How Does A Revolving Loan Fund Work?

What is a Revolving Loan Fund?

A revolving loan fund (RLF) is a source of money that communities can use to provide financing for local economic development projects (Federal Register, 2024). The purpose of an RLF is to provide accessible capital to spur job creation and business development within a specific area.

RLFs are typically funded through federal or state grants and operated by local governments, non-profit organizations, or economic development groups. The initial grant money is used to capitalize the fund and provide the pool of money available for lending. As loans are repaid, the repaid money goes back into the fund to support new loans. In this way, the fund “revolves” over time as loans are made, repaid, and made again from the same original grant money (LISC, 2016).

RLFs provide more flexible loan terms than traditional financing and target assistance to small businesses or development projects that may not qualify for conventional loans. The revolving nature of the fund allows the original grant contribution to have an ongoing impact in the community rather than just supporting a one-time project.

Where Do the Funds Come From?

Revolving loan funds originate from an initial seed capital investment, typically provided through federal, state, or local government grants. For example, the U.S. Environmental Protection Agency provides grants to capitalize revolving loan funds that finance energy efficiency and renewable energy projects (https://www.epa.gov/statelocalenergy/revolving-loan-funds).

As loans are repaid over time, the repaid principal and interest are used to make new loans. So the initial government grants act as seed funding that is perpetually recycled as new loans (https://www.energy.gov/scep/slsc/revolving-loan-funds). The fund revolves as repayments and interest replenish it.

This sustainable lending model allows the initial government grants to be leveraged several times over. The cumulative lending capacity far surpasses the original grant amount, enabling ongoing economic and community development.

Who Administers the Funds?

Revolving loan funds are typically administered by local governments, non-profit organizations, or community development financial institutions (CDFIs). These entities receive an initial infusion of capital from public and/or private sources which is then used to make loans to local small businesses or economic development projects.

Local governments often create revolving loan funds to support economic growth and job creation within their jurisdictions. They seed the funds with grants from federal agencies like the Economic Development Administration as well as their own budgets. Non-profit economic development organizations also administer revolving loan funds, using philanthropic donations or corporate social responsibility investments as startup capital.

CDFIs are specialized financial institutions with a mission of expanding economic opportunity in low-income communities. Certified by the US Treasury Department, CDFIs provide services like microloans and small business lending. Many CDFIs manage revolving loan funds focused on disadvantaged populations who may not qualify for traditional bank loans.

These locally-based revolving loan fund administrators have knowledge of economic conditions and needs in their service areas. They can customize lending programs and provide hands-on technical support to help borrowers succeed.[1]

What Can the Loans Be Used For?

Revolving loan funds can provide financing to support a variety of business and economic development activities. Some of the most common uses of revolving loan funds include:

Business expansion – One of the primary uses of revolving loan funds is to help existing businesses expand their operations by financing the purchase of new equipment, additional inventory, or upgrades to facilities. The loans can enable businesses to increase production capacity, hire more employees, or launch new product lines.

Real estate development – The funds may be used for real estate acquisition, site preparation, construction, renovation or redevelopment of commercial or industrial buildings or mixed-use facilities. This helps support economic growth by improving commercial real estate stock.

Infrastructure – The loans can help finance public infrastructure projects such as water/sewer improvements, streets, broadband networks, and other utilities needed to support business growth and job creation. Improved infrastructure can attract new businesses and development.

Overall, revolving loan funds provide accessible financing to catalyze business growth and community economic development. The flexibility to finance a variety of projects is key to maximizing the fund’s impact.

Sources: https://rutlandvermont.com/lending/

What Are the Loan Terms?

The loan terms for a revolving loan fund can vary, but there are some common features. The interest rates are usually low, often between 3-8%, in order to make the loans affordable for small businesses or projects that need assistance. The repayment periods also tend to be flexible, ranging from 3-10 years for a term loan. The goal is to structure payments so borrowers can repay the loan in a reasonable timeframe from their operating income.

Loan limits are often in the range of $1,000 to $250,000, with microloans on the smaller end and larger loans at the higher end. According to the Ajo Center for Sustainable Agriculture, their revolving loan fund offers loans from $1,000 to $10,000, while other programs may go up to $50,000 or higher.

The loan terms are structured to be accessible to borrowers who may not qualify for traditional financing, while still ensuring the sustainability and growth of the revolving loan fund over time as loans are repaid.

What is the Application Process?

The application process for a revolving loan fund typically involves the following steps:

First, the applicant must determine if they are eligible for the loan program. Eligibility criteria often includes things like being a nonprofit entity, small business, or municipality. There are also requirements around the purpose and use of funds, such as using them for brownfield remediation or small business operations.

Once eligibility is determined, the applicant completes the loan application, including all required documents and financial information. This usually involves details on the project, budget, business operations, collateral, and personal financial statements from owners/partners.[1]

The completed application is submitted to the agency or organization administering the revolving loan fund. A loan committee or similar group then reviews the application to make an approval decision. They evaluate factors like ability to repay, collateral, and the viability of the project or business activities.

If approved, loan terms are finalized between the lender and borrower. This covers the interest rate, repayment schedule, collateral, and other contractual obligations. Once finalized, loan funds are dispersed to the borrower on the agreed upon schedule.

The application and approval process aims to determine eligible applicants who are likely to repay loans and use the funds productively. It involves in-depth documentation and review to reduce risk and promote the ongoing success of the revolving loan program.

How Are Loans Repaid?

Loans from a revolving loan fund typically have a structured repayment schedule laid out in the loan agreement. Borrowers will make periodic payments, often monthly, to pay down the principal and interest on the loan. The repayment term can range from a few years to over 10 years depending on the size and purpose of the loan.

Most revolving loan funds charge market-rate or below market-rate interest on the loans, generating the interest income that allows the fund to continue operating. Interest rates may be fixed for the term of the loan or variable based on certain benchmarks.

Borrowers are expected to make payments on time according to the repayment schedule. If a payment is late, the loan fund may charge a late fee. If payments are missed for an extended period, the loan may go into default status which can trigger more serious consequences. For example, the loan fund may call the full amount of the outstanding loan due immediately. Or they may take legal action to collect on the defaulted loan.

To avoid repayment issues, borrowers should only take out loans they can reasonably afford to pay back on time given their financial circumstances. The loan fund will assess the borrower’s ability to repay during the application process. Ongoing communication with the lender if repayment difficulties do arise can often help find solutions like temporary arrangements for late payments.

Most revolving loan funds aim to be supportive of borrowers making a good faith effort to repay on schedule. But persistent late or missing payments will trigger consequences to maintain the viability of the fund.

What Happens to Repaid Funds?

When loans made from a revolving loan fund are repaid, the principal and interest payments are cycled back into the fund to finance new loans. This replenishment aspect is what makes it a “revolving” fund.

As borrowers make loan payments over time, that money goes back into the central pool. The fund administrator can then issue new loans to other recipients using the repaid capital. Essentially, as loans are made and repaid, the funds revolve from borrower to borrower in an ongoing cycle.

This structure allows the initial seed money to be recycled for community and economic development purposes over the long-term. The same pool of capital can provide loans for years or decades by continuously loaning out funds and then re-lending repayments.

According to the Community Development Financial Institutions Fund, the majority of repaid loan funds, generally around 80-85%, are designated to finance new loans. The remaining 15-20% can be used to cover administrative expenses and loan losses.

In summary, the revolving aspect allows the funds to be perpetually re-invested in the community through new loans rather than just being spent once. This maximizes the long-term impact and sustainability of the loan fund.

What Are the Benefits?

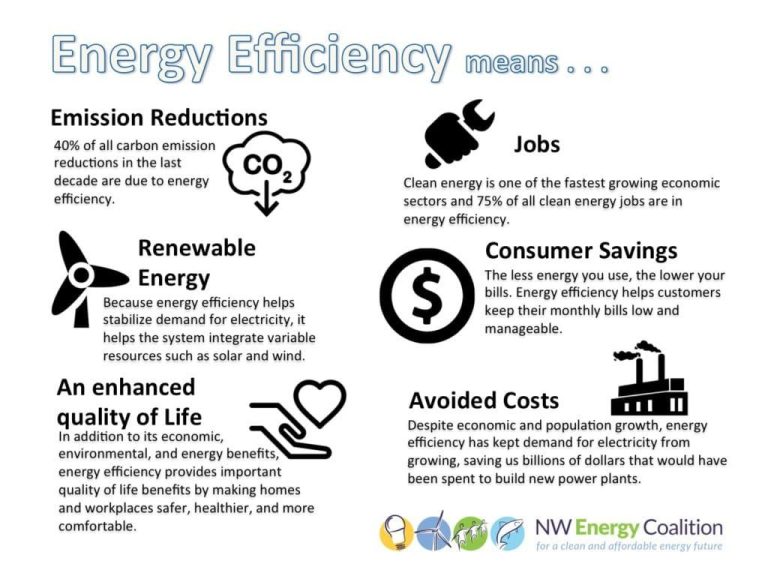

Revolving loan funds provide several key benefits, especially for community economic development:

Job Creation – The loans provide capital to local businesses and organizations to start up or expand, leading to new local job opportunities. Each new job represents an employment opportunity for community members.

Accessible Capital – Small businesses and organizations often have difficulty accessing loans from traditional lenders. A revolving loan fund provides capital that may not otherwise be available in that community.

Community Wealth Building – Loans given to locally-owned businesses and organizations help build assets and capacity. As these entities grow, they create more jobs and circulate more dollars locally.

Self-Sufficiency – Once seeded with initial capital, the fund can operate in perpetuity through the repayment of previous loans. This creates an ongoing source of capital controlled locally.

According to the Community First Fund, revolving loan funds allow continued lending as loans are repaid and recycled. This enables long-term community economic development.

What Are the Challenges?

While revolving loan funds provide many benefits, administering them also comes with some key challenges:

Default risk – There is always a risk that borrowers will default on repayment. This results in a loss of funds and limits the ability to relend to other businesses. Strong underwriting and active loan monitoring can help minimize defaults.

Limited funds – Most revolving loan funds start with a fixed pool of capital. As loans are made, the available capital decreases. New funding may be needed to keep making loans over the long-term. Careful planning around loan amounts and repayment can help extend the fund.

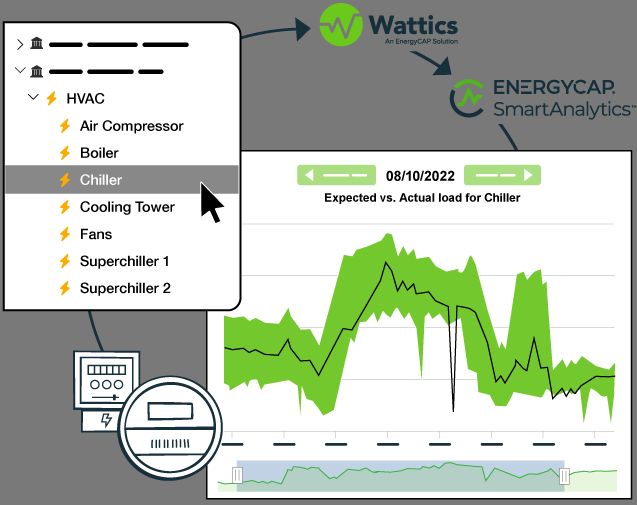

Complex administration – Managing a revolving loan fund requires strong oversight for lending, collecting repayment, tracking funds, and regulatory compliance. This administrative workload can be demanding for the staff involved. Efficient processes and management systems are essential.

Overall, revolving loan funds provide flexible capital but require diligent administration to be sustainable. With proper management, these challenges can be addressed to maintain an effective funding program.

Sources:

https://www.cdfa.net/cdfa/cdfaweb.nsf/0/33B78077F239A1B9882579360059560B

https://www.oig.doc.gov/OIGPublications/OIG-15-031-A.pdf