Solar Incentives And Rebates By State

As awareness of climate change grows and concern about sustainability rises, home solar energy systems have become an increasingly popular home improvement choice. However, the upfront costs of going solar can still be prohibitive for many homeowners. Fortunately, federal and state governments provide incentives to help make residential solar more accessible and affordable. This post is your comprehensive guide to the current state-by-state rundown of solar rebates, tax credits, financing programs and other incentives available. We’ll break down what’s offered in each state, how the programs work, and which homeowners are most likely to benefit. Whether you’re curious about solar potential for your home or ready to start exploring your options, this post gives you the full picture of the financial assistance landscape to help you determine if solar makes economic sense for your situation. Let’s get started with an overview of federal solar incentives and then we’ll dive into the state programs.

Know Your State’S Solar Incentives And Available Rebates

For homeowners who are considering making the switch to solar energy, knowing your state’s solar incentives and available rebates can make a significant difference in the affordability of your solar panel installation. Each state has its unique programs and policies that offer financial assistance, tax credits, and rebates to help offset the initial costs associated with installing a residential solar energy system. Let’s delve into some of the specifics of what you can expect based on your location.

In some states, homeowners can take advantage of direct cash rebates offered by utility companies or state-specific programs. For example, in California, the California Solar Initiative offers a cash rebate for homeowners who install solar panels. Similarly, the New York State Energy Research and Development Authority (NYSERDA) offers a rebate program for qualifying solar panel installations. These programs can provide a significant financial boost for homeowners looking to offset the upfront costs of going solar.

Another common incentive offered by states is the ability to sell excess energy back to the grid through a process called net metering. Under this policy, homeowners can essentially run their electricity meter backward when their solar panels produce more energy than they consume, effectively selling that excess energy back to the utility company. In some states, like California, net metering credits can be rolled over to the following year or even sold to other customers, providing an added financial benefit.

For residents in states with less generous solar incentives, federal tax credits can also help make solar energy more affordable. Under current legislation, homeowners who install solar panels can receive a federal tax credit of up to 26% of the installation costs. However, this federal incentive will start to decrease in value over the coming years, so it may be wise for homeowners to take advantage of these credits while they last.

Overall, there are many different solar incentives and rebate programs available across the United States, each with its own criteria and requirements. Homeowners interested in going solar should take the time to research the specific programs available in their state, including cash rebates, net metering policies, property tax exemptions or reductions, and state-specific financing programs. With careful consideration, homeowners can make the switch to solar energy without breaking the bank and enjoy long-term energy savings while reducing their carbon footprint.

Find The Best State Rebates And Incentives For Installing Solar Panels

After thorough research and analysis, we have determined that Massachusetts offers some of the best rebates and incentives for installing solar panels. The state’s residential solar incentive program, known as SMART (Solar Massachusetts Renewable Target), offers substantial financial benefits to homeowners who install solar panels on their property. With SMART, homeowners can earn monthly payments based on the energy production of their solar panels for up to ten years.

Additionally, Massachusetts provides a state income tax credit of 15% of the total cost of installing a solar system, up to $1,000. This tax credit can be carried over for up to five years if the full credit cannot be used in one year.

Another benefit of choosing Massachusetts for solar panel installation is the state’s net metering policy. Under this policy, homeowners can receive credits for any excess energy their solar panels produce and feed back into the grid. These credits can help offset the cost of electricity during times when the solar panels are not producing enough energy to power the home.

Furthermore, Massachusetts exempts solar equipment from property tax assessments, providing additional financial relief for homeowners who choose to switch to solar energy.

Save Money On Your Solar Energy System With State And Utility Rebates

In addition to the federal and state incentives available, homeowners can also save money on their solar energy system through various state and utility rebates. These rebates can offset the cost of installation and help make solar energy even more affordable.

For instance, in Massachusetts, there are several utility rebates available that can help homeowners save money on their solar energy system. The Berkshire Gas Solar Rebate offers a rebate of $500 per kW for up to 10 kW of installed capacity for residential customers. The National Grid Solar Incentive Program provides a rebate of $1,000 per kW for residential and small commercial solar systems of up to 100 kW. Meanwhile, the Eversource Solar Incentive Program offers a rebate of $1,000 per kW for residential and small commercial systems of up to 25 kW.

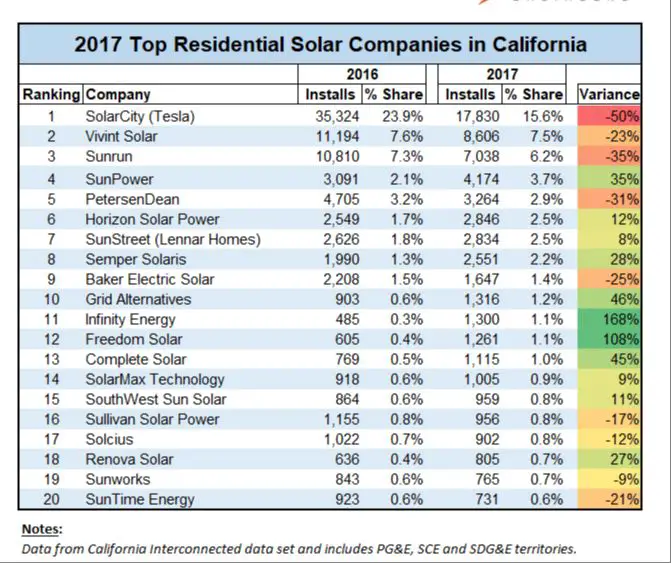

Other states also offer utility rebates for solar energy systems. In California, for example, the California Solar Initiative provides incentives for solar energy systems through the state’s major utilities, including Pacific Gas & Electric, Southern California Edison, and San Diego Gas & Electric. Homeowners can receive rebates of up to $0.35 per watt for eligible solar energy systems.

Furthermore, some states offer additional rebates for specific groups of homeowners, such as low-income households or those with disabilities. In Arizona, for example, the Low-Income Home Energy Assistance Program (LIHEAP) provides financial assistance to low-income households to help cover the cost of installing a solar energy system. Similarly, in New York, the Access to Home program provides assistance to homeowners with disabilities who need to make accessibility modifications to their homes, including the installation of a solar energy system.

Overall, investigating state and utility rebates can be a great way to save money on the installation of a solar energy system. By taking advantage of the available incentives and rebates, homeowners can decrease the upfront costs of going solar and start saving money on their energy bills sooner.

Compare State And Federal Solar Tax Credits To Maximize Your Savings

To truly take advantage of all the incentives available for installing a home solar energy system, it’s important to compare both state and federal tax credits. The two types of tax credits work together to maximize your savings and make going solar more affordable.

First, let’s take a look at the federal solar tax credit. This tax credit is also known as the Investment Tax Credit (ITC) and is available to homeowners who purchase a solar energy system. The ITC provides a credit worth 26% of the total cost of the system, including installation fees. This credit can be used to offset your tax liability, meaning that if you owe $5,000 in federal taxes and qualify for the 26% ITC, you can subtract $5,200 from your tax bill. If the credit exceeds the amount you owe in taxes, you can carry the remaining credit forward to use in future years.

It’s important to note that the federal tax credit is set to start phasing out at the end of 2022. If you install a solar energy system before the end of 2022, you can receive the full 26% credit. The credit will then drop to 22% in 2023 and expire entirely for residential installations in 2024. This makes it all the more important to act quickly if you’re considering installing a solar energy system.

In addition to the federal tax credit, many states also offer their own solar tax credits. These tax credits vary from state to state and can provide significant savings on top of the federal credit. For example, Colorado offers a state tax credit worth up to $1,000 for homeowners who install a solar energy system. Meanwhile, New Jersey provides a tax credit worth up to $1,000 or 15% of the total cost of the system, whichever is less.

By taking advantage of both federal and state tax credits, homeowners can realize significant savings on the cost of installing a solar energy system. It’s important to research the specific tax credits available in your state and to consult with a tax professional to ensure you’re maximizing your savings. Overall, by understanding and taking advantage of the available incentives and rebates, you can make going solar more accessible and affordable, and start saving money on your energy bills sooner.

Ask Your Solar Installer About Current State Rebate Programs

When considering the installation of a home solar energy system, it’s important to know that many states offer rebate programs that can help offset the cost of going solar even further. These rebate programs can provide a significant financial incentive for homeowners, especially when combined with federal and state tax credits.

To take advantage of these rebate programs, it’s a good idea to speak with a solar installer who is familiar with the current programs available in your state. These rebate programs can vary widely from state to state, and keeping up with their latest details and application requirements can be a complex task.

For instance, in California, the California Solar Initiative (CSI) offers rebates for solar energy systems that are installed on single-family homes, multifamily homes, and commercial buildings. This program is intended to help homeowners and businesses switch to cleaner energy sources, and can provide substantial financial savings for qualifying installations.

Another example is in New York, where the NY-Sun program offers several different types of incentives and rebates for solar energy installations. These include cash-back rebates, performance-based incentives, and financing programs that can help offset the initial cost of your solar installation.

Whether you’re looking to install a solar energy system on your home or your business, it’s important to research the various rebate programs that are available in your state. By working with a knowledgeable solar installer, you can identify the programs that can help you save the most money, and ensure that you’re taking advantage of all of the incentives and rebates that are available to you.

So don’t hesitate to ask your solar installer about the current state rebate programs that are available – with a little research and planning, you can make going solar more affordable and accessible than ever before.

Some States Offer Loans Or Financing For Your Solar Energy System

In addition to rebate programs, several states provide loans or financing options for homeowners looking to install solar energy systems. These financing programs offer a more affordable way to pay for the upfront cost of installing solar panels and can help homeowners reap the benefits of solar energy without breaking the bank.

One example of such a financing program is the Connecticut Green Bank, which offers homeowners low-interest loans for renewable energy projects, including solar panel installations. This program is designed to make solar energy more accessible and affordable for all Connecticut residents, regardless of their financial situation.

Similarly, the state of Massachusetts offers the Mass Solar Loan program, which provides low-interest loans for homeowners looking to install solar panels on their homes. These loans can cover the entire cost of the solar installation and can be repaid over a period of up to 20 years, making solar energy a more feasible and practical option for many homeowners in the state.

In addition to these state-specific financing programs, there are also federal loan programs available to homeowners looking to invest in renewable energy. For example, the Federal Housing Administration’s Energy Efficient Mortgage program allows homeowners to finance the cost of an energy-efficient home, including the cost of solar panel installations, as part of their mortgage.

Overall, these loan and financing programs help to make solar energy more accessible and affordable for homeowners across the country. By taking advantage of these programs, homeowners can enjoy the benefits of solar energy while also saving money on their annual energy bills.

Research Renewable Energy Portfolio Standards In Your State

Renewable energy portfolio standards (RPS) are policies that require electricity suppliers within a state to generate a specific portion of their electricity from renewable sources, such as solar, wind, and geothermal power. In the United States, RPS policies have been implemented in 29 states and the District of Columbia, with targets varying from 10% to 100% renewable energy by a certain date.

In the state of California, the RPS sets a target of 60% renewable energy by 2030, with an interim goal of 33% by 2020. As of 2019, California was already generating about 34% of its electricity from renewable sources, including solar, wind, and hydropower. The state also has a goal of reaching 100% zero-carbon electricity by 2045.

Similarly, the state of New York has set a goal of generating 70% of its electricity from renewable sources by 2030 and reaching 100% zero-emission electricity by 2040. To achieve this, the state has implemented a Clean Energy Standard that requires 50% of the state’s electricity to come from renewable sources by 2030, with a specific carve-out for solar energy.

In the state of Texas, which leads the nation in wind power generation, the RPS policy calls for the state to generate 10,000 megawatts from renewable sources by 2025. As of 2019, Texas was already generating over 20% of its electricity from wind power alone.

Other states with notable RPS policies include Hawaii, which has a goal of generating 100% of its electricity from renewable sources by 2045, and Vermont, which has a goal of generating 75% of its energy from renewables by 2032.

Overall, RPS policies are an important driver of renewable energy growth and investment in the United States. By setting specific targets and requiring electricity suppliers to generate a portion of their electricity from renewable sources, these policies encourage the development of new renewable energy projects and help to transition the country towards a cleaner, more sustainable energy future.

Net Metering Policies Allow You To Sell Excess Solar Power Back To The Grid

In addition to the various incentives and rebates offered by federal and state governments to encourage residential solar energy adoption, another important policy that can benefit homeowners with solar panels is net metering.

Net metering policies allow homeowners with solar panels to sell excess solar power back to the grid and receive credits on their electricity bill. This means that on sunny days when a homeowner’s solar panels generate more energy than they use, they can essentially “bank” that excess energy with the utility company. Then, on cloudy days or at night when the solar panels cannot generate enough energy to meet the homeowner’s needs, they can draw upon the credits they earned during sunnier times.

This system is beneficial for both the homeowner and the utility company. Homeowners with solar panels can reduce their electricity bills and potentially even earn income from selling excess energy back to the grid. Meanwhile, utilities can more efficiently manage their energy resources, as they can rely on the excess energy generated from solar panels during peak usage times rather than having to rely solely on non-renewable sources.

Net metering policies vary by state, but they are currently available in 44 states plus the District of Columbia. Some states, such as California and New York, offer very favorable net metering policies that allow homeowners to receive full retail credit for the excess energy generated by their solar panels. Other states, however, may have less advantageous policies that limit the amount of credit homeowners can receive or restrict eligibility to certain customer classes.

Overall, net metering is an important component of the policy landscape that can help make solar energy more affordable and accessible for homeowners across the country. By allowing homeowners to earn credits for excess solar energy and sell it back to the grid, net metering policies provide an additional financial incentive for individuals and families to invest in renewable energy and contribute to a cleaner, more sustainable future.

Check If Your Utility Offers Instant Rebates Or Loyalty Rebates For Solar

In addition to federal and state incentives, it’s important to also look into any potential rebates from your utility company. Some utilities offer instant rebates for homeowners who install solar panels, which can greatly reduce the upfront costs of going solar.

For example, in California, Southern California Edison offers instant rebates of up to $1,800 per kilowatt (kW) for residential solar installations, while Pacific Gas & Electric offers rebates of up to $1,000 per kW. These rebates are applied at the time of installation and can help homeowners save thousands of dollars on their solar systems.

In addition to instant rebates, some utilities also offer loyalty rebates for homeowners who have been customers for a certain period of time. For example, in Maryland, Pepco offers a loyalty rebate of $1,000 for residents who have been customers for at least five years and install solar panels.

It’s important to note that not all utilities offer rebates for solar, and the availability and amount of rebates can vary widely by state and utility. However, it’s always worth checking with your utility company to see if they offer any incentives or rebates for solar installations, as these can greatly improve the financial feasibility of going solar.

Stay Up To Date On Any Changes To Your State’S Solar Incentive Programs

As solar energy continues to gain popularity among homeowners across the country, it’s essential to stay up to date on the latest changes to your state’s solar incentive programs. While federal incentives for solar remain consistent, state programs can vary from year to year or even month to month.

For example, in 2020, New Mexico increased its solar tax credit to 10% of the cost of a solar installation, up to $6,000. Meanwhile, Massachusetts reduced its solar incentive program, resulting in a decrease of over $1,000 in average solar savings for homeowners in the state.

To stay current on your state’s solar programs, it’s important to research the latest legislation and regulations. You can start by checking out the Database of State Incentives for Renewables and Efficiency (DSIRE), which provides comprehensive information on solar incentives, rebates, and policies for each state.

Another resource is your local utility company. Many utilities offer solar programs and rebates, and they can provide valuable information on the latest solar incentives in your area. Additionally, it’s a good idea to consult with a reputable solar installer, who can help you navigate the various incentive programs and options available to you.

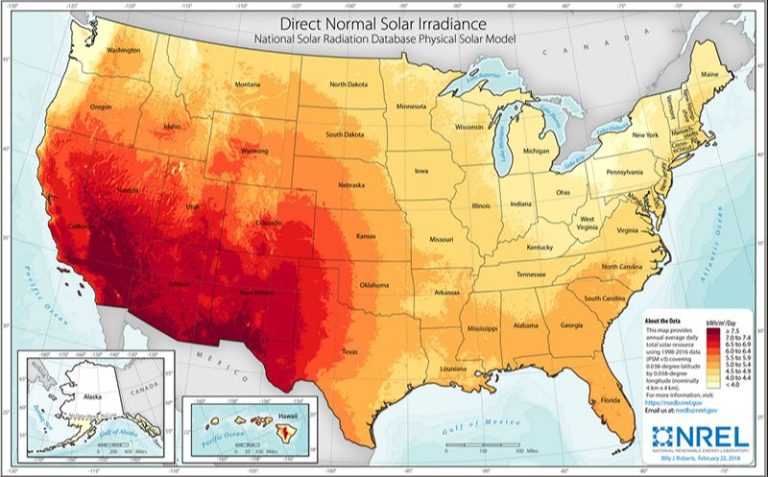

Of course, even with the latest information at your disposal, it’s important to consider whether solar is the right choice for your specific home and situation. Factors such as your location, energy usage, roof orientation, and budget can all impact the feasibility and cost-effectiveness of solar.

Ultimately, taking advantage of solar incentive programs can help make solar energy more accessible and affordable for homeowners, while also supporting efforts to reduce our carbon footprint and combat climate change. So whether you’re considering solar for the first time or looking to upgrade your existing solar system, it pays to stay informed on the latest incentives and policies in your state.

Energy Efficiency Rebates Can Also Lower Your Total Solar Installation Costs

In addition to solar rebates and tax credits, energy efficiency rebates can also contribute to lowering your total solar installation costs. Many states offer energy efficiency programs that can help homeowners improve the energy efficiency of their homes before installing a solar panel system. By reducing the amount of energy consumed, homeowners can decrease the size of their solar panel system, resulting in lower installation costs.

For example, states like California and Vermont offer energy efficiency programs that provide rebates for upgrading to high-efficiency appliances, HVAC systems, insulation, and weatherization. These upgrades help reduce energy consumption, making it easier and more cost-effective to power your home with a solar panel system.

Moreover, some states offer interconnection incentives. These incentives are designed to provide financial assistance to homeowners who are looking to connect their solar panel system to the electricity grid. For instance, Maryland offers a $1,000 Interconnection Grant program to help offset the cost of connecting a solar panel system to the grid.

It’s important to note that energy efficiency rebates vary from state to state and are subject to change. To learn more about energy efficiency programs and incentives available in your state, it’s recommended to consult with your local utility company or a reputable solar installer. They can provide valuable insights and help you determine the best course of action to help make your home more energy-efficient and cost-effective.

Partner With Local Organizations Advocating For Renewable Energy Policies

As a proactive approach to promoting renewable energy policies in your local community, it’s highly recommended to partner with local organizations that advocate for such policies. By doing so, you can increase the visibility and influence of your advocacy efforts while tapping into a network of knowledgeable and like-minded individuals seeking to create a sustainable future.

When seeking out organizations to partner with, consider reaching out to local chapters of national organizations such as the Sierra Club, Natural Resources Defense Council, or the Environmental Defense Fund. Additionally, there may be organizations specific to your state or region, such as the Connecticut Clean Energy Fund, Massachusetts Clean Energy Center, or the North Carolina Sustainable Energy Association.

Partnering with these types of groups can offer numerous benefits, such as access to educational resources, networking opportunities with industry professionals, and greater visibility and support for your advocacy efforts. Additionally, many of these organizations offer local events and outreach programs that provide unique opportunities to engage with your community and build relationships with elected officials and other stakeholders.

It’s also worth considering the potential impact of renewable energy policies on your local economy. According to a report by the Solar Energy Industries Association, the solar industry employs over 240,000 people in the United States, with job growth increasing by 159% since 2010. Additionally, the report notes that solar power accounted for 40% of all new electric generating capacity installed in the United States in 2019. By advocating for renewable energy policies, you can help create jobs and boost economic growth in your local community while also promoting sustainable energy practices.

Conclusion

In conclusion, before investing in solar energy, it is crucial to research and understand the state-specific incentives and rebates available. By taking advantage of these opportunities, you can significantly reduce the cost of your solar system and maximize your savings. Look into state and utility rebates, as well as federal tax credits, to determine which combination will provide the most benefits for your particular situation. It’s also a good idea to consult with your solar installer about current rebate programs and explore options such as loans or financing offered by some states. Additionally, staying informed on renewable energy portfolio standards and net metering policies in your state can ensure that you are making the most out of your solar investment. Don’t forget to check with your utility for any instant or loyalty rebates that may be available as well. And while you’re at it, why not team up with local organizations advocating for renewable energy policies? In doing so, not only will you be helping the environment but also strengthening its presence in your community. With all these resources at hand, going solar has never been more financially feasible. So go ahead and take advantage of all the incentives and rebates available in your state to make a positive impact on the planet while saving money in the process!