How Much Money Is Used For Renewable Energy?

Renewable energy comes from natural sources that are constantly replenished, such as sunlight, wind, rain, tides, waves, and geothermal heat. Tracking global spending on renewable energy provides key insights into the world’s transition to clean energy. This report will examine current and projected investments in renewable energy by region, technology, and sector. It will assess government policies and incentives aimed at accelerating the adoption of renewables. Challenges and opportunities driving future investment will also be analyzed. The goal is to provide a comprehensive overview of global renewable energy financing and its role in shaping a sustainable energy future.

Current Global Investment in Renewable Energy

Total global investment in renewable energy reached $226 billion in 2021, according to the World Health Organization (WHO). This represents an increase of 35% from 2020 and is the highest figure ever recorded. The growth has been driven by countries’ commitments to reduce carbon emissions and mitigate climate change through greater adoption of clean energy.

Most of the investment went to solar and wind projects, which attracted over $177 billion combined. This far surpassed investment in fossil fuels, which stood at an estimated $118 billion in 2021. The gap between renewables and fossil fuels is expected to widen further as more countries pass legislation to curb carbon emissions and companies shift their energy production towards sustainable models.

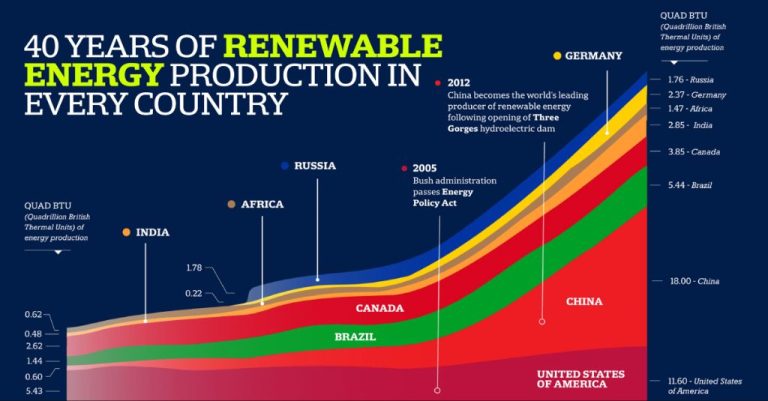

China led in renewable energy investment with over $41 billion spent in 2021. The U.S. ranked second with $36 billion, followed by Europe with $27 billion. Developing countries are also ramping up investments in renewable energy, with the Philippines, Vietnam and South Africa all seeing over 50% increases from 2020.

Investment by Region

Global investment in renewable energy totaled $226 billion in 2021. By region, the largest investments came from Asia with $135 billion, followed by Europe with $57 billion. China led Asia with $83.4 billion invested, primarily in solar and wind projects. In Europe, investments were focused on wind power, especially offshore wind farms like the Dogger Bank project in the UK. The United States invested $27 billion in renewable energy in 2021, down 2% from 2020 but still the largest investor outside Asia and Europe. Investments in the Americas excluding the US totaled $7 billion.

Renewable energy investments have grown substantially in developing countries in recent years. In Africa, investments doubled from 2020 to 2021 to reach $10 billion, driven by growth in wind and solar power in South Africa and Egypt. The Middle East saw investments grow 22% to $14 billion in 2021, led by the United Arab Emirates and Saudi Arabia. Globally, developing and emerging economies accounted for one-third of all renewable energy investments in 2021.

Investment by Technology

In 2021, solar power attracted the largest share of renewable energy investment, accounting for USD 185 billion out of the total USD 367 billion spent on renewables globally. Wind power came in second, attracting USD 126 billion in investment. Other key renewable energy technologies by investment were biofuels at USD 19 billion, hydro at USD 14 billion, geothermal at USD 3 billion, and marine energy at USD 100 million.

Solar investment was driven by the continued cost declines in photovoltaic modules as well as strong growth in distributed solar installations on homes and commercial buildings. China was the top investor in solar in 2021, accounting for USD 76 billion. Wind investment was more geographically diverse, with China at USD 47 billion, the United States at USD 36 billion, and Europe at USD 28 billion making up the top regions.

Going forward, the International Energy Agency (IEA) projects that solar and wind will continue to dominate renewable energy investment through 2026. However, investment is expected to shift somewhat from solar towards wind and other technologies like geothermal and hydro as solar module costs bottom out.

Government Policies and Incentives

Governments around the world have implemented policies and incentives to drive investment in renewable energy and accelerate the transition away from fossil fuels. Key policies and incentives include:

Renewable Energy Targets: Many countries have set targets for the share of energy to come from renewable sources by a future date. For example, the European Union aims for 32% renewable energy by 2030. These targets create incentives for investment in wind, solar, hydro and other renewables.

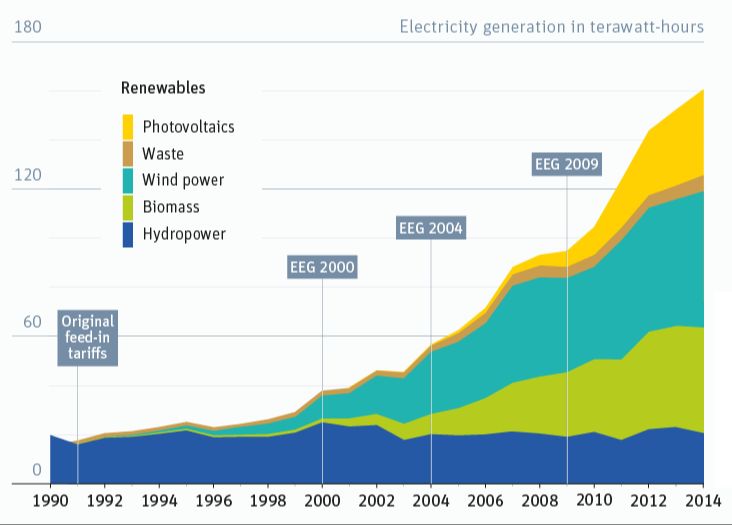

Feed-in Tariffs: These require utility companies to pay a premium rate for electricity generated from renewable sources. This makes renewable projects more financially viable. Feed-in tariffs have successfully driven solar and wind growth in countries like Germany, Spain and South Korea.

Tax Credits: Tax credits provide an income tax reduction based on investment in or production of renewable energy. The U.S. has provided important tax credits for wind and solar, which have spurred investments when utilized.

Renewable Portfolio Standards: These mandate that a certain percentage of electricity sold by utilities must come from renewable sources. RPS policies in U.S. states like California have accelerated utility-scale solar and wind development.

Net Metering: This allows decentralized renewable energy producers, like homes with rooftop solar panels, to sell excess energy back to the grid. Net metering provides a strong incentive for small-scale renewable adoption.

Private Sector Investment

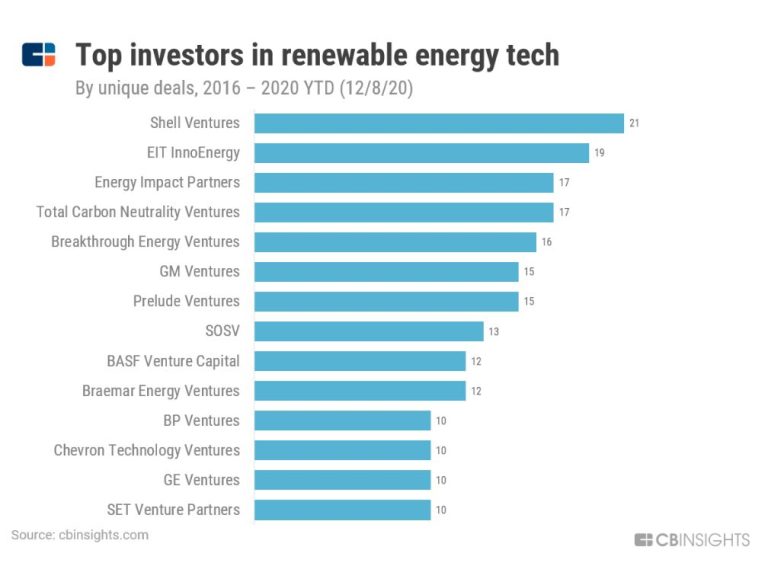

The private sector, including corporations and investors, plays a major role in funding renewable energy projects globally. According to the International Energy Agency (IEA), the private sector invested over $300 billion in renewable power generation in 2021, accounting for over 80% of total investment in renewables that year.[1]

Many large corporations have made commitments to switch to 100% renewable energy to power their operations and are investing heavily in wind and solar projects. For example, companies like Amazon, Apple, and Google have pledged over $6 billion combined to procure renewable energy since 2018.[2]

Major asset managers and investment funds like BlackRock, Goldman Sachs, and Macquarie are also directing billions in capital towards renewable energy assets. Investments by these large institutional investors have been critical in scaling up wind and solar deployment globally.[3]

The private sector is expected to play an even greater role going forward, with estimates that over $1 trillion per year will need to be invested in renewables by corporations and institutional investors to achieve net zero emissions targets.[1]

Future Outlook

Global investment in renewable energy is projected to continue growing through 2025 and beyond according to the latest analysis from the International Energy Agency (IEA) [1]. In their 2020 report, the IEA forecasts that renewable energy capacity will expand globally by 50% between 2019 and 2025, reaching over 1,800 gigawatts. This is equivalent to the total installed power capacity of the United States today. The growth is attributed to continued cost reductions and innovation in technologies like solar PV and wind turbines. The IEA projects solar PV capacity will nearly double between 2019 and 2025. Onshore and offshore wind are also expected to grow substantially, led by China and Europe.

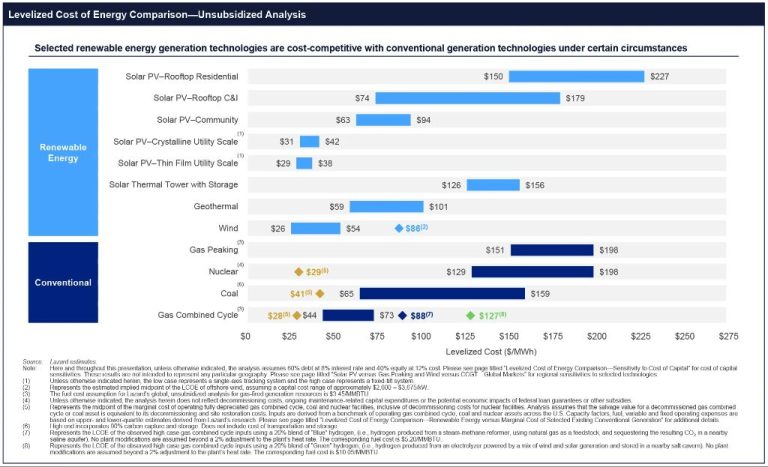

The IEA analysis shows renewables surpassing coal to become the largest source of electricity generation worldwide by 2025 [2]. This remarkable shift is driven by favorable policies and declining costs. With solar and wind already cheaper than new coal or gas plants in most countries, the economic case for renewables will continue strengthening. Private and public investment is anticipated to flow increasingly into renewable power over fossil fuels. While challenges remain around integrating variable renewables, battery storage, and transmission, the future trajectory points to renewables playing a central role in power generation globally within the next few years.

Challenges

Despite the growth in renewable energy investment, there remain significant obstacles to further expansion. Some of the key challenges include:

High upfront costs – The initial capital costs of building large-scale renewable energy projects are still higher than fossil fuels in some cases, creating financial barriers for further adoption. Government subsidies and incentives can help offset these costs.

Inconsistent policies – Renewable energy growth is heavily policy-driven, but support has been inconsistent as governments and priorities change over time. This uncertainty around long-term policies reduces investor confidence. More stable, long-term policies are needed to provide certainty. (The Land-Water-Energy Nexus of Biofuels)

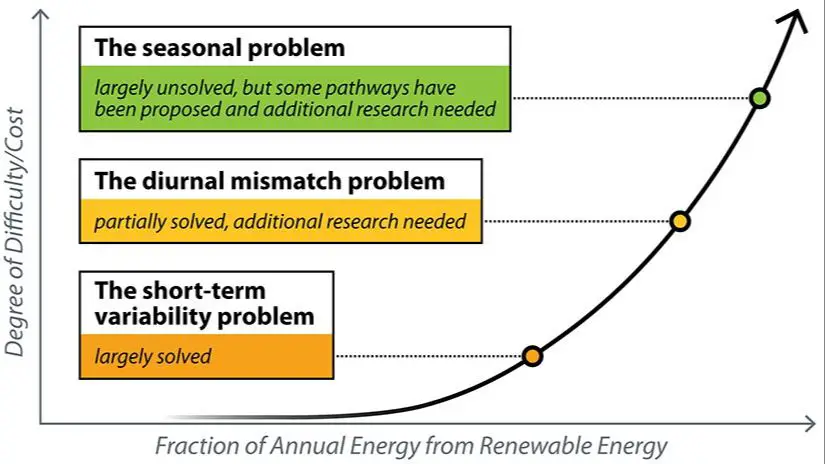

Grid integration – As intermittent renewable sources like wind and solar grow, managing grid stability and peak loads becomes more complex. Additional investments in energy storage, transmission infrastructure, and grid flexibility are required.

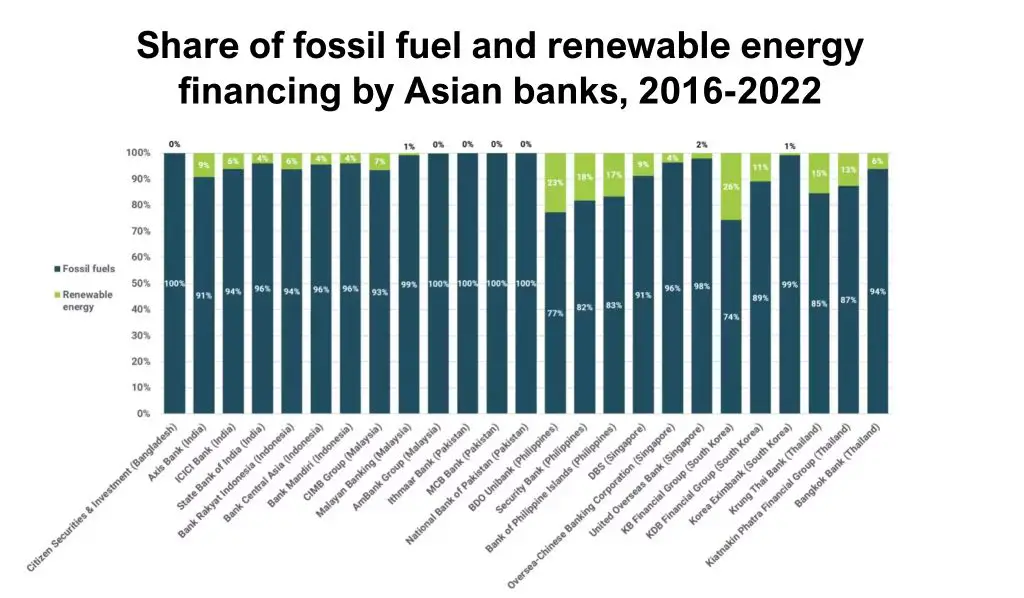

Incumbent fossil fuels – Heavily entrenched and subsidized fossil fuel interests resist the transition to clean energy. Ongoing subsidies for fossil fuels and lack of carbon pricing slows the pace of change.

Scaling emerging technologies – Promising renewable technologies like advanced geothermal, tidal, and wave energy require substantial R&D and investment to reach commercial viability and scale.

Opportunities

There are several promising areas that present major opportunities for investment and growth in renewable energy. According to the Caribbean Renewable Energy Investment Opportunities report, islands in the Caribbean offer abundant solar, wind, geothermal, and biomass resources that remain largely untapped (https://www.investincaribbean.org/industry-opportunities/renewable-energy/renewable-energy-investment-opportunities/). They have set renewable energy targets of 20-50% by 2030, requiring an estimated $19 billion in investment. This presents a sizable opportunity for investors looking to finance solar, wind, and other renewable projects in the region.

Emerging markets in Asia, Africa and Latin America also offer substantial potential. As these regions urbanize and economies grow, energy demand is surging. Building out renewable capacity alongside conventional power offers a chance to leapfrog over traditional energy infrastructure. Many countries have favorable policies to encourage renewable adoption as well (https://de.energy/projects/). Private investment can tap into large underserved markets across these regions.

Innovative business models like renewable energy investment funds, yieldcos, and crowdfunding platforms are also creating new opportunities for individual investors. These options provide portfolio exposure to renewable assets and cash flows without developing projects directly (https://www.carboncollective.co/sustainable-investing/renewable-energy-investment-fund). As sustainable investing gains momentum, accessed through these structures will likely continue growing.

Conclusions

Renewable energy has seen enormous growth over the last decade, driven by declining costs, supportive government policies, and increased environmental awareness. Global investment in renewable power capacity hit record levels in 2022, reaching over $1.3 trillion according to the International Energy Agency. Investments were especially strong in wind and solar PV installations. Several major economies like China, the United States, and the European Union are ramping up investments to meet ambitious climate goals.

While costs have come down dramatically, continued investments in R&D will be critical to drive efficiencies and grid integration improvements. Emerging markets in Asia, Africa, and Latin America represent major growth opportunities, but will require mobilizing finance through international partnerships and private capital. Overall, the renewable energy sector shows immense promise, but sustained political commitment and strategic investments will be key to realizing its full potential and transitioning away from fossil fuels.

In summary, renewable energy has gained significant momentum, but there is still substantial room for growth. With thoughtful policies, technology improvements, and strategic financing, renewable energy can play a major role in building a sustainable low-carbon future while spurring economic development and enhancing energy access.