What Are The Best Renewable Energy Stocks To Buy?

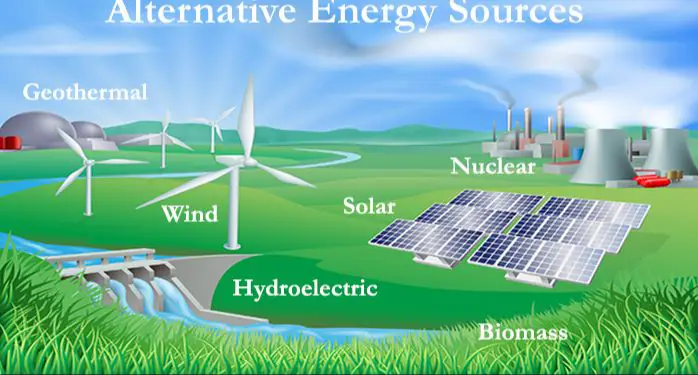

The renewable energy sector is one of the fastest growing markets in the world. According to data from the IEA, global renewable capacity additions are forecasted to increase by 107 gigawatts in 2023 to over 440 GW, the largest absolute increase ever. (IEA)

With concerns over climate change and energy security on the rise, governments and corporations are investing heavily into renewable energy sources like solar, wind and hydroelectric power. The global renewable energy market size is expected to grow from $970 billion in 2022 to over $2.18 trillion by 2032. (Precedence Research)

This article will provide an overview of the top renewable energy stocks to consider buying to capitalize on the projected growth in this sector. With the right investments, investors can profit from the global transition towards renewable energy while also supporting more sustainable energy production.

Solar Energy

Solar energy is the largest renewable energy sector, accounting for over 40% of new power capacity added globally in recent years [1]. The solar PV market has experienced rapid growth, with annual installations rising from under 5 GW in 2005 to over 100 GW in 2018 [1]. Key factors driving growth include falling costs, supportive policies, and technological advances.

Some of the leading solar energy companies to consider investing in include:

- First Solar (FSLR) – One of the largest global solar panel manufacturers.

- SunPower (SPWR) – Focused on high-efficiency solar panels.

- SolarEdge (SEDG) – Specializes in solar inverters and power optimizers.

- Enphase Energy (ENPH) – Leading supplier of microinverters for residential solar.

These companies are well-positioned to benefit from the continued strong growth expected in the solar industry. Their innovative products, economies of scale, and brand recognition provide competitive advantages.

Wind Energy

Wind energy is the second largest renewable energy sector after hydroelectric power. The global wind energy market is expected to grow substantially in the coming years, both onshore and offshore. Many countries are investing heavily in wind power to reduce carbon emissions and meet renewable energy targets. There is immense potential for continued wind energy growth, especially offshore wind farms which can harness stronger and more consistent winds.

Some of the major wind energy stocks to consider buying are:

- Vestas Wind Systems (OTC: VWDRY) – A Danish company that manufactures, installs, and services wind turbines. They operate globally and lead the market in Europe, Africa, the Middle East, and Latin America. Vestas is a pioneer in offshore wind technology. Vestas Wind Systems

- Siemens Gamesa Renewable Energy (OTC: GCTAF) – A Spanish-German multinational company and a leader in offshore wind turbines. They have installed over 107 GW worldwide. Siemens Gamesa is rapidly expanding in Asia Pacific markets. Siemens Gamesa

- Ørsted (OTC: DNNGY) – A Danish renewable energy company focused on wind, solar, storage, and more. Ørsted operates the world’s largest offshore wind farm. They have invested heavily in U.S. offshore wind projects. Ørsted

Hydroelectric Power

Although hydroelectric power may be considered a mature renewable energy source with relatively limited additional growth potential, it still represents an important component of the renewable energy mix today. Some of the largest operators of hydroelectric generation include:

Fortis Inc. (TSX: FTS): Fortis owns and operates 180 hydroelectric generating facilities across Canada, the United States, and the Caribbean with total capacity of over 2,300 megawatts.https://www.stocktrades.ca/top-canadian-utility-stocks/

Brookfield Renewable Partners (NYSE: BEP): With over 5,300 megawatts of hydroelectric generating capacity globally, Brookfield is one of the largest publicly traded hydroelectric power operators.https://www.globalxetfs.com/beff/

Algonquin Power & Utilities (TSX: AQN): This diversified renewable energy company has interests in 85 hydroelectric facilities with 172 megawatts of capacity in North America.

While growth prospects may be limited relative to other renewable energy sources, established hydroelectric power companies can provide stable cash flows and dividends for investors looking to add renewable energy exposure.

Geothermal Energy

Geothermal energy is a small but growing sector of the renewable energy market. Geothermal plants use heat from deep inside the Earth to produce steam to spin turbines and generate electricity. In 2019, geothermal power accounted for 0.4% of total U.S. utility-scale electricity generation (Source 1).

In addition to electricity production, geothermal energy can also be used directly for heating applications such as buildings, greenhouses, fish farms and industrial processes. The global geothermal heating market is expected to grow from $4.4 billion in 2021 to $6.8 billion in 2026 (Source 2).

Some of the top publicly traded geothermal energy companies include Ormat Technologies (ORA), Enel Green Power (ENLAY), Alterra Power Corp (MGMXF), U.S. Geothermal (HTM) and Calpine Corp (CPN) (Source 3). These companies develop and operate geothermal electricity generation plants around the world.

Bioenergy

Bioenergy refers to renewable energy derived from organic matter, known as biomass. The main types of bioenergy include:

- Biomass – Plant or animal material used as fuel.

- Biofuels – Fuels like ethanol and biodiesel produced from biomass.

- Biogas – Methane gas produced from decomposing organic waste.

Some of the top companies involved in bioenergy include Enexor BioEnergy, Ensyn Corporation, and Fulcrum BioEnergy. These companies convert biomass feedstocks like wood, agricultural waste, and municipal solid waste into renewable biofuels and biopower.

While bioenergy holds great potential, some challenges remain. High production costs, land use constraints, and impacts on food production can limit growth. However, continued technological advances and supportive policies can help overcome these hurdles. The global bioenergy market is projected to grow steadily in the coming decades as countries seek to increase their renewable energy mix and reduce carbon emissions.

Energy Storage

Energy storage is crucial for enabling further growth and adoption of renewable energy. As wind and solar power are intermittent sources, energy storage allows the power generated to be captured and released on demand. Without adequate storage capacity, excess renewable energy is wasted when supply exceeds demand. With storage to balance supply and demand, higher penetration levels of renewables are viable on the grid.

Lithium-ion batteries have become the dominant form of energy storage, with companies like Tesla leading in battery technology and manufacturing. However, there are also alternatives to lithium-ion batteries being explored and scaled up. Other methods of energy storage include pumped hydro storage, compressed air energy storage, flywheels, thermal storage, and hydrogen storage.

Key players in energy storage include Fluence Energy, Tesla, Enphase Energy, Albemarle Corporation, and AES Corporation. These companies are positioned to capitalize on the massive growth projected in the energy storage market over the coming decade.

Smart Grid

A smart grid is an electrical grid that uses digital communications technology and information systems to detect and react to local changes in usage. This allows the smart grid to efficiently deliver electricity and integrate renewable energy sources like solar and wind power. Smart grids are needed to enable larger-scale adoption of renewable energy and improve grid reliability.

Some of the key companies enabling smart grid technology and integration of renewables include:

- Itron (NASDAQ: ITRI) – Provides metering systems, software, and services for utilities to manage smart grids. Based in the U.S.

- Landis+Gyr (SWX: LAND) – Major global provider of smart metering solutions. Based in Switzerland.

- Schneider Electric (EPA: SU) – Leading energy management and automation company. Based in France.

- ABB (SWX: ABBN) – Multinational corporation that provides smart grid integration solutions. Based in Switzerland.

Investing in these companies can offer exposure to the growth of smart grid technology as power grids modernize to support renewables and get smarter. According to this source, the global smart grid market is expected to reach $123 billion by 2027.

Top Stock Picks

Based on factors like revenue growth, profitability, and market potential, here are the top renewable energy stocks to consider buying:

NextEra Energy (NEE)

NextEra Energy (https://list.solar/stocks/top-renewable-stocks/) is the world’s largest utility company by market capitalization. It operates regulated electric companies in Florida but also has a fast-growing clean energy business. NextEra Energy Resources owns solar, wind, and energy storage assets across the US and Canada. With consistent revenue and earnings growth powered by renewable energy expansion, NextEra is a top pick.

Brookfield Renewable Partners (BEP)

Brookfield Renewable Partners (https://www.nasdaq.com/articles/3-top-renewable-energy-stocks-to-watch-in-the-stock-market-this-week-2021-10-27) operates one of the world’s largest publicly traded renewable power platforms. Its portfolio includes hydroelectric, wind, solar, energy storage and distributed generation facilities. With projects across North America, South America, Europe, and Asia, Brookfield offers global diversification. Its cash flows support an attractive dividend yield.

Enphase Energy (ENPH)

Enphase Energy (https://www.wallstreetzen.com/industries/best-renewable-energy-stocks) is a leading supplier of solar microinverters and batteries. Its semiconductor-based products enable solar systems to be highly efficient, networked, and software controlled. Enphase grew revenue over 65% in 2021, reflecting strong demand. Its solutions enhance solar economics and are critical for growth in residential and commercial markets.

SolarEdge Technologies (SEDG)

SolarEdge Technologies (https://list.solar/stocks/top-renewable-stocks/) provides photovoltaic inverters, power optimizers, and monitoring systems for solar arrays. This allows optimal energy production and management. With smart energy technology, SolarEdge aims to lead in worldwide module-level power electronics. It should benefit as solar power scales up globally. The stock has delivered exceptional returns in recent years.

Plug Power (PLUG)

Plug Power (https://www.wallstreetzen.com/industries/best-renewable-energy-stocks) is a leader in hydrogen fuel cells and electrolyzer systems that help decarbonize transportation and energy. Its GenKey solution integrates all the elements to power electric forklift fleets with hydrogen. Plug also partners with automakers to develop fuel cell systems for electric vehicles. With only a small market share today, growth potential is massive if hydrogen gains broad adoption.

Conclusion

Renewable energy represents an incredible growth opportunity for investors interested in companies working to combat climate change. This article has covered some of the top stocks across key renewable energy sectors like solar, wind, hydroelectric, geothermal, bioenergy, energy storage, and smart grid technology.

In summary, some of the most promising stocks to consider buying are SolarEdge Technologies in solar, Vestas Wind Systems in wind energy, NextEra Energy for utility-scale renewables and energy storage, and Enphase Energy for solar and energy storage solutions for homes. Many of these stocks have strong growth potential as renewable energy expands its share of electricity generation globally.

The future outlook for renewable energy stocks is very bright. Renewables are expected to grow rapidly as costs continue falling and concerns over climate change escalate. Governments around the world are passing regulations to mandate and incentivize greater adoption of renewable energy. Major corporations are also voluntarily buying more clean power. These trends will provide strong tailwinds for leading renewable energy stocks for years to come.

Investors should maintain a diversified portfolio of stocks across the major renewable energy sectors discussed in this article. Dollar cost averaging into these stocks over time can be a sound strategy. With patience and a long-term outlook, renewable energy stocks have the potential to generate strong returns for environmentally conscious investors.