What Do Renewable Energy Credits Do?

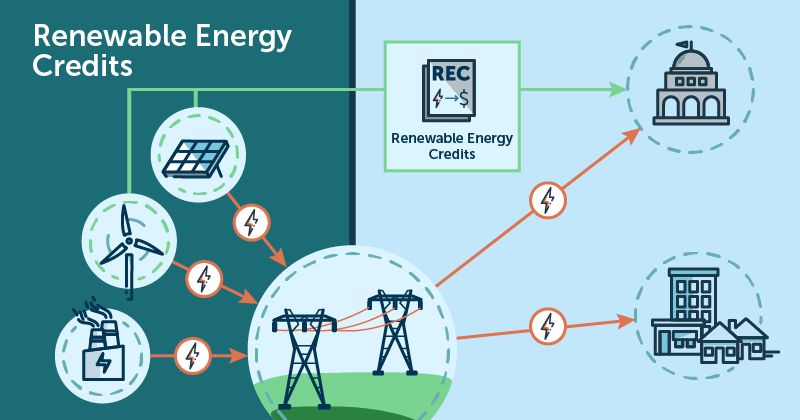

Renewable energy certificates (RECs), also known as green certificates, green tags, or tradable renewable certificates, are tradable, non-tangible energy commodities that represent proof that 1 megawatt-hour (MWh) of electricity was generated from an eligible renewable energy resource and was fed into the shared system of power lines that transport energy (1).

RECs were created in the 1990s as part of electricity deregulation in the United States, which allowed consumers to choose their electricity provider and source. RECs enable the renewable attributes of solar, wind, and other renewable electricity generation to be unbundled from the physical electricity and traded separately. The credits can be sold and traded, and the owner of the REC can claim to have purchased renewable energy. This provided a new market mechanism to finance renewable energy projects (2).

Since their inception, RECs have been an important tool for tracking and trading renewable electricity in voluntary and compliance markets. They create a revenue stream for renewable energy projects in addition to the electricity being generated, making renewable energy more financially viable.

How RECs Work

RECs represent 1 MWh (megawatt hour) of electricity generated from renewable energy sources like wind and solar. They are created at the point of generation for each MWh of renewable electricity produced (Watchwire.ai, 2022). RECs represent the environmental attributes associated with that unit of renewable energy, and they can be unbundled and sold separately from the underlying electricity.

The physical electricity goes into the grid as an undifferentiated mix of energy sources, but the RECs can be tracked and traded separately in parallel markets. RECs certify that renewable generation has occurred, even though the physical electrons cannot be traced on the grid (ESG Guides, 2022). This allows companies and individuals to support and invest in renewable energy generation regardless of their location. The revenue from REC sales provides incentive for developing more renewable projects.

Tracking RECs

To prevent double counting of RECs, each certificate is assigned a unique identification number and tracked through an electronic tracking system. There are regional tracking systems in the United States like the Western Renewable Energy Generation Information System (WREGIS) for the Western Electricity Coordinating Council (WECC) region, which covers the Western U.S., parts of Canada, and Mexico (Product Spotlight: Renewable Energy Credit Tracking). WREGIS tracks each REC using a unique serial number and reports monthly on the production, sale, and retirement of RECs (WAC 194-37-210 Renewable energy credit tracking system).

Tracking systems like WREGIS allow buyers to retire RECs to claim renewable energy usage. Retiring RECs removes them from circulation permanently so they can’t be double counted or resold (OATI). The unique IDs enable regulators and other parties to audit REC transactions and verify usage claims.

Voluntary vs. Compliance Markets

Renewable energy credits are traded in two types of markets: voluntary markets and compliance markets. The key difference between these markets is who is buying the RECs and why.

Voluntary REC markets refer to the buying and selling of RECs outside of any legal mandate. In voluntary markets, consumers, businesses, and organizations purchase RECs on a voluntary basis to meet sustainability goals or offset carbon emissions. For example, a company may choose to buy RECs voluntarily in order to claim they are using 100% renewable electricity, even if the electricity they are physically consuming is not from renewable sources.

In contrast, compliance markets exist to help utilities, suppliers, and other entities meet state-level Renewable Portfolio Standards (RPS). RPS policies require that a certain percentage of electricity sold comes from renewable sources. If a utility fails to procure enough renewable energy to meet their RPS target, they must purchase RECs to make up the difference. The RECs provide proof that renewable electricity was generated, allowing the utility to comply with the RPS rules. So in compliance markets, RECs are purchased out of regulatory necessity rather than voluntary choice.

In the United States, compliance markets make up the majority of REC trading. However, voluntary REC markets are growing as interest increases in corporate and individual renewable energy procurement.

Using RECs for Carbon Offsets

RECs are sometimes used by companies and individuals to offset carbon emissions instead of directly reducing them. The idea is that buying RECs to support renewable energy can counteract emissions from activities like air travel or electricity use.

However, some argue there can be issues with the “additionality” of using RECs for voluntary carbon offsets. The concept of additionality means that carbon offsets should represent emissions reductions that are additional to any that would have happened anyway.[1]

For example, if a company buys RECs from a wind farm built years ago, those RECs don’t really offset new emissions since that renewable energy would have been generated anyway. Buying such RECs just transfers ownership of the renewable attributes.

Many carbon offset standards don’t accept RECs for this reason or have additionality requirements. However, some argue that increasing REC demand can help incentivize new renewable development which could reduce emissions overall.[2]

There are also concerns that double counting could occur if the same RECs are used by multiple parties for voluntary carbon offsets.[3]

The debate continues around the best way for RECs to aid companies in reducing carbon footprints through offsets.

RECs and Green Power

RECs are often associated with green power programs and marketed as a way for consumers to support renewable energy. When a consumer buys a REC, the consumer is paying for the renewable attributes of 1 megawatt-hour (MWh) of renewable electricity generation (EPA, 2018). This helps create demand and funding for new renewable energy projects. However, buying RECs does not mean the consumer is necessarily using renewable electricity. The physical power associated with the REC may be fed into the grid to serve regular electricity demand.

Green power programs allow consumers to buy RECs bundled with their electricity service from their utility company. The consumer receives regular grid electricity but the utility company retires RECs on the customer’s behalf to offset their electricity usage (Sumner et al., 2023). Some green power programs also build new renewable energy projects and feed that electricity into the grid. So green power programs promote renewable energy both through retiring RECs and sometimes also supplying renewable electricity.

Pricing and Supply

The pricing of RECs is determined by the basic economic principles of supply and demand. When demand for RECs is high, and supply is constrained, prices increase. Conversely, when demand softens or new renewable energy capacity boosts supply, REC prices tend to decline.

Regional factors heavily influence REC pricing as well. According to S&P Global Market Intelligence[1] REC markets tend to be segregated by region, and transmission constraints limit the geographic reach of certain RECs. Areas with abundant inexpensive renewable generation see lower REC prices, while regions with fewer renewable resources and higher compliance demands face steeper REC costs. For example, PJM REC prices averaged just over $1 per MWh in 2020, while New England prices exceeded $50 per MWh.

Benefits of RECs

One of the main benefits of RECs is that they incentivize renewable energy development. When a renewable energy project sells RECs, it provides an additional revenue stream beyond just selling electricity. This extra revenue makes renewable energy projects more economically viable and attractive to build. More renewable energy projects means more clean electricity being added to the grid.

RECs also help make up the cost difference between cheap fossil fuel energy and more expensive renewables. Without RECs, some renewable projects would not pencil out financially compared to traditional energy sources. RECs help bridge that gap.

Additionally, the REC market provides tangible proof of demand for renewable energy. As more RECs are voluntarily purchased by individuals, businesses and utilities, it sends a signal to developers that there is interest in bringing online more clean energy. RECs help translate this interest into real renewable energy capacity.

Overall, RECs play an integral role in spurring renewable energy deployment and growth. The revenue they provide makes projects attractive to build while also demonstrating buyer demand. RECs incentivize the transition to renewable energy by supporting project development.

Sources:

https://www.energysage.com/other-clean-options/renewable-energy-credits-recs/

https://cedarcreekenergy.com/what-you-need-to-know-about-renewable-energy-credits/

Criticisms of RECs

While renewable energy certificates provide benefits, they also face some criticism. One of the main concerns around RECs relates to additionality.

Additionality refers to a requirement that REC purchases lead to additional renewable energy generation beyond business-as-usual. Since RECs are sold separately from the underlying electricity, there is a question of whether REC demand actually drives new renewable energy deployment.

Some argue that many REC purchases support renewable generation that would have occurred anyway. There are concerns that the REC market lacks adequate proof of leading to additional renewable capacity. This is an ongoing debate in the industry.

There are also concerns that RECs only address the renewable attributes of generation. They don’t account for all the external costs and benefits of different energy sources. For example, RECs don’t reflect local environmental or grid impacts of different renewable energy projects.

While RECs help address carbon emissions, they don’t provide a full representation of the externalities around energy generation and use. There are calls for more comprehensive accounting through mechanisms like carbon pricing.

Future Outlook

The future of renewable energy credits will likely depend on potential policy changes and emerging trends.

At the federal level, the Inflation Reduction Act passed in 2022 extended tax credits for renewable energy projects, which helps support demand for RECs. However, some in Congress have proposed reducing incentives for RECs as part of negotiations over the debt ceiling, which could negatively impact the REC market if enacted (Forbes).

Emerging applications for RECs include using them as carbon offsets for corporate sustainability goals. As more companies aim to reduce their carbon footprints, demand for RECs and other offsets may rise. New blockchain-based REC tracking systems are also being developed to modernize REC trading and address criticisms about double counting and transparency (Medium).

In summary, RECs face both policy risks and opportunities to expand their role in renewable energy and emissions reduction efforts in the years ahead.