Do You Actually Save Money Going Solar?

With electricity rates rising and solar panel costs dropping, many homeowners are wondering if going solar could help them save money on their energy bills. Over the past decade, the solar industry has experienced massive growth, with total installed capacity in the U.S. tripling since 2015. According to SEIA forecasts, home solar power will grow by around 6,000 to 7,000 MW per year between 2023 and 2027. But does installing a solar energy system actually lead to long-term savings for homeowners?

This article will analyze the costs and benefits of going solar for the average homeowner. We’ll look at upfront installation expenses, available tax credits and incentives, electricity bill savings, system maintenance, lifespan, resale value, and financing options. By weighing all these factors, we’ll determine whether rooftop solar delivers meaningful energy savings over time or if it’s merely hype.

Upfront Costs

The upfront cost of installing a solar panel system on your home can range from around $10,000 to $30,000 depending on the size of the system, type of panels, and location. According to MarketWatch, the average cost falls between $15,000-$20,000.

The overall price is largely determined by the number of solar panels needed, which depends on factors like the square footage of your roof and how much electricity you use. More solar panels means higher upfront costs. Location also impacts price with systems costing more in some states due to permitting fees, labor costs, and sales tax.

Federal Tax Credits

The federal government offers a tax credit to help offset the cost of installing solar panels. According to the IRS, the Residential Clean Energy Credit equals 30% of the costs of new, qualified clean energy property installed anytime from 2022 through 2032. This includes the full cost of purchasing and installing solar panels.

So if you spent $15,000 to purchase and install solar panels on your home, you could claim a credit of $4,500 on your federal taxes (30% of $15,000). This significantly reduces the upfront costs of going solar. The credit applies not just to the solar panels themselves, but also the inverters, wiring, and any other equipment related to the system. There is no maximum limit on the credit amount.

See Residential Clean Energy Credit | Internal Revenue Service and Homeowner’s Guide to the Federal Tax Credit for Solar … for more details.

State/Local Incentives

In addition to the federal solar tax credit, many states and localities offer their own incentives to go solar. These can include state tax credits, rebates, net metering programs, and more. Some of the top state solar incentives include:

California offers both an upfront rebate through the California Solar Initiative as well as performance-based incentives that pay solar owners for the renewable energy their systems generate. Other incentives are available through local utility providers.

Massachusetts has a state tax credit called the Solar Massachusetts Renewable Target (SMART) program. This provides a base compensation rate per kWh generated. Higher compensation rates are offered to projects built to benefit low-income residents.

New Jersey has a strong solar Renewable Energy Certificate (SREC) market. Solar panel owners earn credits for the clean energy they produce. These SRECs can then be sold on the open market for additional income.

Nevada reinstated its net metering policy in 2017, allowing full retail credit for excess solar energy sent back to the grid. This makes home solar much more financially viable.

Several other states like New York, Illinois, and North Carolina also offer rebates, tax credits, net metering, SRECs, and other incentives. Be sure to research what is available in your specific location.

Sources:

https://www.forbes.com/home-improvement/solar/solar-tax-credit-by-state/

https://www.seia.org/initiatives/what-rebates-and-incentives-are-available-solar-energy

Electricity Bill Savings

The most obvious and immediate benefit of installing solar panels is reducing your monthly electricity bills. According to the Department of Energy, the average homeowner saves $20-$30 per month on their electric bill after going solar. However, the savings can be much higher depending on factors like your energy usage, electricity rates, solar panel system size, and more.

For example, a homeowner in Arizona with a 5 kW solar system could save around $100-$150 per month on their electric bills. Whereas a homeowner in New York with a smaller 3 kW system may only save around $50 per month. The key is to install an appropriately-sized system to maximize your monthly savings.

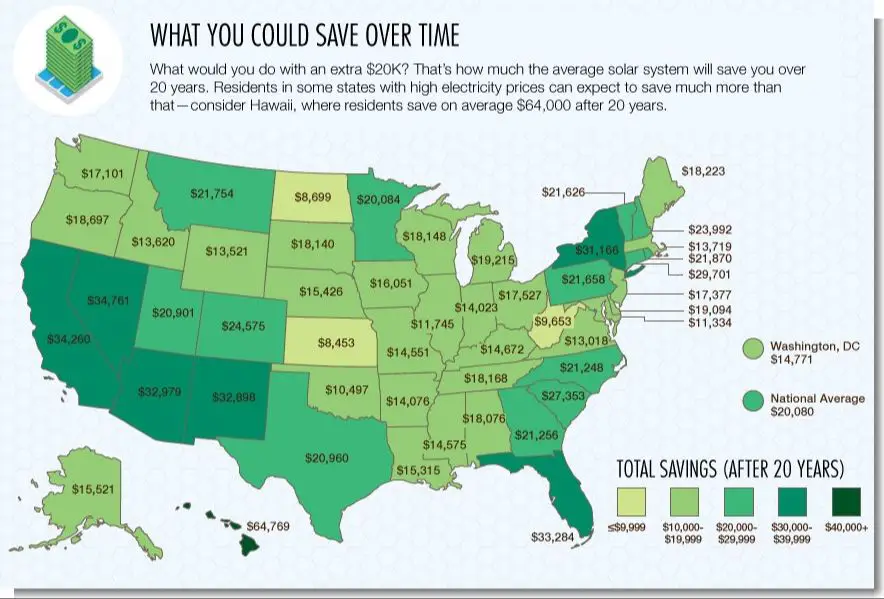

Over the 25+ year lifetime of a solar panel system, electricity bill savings really add up. According to EnergySage, the average homeowner saves between $20,000-$30,000 over the full lifespan of their solar system. In areas with high electricity rates like California or Hawaii, total lifetime savings can exceed $96,000 with solar panels.

Maintenance Costs

The cost of maintaining solar panels includes cleaning, inverter replacements, and any repairs over the system’s lifespan. According to the National Renewable Energy Laboratory (NREL), solar panel maintenance costs average around $31 per kW per year. For a typical 5 kW residential system, this equates to around $155 annually.

Regular cleaning is recommended to keep panels operating efficiently by removing dirt, dust, bird droppings, etc. Most homeowners can handle basic cleaning themselves using a soft brush and soapy water, at a cost of $20-50 each cleaning. Professional cleaning may cost $100-150 annually.

Inverters, which convert the DC power into usable AC power, usually last 10-15 years before needing replacement. The cost of a new inverter ranges from $800-2000 installed. Factoring in one replacement over a 25 year lifespan adds about $40 annually.

Other maintenance costs are minor if the system was installed properly. Loose wiring, damaged panels, or other repairs may be needed over the lifetime, adding perhaps $50 annually for a typical residential system. According to RoofGnome, total annual solar panel maintenance costs range from $400 to $740 for most homes.

System Lifespan

The lifespan of a typical solar panel system is 25-30 years, according to most manufacturers’ warranties and industry standards (Forbes). Solar panels can continue producing energy beyond this timeframe, but at reduced efficiency and output. After around 25 years, panels may only generate around 80% of their original rated capacity.

When solar panels reach the end of their usable lifespan, homeowners have a few options. Many solar installation companies will remove and recycle the old system at no additional cost when installing a new system. Some homeowners choose to keep their original panels and supplement with newer, more efficient panels. Another option is to fully replace the system to benefit from the latest technology. With proper maintenance, a solar system can provide carbon-free energy to a home for decades.

Resale Value

Solar panels can increase the resale value of your home. According to Architectural Digest, solar panels increase a home’s appraisal value by 4.1% on average. The exact impact on home value depends on factors like your location and local electricity costs.

Home buyers are increasingly looking for energy efficient features like solar. Solar panels can save new owners money on electric bills, so this gets factored into the home’s value. Upfront solar installation costs can typically be recouped through increased resale value.

According to MarketWatch, homes with solar panels sell 20% faster than comparable homes without solar. So installing solar now can pay off in the form of a quicker, higher value sale later.

Financing Options

When looking to go solar, most homeowners find that financing is required since solar panels and installation costs can range from $15,000 to $25,000 according to EnergySage. Rather than paying out of pocket upfront, many turn to financing options like solar loans, solar leases, and power purchase agreements to cover these costs over time.

Loans: With solar loans, you borrow money from a lender like a bank or credit union and make monthly payments over a fixed term, usually around 5-20 years. You own the system outright. Interest rates vary but can be under 5% for well-qualified borrowers. Examples include home equity loans and special solar loans from lenders like Lightstream and Dividend Finance.

Leases: Solar leases allow you to pay zero money down in exchange for monthly payments to a solar company that installs and owns the equipment. Payments are fixed for a term around 15-25 years. You’re unable to claim tax credits and incentives. Companies like Sunrun offer solar leases.

Power Purchase Agreements (PPAs): Under a PPA, a solar company installs and owns the system. Instead of fixed monthly lease payments, you agree to purchase the power generated from the panels at a fixed rate that’s lower than your current utility. The rate is locked in for 15-25 years. Like leases, tax credits go to the solar company. SunPower offers PPAs.

Conclusion

In summary, going solar requires significant upfront costs to purchase and install the system, but there are federal and state tax credits and incentives available that can reduce that initial investment. Once installed, solar can generate significant electricity bill savings over the 20-30 year lifespan of the system. However, there are ongoing maintenance costs to keep the system operating efficiently.

When weighing all the costs and savings over the lifetime of a solar system, the key factors that determine if solar will save money for a household are the local electricity rates, amount of sun exposure, and the financing options available. With favorable conditions like high energy prices, full sun and low-interest financing, solar can absolutely save homeowners money in the long run. The falling prices of solar panels also continue to improve the return on investment for going solar year after year.

Therefore, for most homeowners today with the right conditions, investing in residential solar can make good financial sense and provide decades of electricity bill savings. Speak to a qualified solar installer in your area to discuss your specific situation and get a detailed analysis of the costs, incentives and projected savings to know for sure if going solar will save you money.