How Big Is The Energy Efficiency Market?

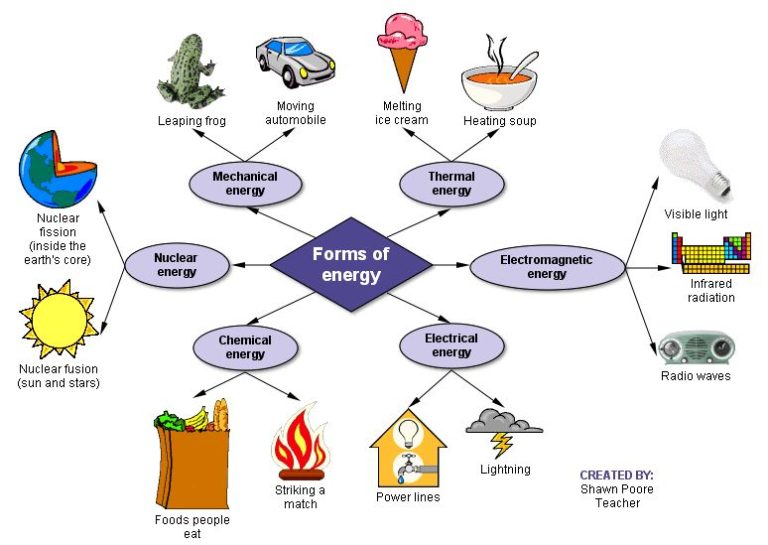

Energy efficiency refers to using less energy to provide the same service. Energy efficiency lowers energy consumption, saves money, reduces pollution, and mitigates climate change. Measuring the size of the global energy efficiency market provides critical data on the growth and impact of energy efficient products, services, and programs.

Understanding the market size helps set policy priorities, direct investments, inform business strategies, and track progress. With growing urgency to address energy usage and emissions, quantifying the energy efficiency industry indicates its capacity to deliver solutions.

Market Overview

The global energy efficiency market reached $310 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 9% from 2022 to 2027, reaching nearly $530 billion by 2027 according to the International Energy Agency. Key market segments driving this growth include buildings, industrial processes, transportation, utilities, and consumer products.

Buildings account for over 30% of global final energy consumption and represent the largest opportunity for energy savings. Retrofitting existing buildings and implementing efficiency standards for new construction are key strategies. The industrial sector focused on systems optimization, waste heat recovery, efficient motors and pumps. The transportation industry is transitioning toward more efficient vehicles including electric cars and trucks. Utilities are deploying smart meters and grid technologies to better manage energy supply and demand. Efficient lighting, appliances, and electronics represent a fast-growing segment in developing economies.

Governments play a major policy role through building codes, appliance standards, and incentives. Corporations are investing in energy management initiatives to cut costs and meet environmental goals. Energy service companies offer performance contracting services. Consumers increasingly consider efficiency in purchasing decisions. With rising energy prices and climate change concerns, global energy efficiency investment is expected to increase across all sectors.

Buildings

The building sector represents a major portion of the energy efficiency market, comprising both residential and commercial buildings. There is significant potential to improve efficiency through building envelopes, lighting, heating, ventilation and air conditioning (HVAC), and appliances.

Energy efficient building materials like insulation, energy-efficient windows and doors play a key role in reducing heating and cooling loads. The global market for insulation materials alone is expected to reach $77 billion by 2025.[1] Advanced HVAC systems can provide substantial efficiency gains, with the global HVAC market size projected at $240 billion by 2028.[2]

Transitioning to LED lighting represents one of the most cost-effective ways to reduce electricity use, with the global market expected to grow from $67 billion in 2021 to $111 billion in 2026.[1] Energy efficient appliances like refrigerators, washing machines and dishwashers also offer significant potential, especially as older inefficient models are replaced.

Industrial

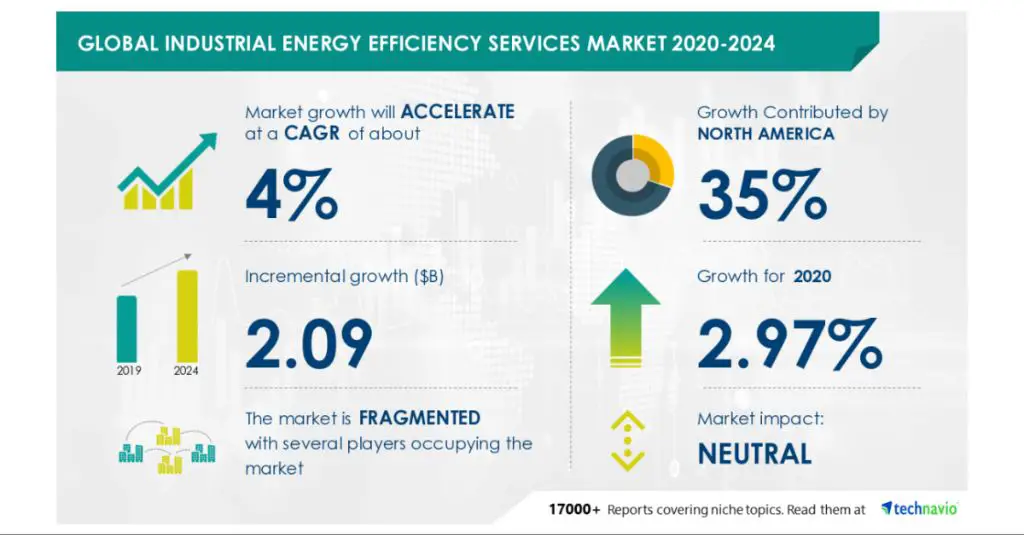

The industrial sector represents a major opportunity for energy efficiency improvements. Industrial facilities account for about one-third of global final energy consumption and they offer significant potential for efficiency gains through technologies like high-efficiency motors, boilers, compressors, pumps, and fans (IEA, 2020). The industrial energy efficiency market was valued at $18.3 billion in 2018 and is projected to reach $41.2 billion by 2030, growing at a CAGR of 8.6% from 2023 to 2030 according to Coherent Market Insights.

Energy efficient technologies like variable speed drives, high efficiency motors, and upgrades to compressed air systems can reduce energy use in manufacturing facilities by 10-30%. The use of combined heat and power systems can raise efficiency up to 80% by harnessing waste heat. Switching to LED lighting and occupancy sensors creates additional savings. Proper maintenance and operational improvements also optimize energy performance. The US Department of Energy (DOE) states that energy efficiency innovations enable industrial facilities to use less energy to accomplish the same tasks as older technologies (DOE, 2022).

Transportation

The transportation sector accounts for about 28% of total U.S. energy consumption, so increasing efficiency in this sector can have a major impact on overall energy use (1). Transportation energy efficiency has improved in recent decades due to gains like more fuel efficient vehicles, growth of electric vehicles, and investments in mass transit.

One of the biggest factors influencing transportation efficiency has been federal fuel economy standards for vehicles. These standards have progressively tightened since they were first introduced in 1975, resulting in new passenger vehicles increasing their average fuel economy from about 13 miles per gallon (mpg) in the 1970s to 25 mpg today (2). Further tightening of fuel economy standards to 54.5 mpg is planned by 2025, which could save around 2 million barrels of oil per day (3).

Electric vehicles are also playing a growing role. As of 2021, about 2% of light-duty vehicle sales in the U.S. were electric, up from less than 1% in 2019 (4). Wider adoption of electric vehicles, with their improved efficiency compared to gasoline-powered vehicles, can substantially reduce transportation energy use. Investment in charging infrastructure and decreasing battery costs may accelerate electric vehicle growth.

Public transportation like buses and trains are on average more energy efficient per passenger mile than passenger vehicles. Transit ridership declined during the COVID-19 pandemic but investments in expanded and electrified mass transit could improve efficiency in the long-term (5). Urban planning that emphasizes walkable neighborhoods and alternatives to driving can also restrain growth in transportation energy demand.

While significant progress has been made, additional efficiency policies, technology advances, and consumer adoption will be needed for the transportation sector to meet future energy and emissions reduction goals.

Utilities

Utilities play a major role in driving energy efficiency through programs and investments. According to ACEEE, utility spending on electric efficiency programs increased to $8.6 billion in 2021, up from $7.4 billion in 2020. Natural gas efficiency program spending also rose to nearly $2 billion. These utility programs help fund energy audits, provide rebates and incentives for efficient appliances and equipment, offer retrofit services, and more.

Some key areas where utilities are advancing energy efficiency include smart meters, grid optimization, and demand response programs. Smart meters provide greater visibility into energy usage patterns and enable time-of-use pricing to shift demand. Grid optimization technologies help balance supply and demand more efficiently. Demand response programs incentivize consumers to reduce energy use during peak times. For example, according to the EPA, some utilities offer rebates for allowing brief adjustments to smart thermostats when energy demand is high.

Overall, utilities are positioned to drive continued progress on energy efficiency through their customer relationships, program administration capabilities, access to usage data, and knowledge of grid operations.

Consumer Products

The consumer products market represents a major opportunity for energy efficiency. Household appliances, electronics, lighting, and office equipment account for a significant portion of residential energy use. According to the U.S. Energy Information Administration, major appliances and electronics make up nearly 30% of an average home’s electricity use.1 As consumers replace old, inefficient models with newer ENERGY STAR certified products, they can realize substantial energy savings. The EPA estimates consumers and businesses saved over 430 billion kWh of electricity in 2020 from using certified products, resulting in utility bill savings of over $55 billion.2

Major appliance categories seeing strong adoption of efficient models include refrigerators, dishwashers, washing machines, and room air conditioners. For example, over 80% of new room air conditioners sold in the U.S. are ENERGY STAR certified.2 Consumers are increasingly choosing efficient electronics as well, with nearly 90% of TVs, sound bars, and audio/DVD systems sold in 2020 meeting ENERGY STAR requirements.2 For office equipment, categories with high efficient market share include displays, printers, copiers, and servers.

Financing

There are several financing options available to help fund energy efficiency upgrades for homes, businesses, and industry. Many utilities and governments offer rebates, incentives, and low-interest loans to encourage investing in more efficient equipment and buildings.

For homeowners, there are energy-efficient mortgages that allow buyers to finance energy efficiency improvements as part of their home purchase or refinance. Many utilities like PG&E also offer special low-interest loans, often at 0%, for upgrading to more efficient lighting, HVAC systems, appliances, windows, insulation and other improvements.

There are also various loan and financing programs offered by state and federal agencies to help commercial buildings, industrial facilities, and other organizations finance energy efficiency projects and upgrades. These programs can significantly reduce the upfront costs and enable investments that provide ongoing energy and cost savings.

Policy

Policies and regulations aimed at improving energy efficiency have played an important role in the growth of the energy efficiency market in the United States.

Building energy codes and appliance standards are two key policy mechanisms that drive energy efficiency improvements in the building and consumer products sectors. Building energy codes set mandatory requirements for energy efficiency in new construction and major renovations, ensuring a minimum level of efficiency in all new buildings. Appliance standards similarly set mandatory efficiency levels for consumer and commercial products like refrigerators, washing machines, and air conditioners. According to the US Department of Energy, national appliance standards implemented since 1987 have saved consumers over $2 trillion dollars as of 2020.

Financial incentives like tax credits, rebates, and low-interest loans also help spur adoption of energy efficient technologies and practices. At the federal level, tax incentives like the Section 179D tax deduction for commercial buildings and the Section 25C tax credit for homeowners have driven investments in upgrades like insulation, HVAC, windows, and appliances. Many state and utility programs offer additional rebates on top of federal incentives.

Overall federal, state, and local policies have played a key role in unlocking the energy efficiency market and driving continuous improvements over the past several decades. According to the International Energy Agency, an additional $560 billion in cumulative global investment could be mobilized by 2025 through supportive policies and programs. Energy Efficiency Impact Report

Future Outlook

The future of the energy efficiency market looks bright, with projections of strong growth driven by several key factors. One major driver is continued policy support and government incentives for energy efficiency, as nations aim to meet emissions reductions targets and improve energy security. Many experts predict a loosening of purse strings for energy efficiency stimulus programs as part of economic recovery efforts post-pandemic.

Rising energy prices will also motivate more investment in efficiency upgrades to save money. In addition, innovations in technology and financing are making it easier and more affordable to implement upgrades. The proliferation of smart meters, sensors, controls and data analytics enables greater optimization of energy use.

However, the market faces challenges too. Installed costs of some efficient equipment remain high, deterring adoption. Split incentives between landlords and tenants as well as inadequate information about savings potential also obstruct investments. And although financial innovations have unlocked new sources of capital, expanded access to attractive financing is still needed.

Overall the market is ripe with opportunity for companies along the whole supply chain, from manufacturers to engineering firms, contractors, financiers and software developers. Companies that can successfully bring down costs, creatively engage customers and demonstrate measurable returns will be well-positioned to tap into the large and expanding energy efficiency market.