAC, building envelope, and other efficiency improvements to cut energy use by 50% or more compared to ASHRAE standards (EDF).

There are also enhanced tax credits available under Section 45L for energy efficiency improvements to lighting, HVAC systems, hot water systems, and building envelopes. The credit covers 30% of the cost for the most efficient upgrades (Films and Graphics).

The IRA also provides a tax credit for building owners that achieve at least a 25% energy use reduction compared to the same building’s usage during 2015-2019. The credit starts at $2 per square foot for a 25% reduction and increases up to $5 per square foot for a 50% or greater reduction (EESI).

These incentives aim to spur building owners to invest in energy efficiency upgrades that will lower utility bills, reduce emissions, and improve sustainability.

Electric Vehicle Tax Credits

The Inflation Reduction Act significantly expands and reforms the federal tax credit for purchasing electric vehicles. The previous tax credit of up to $7,500 started phasing out after an automaker sold 200,000 electric vehicles. The new law removes this cap, making the tax credits available again for vehicles from manufacturers like Tesla and GM who had previously hit the limit.

There are now tax credits worth up to $7,500 for new electric vehicles and $4,000 for used electric vehicles. The used EV credit is limited to vehicles with sale prices up to $25,000. To be eligible, new EVs must have final assembly in North America, while critical battery minerals for new and used EVs must be sourced from countries with which the U.S. has a free trade agreement or recycled in North America. There are also new income caps that start phasing out the credits for individuals making over $150,000 per year or $300,000 for joint married filers.

With these reforms, the tax credits aim to incentivize domestic manufacturing and mineral sourcing while also making EVs more affordable for middle and lower income Americans. The changes take effect for vehicles purchased in 2023 and going forward.

Clean Energy Manufacturing

The Inflation Reduction Act allocates $60 billion in grants and loans to boost domestic clean energy manufacturing in sectors like solar panels, wind turbines, batteries, and critical minerals processing. This aims to expand American manufacturing capacity and reduce reliance on imports. The Department of Energy will distribute grants and loans to support new and upgraded factories, increase production, and strengthen supply chains.

Specifically, the law provides $40 billion for DOE loans supporting manufacturing of solar panels, electric vehicles, batteries and critical minerals processing. Another $20 billion in grants will go to state and local governments to support clean energy manufacturing projects. The goals are to create good-paying jobs, support disadvantaged communities, enhance national and economic security, and make the U.S. a leader in clean energy manufacturing.

Early results show the investments are working. In the year since passage, companies like First Solar, Intel, Honda, and others have announced billions in manufacturing investments supported by the law. Clean energy leaders expect this is just the beginning of a resurgence in domestic manufacturing as more IRA funds are deployed.

Energy Efficiency Grants

The Inflation Reduction Act provides $27 billion in grants and loans to state and local governments, tribes, nonprofits, and small businesses for energy efficiency improvements through the Department of Energy. The largest program is the $9 billion State and Local Energy Efficiency Program, which will provide formula funding to states, localities, and tribes for residential and commercial building energy efficiency upgrades. Another key program is the $550 million Rural Energy Savings Program, which will provide grants to rural electric co-ops and other rural energy providers to fund zero-interest loans for efficiency improvements in homes and small businesses.

The funds can cover costs like weatherization, installing efficient HVAC and water heating systems, adding insulation, replacing inefficient lighting and appliances with ENERGY STAR models, upgrading to efficient windows and doors, etc. To access the grants, states and localities will need to submit plans to the DOE describing how they will use the funds. The goal is to improve energy efficiency and cut energy costs for consumers while also reducing greenhouse gas emissions.

In addition, nonprofit organizations and small businesses can apply for grants up to $500,000 from the $11 billion Energy Efficiency and Clean Electricity Loan Program. Overall, these substantial investments aim to significantly expand energy efficiency upgrades across the public, private, and nonprofit sectors.

Environmental Justice

The Inflation Reduction Act allocates significant funding to advance environmental justice by supporting clean energy and energy efficiency projects in disadvantaged communities. The act provides $27 billion for a Greenhouse Gas Reduction Fund, which will provide grants and investments to reduce greenhouse gas emissions in disadvantaged communities. According to the EPA, 40% of the benefits from clean energy and climate investments will go to disadvantaged communities.

The act also provides $3 billion for an Environmental and Climate Justice Block Grant program, which will fund community-led projects to address climate and environmental justice. The grants can support a range of initiatives including energy efficiency upgrades, renewable energy systems, clean transit, and climate resiliency. At least half of the block grant funding is designated for projects proposed by non-profit community organizations.

In addition, the act allocates $20 million annually for EPA technical assistance grants to help disadvantaged communities access funding opportunities and participate meaningfully in federal climate, energy, and environmental programs. Overall, the Inflation Reduction Act makes historic investments to deliver the benefits of the clean energy transition to disadvantaged communities and advance environmental justice.

Job Creation

The Inflation Reduction Act is expected to create around 9 million jobs over 10 years from investments in energy efficiency and clean energy manufacturing, according to an analysis by the BlueGreen Alliance Foundation.

The investments in home energy rebates, commercial building upgrades, clean energy manufacturing grants, and other programs are projected to support millions of jobs, including construction jobs installing efficient HVAC systems, weatherizing homes, and manufacturing jobs producing clean energy technology like solar panels and heat pumps (source).

Many of the jobs are expected to be good-paying, local jobs that cannot be outsourced. The investments aim to revitalize American manufacturing and build domestic supply chains for clean energy technology (source).

States like Indiana are already seeing major manufacturing investments for electric vehicles and batteries thanks to the Act’s incentives and grants for clean energy manufacturing (source).

Criticisms

The Inflation Reduction Act has received some criticism regarding its energy efficiency measures. Top EU officials have argued that certain provisions, like tax credits for electric vehicles assembled in North America, are discriminatory and protectionist. They claim these policies favor American manufacturers over foreign competitors. Some economists believe the EV tax credits could negatively impact EV adoption if they make vehicles more expensive. There are also concerns that the timeline for implementation of energy efficiency incentives is too slow and will not achieve emissions reductions fast enough.

Additionally, there is debate around whether the legislation does enough to ensure equitable access to its benefits. The environmental justice provisions have been called insufficient by some advocates. They argue more targeted investment is needed in disadvantaged communities. There are also questions about how effective the IRA’s job creation measures will be. Forecasts vary widely on the number of jobs that will be generated.

While the Inflation Reduction Act makes historic investments in clean energy and emissions reductions, its energy efficiency programs continue to face criticism on issues like fairness, speed of implementation, and economic impacts.

Conclusion

In summary, the Inflation Reduction Act is landmark legislation that will have a significant impact on boosting energy efficiency in the United States. By providing subsidies, tax credits, grants, and other incentives, the IRA aims to accelerate the transition to clean energy across the residential, commercial, industrial, transportation, and manufacturing sectors.

Some of the key energy efficiency provisions in the IRA include rebates for homeowners to electrify and increase efficiency, tax credits for commercial building upgrades, grants for state and local governments to fund efficiency projects, and loans and tax credits to spur domestic manufacturing of clean energy technology and vehicles.

While the full impact will take time to be realized, the IRA makes historic investments in energy efficiency, with over $370 billion allocated. This will help create jobs, improve public health outcomes, reduce carbon emissions, improve energy affordability and access toefficiency upgrades for low and moderate income households, and strengthen American energy security.

Overall, the wide-ranging incentives and funding in the Inflation Reduction Act represent the largest climate investment in U.S. history. The provisions for energy efficiency will provide substantial support and momentum for transitioning one of the biggest contributors to emissions – buildings and transportation – to be more sustainable. With proper implementation, the IRA’s energy efficiency measures can significantly help the U.S. meet its climate goals and build a more resilient clean energy economy.