How Does Loan Guarantee Work?

What is a Loan Guarantee?

A loan guarantee is a promise by a third party, known as a guarantor, to repay the loan if the borrower defaults. The guarantor will pay back the principal and interest owed to the lender. This provides security to the lender and makes it possible for borrowers who otherwise may not qualify to obtain financing. Loan guarantees allow lenders to provide capital while lowering their risk.

Loan guarantees can apply to many types of loans such as mortgages, student loans, small business loans, and more. The guarantor charges a fee to the borrower, usually 1-3% of the loan amount, for providing the guarantee. If the borrower repays the loan as agreed, the fee is the only cost. But if they default, the guarantor will cover the unpaid balance so the lender does not lose the principal.

By reducing the lender’s risk with a third party guarantee, borrowers who may not meet conventional lending criteria can access loans. The guarantor’s promise to pay if the borrower defaults enables financing that otherwise may not be possible.

Benefits of Loan Guarantees

Loan guarantees provide several key benefits for borrowers who may have difficulty obtaining financing on their own:

Access to Credit

The main advantage of a loan guarantee is that it allows borrowers who might not otherwise qualify for a loan to access credit. Guarantees enable lenders to extend credit to higher-risk borrowers by absorbing some of the risk.

Better Loan Terms

In addition to accessing credit, borrowers can often get better loan terms with a guarantee. Lenders may offer lower interest rates, reduced fees, longer repayment terms, or larger loan amounts because the guarantee lowers their risk.

Lower Interest Rates

By sharing the risk with the guarantor, lenders feel more secure extending credit at lower interest rates. The guarantee cushions the lender’s potential loss, allowing them to offer cheaper financing costs. This makes projects more affordable.

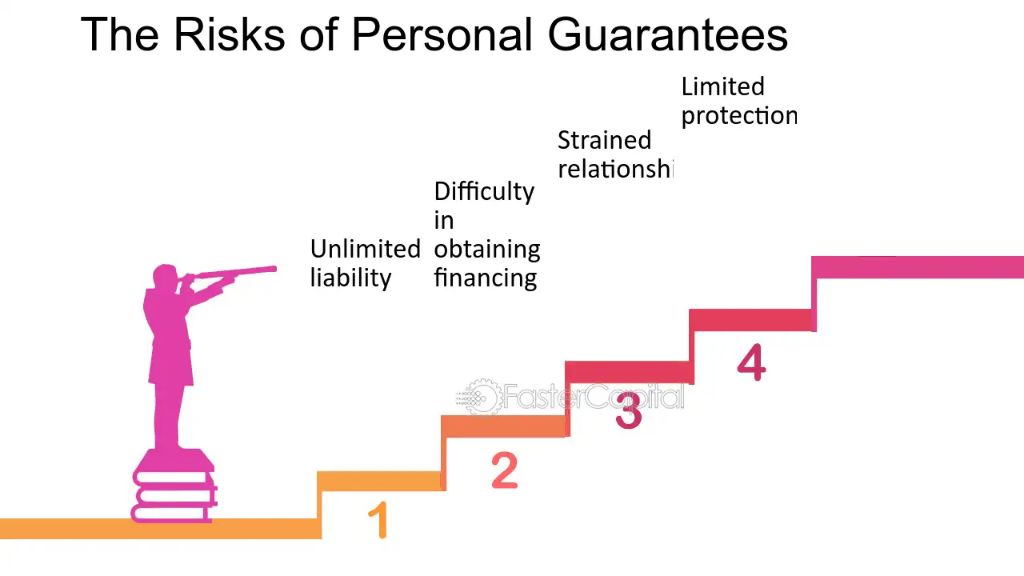

Risks of Loan Guarantees

While loan guarantees can expand access to credit, they also come with risks that need to be carefully managed. The main risks of loan guarantees include:

Moral Hazard – Loan guarantees can create incentives for more reckless financial risk-taking by lenders and borrowers. If losses are covered by a guarantee, lenders may be more willing to provide loans to high-risk borrowers. Borrowers may also take on excessive debts if they know losses will be covered.

Higher Default Rates – By expanding access to credit, loan guarantees can expose lenders to higher default rates. Without proper risk controls, default rates on guaranteed loans could exceed losses on non-guaranteed loans.

Taxpayer Liability – Since loan guarantees are often provided by government agencies, losses that are not recovered can represent a liability to taxpayers. If default rates are high, taxpayers may have to cover shortfalls in guarantee funds.

These risks highlight the need for prudent administration of loan guarantee programs. Lenders and borrowers should have “skin in the game” so they are incentivized to manage risk. Guarantee funds also need to be sufficient to cover expected losses.

Who Provides Loan Guarantees?

There are several different types of organizations that provide loan guarantees:

Government Agencies

Many federal government agencies offer loan guarantee programs to support public policy goals like increasing access to housing, education, and small business capital. Some of the largest federal loan guarantee programs are run by the Department of Education for student loans, the Department of Housing and Urban Development for mortgages, and the Small Business Administration.

Non-Profit Organizations

Some non-profit organizations provide loan guarantees to advance their missions. For example, the non-profit Fannie Mae was created to expand affordable housing by providing loan guarantees for qualifying mortgages. Other non-profits may offer limited guarantees for small business or student loans.

Private Companies

There are also private companies that will guarantee loans for a fee. This can help borrowers who don’t qualify for government or non-profit loan guarantee programs. Private loan guarantee companies take on the risk of the borrower defaulting in exchange for compensation from the lender and/or borrower.

Types of Government Loan Guarantees

The government provides loan guarantees for several key areas to promote economic growth and opportunity. Some of the main types of loan guarantees offered by government agencies include:

Student Loans

The federal government guarantees student loans issued by private lenders to help finance higher education. These loans make it possible for students to access funding for college and graduate school. Government-backed student loans include subsidized and unsubsidized Stafford loans, PLUS loans for parents and graduate students, and consolidation loans.

Small Business Loans

Government agencies like the Small Business Administration guarantee loans from private lenders to help entrepreneurs and small business owners access capital. These loan guarantees encourage lending to businesses that may not qualify for conventional loans. SBA-guaranteed loans include 7(a) loans, 504 loans, microloans, and disaster relief loans.

Mortgages

Federal mortgage loan guarantees facilitated by agencies like the Federal Housing Administration, Department of Veterans Affairs, and Rural Housing Services help first-time homebuyers and other qualified borrowers purchase homes with low down payments. These programs make homeownership more accessible.

Municipal Bonds

State and local governments can issue municipal bonds to finance public infrastructure projects, with the repayment guarantee backed by the issuing agency or municipality. Municipal bonds help expand core facilities and services in communities across the country.

Fee-Based Loan Guarantees

Unlike some government loan guarantee programs that are offered at no charge, many loan guarantees are fee-based. This means that the borrower pays an ongoing guarantee fee to compensate the guarantor for the risk of having to repay the loan if the borrower defaults.

Guarantee fees are generally based on the assessed risk level of the borrower. Applicants deemed to be higher risk are typically charged higher guarantee fees. The fee amount may be a percentage of the loan amount or a flat fee, and fees often vary between different guarantee programs.

Guarantee fees can be likened to interest rates on a loan – they both compensate the lender/guarantor for the risk and cost of providing the loan/guarantee. However, a key difference is that interest is usually variable over the loan term as rates fluctuate, whereas guarantee fees tend to be fixed at loan origination.

The Guarantee Process

The guarantee process typically involves several steps for the borrower:

Application Requirements

The borrower must submit an application providing information about themselves, the loan purpose, the business or project, and collateral or security. Requirements vary but often include financial statements, projections, business plans, and credit reports.

Underwriting Criteria

The lender will analyze the application to determine if the borrower and loan meet the program’s eligibility and credit requirements. This underwriting examines factors like the borrower’s finances, management expertise, repayment ability, and the adequacy of collateral.

Approval/Denial

If the loan application satisfies the lender’s underwriting criteria and program requirements, it will be approved for the guarantee. However, the lender can deny the application if the borrower or project is deemed too risky or does not meet standards.

The guarantee decision process aims to only approve creditworthy borrowers likely to repay the loan. Its requirements and analysis help minimize losses from defaults.

Guarantee Claims

When a borrower defaults on a guaranteed loan, the lender can file a claim to recover losses from the guarantor. Here’s what lenders need to know about the claims process:

The lender is responsible for declaring a loan in default according to the terms of the guarantee agreement. Common default triggers include missed payments, bankruptcy, or lender collaterals seized. Once default occurs, the lender has the right to make a claim.

To file a claim, the lender must submit all required documentation to the guarantor. This usually includes proof of default, loan documents, disbursement information, collection efforts, and financial statements. The lender should compile and submit these materials promptly to avoid delays.

After claim submission, the guarantor will review the documentation and validate the default and loss amount. If approved, the guarantor will pay out a percentage of the loss, up to the guaranteed amount, within 30-90 days in most cases. The guarantee agreement dictates the specific payout timeline.

Understanding the guarantee claim process allows lenders to file complete claims efficiently and recover losses from loan defaults.

Alternatives to Loan Guarantees

While loan guarantees can help borrowers access credit, there are other options that provide similar benefits without some of the risks. Here are a few popular alternatives:

Other Credit Enhancements

Instead of a third party guaranteeing repayment, borrowers can use other forms of credit enhancement. For example, borrowers may pledge collateral, get a cosigner, or purchase private mortgage insurance. These options provide extra security to the lender without involving an outside guarantor.

Peer-to-Peer Lending

Peer-to-peer lending connects borrowers directly with investors online. By expanding the pool of potential lenders, borrowers can sometimes find better rates and terms than traditional loans. The peer-to-peer model also spreads risk across many small lenders instead of one guarantor.

Crowdfunding

Crowdfunding platforms allow borrowers to raise small amounts of capital from a large number of backers. This makes crowdfunding well-suited for modest loans that traditional lenders may overlook. While less predictable than a guarantee, crowdfunding can provide affordable financing without a third party guarantee.

The Future of Loan Guarantees

The loan guarantee market is likely to see continued growth and innovation in the coming years. Here are some key trends to watch:

Market Trends: As access to capital remains challenging for many borrowers, demand for loan guarantees is expected to increase. This is especially true for small businesses, startups, and borrowers with limited credit history. Guaranteed loan programs are likely to expand into new sectors.

Regulation Updates: Regulations around financial services and lending are constantly evolving. Policymakers may introduce new rules or programs around loan guarantees. For example, guarantee limits or eligibility criteria could change. This could impact the availability of guarantees.

Innovation: Technology is enabling new models for underwriting and administering loan guarantees. Online platforms can match borrowers and lenders, while advanced analytics assess risk levels. Blockchain and smart contracts may also transform how guarantees are issued and managed. The future likely holds continued fintech innovation in the guarantee sector.

As loan guarantees evolve, they will remain an important tool for credit access and risk management. Both established and emerging players in finance will shape the future landscape of guarantees.