Is Gold A Non-Renewable Resource?

What is Gold?

Gold is a chemical element with the symbol Au (from the Latin word aurum meaning “shining dawn”) and atomic number 79. In its pure form, gold is a bright, slightly reddish yellow, dense, soft, malleable, and ductile metal (Source: https://www.britannica.com/science/gold-chemical-element).

Some key properties of gold include:

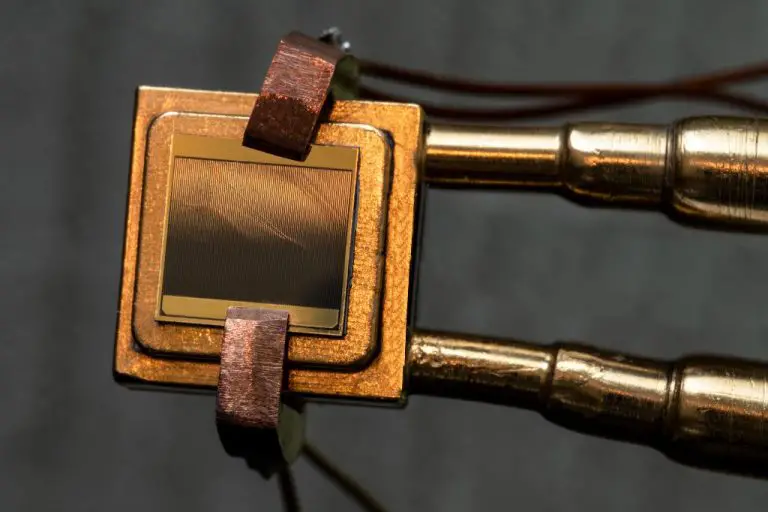

- Highly conductive of electricity and heat

- Reflective of infrared radiation

- Chemically unreactive and resistant to corrosion or tarnishing

- Highly malleable and ductile allowing it to be drawn into extremely thin wire or hammered into thin sheets (Source: https://www.livescience.com/39208-what-is-gold.html)

Gold has been highly valued as a precious metal for coinage, jewelry, and other arts throughout history. It is also used extensively in electronics for wiring, connectors, and conduction of electricity in circuits due to its high conductivity and resistance to corrosion (Source: https://www.usgs.gov/faqs/what-are-uses-gold).

How is Gold Formed?

Gold is formed through a long geological process spanning billions of years. According to the U.S. Geological Survey, many gold deposits formed from hydrothermal fluids depositing gold into volcanic and sedimentary rocks[1]. This process, known as mineralization, involves gold being dissolved in superheated, acidic underground water. As this fluid moves through rock fractures and void spaces, changes in temperature and chemistry cause the gold to precipitate out of solution and crystallize[2].

Gold deposits are often found concentrated along the margins of greenstone belts and diorites, where the hydrothermal fluids interacted with chemically reactive rocks. Major gold producing regions typically have ancient greenstone belts rich in volcanic-sedimentary rocks and plutonic rocks like granite that provided the right conditions for hydrothermal fluid flow and gold precipitation over billions of years.

Why is Gold Considered a Non-Renewable Resource?

A non-renewable resource is one that cannot be readily replenished by natural means within a reasonable timeframe or is in limited supply around the world. These resources take an extremely long period of time to form naturally.

Gold is considered a non-renewable resource because it cannot be grown, regenerated, or created once it has been extracted and used. The process of gold formation within the earth’s crust takes billions of years under very specific conditions. According to this source, gold is created when fluid deposits leach gold from the earth’s crust and carry it to areas where it precipitates into veins, nuggets, and deposits. The worldwide reserves of easily accessible gold are limited and will eventually be depleted through mining and extraction activities.

Unlike renewable resources like wind, solar, or timber which can be regenerated within a human lifespan, the formation of new gold reserves takes epochs. Essentially, once the limited supplies of gold around the world are exhausted through mining, there is no feasible way to replenish those supplies. That is why gold is considered a finite, non-renewable resource.

Global Gold Reserves

According to data compiled by the International Monetary Fund, the global reserves of gold held by central banks and financial organizations amounted to around 35,000 tonnes as of Q3 2022.

The United States holds the largest gold reserves in the world. As of February 2023, the U.S. gold reserves totaled over 8,000 tonnes, accounting for nearly a quarter of official global gold reserves. Germany comes in second with gold reserves of over 3,300 tonnes, followed by the International Monetary Fund with over 2,800 tonnes. Other major reserve holders include Italy, France, Russia, China, Switzerland, Japan, India, and the Netherlands.

Most central banks hold a portion of their reserves in gold, which is valued for its role as a safe haven investment during times of economic volatility. Global gold reserves peaked in the 1960s, declining in subsequent decades as countries moved away from the gold standard. More recently, gold reserves in some countries have begun increasing again as central banks diversify their reserve assets.

Gold Mining Challenges

The gold mining industry faces several key challenges related to finding new sources of gold and minimizing environmental damage. As reported, gold mines are having to dig deeper to access veins and deposits, leading to higher costs and technical difficulties. Additionally, easily accessible deposits near the earth’s surface have already been extracted over decades of mining.

This makes finding new, high-quality sources more challenging than ever before. Environmental concerns are another major issue, as mining can negatively impact air and water quality, destroy landscapes, and harm wildlife if not properly regulated and managed. Cyanide and mercury, commonly used in gold extraction, can leak into the environment and pose health hazards if not contained and disposed of safely.

According to a report, mining companies must implement responsible and sustainable practices to obtain social licenses and operate successfully in the long run. This includes reducing water usage, minimizing land disturbance, preventing spills, and properly closing sites after mining is completed. Overcoming technical hurdles while protecting the environment remains an ongoing struggle worldwide for gold miners.

Gold Recycling

Gold is one of the most recyclable metals, with gold recycling rates estimated to be over 90% globally. This is primarily driven by the high value of gold, which makes it economically worthwhile to recover even small amounts from waste streams. According to the World Gold Council, around 30% of annual gold supply comes from recycled gold.

There are several ways that gold can be recycled and recovered:

- Jewelry recycling – Old, broken, or unwanted gold jewelry can be sold back to jewelers or gold dealers. The gold is extracted and purified for reuse.

- Electronics recycling – Gold can be recovered from discarded electronic devices like computers and cell phones which use gold in components. This “e-waste” is an increasing source of recyclable gold.

- Dental scrap – Dentists frequently use gold alloys. Scrap crowns, fillings, and other dental waste containing gold are regularly collected and recycled.

- Industrial scrap – Manufacturing waste containing gold is smelted to reclaim the precious metal. Aerospace companies, glass makers, and other industries recover gold this way.

In 2021, over 270 tonnes of gold were recycled globally according to the World Gold Council, accounting for around 30% of total supply that year. Recycling rates can fluctuate based on gold prices and economic conditions, but the combination of gold’s value and amenability to recycling ensures old gold streams continue flowing back into the market.

Gold Alternatives

While gold is considered a rare and valuable commodity, there are some other metals that can serve as alternatives to gold in certain applications. Some key alternatives include:

Silver – Silver has some similarities to gold in terms of scarcity, conductivity, and aesthetic appeal. It is more abundant than gold, so it tends to be less expensive. The main advantage of silver is its lower price point, making it accessible to more investors. The downside is it is not as rare or valuable as gold on a per ounce basis.

Platinum – Platinum has a higher melting point than gold, so it holds up better in high temperature applications. It is rarer than gold, but has less demand, so currently trades at a lower price point. Platinum is harder than gold, so it has some benefits in jewelry and industrial uses when hardness and durability are desired.

Palladium – Palladium is a precious metal in the platinum group. It is rare and has some catalytic properties that make it useful for electronics and industrial applications. Palladium is lighter and less dense than platinum. It also currently has a lower spot price than gold or platinum.

While alternatives like silver, platinum, and palladium have some benefits over gold, gold remains the most popular store of value investment given its scarcity, history as money, and liquidity. However, the other precious metals can diversify an investor’s holdings.

Gold Price Trends

The price of gold has fluctuated widely over the past century. According to historic data from Macrotrends, the price for an ounce of gold in 1915 was around $20. By the mid-1930s during the Great Depression, the price had increased to around $35 per ounce. There was relatively little movement in the gold price between the mid-1930s through the end of the 1960s, when the price held steady at $35 per ounce.

In the 1970s, the global gold market underwent a series of shocks that rapidly increased the price of the precious metal. In 1971, President Nixon took the United States off the gold standard, which effectively de-pegged the dollar from gold. In the aftermath, gold prices began rising rapidly, eventually peaking at around $850 per ounce in 1980. After 1980, gold prices entered a multi-decade decline, falling as low as $250 per ounce by 1999.

Since the turn of the century, gold prices have risen substantially due to factors like a weakening US dollar, low real interest rates, geopolitical uncertainty, and increasing demand from emerging markets like China and India. In 2011, prices peaked at over $1,800 per ounce before dropping back down to around $1,050 in 2015. Today in 2022, gold trades at around $1,850 per ounce, near its previous all-time high.

Looking forward, many analysts see continued volatility in gold prices driven by economic conditions, central bank policies, political uncertainties, and shifts in supply and demand. However, if history is any guide, gold will likely maintain its status as a reliable long-term store of value.

Sources: Macrotrends, National Mining Association

Gold Market Factors

The price of gold is primarily driven by supply and demand. Some key factors that influence the price of gold include:

- Inflation rates – Rising inflation generally leads to higher gold prices, as gold is viewed as a hedge against inflation. Falling inflation can decrease gold prices. (Investopedia)

- Interest rates – There is generally an inverse relationship between interest rates and gold prices. As interest rates rise, the opportunity cost of holding non-yielding gold increases, putting downward pressure on prices. (Money)

- US dollar strength – Since gold is dollar-denominated, a stronger dollar makes gold more expensive for foreign currency holders, decreasing demand and putting downward pressure on prices. (Investopedia)

- Geopolitical uncertainty – During times of political or economic instability, investors tend to flock to gold as a safe haven asset, driving prices higher.

- Central bank policy – Central bank gold buying and selling impacts supply dynamics and can influence prices.

- Investor demand – Strong investment demand, through gold ETFs and other financial instruments, can bid up prices.

These factors combine to determine daily fluctuations in gold prices around the world. However, the primary long-term driver remains the limited supply of gold relative to demand.

The Future of Gold

One of the most pressing concerns about gold is whether it will eventually run out. Given that gold is a finite resource and mining output is declining, some analysts predict that global gold reserves could be depleted within the next few decades.

According to an analysis cited in Yahoo Finance, existing gold deposits could be exhausted by 2050 at current mining rates (source). Other predictions estimate the world only has 20 or 30 more years of extractable gold left.

However, the exact timescale is debatable and depends on several variables. On the supply side, recycling and new technological methods could help extend viable gold reserves. Demand is also a major factor; if gold consumption increases, especially for industrial uses, accessible deposits would deplete faster.

While a definitive depletion date for gold is difficult to pinpoint, it’s clear that remaining supplies are finite. Going forward, recycling and more efficient use of gold will be crucial to sustaining reserves. The gold industry may also need to shift reliance to lower grade deposits that require more intensive mining. Concerns over “peak gold” will likely impact prices as well as mining methods and technologies in the 21st century.