What Is The Energy As A Service Financing Model?

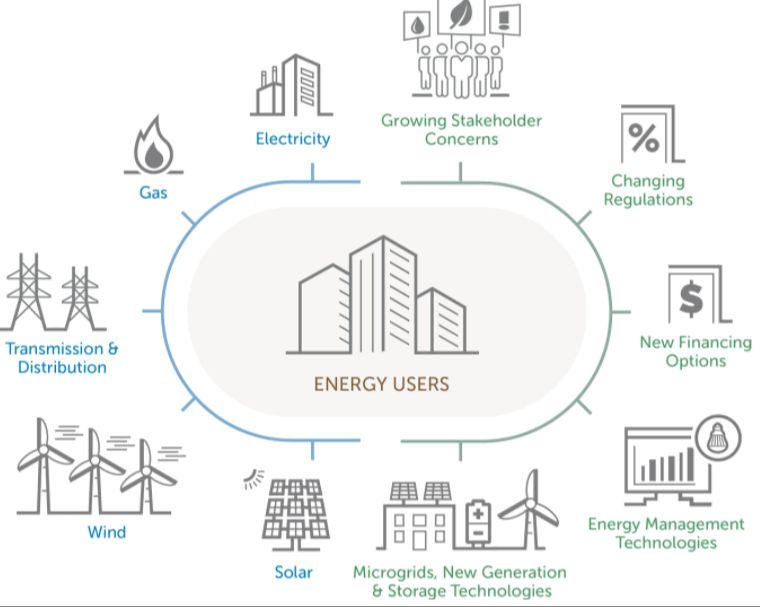

Energy as a service (EaaS) is a new business model for financing energy-related projects. Under this model, customers pay for an energy service rather than making an upfront capital investment in equipment or facilities. Instead, an EaaS provider analyzes, installs, finances, operates, and maintains the energy assets on a customer’s behalf.

The EaaS model works by shifting the costs of energy solutions from a capital expense (capex) to an ongoing operating expense (opex). The EaaS provider owns the assets and charges the customer a fee based on the service provided over the contract term, which is typically 10-20 years. This allows the customer to pay for energy services as they are consumed without large initial outlays.

In essence, EaaS enables organizations to implement energy projects with no upfront costs. The provider handles the design, funding, installation, and maintenance of a project while the customer pays solely for the services delivered. This helps overcome capital barriers to new energy solutions.

Benefits of Energy as a Service

Energy as a service (EaaS) financing models offer a number of benefits for companies looking to implement energy efficiency improvements or renewable energy systems. Some of the key benefits include:

Cost savings – One of the biggest benefits of EaaS is that it allows companies to implement energy upgrades with little to no upfront capital investment. The service provider covers the upfront costs and is then paid back over time through the energy savings generated by the upgrades. This saves organizations money on energy costs right away. (source)

Predictable costs – With an EaaS agreement, companies pay a fixed monthly fee to the service provider. This makes energy costs more predictable and easier to budget for. Since the fee is based on actual metered savings, it rises and falls with the performance of the equipment. (source)

Access to expertise – EaaS providers have extensive knowledge of energy efficient technologies and best practices. They handle all aspects of project development, installation, maintenance, and monitoring over the contract term. This allows companies to leverage outside expertise. (source)

Focus on core business – With an EaaS provider handling the technical energy aspects, companies can stay focused on their core business operations rather than having to become energy experts themselves.

How it Works

In the energy as a service financing model, the energy service provider owns and maintains the equipment like solar panels or HVAC systems. The customer pays a fee based on their usage of the equipment’s services, rather than owning the equipment themselves.

This setup is similar to leasing rather than buying. The provider retains ownership of the capital equipment and is responsible for installation, maintenance and optimizing performance. The customer simply purchases the energy produced as a service based on metered usage. Rates are usually set per kilowatt hour or heating/cooling units delivered.

For example, a company may contract with a solar power provider to install, operate and maintain a rooftop solar array. The company doesn’t own the panels, but agrees to purchase the solar electricity generated on their roof at an affordable rate through a service agreement. This structure allows the company to benefit from solar power with little upfront cost.

The service provider handles all monitoring, maintenance, insurance and other operational aspects. Customers don’t have to worry about breakdowns or performance issues. The service fee rate is contractually established, providing the customer cost savings and stability.

Applications

Energy as a service (EaaS) financing models are particularly well-suited for certain energy-related applications where upfront costs have traditionally been a barrier. Some key applications that can benefit from EaaS include:

Lighting – Upgrading a building’s lighting to more energy efficient LEDs requires a significant upfront investment. With EaaS, the cost of new lighting equipment can be wrapped into a monthly service fee, eliminating the need for lump-sum payment.

HVAC – New heating, ventilation and air conditioning (HVAC) systems help buildings become more energy efficient, but are costly to purchase and install. EaaS allows businesses to pay for new HVAC equipment through a monthly subscription fee.

Distributed Generation – On-site power generation from solar panels, batteries, fuel cells or microturbines can be paid for through a EaaS contract, avoiding major capital expenditures.

EV Charging – Electric vehicle (EV) charging stations have high upfront expenses. EaaS enables the costs to be distributed into a monthly payment plan tied to the services delivered.

Microgrids – Microgrid systems that allow buildings to island from the main grid require substantial investment. EaaS contracts allow microgrid costs to be paid for over time based on energy performance.

The flexible financing structure of EaaS makes modern energy technologies and infrastructure upgrades more accessible for companies and organizations. By eliminating upfront capital costs, it removes a key barrier to efficiency and sustainability upgrades.

Providers

The energy as a service market involves several types of providers like energy service companies (ESCOs), utilities and solar/energy companies. Major players include energy giants like Schneider Electric, Engie and Ossiaco as well as utilities providing EAAS services.

ESCOs are experienced in designing, implementing and funding energy efficiency projects. They have the expertise to deliver energy savings through innovative solutions. Major ESCO players in the EAAS space include Schneider, Engie, Veolia, Honeywell and Siemens.

Electric utilities are also getting into EAAS to meet sustainability goals and provide new value to customers. They can utilize their large customer bases, access to usage data and grid expertise. Key utilities involved with EAAS include Duke Energy, Southern California Edison, Pacific Gas & Electric and others.

In addition, newer startups and solar companies like Ossiaco are driving EAAS innovation. They are bringing advanced data analytics, flexible financing and digital platforms to optimize energy use and savings.

Customers

The primary customers for energy as a service are commercial, industrial, nonprofit, and government organizations. These customers can benefit from EaaS in several ways:

Reduced upfront costs – EaaS allows customers to implement energy efficiency upgrades without large initial capital expenditures. The service provider covers the upfront costs.

Risk mitigation – Customers avoid technology risk, since the service provider maintains and updates equipment. Maintenance and performance risks shift to the provider.

Energy cost savings – Customers can reduce energy consumption and benefit from stabilized energy prices through fixed rate contracts.

Sustainability improvements – EaaS enables customers to meet environmental and emissions goals by increasing energy efficiency and using more renewable energy.

Operational efficiency – Customers can refocus internal resources on core operations rather than energy management.

According to Schneider Electric, ideal EaaS customers have high energy spend, aging infrastructure, sustainability goals, limited capital availability, and complex operations.

Contracts

EaaS contracts are typically long-term agreements that can span 10-20 years. This allows the costs of upgrades to be spread out over time rather than paid upfront. According to the DOE’s Better Buildings Solution Center, an EaaS contract will specify the energy savings that will be achieved as well as define performance guarantees, measurement and verification procedures, and other terms [1].

There are two common pricing models for EaaS contracts:

- Shared Savings Model: The customer pays a percentage of realized energy savings to the EaaS provider over the term of the contract. This transfers performance risk to the provider.

- Managed Services Model: The customer pays a fixed monthly or annual fee over the contract term, allowing them to accurately budget for the service. The provider assumes all performance risk.

According to the Energy as a Service report from ACEEE, the contract should clearly specify the services included, performance guarantees and remedies for non-performance, terms and conditions for early contract termination, ownership of installed equipment, and other details [2]. Having clear contract terms upfront is important for the success of EaaS projects.

Challenges

The energy as a service financing model comes with some key challenges that companies need to consider before adopting it:

Upfront Costs

The upfront costs of installing new energy equipment can be high for companies. While EaaS providers own the assets, customers may still need to pay some upfront fees for installation and integration into their facilities (Guerrero, 2022).

Risk Transfer

With EaaS, companies transfer technical and performance risks to the service provider. However, customers take on the risk of unpredictable pricing if rates are variable. There are also data security risks from interconnecting systems (Kolb, 2021).

Changing Needs

As a company’s energy needs change over a long-term contract, the EaaS solution may no longer be optimized. Customers take on some risk of the solution becoming outdated before the contract ends (Jungclaus and Rittershofer, 2022).

Companies weigh these challenges against the benefits when evaluating if EaaS aligns with their business needs and sustainability goals.

Sources:

Guerrero, J. (2022). The 5 Biggest Challenges of Equipment-as-a-Service and How to Overcome Them. Retrieved from https://www.to-increase.com/rental-and-lease/blog/challenges-product-as-a-service

Kolb, S. (2021). Energy data security risks and data interoperability challenges for Energy-as-a-Service business models. Retrieved from https://www.linkedin.com/pulse/energy-data-security-risks-interoperability-challenges-kolb

Future Outlook

The future looks bright for the energy as a service model. Analysts predict strong growth potential as more companies adopt this innovative approach. According to one report, the global EaaS market is expected to reach USD XX billion by 2028, up from just USD XX billion in 2022.

New business models will likely emerge that expand EaaS beyond electricity to heating, cooling, and electric vehicle fleets. Companies like Enel X are already offering these types of integrated energy management services. As EaaS broadens in scope, it can help organizations optimize energy usage across their entire operations.

Technologically, innovations like batteries, smart meters, AI optimization, and blockchain will enable more sophisticated EaaS offerings. These advances can drive personalization, automation, transparency, and decentralization. For example, blockchain could facilitate peer-to-peer energy trading or allow consumers to track the source of their energy supply. Overall, technology will expand the capabilities and configurability of EaaS solutions.

The EaaS model has significant room for growth. As providers enhance their offerings and more customers recognize the benefits, EaaS has the potential to fundamentally transform how organizations manage and consume energy.

Conclusions

The energy-as-a-service financing model offers a compelling new way for companies to procure renewable energy. By enabling businesses to pay for energy services rather than infrastructure, it reduces upfront costs and risk. Key advantages of this model include predictable pricing, access to specialized expertise, and the ability to more easily scale clean energy projects over time.

However, there are challenges around contract complexity, customer retention, and uncertainty around long-term pricing. Overall the market is still nascent but rapidly evolving, with companies like Engie, Enel X, and Schneider Electric emerging as early providers. Though questions remain, the flexibility and low-risk nature of energy-as-a-service makes it an attractive option for businesses looking to meet sustainability goals. With proper due diligence and vetting, it offers the potential to accelerate corporate renewable energy procurement.

According to a study published at https://www.ncbi.nlm.nih.gov/pmc/articles/PMC10561576/, initial research indicates the energy-as-a-service model can enable easier access to renewable energy with less upfront investment. However, longer-term research is still needed to fully validate the costs and benefits over decades-long contract periods.