Is Solar Lease A Good Idea?

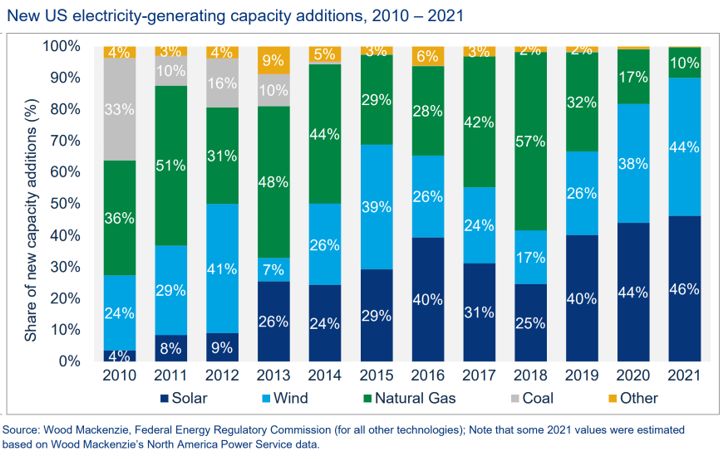

Solar leasing has become an increasingly popular way for homeowners to go solar in recent years. With a solar lease, a solar company installs a solar energy system on a customer’s home at little to no upfront cost. The homeowner then makes monthly payments to essentially “rent” the system. This allows homeowners to access solar energy without large upfront costs. The solar lease market has seen massive growth since 2010. According to SEIA, the solar industry overall has grown at an average annual rate of 24% over the last decade.

In this article, we’ll provide an overview of how solar leasing works, the pros and cons, key factors to consider, and examine whether it is a good option for you.

How Solar Leasing Works

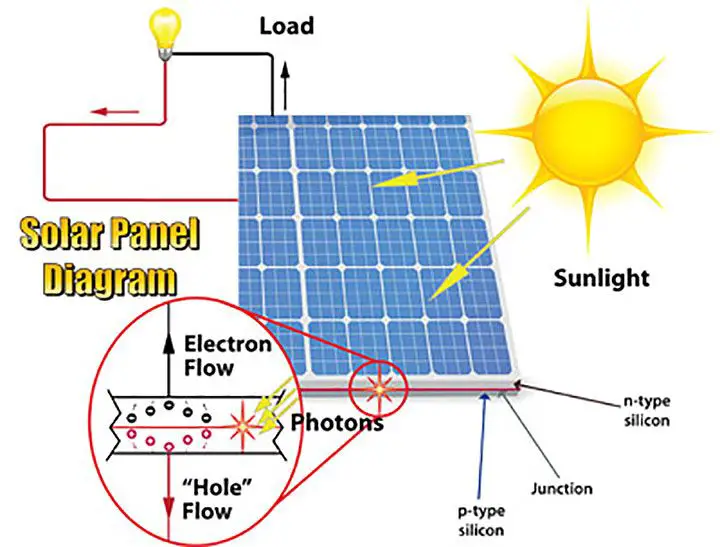

Solar leasing allows homeowners to go solar with little to no upfront costs. With solar leasing, a solar company owns, installs, and maintains the solar panels on a homeowner’s roof while the homeowner pays a monthly fee to essentially “rent” the system and purchase the power it produces (Palmetto). This eliminates the high upfront costs of purchasing and installing a solar system, which can run $10,000-$25,000 on average.

Instead, the homeowner signs a long-term contract, usually 20-25 years, with the solar company and agrees to pay them monthly payments to use their solar system. The homeowner consumes the solar power produced from the panels and receives credit on their utility bill for excess power sent back to the grid. The monthly payments are often structured to be lower than the homeowner’s current electricity bill so they can start saving money right away (Solarcents).

At the end of the lease term, the homeowner can renew the contract, have the panels removed at no cost, or buy the system at fair market value. This leasing model allows almost any homeowner to go solar without large upfront investment.

Pros of Solar Leasing

One of the biggest advantages of solar leasing is that there are no upfront costs. With a solar lease, you don’t have to pay tens of thousands of dollars for the solar panel system and installation. Instead, you simply make a monthly payment to the solar company for use of their equipment (Source: https://www.marketwatch.com/guides/solar/leasing-solar-panels/).

Since there is no large initial investment, solar leasing opens up solar energy to many homeowners who can’t afford to purchase a system outright. You don’t need to take out a loan or pay interest. The monthly lease payments are fixed, so you know exactly what to budget each month.

Solar leasing provides cost certainty and avoids system ownership risks. The solar company handles maintenance, repairs, and operations. If there are any problems with the solar panels, the solar provider will fix them as part of the lease agreement (Source: https://palmetto.com/learning-center/blog/leasing-vs-buying-solar-pros-cons-advantages-disadvantages-benefits-drawbacks/).

Cons of Solar Leasing

One of the main drawbacks of solar leasing is that you don’t own the solar system. The solar company owns the equipment and is responsible for the maintenance and repairs. This means you are obligated to make payments for the duration of the lease term, usually 20-25 years, regardless of whether you move or stay in the home. If you sell the home, the new owners take over the lease.

The lease terms can also be problematic. The lease payment amount is fixed, but lease companies often build in annual payment escalators of 2-3% to account for inflation. This increases your costs over time. Additionally, there are often fees for early buyout of the lease. So if you want to own the system outright before the term ends, you’ll have to pay a hefty fee which reduces the long-term savings. According to Choose Energy, buying out a 20 year lease early could cost $7,000-$10,000.

Other Financing Options

Besides leasing, there are a few other options for financing solar panels including solar loans, power purchase agreements (PPAs), and buying the system outright. According to EnergySage, the main financing options are:

Solar Loans – You can take out a loan specifically for installing solar panels. These loans often have better terms than other financing options since they are secured against your home. Interest rates can range from 3-8% for 10-20 year loan terms.

Power Purchase Agreements (PPAs) – A PPA is like a solar lease but instead of fixed monthly payments, you pay only for the power produced each month. The solar company owns and operates the system while you purchase the electricity generated at a fixed rate.

Buying – You can purchase a solar system outright, either with cash or by folding it into your mortgage. This gives you full ownership as well as tax credits and incentives. However, it requires large upfront capital.

Cost Savings

One of the biggest benefits of going solar with a lease is the potential for significant cost savings on your monthly electricity bill. By installing a solar energy system on your roof, you can reduce or even eliminate the amount of electricity you need to buy from the utility company.

Exactly how much you’ll save depends on several factors like your electricity usage, system size, local electricity rates, and the terms of your solar lease. But most solar companies will provide you with an estimate of your projected savings over the lifespan of your system.

For example, if you lease a 5 kW system, you might save around $100 per month, or $1,200 per year on your electricity costs. Over a 20 year solar lease, that could mean over $24,000 in cumulative savings.

Some key advantages to leasing include:

- No upfront system purchase costs

- Lower and predictable monthly payments

- savings from day one of system installation

The money you save each month is money that stays in your pocket rather than going to the utility. Just be sure to verify the estimated savings and understand all the costs involved before signing a solar lease agreement.

Factors to Consider

There are a few key factors to consider when deciding if a solar lease is right for you:

Roof Ownership – If you don’t own the roof, you’ll need permission from the owner to install solar panels. Renters and those in apartments or condos may not have control over their roof.[1]

Lease Terms – Understand the full terms of the lease, including the length, price escalators, maintenance responsibilities, etc. A long lease of 20+ years can seem daunting.[2]

Move Plans – If you plan to move soon, a lease may not make financial sense. You’ll want to recoup the savings over many years. Pay attention to any fees for transferring or buying out the lease.[2]

Who is a Good Fit?

Solar leasing tends to be a good option for long-term homeowners who plan on staying in their house for many years. Since solar lease contracts are typically 20-25 years, you’ll want to be sure you don’t move or sell your home before the lease term is up. Otherwise, you may face penalties or have to buy out the remainder of the lease.

Homeowners with good credit scores are ideal candidates for solar leasing as well. Most solar lease providers will check your credit before approving you. Good credit means you’re more likely to qualify and get better lease terms. If your credit is poor, you may not qualify at all or may get stuck with higher interest rates.

Long-term homeowners with strong credit have the most financial stability, allowing them to comfortably make those 20+ years of monthly lease payments. As long as you plan on staying put in your home and have a solid credit history, a solar lease could be a great, affordable way to go solar.

Citations:

https://www.forbes.com/home-improvement/solar/leasing-vs-buying-solar-panels/

https://www.marketwatch.com/guides/solar/leasing-solar-panels/

Other Questions to Ask

When evaluating a solar lease, here are some other key questions to ask the solar company:

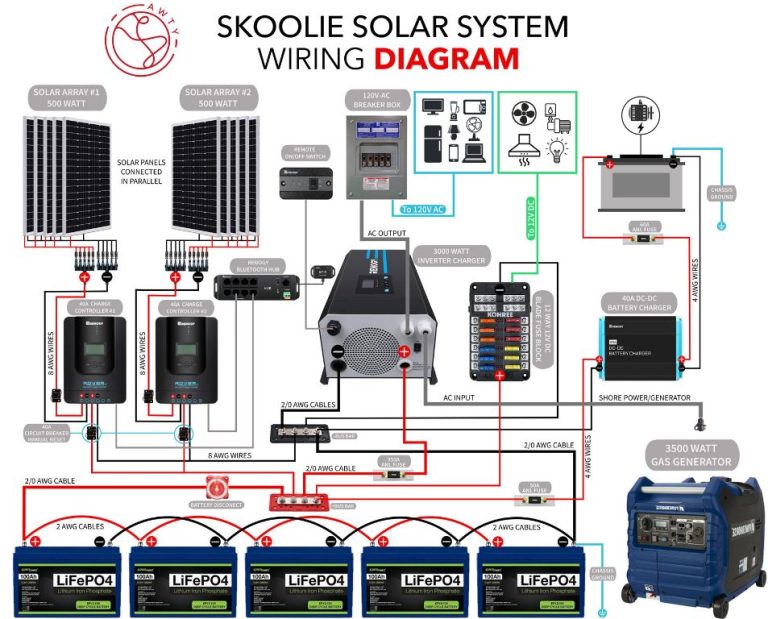

Maintenance and Repairs

Who is responsible for maintenance and repairs on the solar panels and equipment? Typically with a lease, the solar company is responsible for maintenance, repairs, and any replacement parts that may be needed. Be sure to confirm this and understand what is covered under their maintenance plan. Ask what type of maintenance schedule the panels and equipment will be on. Ask what the estimated lifespan is for the panels and equipment (1).

Insurance

Find out what type of insurance coverage the solar company has. They should be able to provide general liability insurance as well as workers’ compensation. Ask if their coverage would protect your home in case of any damage done during installation or a resulting problem. You may want to check with your home insurance company if any additional coverage is needed on your end once you have solar installed (2).

Be sure to ask any other questions about the terms of their maintenance plan, the lease agreement, insurance coverage, or anything else that is unclear or concerning. Taking the time to fully understand all aspects of a solar lease is vital.

Conclusion

In summary, solar leasing offers some attractive benefits like no upfront costs, maintenance included, and predictable monthly payments. However, there are also downsides like not owning the system, limited control, and potentially higher long-term costs compared to purchasing. Key considerations are your long-term plans in the home, desire for system ownership, and whether your roof is suitable for a leased system.

Leasing can be a smart choice for those wanting to go solar with minimal upfront costs and unpredictability. It works best for people planning to stay in their current home up to the length of the lease term, and who prioritize low monthly payments over system ownership. However, purchasing is generally recommended for those who can afford it, plan to be in their home long-term, want full control, and prefer the long-term savings.

Overall, solar leasing opens up solar energy to more homeowners who may not be able to purchase systems. While purchasing is advisable when possible, leasing remains a viable option to consider, especially if you want to start saving on electricity right away with minimal investment.