How Many Homes Will Have Solar In 2030?

The residential solar market in the United States has experienced rapid growth over the past decade. According to the Solar Energy Industries Association (SEIA), solar has grown at an average annual rate of 24% since 2010, reaching over 110 gigawatts of installed capacity in 2022.

Several factors have driven the expansion of residential solar. Declining costs, supportive policies and incentives, and increasing awareness of solar’s benefits have made it an attractive option for homeowners. The SEIA predicts continued strong growth in the coming years.

With this background of exponential growth, a natural question arises: How many homes in the U.S. will have rooftop solar installations by the year 2030? This article will examine past and projected trends to estimate the number of solar homes at the end of this decade.

Current Number of Homes with Solar

As of 2022, there are over 3 million homes in the United States with solar panel installations, according to the Solar Energy Industries Association (SEIA). This represents a 23% increase from 2021, when there were approximately 2.4 million homes with solar panels installed https://www.seia.org/solar-industry-research-data. The growth in residential solar adoption has been rapid, with the number of homes with solar more than tripling over the past decade. SEIA projects there will be 4.6 million homes with solar by 2023.

Solar Panel Cost Trends

Solar panel costs have declined dramatically over the past decade. According to CNET, the average cost of solar panels has dropped from around $50,000 for a 6kW system just 10 years ago to around $14,000 today. This represents an over 60% reduction in costs. There are several factors driving this steady decline:

First, technological improvements and economies of scale have led to lower production costs for solar manufacturers. As solar production scales up to meet growing demand, manufacturers can take advantage of efficiencies and declining silicon prices.

Second, market competition and oversupply have also pushed prices down. As more players have entered the solar market, there is increased competition to offer attractive pricing to consumers.

Third, installation costs are decreasing as solar companies refine and optimize the installation process. Racks, wiring and labor expenses are declining with experience.

According to Arka360, experts predict solar panel pricing will continue to experience a gradual 1-3% price drop annually going forward. This steady decline will be driven by the ongoing factors above as solar technology continues to mature.

Solar Policy and Incentives

Many states and the federal government provide incentives to encourage home solar adoption. These policies help make solar power more affordable and accelerate growth. Key incentives to be aware of include:

The federal government offers a 26% tax credit for installing residential solar through 2032. This can reduce out-of-pocket costs significantly.

Some states such as California, Massachusetts and New York also offer additional state tax credits and rebates from 10-25% of system costs. For example, California provides rebates through the California Solar Initiative.

Many states allow solar customers to sell excess power back to the grid through net metering, providing bill credits that help offset costs. Top net metering states include California, New Jersey, Arizona and Nevada.

Over half the states have Renewable Portfolio Standards requiring utilities to get a percentage of their power from solar and renewables. These create renewable energy credit markets that provide additional value for home solar.

Some utilities and municipalities provide upfront rebates to reduce purchase and installation costs. For example, Salt River Project in Arizona offers rebates up to $2,000.

Property tax exemptions in states like Florida can exclude the value added by solar installations from assessed home values for tax purposes.

Policies like these make solar more affordable and accessible. They are key drivers enabling growth in residential solar adoption across many states.

Grid Parity

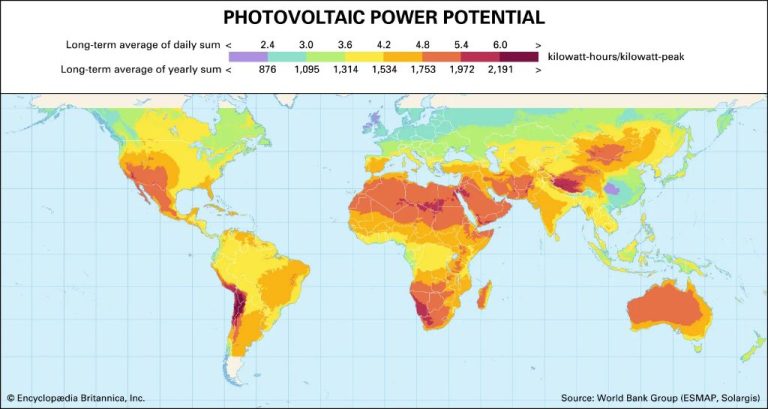

Grid parity occurs when the cost of producing electricity from solar photovoltaics is equal to or less than the cost of buying power from the electricity grid. This makes solar power financially competitive on its own with traditional grid electricity. According to an interactive grid parity map from Sunmetrix, over 70% of U.S. states have already reached grid parity for residential solar as of 2020, compared to just 3 states in 2005 (Source). Favorable solar policies, incentives, declining PV costs, and rising retail electricity rates have enabled solar to hit this milestone across much of the nation.

Some key regions hitting grid parity include California, the Southwest, New England, and Mid-Atlantic states like New Jersey and Pennsylvania. These areas tend to have strong solar resources and high electricity prices. According to an NREL study, the median price to install a solar PV system dropped from $12 per watt in 1998 to under $4 per watt by 2011, while retail electricity prices rose across most states over that same timeframe (Source). This dynamic has allowed solar to become cost-competitive with grid power.

Projected Solar Growth

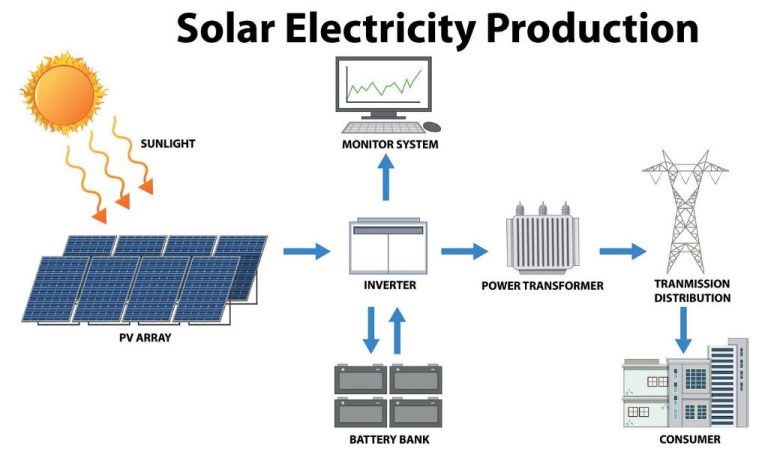

The solar industry is expected to see significant growth over the next decade. According to the Solar Energy Industries Association (SEIA), solar installations must increase by nearly 130% between 2022-2030 to reach the new target of 30% solar by 2030.

SEIA forecasts that annual residential solar installations will grow from 3.9 GW in 2022 to over 6 GW in 2023, an increase of over 50%. By 2030, total operating residential solar capacity is projected to be over 100 GW, up from 16.4 GW in 2020.

Research from SEIA shows the U.S. solar market grew 43% in 2021, showing the potential for rapid industry growth. The 30% by 2030 target calls for average annual solar deployment to quadruple within this decade (SEIA).

Barriers to Adoption

While solar panel costs have dropped dramatically, the upfront cost of installing a residential solar system remains prohibitive for many homeowners. According to Lynn Jurich, co-founder of Sunrun, “We remove two of the biggest barriers to home solar adoption: high upfront costs and the hassle of owning solar panels.” [1] Upfront installation costs can range from $10,000-$25,000 depending on the home’s location and system size, which is a significant investment for most families. Financing options like solar leases and loans have expanded access, but not everyone qualifies.

Homeownership rates also impact adoption, as solar installation only makes financial sense if families plan to live in their home long enough to recoup the upfront investment through energy savings. Renters cannot install solar panels on their roof. The US homeownership rate is around 65%, limiting the proportion of households eligible for rooftop solar.

[1] https://www.businesswire.com/news/home/20130620005244/en/Sunrun-Expands-Affordable-Solar-Power-Service-to-Connecticut

Innovations to Drive Growth

There are many new and emerging solar technologies and business models that can help drive wider adoption in the residential sector. Some key innovations include:

Improved solar panel efficiency – Companies are developing more efficient solar panels that can generate more electricity from the same amount of roof space. For example, SunPower offers panels with 22% efficiency compared to 15-18% for standard panels.[1]

Integrated solar roofs – Tesla’s solar roof tiles and GAF’s solar shingles embed solar cells directly into roofing materials for a sleek, integrated look. This can help overcome aesthetic concerns about traditional roof-mounted panels.[2]

Community solar – This allows households to buy or lease part of a larger shared solar installation, overcoming siting limitations for residential solar. It provides solar access to renters and homes with unsuitable roofs.[3]

Solar leases and PPAs – Companies like Sunrun offer $0 down leasing and power purchase agreements, reducing upfront costs. This financial innovation opened solar to new demographics.[4]

Battery storage – Pairing solar with batteries like Tesla Powerwall allows households to store solar energy for use at night. This increases self-consumption and savings from solar.[5]

Predictions for 2030

Synthesizing projections and growth trajectories, most experts predict that solar adoption in U.S. homes will see massive growth by 2030. According to the Solar Energy Industries Association (SEIA), with the right policies and incentives in place, solar could reach 30% of total electricity generation by 2030, up from just 3% in 2020 [1]. This would require solar installations to quadruple from current levels. Similarly, a Reuters report predicts the extension of the federal investment tax credit will drive a quadrupling of total solar installations by 2030 [2]. The Department of Energy’s SunShot initiative aims to cut the cost of solar by 50% between 2020 and 2030 through research and development, which could further accelerate adoption [3]. With rapidly declining costs, supportive policies, and increasing demand for clean energy, most projections estimate U.S. home solar installations will see dramatic growth, potentially reaching over 30% of homes by 2030.

Conclusion

In summary, solar energy adoption in the United States has been growing at a rapid rate over the past decade due to declining costs, supportive policies, increased accessibility, and environmental awareness. Current projections estimate that solar will continue robust growth, with the number of homes powered by solar expected to reach between 30-40 million by 2030.

Key factors driving this projected growth include solar reaching grid parity in most markets, new innovations lowering hardware costs, financing options expanding access, and local and federal incentives encouraging adoption. This puts solar on track to supply up to 20% of U.S. electricity generation by 2030.

While some challenges remain around grid integration and permitting, the economic and environmental benefits of solar ensure strong tailwinds. With solar already at price parity in many areas and costs continuing to fall, the 2020s is poised to be the decade of mass solar adoption for American households.