How To Finance Energy Projects?

With growing interest in renewable energy and energy efficiency projects, finding suitable financing has become a key challenge (

Having adequate financing is essential for any organization, business, or individual seeking to implement an energy generation project. Carefully evaluating the different financing methods can ensure you choose the optimal funding source to get your renewable energy or efficiency initiative up and running.

Government Grants

The U.S. Department of Energy (DOE) offers various grants to support energy projects, primarily through the Office of Energy Efficiency and Renewable Energy (EERE). Some major grant programs include:

- State Energy Program (SEP) – Provides formula and competitive grants to states to support renewable energy and energy efficiency initiatives. In 2021, over $100 million was awarded through SEP competitive grants (DOE Funding & Financing)

- Weatherization Assistance Program (WAP) – Provides funding to states to weatherize homes of low-income families to improve energy efficiency and reduce energy costs. In 2021, WAP provided over $227 million in formula grants to states (Grants.gov)

- Tribal Energy Program – Provides financial and technical assistance to Tribal governments to evaluate energy efficiency and renewable energy opportunities. Over $15 million was awarded in 2020 (DOE Funding Opportunities)

Other DOE offices like the Office of Science and Loan Programs Office also offer energy-related grants. Additionally, other federal agencies like USDA and HUD offer grants that can support energy projects.

Tax Credits

There are federal and state tax credits available to help finance renewable energy projects like solar, wind, geothermal, and others. The two main federal tax credits are the Investment Tax Credit (ITC) and the Production Tax Credit (PTC).

The ITC allows businesses to deduct 30% of the cost of installing solar panels or other renewable energy systems from their federal taxes owed (source: https://www.novoco.com/resource-centers/renewable-energy-tax-credits/about-renewable-energy-tax-credits). This can significantly reduce the payback period for renewable energy investments.

The PTC provides a tax credit per kWh of electricity generated by qualified renewable energy projects, such as wind farms or solar arrays. The PTC starts at a base rate of 0.3 to 0.7 cents per kWh, depending on the technology (source: https://www.epa.gov/lmop/renewable-electricity-production-tax-credit-information).

Many states also offer additional tax credits to support renewable energy, such as deductions for purchasing solar panels or sales tax exemptions for renewable energy equipment. Checking state incentives can help make renewable energy projects more financially viable.

Green Bonds

Green bonds are a type of fixed-income instrument designed specifically to fund projects that have positive environmental and/or climate benefits. The green bond market has grown rapidly in recent years as investors have sought socially responsible investments. According to the Climate Bonds Initiative, over $100 billion in green bonds were issued globally in 2016 alone.[1]

Green bonds work similarly to regular bonds, providing a fixed return over a defined period of time. However, the proceeds raised must be used for financing environmentally friendly projects, such as renewable energy, clean transportation, pollution prevention, biodiversity conservation, etc.[2] Major issuers of green bonds include development banks, government agencies, municipalities and corporations.

Some key benefits of green bonds include expanding financing for climate-aligned projects, allowing issuers to diversify their investor base, and meeting rising investor demand for sustainable investments. The green label highlights the climate-focused use of funds to investors.

Overall, green bonds are an innovative tool for financing environmental initiatives and renewable energy projects around the world. They are helping mobilize new sources of capital for the green economy.

[1] “Green Bonds | Better Buildings Initiative – Department of Energy”

[2] “What are Green Bonds and what projects do they finance?”

Crowdfunding

Crowdfunding has emerged as a powerful tool for financing renewable energy projects. By pooling together small investments from a large number of people, crowdfunding platforms can raise substantial amounts of capital for green energy initiatives. There are several popular models of crowdfunding being utilized for energy projects:

Equity-based crowdfunding – Investors receive shares or equity in the project. This allows people to directly invest in and own part of renewable energy initiatives.

Debt-based crowdfunding – Individuals provide loans to projects and receive principal plus interest back over time. This model allows people to contribute to projects while also earning a financial return.

Donation-based crowdfunding – People contribute or pledge money to projects with no expected financial compensation. This allows individuals to support causes they believe in.

Some top crowdfunding platforms focused on renewable energy projects include Invesdor, ecoligo, Ener2Crowd, Letsinvest, and Spreds.

Community Solar

Community solar allows groups of people to share the benefits of solar power even if they can’t or don’t want to install solar panels on their property.https://www.energy.gov/eere/solar/community-solar-basics Community solar projects are typically financed through a combination of arrangements like membership fees, direct ownership, crowdfunding, and donations.

In shared solar models, members pay an upfront or monthly fee to purchase a portion of the project and receive credits on their electricity bills based on the energy produced by their share. This provides a way to access solar power without installing it on your own roof.https://www.visionsfcu.org/products/community-solar

Loans and other financing options tailored for community solar help cover the upfront costs of these projects in exchange for the long-term energy savings and incentives. Some credit unions and lenders now offer specific community solar loans.https://www.solarpowerworldonline.com/2023/07/how-to-get-financing-for-your-community-solar-project/ This allows people to go solar with little or no money down through a loan repaid over time by the energy bill savings.

Power Purchase Agreements

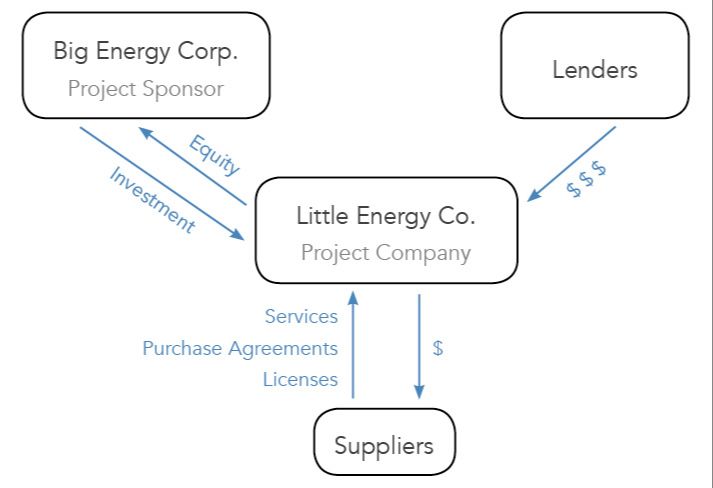

A power purchase agreement (PPA) is a financial arrangement where a developer arranges for the design, permitting, financing and installation of a renewable energy system on a customer’s property at little to no cost. The developer sells the power generated to the host customer at a fixed rate that is typically lower than what the local utility would have charged.

PPAs provide a means to avoid the often prohibitive upfront costs of installing a renewable energy system. The developer owns, operates and maintains the system for the duration of the contract (typically 15-25 years), during which time the host customer agrees to purchase the electricity generated by the system. The host pays only for the power produced, receiving lower, more stable power prices over the term of the contract. Meanwhile, the developer recoups the project costs through these ongoing energy payments.

This arrangement allows the host customer to meet emissions or renewable energy targets with no capital expenditure. The developer receives the economic benefits of the incentives and can monetize tax credits. PPAs provide the developer with a long-term revenue stream, improving project finance options.

Source: https://betterbuildingssolutioncenter.energy.gov/financing-navigator/option/power-purchase-agreement

On-Bill Financing

On-bill financing allows customers to finance energy efficiency upgrades or renewable energy systems through their utility bill. With on-bill financing, the utility company incurs the upfront cost of the upgrade and the customer repays the cost over time through their monthly utility bill (Energy.gov).

On-bill financing makes financing more accessible since repayments are made through the existing utility bill. Repayments are typically structured to not exceed the estimated energy savings, so customers can realize net energy cost savings from day one. On-bill financing opens up financing to customers who may not qualify for standard loans. No down payment or credit check is required in most programs (EESI).

On-bill financing is offered by some utilities like PG&E and National Grid. Programs are typically available for residential and business customers. Eligible upgrades may include energy efficiency improvements like heating and cooling systems, insulation, lighting, water heaters, and renewable energy systems like solar panels or wind turbines. Loan terms are often 5-10 years or longer (Better Buildings).

On-bill financing can be an attractive option to finance clean energy projects through a utility bill while realizing immediate energy savings.

Commercial Loans

Commercial bank loans are one of the most common ways to finance energy efficiency and renewable energy projects for businesses, nonprofits, and government organizations (Commercial Energy Financing Primer). Banks provide financing to qualified borrowers to fund projects like installing solar panels, upgrading HVAC systems, replacing lighting or windows, etc. The borrower repays the bank over time, with interest.

Compared to other financing options, the advantage of commercial loans is that they provide large upfront capital and flexible terms. Loan amounts can range from thousands to millions of dollars, with repayment terms from 2-20 years typically. Interest rates vary based on creditworthiness of the borrower, collateral, and other factors.

To qualify for a commercial energy loan, the borrower must have a good credit score and meet the bank’s debt-to-income ratio requirements. Having sufficient collateral and a strong business plan are also key qualifying factors. The energy efficiency upgrades can help improve the project’s cash flow and collateral position to boost loan approval chances (Renewable Energy Business Loans).

Conclusion

There are a variety of financing options available for energy projects, from government grants and tax credits to innovative models like crowdfunding and community solar. Some key points to summarize the main financing options discussed in this article:

– Government grants provide funding that does not need to be repaid. Tax credits reduce tax liability for project owners. These help offset project costs and make renewable energy more affordable.

– Green bonds allow investors to fund renewable projects through bond offerings. This expands the investor pool.

– Crowdfunding platforms let many small investors contribute to projects through online portals. This democratizes renewable energy investment.

– Community solar allows utility customers to subscribe to portions of larger solar installations. This enables access for those who cannot install on their own property.

– Power purchase agreements allow developers to install systems on properties they do not own, with the property owner agreeing to purchase power. This removes upfront costs.

– On-bill financing ties repayment to utility bills. Loans can transfer between property owners. This also reduces upfront cost barriers.

– Commercial loans from banks and credit unions offer conventional financing for projects. Rates may be more favorable for renewables.

With many options now available, financing can be tailored to meet the needs of most energy projects.