What Are The Climate Change Tax Credits For 2023?

With the increasing threats of climate change, governments around the world are taking action to incentivize individuals and businesses to adopt more eco-friendly practices. One of the main ways this is being done in the US is through climate change tax credits – new and expanded tax breaks aimed at encouraging investments in energy efficiency, renewable energy, electric vehicles, and other green initiatives.

These tax credits can significantly reduce the costs of going green, making environmentally friendly choices more accessible and affordable. In 2023, the US expanded and introduced several new climate credits through the Inflation Reduction Act signed into law in 2022. With the urgency of tackling climate change, these credits provide strong financial motivations to transition to clean energy and make green upgrades.

This article will provide an overview of the new and expanded climate change tax credits available for 2023, who qualifies, and how to claim them. With the right information, these credits could help you or your business make meaningful climate-smart changes while lowering your tax bill.

What are climate change tax credits?

Climate change tax credits are credits offered by the federal government to incentivize individuals and businesses to adopt more energy-efficient and environmentally-friendly practices. They aim to reduce greenhouse gas emissions and mitigate climate change. The credits provide a dollar-for-dollar reduction in the income taxes owed by taxpayers who make qualifying energy-efficient upgrades or investments.

Some examples of activities that may qualify for climate tax credits include:

– Installing solar panels or other renewable energy systems in a home or business (cite: https://www.novoco.com/periodicals/articles/washington-wire-impact-political-climate-change-tax-credit-legislative-agenda)

– Purchasing an electric vehicle (cite: https://www.cbpp.org/sites/default/files/archive/4-24-08climate-testimony.htm)

– Making energy efficiency upgrades like installing insulation, energy-efficient windows, HVAC systems, etc.

– Installing clean energy equipment like geothermal heat pumps, small wind turbines, etc.

The tax credits are available to homeowners, renters, and businesses. The credit amounts vary based on the type of upgrade or investment made. The credits aim to make these climate-friendly upgrades more affordable.

New climate credits for 2023

The Inflation Reduction Act of 2022 introduced several new climate tax credits that take effect in 2023. These credits aim to incentivize individuals and businesses to invest in energy efficient improvements and reduce greenhouse gas emissions.

The key new climate tax credits for 2023 include:

- Home energy efficiency tax credits – Provides up to $1,200 for installing energy efficient windows, insulation, doors, and more.

- Electric vehicle tax credit – Offers up to $7,500 for purchasing new electric vehicles.

- Solar panel tax credit – Increased to 30% of the cost to install residential solar panels.

According to the MMA, the purpose of the new climate tax breaks is to “bring down sticker prices by thousands of dollars to encourage adoption of technologies that reduce greenhouse gas emissions.” The credits aim to make eco-friendly home improvements and vehicles more affordable for average Americans.

Manufacturers can also benefit from credits for commercial electric vehicles, energy efficient HVAC systems, electric forklifts, and more. Overall, the new credits provide strong incentives for individuals and businesses to invest in clean energy and emission reducing technologies starting in 2023.

Home energy efficiency tax credits

The new home energy efficiency tax credit for 2023 allows homeowners to receive a tax credit for installing certain energy-efficient home improvements that meet specific requirements. The credit is worth up to $1,200 and covers the following upgrades according to the IRS (Blockadvisors):

- Insulation

- Windows and doors

- Roofs

- Heating, ventilating, and air-conditioning (HVAC) systems

Each type of upgrade has its own requirements to qualify for the credit. For example, for insulation the R-value must meet certain thresholds, windows and doors must meet ENERGY STAR requirements, roofs must have appropriate solar reflectance, and HVAC systems must meet specific efficiency ratings (Forbes). The maximum credit for windows, doors, roofs, and HVAC equipment is $600 each, while the maximum for insulation is $150.

Electric vehicle tax credits

The electric vehicle tax credit, also known as the EV tax credit, allows taxpayers to claim up to $7,500 on their federal income taxes for purchasing an eligible electric vehicle. For 2023, the credit amount phases out once an automaker sells 200,000 qualifying EVs. The EV credit will be getting some major changes in 2024 based on new climate legislation.

As of January 1, 2023, the following electric vehicles from these automakers qualify for the full $7,500 credit according to the IRS (source):

- Audi (fully electric models only)

- BMW (fully electric models only)

- Byd

- Cadillac (Lyriq only)

- Chevrolet (Bolt, Bolt EUV only)

- Chrysler (Pacifica PHEV only)

- Ford (F-150 Lightning, E-Transit, Mustang Mach-E only)

- Genesis (GV60 only)

- GMC (Hummer EV only)

- Hyundai

- Kia

- Lucid

- Mercedes-Benz (EQ models only)

- Nissan (Leaf only)

- Polestar

- Rivian

- Volvo (fully electric models only)

Vehicles from Tesla and GM no longer qualify for the credit as they’ve sold over 200,000 EVs. The tax credit begins phasing out for a manufacturer after 200,000 qualifying sales.

Solar panel tax credits

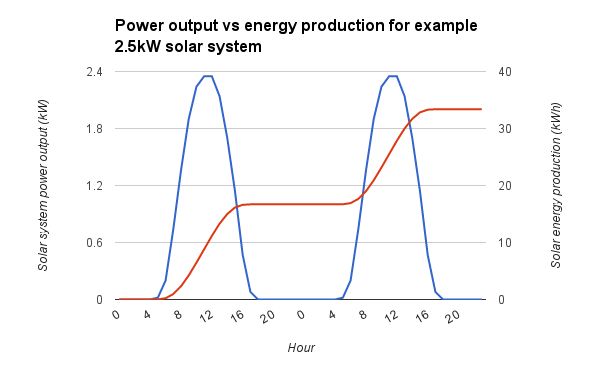

One of the key climate change tax credits for 2023 is for installing solar panels. The solar Investment Tax Credit (ITC) allows taxpayers to deduct 26% of the cost of installing a residential solar energy system from their federal taxes for systems installed in 2023. This credit will increase to 30% for systems installed from 2024 through 2032 before being phased out.1

To claim the credit, homeowners need to file IRS Form 5695 with their tax returns. The credit is calculated as a percentage of the total cost basis, including solar panels, inverters, wiring, mounting systems, battery storage, sales tax, inspection fees, and the cost of installation. There is no maximum cap on the amount that can be claimed.2

The solar tax credit is a key incentive to make installing a solar energy system more affordable for homeowners. With solar panel costs dropping, plus available rebates, the tax credit can cover a substantial portion of the overall investment. This credit applies not just to solar panels, but also solar heating and cooling systems as well.

Other credits

There are several other tax credits available for 2023 that support the adoption of clean energy technologies and energy efficiency improvements. One of the biggest is the geothermal heat pump tax credit.

Homeowners who install an eligible geothermal heat pump system can receive a tax credit for 30% of the cost, up to $2,000 per home. According to the Department of Energy, geothermal heat pumps can be over 45% more efficient than even the most efficient gas furnace. Federal Tax Credits for Energy Efficiency

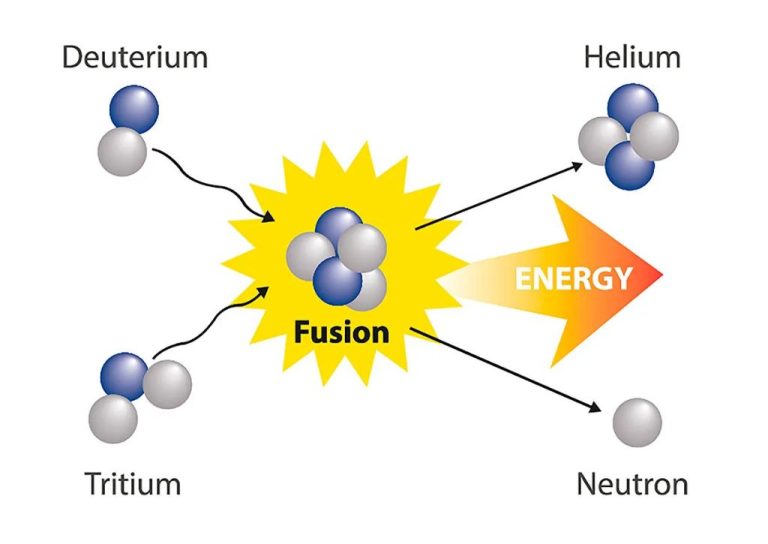

Fuel cell technology also qualifies for a tax credit. Homeowners can receive a credit for 30% of the cost of a fuel cell system, up to $500 per 0.5 kW of power capacity. Fuel cells generate electricity through an electrochemical reaction and can provide clean, efficient power. DOE Fuel Cell Technologies Office

Finally, homeowners who install qualified combined heat and power (CHP) systems can receive a 10% investment tax credit. CHP systems generate electricity while capturing waste heat for domestic or industrial heating. They can achieve efficiencies over 80%. DOE CHP Basics

How to claim the climate change tax credits

To claim the climate change tax credits for 2023, taxpayers need to complete and file IRS Form 5695 along with their annual income tax return. The tax credits can reduce your tax liability dollar-for-dollar. It’s important to have receipts, invoices or other documentation showing eligible purchases or installations for the credits.

For home energy efficiency upgrades like insulation, ENERGY STAR products or high efficiency heating and cooling systems, you’ll need a Manufacturer’s Certification Statement for what was installed. For electric vehicles, you’ll need the VIN, make, model year and other details to calculate the credit. For solar panels, retain documentation showing the installation date, cost, specs and where the panels were made.

The credits are not refundable, meaning they can lower your tax liability to zero but you won’t get a refund check for any unused portion. However, unused credits can be carried forward to future tax years. Work with your tax preparer to complete Form 5695 and claim any credits you’re eligible for based on climate-friendly purchases in 2023.

Criticisms

While climate change tax credits aim to incentivize emissions reductions, there are some concerns about their effectiveness and equity. One criticism is that the credits may not lead to meaningful emissions reductions if polluting activities continue or even increase in response to the credits (Source 1). There are also concerns that the credits may disproportionately benefit higher income households who can more easily afford clean energy upgrades like solar panels or electric vehicles (Source 2). This could make the tax credits regressive. Additionally, some worry the credits will add significantly to government spending and deficits without guaranteeing emissions reductions (Source 1). More analysis may be needed to determine the true climate and equity impacts of the tax credits.

Conclusion

In conclusion, the climate change tax credits available in 2023 offer homeowners and vehicle owners new ways to get money back for making their homes and cars more energy efficient and environmentally friendly. The home energy efficiency tax credits allow for up to $1,200 back for installing things like insulation, energy efficient windows, water heaters, air sealing and more. The electric vehicle tax credit now offers up to $7,500 back for purchasing a new electric vehicle. Solar panel tax credits let homeowners deduct 30% of the cost of installing solar panels. While not everyone will be able to take full advantage of these credits, they demonstrate a shift in policy towards encouraging more climate-friendly consumer choices through financial incentives. More broadly, these credits show an effort to address climate change through private action in addition to public policy.

To recap, the new slate of climate change tax credits for 2023 focuses on home energy efficiency, electric vehicles, and solar panels. With proper documentation, homeowners can claim thousands of dollars back at tax time by making upgrades and purchases that are beneficial for the climate. While the credits have limitations, they present exciting opportunities to be rewarded financially for going green.