How Much Money Can I Make With Solar Panels?

Solar panels can provide substantial long-term savings on electricity costs for homeowners and businesses. However, the upfront investment for purchasing and installing a solar panel system is significant. Typical costs range from around $10,000 to $25,000 depending on system size, location, incentives, roof type, and other factors. Understanding the key components that drive overall solar panel system costs is important for evaluating potential return on investment.

This guide provides an overview of the typical costs for residential solar panel systems in 2024. It breaks down the upfront purchase and installation costs, ongoing maintenance expenses, available rebates and tax credits, and considerations for calculating long-term return on investment. With current incentives, most solar systems can pay for themselves within 4-8 years through electricity savings, with panels lasting 25-30 years. While solar is a major investment, for many homeowners the long-term savings and environmental benefits make it worthwhile.

Upfront Costs

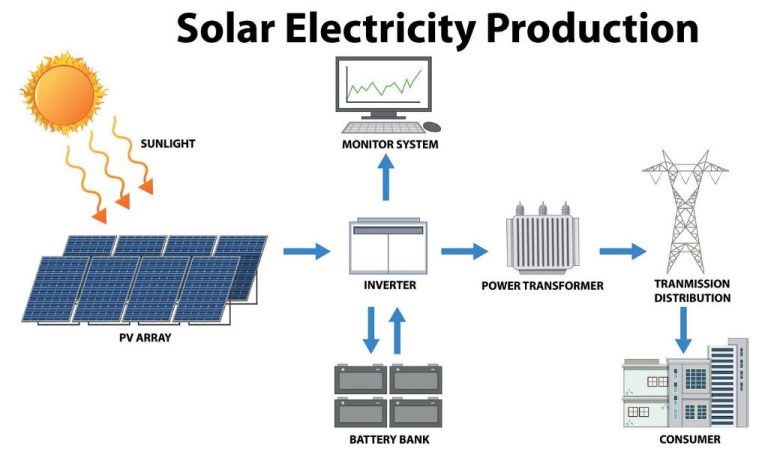

The main upfront costs of installing solar panels include the solar panels themselves, inverters that convert the DC power from the panels to AC power for your home, and racking to mount the solar panels. According to Forbes, in 2024 the average cost of a 6 kW solar panel system ranges from $10,200 to $15,200 depending on which state you live in. The solar panels themselves make up around 40-50% of this cost. Quality monocrystalline solar panels today typically cost $0.70 to $0.90 per watt. So for a 6 kW system you can expect to pay $4,200 to $5,400 just for the solar panels. Inverters cost around $0.20 to $0.40 per watt, so figure $1,200 to $2,400 for a 6 kW system. Racking often adds another $1,000 to $2,000 in costs. The remaining balance goes towards other equipment like wiring and disconnects, as well as labor and permitting.

Installation Costs

The cost to install solar panels can vary greatly depending on your location, system size, and the complexity of the installation. According to the Forbes research, the average cost to install a 6kW solar system ranges from $10,200 to $15,200 nationally after incentives. This factors in permitting fees, labor, and equipment costs.

Labor makes up a significant portion of the installation expense. Most solar installers will charge between $150 to $350 per hour for a 2-3 person installation crew. The total labor time will depend on the system size and roof complexity, but often ranges from 10-25 hours for a typical 6kW residential system according to NerdWallet’s research.

Permitting fees can also add a few hundred dollars depending on your city and county regulations. The permitting process involves an inspection from your local building authority to ensure the solar panels meet code requirements.

The remaining costs go towards physical equipment like solar panels, inverters, racking and wiring. Solar panel prices have dropped significantly over the years, but can still range from $2 to $4 per watt according to the National Renewable Energy Laboratory.

Incentives and Rebates

There are various incentives and rebates available at the federal, state, and local levels to help reduce the cost of installing solar panels. The main federal incentive is an investment tax credit (ITC) that allows you to deduct 26% of the cost of installing a residential solar energy system from your federal taxes through 2032 (the ITC will be reduced after 2032) [1]. This can save thousands of dollars on the overall cost. The ITC applies to both owned and leased solar panel systems.

Many states and utilities also offer additional incentives, such as rebates, tax credits, or exemptions, and performance-based incentives that pay you for the amount of electricity generated. State tax incentives can range from 10-35% of installation costs. Top states for solar incentives include California, Massachusetts, Arizona, Nevada, New Jersey, and North Carolina [2][3].

Some local and municipal governments also have solar incentives, such as property tax exemptions or credits, rebates, and special electricity rates. Be sure to check databases like DSIRE for incentives available in your area.

When combining federal, state, and local incentives, you can reduce the upfront costs of a solar array by 50% or more in some cases. This can greatly accelerate your return on investment.

[1] https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics

[2] https://www.bankrate.com/homeownership/solar/tax-incentives-by-state/

[3] https://unboundsolar.com/solar-information/state-solar-incentives

Electricity Savings

Installing solar panels allows homeowners to generate their own electricity, offsetting the amount they need to purchase from their utility company1. The more energy your solar system produces, the more you’ll reduce your electricity bills.

On average, a 5 kW solar system can save homeowners $100-$150 per month on their electric bills1. However, actual savings depend on several factors like your electricity rate, system size, orientation, efficiency, and more. Systems in sunnier locations will produce more energy and therefore lead to higher savings.

For example, if your typical electricity rate is 16 cents/kWh and your solar panels generate 10,000 kWh per year, you would save around $1,600 annually2. Over the 25+ year lifespan of a solar system, your total electricity savings could range from $25,000 – $33,0003.

Selling Excess Electricity

One way to earn money from your solar panel system is by selling any excess electricity you generate back to the grid. This is done through net metering programs offered by utility companies.

Net metering allows solar panel owners to get credit for any surplus power fed into the grid. Your utility company will install a special net meter that tracks both your electricity usage and any excess generation. You’ll earn credits for the excess kilowatt-hours (kWh) produced, which can offset your electricity purchases from the utility company during times when your solar panels aren’t actively generating, like at night.

The amount you get paid per kWh depends on your state and utility company’s net metering policies. The national average is around 10-15 cents per kWh, but rates can vary from 5-30+ cents per kWh. According to one analysis, solar panel owners make $50-$700+ per month selling excess electricity back to the grid through net metering programs.

Some states also have feed-in tariff (FIT) programs that set higher fixed rates per kWh for the renewable energy you feed into the grid. FIT rates are typically 15-40+ cents per kWh. FIT programs provide more incentive for renewable energy generation, but availability varies significantly by location.

To maximize your earnings from selling excess solar power, it’s important to size your system to produce more than your home’s typical usage. Any surplus generation beyond your own needs gets credited/paid back to you through net metering or FIT programs.

Tax Credits

One of the biggest financial benefits of installing solar panels is the federal solar tax credit, also known as the Investment Tax Credit (ITC). The ITC allows homeowners to deduct 26% of the cost of installing a solar energy system from their federal taxes for systems installed in 2020-2021. In August 2022, Congress passed an extension of the ITC, raising it to 30% for systems installed from 2022 through 2032 (Source). After 2032, the ITC will step down annually until it reaches 10% in 2042.

There is no cap on the ITC, meaning it can be used to offset both regular income taxes and alternative minimum tax. If the tax credit exceeds your tax liability for the year, you can carry forward the leftover amount to future tax years. This makes the ITC very valuable for deferring or reducing taxes. The credit applies to both home solar systems and solar panels installed on second homes (Source).

In addition to the ITC, homeowners may be able to claim accelerated depreciation deductions on their solar panels. Consult with a tax professional to determine eligibility.

Maintenance Costs

The main maintenance costs for solar panels come from periodic cleaning and eventual inverter replacement. Cleaning the solar panels is recommended every 6 months to remove any dirt, dust, snow, leaves, bird droppings etc. that can block the sunlight. This can typically be done with a soft brush, water and mild detergent. Professional cleaning may cost around $100-150 for a typical 6 kW system. Not cleaning the panels regularly can reduce their efficiency by up to 25%.

The inverter is a key component that converts the DC electricity from the solar panels into usable AC electricity for your home. Inverters typically last 10-15 years before needing replacement. The cost of a new inverter is usually $800-2000 installed. Factoring in periodic cleaning costs and one inverter replacement during the 25 year lifespan, total maintenance costs over 25 years average around $30 per kW per year.

Financing Options

When it comes to financing solar panels, there are three main options: loans, power purchase agreements (PPAs), and leasing. Many homeowners choose to take out a loan to cover the upfront costs of purchasing and installing a solar system. Personal loans, home equity loans, and solar-specific loans can offer competitive interest rates and flexible repayment terms over 10-25 years (https://www.energysage.com/solar/how-to-pay-for-solar/). With a solar loan, you own the system outright. Another option is a PPA, where a solar company installs and maintains the system on your property at little to no cost. You agree to purchase the power generated from the solar company at a fixed rate that is typically lower than your utility’s retail rate (https://www.bankrate.com/homeownership/solar/solar-financing/). PPAs typically range from 10-25 years, after which you may have the option to buy and own the system. Finally, solar leasing works similarly to a PPA, but there is a set monthly lease payment rather than per kilowatt-hour charge. At the end of the lease term, which is typically 15-25 years, you may have the option to buy the system, have it removed, or renew the lease.

Calculating ROI

Calculating the return on investment (ROI) for solar panels allows homeowners to determine if and when the upfront costs will be recouped through electricity savings. The ROI formula is fairly simple:

ROI = (Net Profit ÷ Total Investment) x 100

Net profit is calculated by adding up the total lifetime electricity savings and incentives/rebates and subtracting the total upfront and maintenance costs. Total investment is simply the upfront costs (system cost minus incentives/rebates).

For example, if a solar system costs $15,000 to install but has a $3,000 federal tax credit and $2,000 utility rebate, the net investment is $10,000. If the system saves $1,200 per year in electricity costs, with a usable lifespan of 25 years, the total lifetime savings is $30,000. That represents a net profit of $20,000. With a $10,000 investment, the ROI is:

$20,000 Net Profit ÷ $10,000 Investment x 100 = 200% ROI

In this example, the homeowner earns back their entire investment in under 10 years and realizes a total 200% return on their solar panel system over 25 years. Actual ROI can vary based on system costs, electricity rates, incentives, performance, and location [1]. But for most homeowners solar offers excellent returns compared to other investments.