How Do Renewable Energy Projects Get Funding?

As the world looks to transition away from fossil fuels, there is an increasing demand for renewable energy, such as solar and wind power. The renewable energy market is expected to grow at a compound annual growth rate of 8.4% from 2022 to 2030, reaching over $2 trillion by 2030 according to one forecast (https://www.grandviewresearch.com/industry-analysis/renewable-energy-market). With fossil fuel resources declining and concern over climate change rising, renewable energy projects provide a sustainable way to meet energy needs now and into the future. However, these projects require significant upfront funding before they can begin generating electricity. This article will explore the various ways renewable energy projects get the financing needed to go from idea to reality.

Government Funding

There are a range of grants, tax credits, and other incentives available from federal, state, and local governments to support renewable energy projects. At the federal level, the Department of Energy (DOE) offers a number of funding and financing programs through its Office of Energy Efficiency and Renewable Energy (EERE). These include research grants to help drive innovation, loan guarantees to offset risk for clean energy projects, and funding for state and local governments to deploy renewable energy technologies (DOE Funding).

The USDA also provides guaranteed loans and grants for renewable energy systems in rural areas through its Rural Energy for America Program (REAP) (REAP Program). Many states and utilities offer additional incentives like rebates, tax credits, and performance-based incentives to support renewable energy adoption. Local governments may also offer property tax exemptions, expedited permitting, or other incentives for renewable projects. By leveraging federal, state, and local resources, renewable energy developers can offset the upfront costs of installing systems.

Utility Programs

Utility companies in the United States offer various programs and incentives to support renewable energy projects. Some of the major ones include rebates, net metering, and feed-in tariffs.

Rebates are payments made by utilities to customers who install qualifying renewable energy systems, usually solar panels or wind turbines. These one-time cash rebates help offset the upfront cost of installation. According to the Database of State Incentives for Renewables & Efficiency (DSIRE), over 30 states have utility rebate programs in place (DSIRE).

Net metering allows utility customers with renewable energy systems to earn bill credits for excess electricity fed back to the grid. This helps offset the cost of installation over time. Net metering policies and regulations vary by state. As of 2022, 41 states had implemented mandatory statewide net metering (EIA).

Feed-in tariffs require utility companies to purchase renewable electricity generated by customers at above-market rates through long-term contracts. These guaranteed revenue streams make renewable projects more financially viable. While feed-in tariffs have declined in the U.S., they are still offered in a few states like California, Hawaii, Maine, and Vermont (Energy.gov).

Private Investors

Private investors like angel investors, venture capital firms, and investment banks are a major source of funding for renewable energy projects. According to IRENA, the global volume of private investment in renewable energy reached $301.7 billion in 2019. This accounted for over half of total investment that year. Private investors are attracted by the steady returns and long-term contracts that renewable energy projects can provide.

Angel investors and venture capital firms often provide early stage and growth funding for renewable energy technology startups. They help get innovative new technologies off the ground that can then be deployed at scale. Major investment banks like Goldman Sachs have helped finance billions of dollars worth of wind and solar projects. They offer structured financing like green bonds and tax equity to help fund major capital projects.

While private investment is increasing, barriers like policy uncertainty and high transaction costs can deter investors. More financial tools and incentives are needed from governments to de-risk renewable investments and unlock greater flows of private capital according to ACP.

Crowdfunding

Crowdfunding has emerged as a popular way for renewable energy projects to raise funds through small investments from a large number of individuals. Online platforms like Invesdor, ecoligo, and Ener2Crowd allow people to invest as little as $25 in solar, wind, or other clean energy projects. This enables community participation and democratizes access to green investments. According to Energy 4 Impact, crowdfunding is especially suitable for smaller distributed renewable energy projects, though some platforms finance larger utility-scale developments as well. The crowdinvesting model taps into public interest in addressing climate change through impact investing.

Green Bonds

Green bonds are a special type of bond issued specifically to finance environmental projects like renewable energy and energy efficiency. As explained by the EPA, “Green bonds are a bond instrument that use proceeds to finance or refinance environmental, water, or clean energy projects” (EPA). They work similarly to traditional bonds, but the funds go towards sustainability efforts.

According to the Department of Energy, green bonds can help fund projects like “energy efficiency, renewable energy, or other projects that have positive environmental and/or climate benefits” (DOE). Major companies and municipalities are issuing these bonds to support renewable energy development.

For investors, green bonds provide a way to get a return while also supporting environmental sustainability. As Nerdwallet explains, they are “fixed-income securities with the added benefit of funding projects that could help the environment” (Nerdwallet). Though they work like regular bonds, the environmental focus makes green bonds attractive for values-based investors.

Power Purchase Agreements

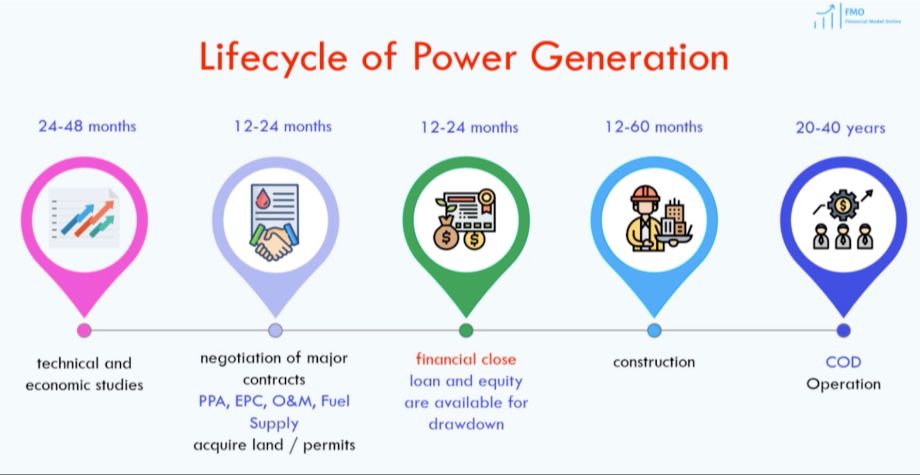

A Power Purchase Agreement (PPA) is a contract to purchase electricity from a renewable energy project like wind or solar [1]. The developer builds, owns, and operates the system, while the customer agrees to host the project on their property and purchase the power generated. PPAs provide several benefits for renewable energy projects:

First, they enable the developer to secure a buyer for the electricity before the project is even built. This provides long-term certainty on revenue and pricing, making it easier to obtain financing [2]. The customer benefits from stable, often lower cost electricity without having to pay any upfront capital costs for construction.

Second, the developer handles the permitting, construction, and O&M of the system. The customer does not have to invest any time or money into system development or maintenance. Their main role is providing the site and purchasing the electricity.

Finally, PPAs make it easier for tax-exempt entities like government, schools, and nonprofits to utilize renewable energy. Since they do not own the system, there are no tax credit limitations. The developer can monetize the tax credits, reducing the PPA price.

Overall, PPAs allow customers to switch to renewable energy with no upfront costs, fixed long-term pricing, and minimal risk or maintenance responsibilities.

On-Bill Financing

On-bill financing allows homeowners and businesses to get loans for renewable energy upgrades, energy efficiency improvements, or other clean energy projects and pay back those loans over time through their utility bills.

Here’s how it works:

A financial institution or third party provides the upfront capital for the renewable energy system or efficiency upgrade. The utility administers the loan repayment, which is structured to match the projected energy savings so that utility bills remain about the same. The loan payments are incorporated into the customer’s regular utility bills.

On-bill financing makes investing in renewable energy and efficiency projects more affordable because the upfront costs are spread out over time. Customers can pay off the loans gradually without having to take out a separate loan or pay high interest rates.

On-bill financing also lowers the risk for consumers, since the loan is tied to the utility meter rather than an individual. If the customer moves, the repayment obligation stays with the meter/utility service for that property. The new owner or renter then inherits responsibility for repaying the remainder of the loan.

Community Solar

Community solar refers to shared solar energy projects that allow a group of individuals to share the costs and benefits of solar power. Instead of installing solar panels on their own properties, community members can purchase or lease solar panels in an offsite, centralized solar array. They receive credits on their electricity bills for their share of the power produced by these solar panels.[1]

Typical financing options for community solar projects include:

- Public grants and incentives

- Tax equity financing

- Institutional debt

Community solar provides an accessible way for renters, condo owners, and others who can’t install solar on their own property to still benefit from clean energy. These shared solar developments allow people to pay for just a portion of a solar installation and receive proportional energy credits. This helps expand solar access to a wider group.

Some electric utilities and cooperatives have developed community solar programs. These allow customers to subscribe to a portion of a larger, shared solar array. The energy produced is fed into the grid, and subscribers receive bill credits based on their share of production.[2]

[1] https://www.energy.gov/eere/solar/community-solar-basics

[2] https://www.visionsfcu.org/products/community-solar

Conclusion

In summary, renewable energy projects can secure funding from a variety of sources. Government programs provide grants, loans, tax credits and other incentives to support renewable energy deployment. Utilities are also investing in renewable power through green pricing programs that allow customers to pay a premium for cleaner energy. Private equity firms and other investors are increasingly providing capital for large-scale renewable energy projects, viewing them as long-term assets. Crowdfunding platforms allow individual investors to fund small-scale solar and wind projects, often receiving tax credits or a return on investment in exchange. Green bonds are fixed-income financial instruments where capital is used for environmentally friendly projects. Power purchase agreements allow developers to secure long-term revenue by selling power to an electric utility or large energy buyer. On-bill financing programs let households or businesses finance renewable energy systems through installments on their utility bills. Community solar projects allow collective investment in a shared solar array. The future outlook for renewable energy funding remains positive, as costs continue to decline and policies, investments, and financing mechanisms increasingly align to accelerate the transition to carbon-free energy.