Is Commercial Solar Profitable?

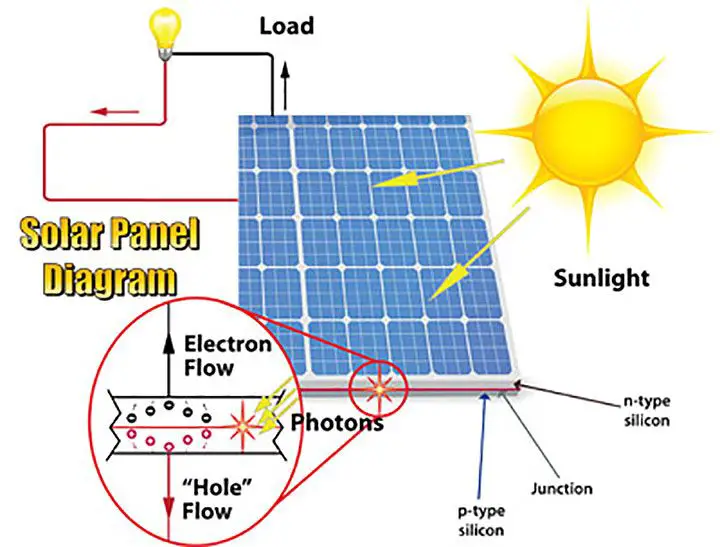

Commercial solar energy systems refer to photovoltaic (PV) panel installations that generate electricity from sunlight for use by businesses, corporations, nonprofits, and government organizations. Unlike residential solar, which powers private homes, commercial solar powers the facilities and operations of companies, factories, warehouses, office buildings, retail stores, schools, municipal buildings, and more.

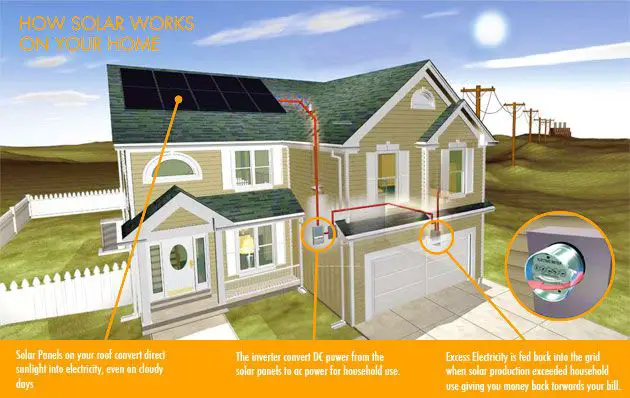

Commercial solar systems are typically large, grid-connected installations that offset some or all of the energy usage of the host site. They can range from 10 kilowatts on a small commercial roof to megawatt-scale solar farms covering many acres. The solar electricity generated feeds into the main utility grid, and the business draws power as needed directly from the grid. With net metering, any surplus solar energy produced can be sold back to the utility.

Installing a commercial solar system allows businesses to reduce their energy bills, hedge against future rate hikes, lower their carbon footprint, and meet sustainability goals. The upfront investment in a PV system pays dividends for decades through electricity savings and environmental benefits.

Costs of Commercial Solar

The costs of commercial solar include the system components, installation, and ongoing maintenance. The main factors are:

System Costs

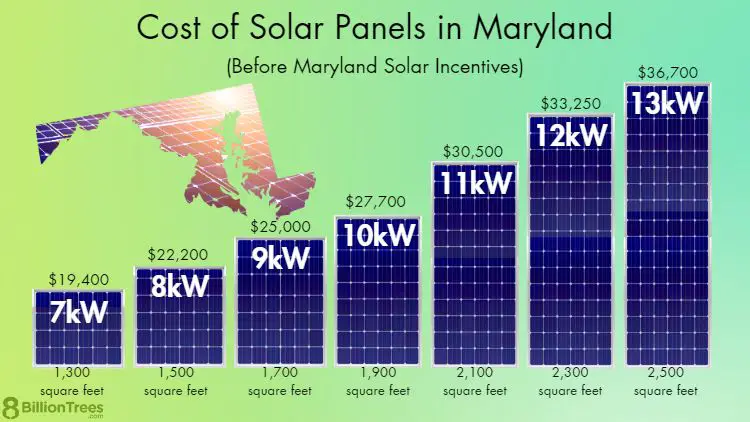

The solar panels, inverters, racking, and other equipment can cost anywhere from $1.50 to over $3.00 per watt for a commercial system. Larger projects typically cost less per watt due to economies of scale. Total system costs for a 100 kW commercial array may range from $150,000 to $300,000 or more.

Installation Costs

Installing a commercial solar energy system requires electrical work, structural assessments, permits and inspections. Installation costs can add $0.50 to $1.00 per watt or more, bringing the total installed costs to $2.00 – $4.00 per watt for a 100 kW system.

Maintenance Costs

Commercial solar arrays require little maintenance, but regular inspections, panel cleaning and inverter replacement may cost around $10,000 to $20,000 over the system lifetime. Proper maintenance is important to maximize energy production.

Financial Incentives for Commercial Solar

There are several financial incentives available that can lower the upfront costs of installing commercial solar and improve ROI. These include:

Federal Tax Credits – The federal government offers a 26% tax credit for solar installations. This credit applies to both residential and commercial systems. The tax credit lowers the effective costs of a solar energy system by 26%.

State/Local Rebates and Tax Credits – Many states, cities, and utilities offer additional rebates and tax credits beyond the federal credit. These can range from several hundred dollars per kW installed up to 50% or more of system costs. Research what rebates are available in your specific location.

Net Metering – Net metering allows commercial solar customers to get credit for excess electricity fed back to the grid. This credit offsets electricity drawn from the grid when solar isn’t producing. Net metering makes solar more valuable by lowering effective costs.

Renewable Energy Certificates (RECs) – For each MWh of solar electricity produced, 1 REC is generated. These can be sold on REC markets to utilities needing to fulfill renewable energy mandates. REC sales provide additional solar revenue.

Electricity Bill Savings

One of the main financial benefits of installing commercial solar is the ability to offset electricity purchased from the utility. Solar panels generate electricity during daylight hours that can directly power your building. This clean solar electricity replaces grid electricity usage and therefore lowers your monthly utility bills.

The more solar energy your system produces, the greater your utility bill savings will be. Solar production depends on factors like your region’s solar resource, the size of your solar array, system efficiency, and building load profile. But in general, commercial solar offsets a significant portion of grid purchases, often 30-60% or more of total usage.

Savings accumulate over the system lifetime of 20-30 years. With solar electricity prices lower than utility rates that tend to rise over time, the savings can be substantial. Electricity bill savings provide the most direct and predictable source of ROI from commercial solar.

Payback Period

The payback period refers to the number of years it takes for the savings a commercial solar system generates to equal the cost of installing and maintaining the system. It represents the breakeven point where the solar investment has paid for itself through electricity bill savings and other solar benefits.

For commercial solar projects, the payback period typically ranges from 5-7 years. This timeframe can vary based on factors like:

- System size and cost

- Electricity rates and utility incentives

- Solar resources and production at the site

- Operations and maintenance costs

A shorter payback period of 5 years or less is considered favorable in the solar industry. This means the system earns back its initial investment relatively quickly, reducing the payback risk over time.

There are financing options like power purchase agreements (PPAs) that allow businesses to adopt solar with little to no upfront costs. Under a PPA, a third-party developer owns and operates the system while the business purchases the generated electricity at a fixed rate over a long-term contract. This can make commercial solar feasible even with longer payback periods.

Lifetime Savings

When considering the financial benefits of a commercial solar system, it’s important to look beyond just the payback period and consider the total lifetime savings. Most solar panels come with 20-30 year performance warranties, meaning they are engineered to produce electricity for decades.

Over the life of a commercial solar system, the electricity produced provides essentially free electricity savings that go right to a business’s bottom line. While electricity rates from the utility grid often increase 3-5% per year, the “fuel” for solar panels is free. This enables substantial cumulative electricity bill savings over the system lifetime.

Detailed financial modeling is required to make an accurate lifetime savings projection. This factors in the upfront system cost, expected electrical production each year, anticipated utility rate increases, system degradation, insurance and maintenance costs, and more. Lifetime savings are also highly dependent on incentives like tax credits and accelerated depreciation which provide significant financial benefits.

Most experts estimate commercial solar systems provide 25-40% return on investment over their lifetime. While payback periods are getting shorter, the decades of free electricity remain the primary driver of solar’s financial return. For any substantial commercial solar installation, the lifetime savings should be calculated to fully understand the long-term benefits.

Grid Services Revenue

Many utility companies and grid operators offer payments to commercial solar system owners for sending excess electricity to the grid. This provides valuable grid services and helps stabilize the overall electrical infrastructure. With net metering policies, any excess solar electricity sent to the grid results in a credit on your utility bill. But some grid operators take this a step further by providing direct payments through grid services programs.

For example, a commercial solar system may be enrolled in a frequency regulation program. By adjusting solar output up or down on short notice when called upon, the system helps maintain ideal grid frequency. The grid operator pays the solar system owner for providing this valuable service. Other programs may pay for operating reserves, voltage support, or peak shaving. The revenue from such grid services can improve the economic proposition of commercial solar.

Carbon Credits

Commercial solar projects often generate additional revenue through the sale of carbon credits. When a business installs solar, it directly reduces greenhouse gas emissions from fossil fuel power plants. Each ton of avoided CO2 emissions equals one carbon credit. These credits can be sold on voluntary carbon markets, providing commercial solar adopters with supplemental income.

The value of carbon credits fluctuates, but generally ranges from a few dollars to twenty dollars per ton of CO2. The number of credits earned depends on the solar array’s size and energy output. Though carbon credit sales may not make or break a project’s economics, they provide a nice bonus that improves the investment over time. For companies looking to reduce their carbon footprint and meet sustainability goals, monetizing those emissions reductions through credit sales is an appealing opportunity.

Improved Property Value

Adding a solar photovoltaic system can significantly increase the value of a commercial property. Studies have shown that solar systems can increase building value by an average of $15 per square foot. For a 100,000 square foot building, that translates to a $1.5 million increase in property value. There are several reasons why solar increases property value:

– Solar systems lower operating expenses by reducing energy bills. Lower expenses directly translate to higher building value.

– Solar PV is a long-term asset that continues generating electricity and revenue over a system lifetime of 25-30 years.

– Solar demonstrates a property’s commitment to sustainability. In today’s market, eco-friendly buildings command higher rents and sale prices.

– The long-term, fixed-price electricity from solar hedges against utility rate increases. This can make net operating income more stable and predictable.

– Solar increases a property’s desirability with tenants who want clean, renewable power. It’s a clear differentiator for attracting high-quality tenants.

– Solar systems are eligible for bonus depreciation and tax credits. These financial incentives can further enhance investment value.

In summary, adding commercial solar PV provides financial, operational, and marketing benefits that translate into higher building value. Wise commercial property owners consider solar for maximizing the value of their assets.

Conclusion

In summary, there are several factors that determine the profitability of commercial solar projects. The upfront costs of the solar panels and installation must be weighed against the long-term electricity bill savings and additional revenue streams. Key considerations include available financial incentives like tax credits, the projected payback period, lifetime energy savings, and income from programs like net metering, solar renewable energy credits, and demand response services. Improvements to property value can also offset costs. Overall, solar is becoming increasingly affordable and financially beneficial for many commercial property owners. Careful analysis of the specific costs, incentives, and projected savings will determine if solar is a profitable investment over the system’s 20-30 year lifespan.